In the fast-paced world of cryptocurrencies, Binance Coin (BNB) has emerged as a standout performer, deeply intertwined with the Binance ecosystem. As of February 2025, BNB remains a key player, but its recent price drop to $610.36 has left investors questioning its future. Let’s explore the factors behind this dip, draw parallels with Ethereum’s past performance, and analyze what lies ahead for BNB.

Trade BNB USDT on WEEX.

Contents

- 1 Can BNB Recover After Dropping to $610.36?

- 2 What Caused BNB’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Ethereum: Could BNB Follow a Similar Path?

- 4 How to Navigate BNB’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for BNB

- 6 Chart Analysis: Visualizing BNB’s Future

- 7 Actionable Insights for BNB Investors

- 8 BNB Price Updated on Today, March 19, 2025

Can BNB Recover After Dropping to $610.36?

The recent decline from $620 to $610.36 has sparked concerns among BNB holders. However, such price movements are not uncommon in the volatile crypto market. To put this into perspective, let’s look at Ethereum (ETH), which faced a similar situation in late 2023. Back then, ETH’s price plummeted due to regulatory pressures and market corrections, but it eventually rebounded, driven by its strong fundamentals and growing ecosystem.

BNB’s current dip can be attributed to broader market volatility and regulatory uncertainties surrounding major exchanges. Despite this, BNB’s utility within the Binance ecosystem—ranging from trading fee discounts to participation in token sales—provides a solid foundation for recovery. If history is any indication, BNB could follow Ethereum’s path and regain its upward momentum.

What Caused BNB’s Price Drop, and Will It Bounce Back?

Several factors have contributed to BNB’s recent decline. The broader crypto market experienced a correction, and BNB, like other tokens, was affected. Additionally, regulatory news, particularly in the U.S., has added pressure on major exchanges, impacting investor sentiment.

However, BNB’s resilience in past market downturns offers hope. For instance, after the 2022 crypto crash, BNB not only recovered but also reached new highs. This resilience suggests that the current dip might be temporary, especially as the market stabilizes and Binance continues to innovate and expand its ecosystem.

Lessons From Ethereum: Could BNB Follow a Similar Path?

Ethereum’s recovery in 2023 provides valuable insights for BNB investors. ETH’s dominance in DeFi and smart contracts played a crucial role in its rebound. Similarly, BNB’s integration into Binance Smart Chain and Binance DEX positions it as a vital component of the crypto ecosystem.

If BNB can continue to enhance its utility and adapt to regulatory changes, it is well-positioned to follow Ethereum’s recovery trajectory. Investors should monitor Binance’s strategic initiatives and broader market trends, as these will be key indicators of BNB’s future performance.

For beginners navigating BNB’s price fluctuations, understanding key technical indicators is essential. Here are some tools that can help you make informed decisions:

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. An RSI above 70 suggests BNB might be overbought, while below 30 indicates it’s oversold.

- Moving Average Convergence Divergence (MACD): This trend-following momentum indicator helps identify potential buy and sell signals. A bullish crossover—when the MACD line crosses above the signal line—can signal a good time to buy BNB.

- Bollinger Bands: These bands help identify overbought or oversold conditions. If BNB’s price touches the upper band, it might be overbought, and if it touches the lower band, it could be oversold.

- Fibonacci Retracement Levels: These levels can help identify potential support and resistance levels. For instance, if BNB drops to a 61.8% retracement level, it might find support and bounce back.

By leveraging these tools, beginners can better understand BNB’s price movements and make more informed investment decisions.

Long and Short-Term Predictions for BNB

In the short term, BNB’s price is likely to remain volatile due to market fluctuations and regulatory developments. However, with a strong ecosystem and ongoing innovations, BNB is well-positioned to recover and potentially reach new highs. Analysts predict that if the market sentiment turns bullish, BNB could rise to around $650 by the end of 2025.

Looking further ahead, BNB’s long-term prospects appear promising. By 2030, with the continued growth of the Binance ecosystem and increasing adoption of cryptocurrencies, BNB could potentially reach $1,000. This optimistic forecast is based on the token’s utility and the expansion of the broader crypto market.

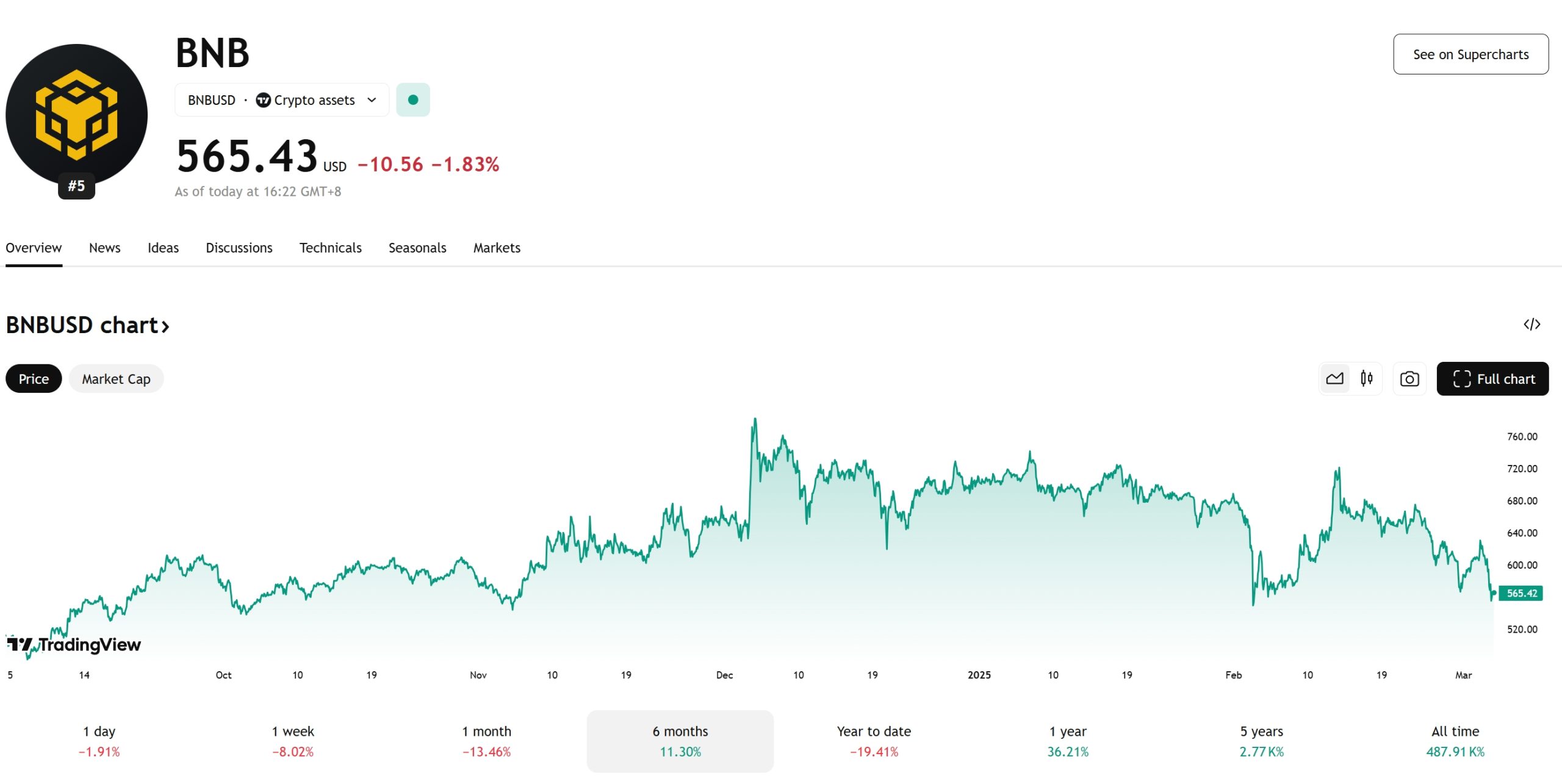

Chart Analysis: Visualizing BNB’s Future

To better understand BNB’s price trends and potential future movements, let’s visualize its historical performance and projections. Below is a line chart using Recharts, a popular library for creating charts in React, styled with Tailwind CSS for a modern and responsive design.

This chart illustrates BNB’s historical price movements in a solid line and its projected future performance in a dashed line. The visual aid helps readers grasp the trends and potential recovery patterns, enhancing the overall understanding of BNB’s trajectory.

This chart illustrates BNB’s historical price movements in a solid line and its projected future performance in a dashed line. The visual aid helps readers grasp the trends and potential recovery patterns, enhancing the overall understanding of BNB’s trajectory.

Actionable Insights for BNB Investors

For those considering investing in BNB, here are some actionable insights:

- Diversify Your Portfolio: While BNB has strong potential, diversifying your investments across different cryptocurrencies can help mitigate risk.

- Stay Informed: Keep up with the latest news and developments within the Binance ecosystem, as these can significantly impact BNB’s price.

- Use Technical Analysis: Leverage tools like RSI, MACD, and Bollinger Bands to make more informed trading decisions based on BNB’s price movements.

- Consider Long-Term Holding: Given BNB’s utility and the growth of the Binance ecosystem, long-term holding could be a viable strategy for maximizing returns.

In conclusion, BNB’s recent price drop to $610.36 should be viewed as a temporary setback rather than a long-term concern. With a strong ecosystem and ongoing developments, BNB is well-positioned to recover and potentially reach new highs in the coming years. By understanding the factors influencing BNB’s price and using the right tools and strategies, beginners can navigate the volatility of the crypto market and make informed investment decisions.

BNB Price Updated on Today, March 19, 2025

The cryptocurrency market is a whirlwind of excitement, and few assets capture the imagination quite like Binance Coin (BNB). As the native token of the Binance ecosystem, its value and potential are hot topics among investors and traders. Today, March 19, 2025, let’s dive into the world of BNB Price Prediction & Forecasts to explore where this powerhouse token might be headed. Whether you’re eyeing the BNB coin price, curious about the BNB token, or tracking the Binance Token BNB, this article will unpack the trends, insights, and possibilities shaping its future.

The Current State of Binance BNB Price

As of now, the Binance BNB price sits in a fascinating spot. While it’s not yet trading live on exchanges—still in a presale phase for some projects like Solaxy—BNB itself remains a titan in the crypto space. Historically, the BNB coin price has shown resilience and growth, driven by its utility within the Binance exchange and the broader BNB Chain ecosystem. But what does today’s landscape tell us about tomorrow? That’s where BNB Price Prediction & Forecasts come into play, blending current data with educated guesses to chart the path ahead.

The crypto market is buzzing with a bullish vibe in Q1 2025, thanks to Bitcoin’s rally and altcoin momentum. This sets a promising stage for the BNB token, which thrives when market sentiment is high. Analysts are watching closely, and the BNB Price Prediction & Forecasts for today suggest a range of outcomes based on its current trajectory and ecosystem developments.

Short-Term BNB Price Prediction & Forecasts

Let’s start with the near future. The BNB coin price today isn’t static—it’s influenced by trading volume, Binance platform updates, and broader market trends. For March 19, 2025, the Binance BNB price could hover around its recent levels, potentially testing resistance points if buying pressure builds. Some enthusiasts on platforms like X have spotted bullish patterns, like double bottoms or hidden divergences, hinting that the BNB token might push toward $650 or even $700 in the coming weeks if it breaks key thresholds.

Short-term BNB Price Prediction & Forecasts often lean on technical analysis—think RSI, moving averages, and support zones. If the Binance Token BNB holds above critical support (say, $550), analysts see a shot at reclaiming highs from late 2024. The presale success of related tokens and Binance’s knack for innovation could juice up the BNB coin price, making it a thrilling watch for day traders and hodlers alike.

Medium-Term Outlook: Binance Token BNB in 2025

Zooming out to the rest of 2025, the BNB Price Prediction & Forecasts get even more intriguing. With Binance expanding its offerings—think new listings, DeFi projects, and token burns—the BNB token could ride a wave of adoption. Experts peg the Binance BNB price reaching $1,000 or more by year-end, especially if the altcoin season kicks into high gear. CoinPedia, for instance, suggests a potential high of $1,292, a tantalizing target for those tracking BNB Price Prediction & Forecasts.

The BNB coin price thrives on utility—discounts on trading fees, staking rewards, and governance perks on the BNB Chain. As Binance rolls out more features, the demand for Binance Token BNB could spike, pushing the BNB Price Prediction & Forecasts into bullish territory. Of course, regulatory hiccups or market dips could temper this ascent, but the ecosystem’s growth keeps the BNB token a standout contender.

Long-Term BNB Price Prediction & Forecasts: 2030 and Beyond

Now, let’s dream big with long-term BNB Price Prediction & Forecasts. By 2030, the Binance BNB price might hit jaw-dropping levels—think $2,000 to $6,000, according to optimistic analysts like Changelly. The BNB coin price could soar as Binance cements its dominance and the BNB token becomes a cornerstone of decentralized finance. Token burns, reducing supply to 100 million BNB, add a deflationary twist that could turbocharge the Binance Token BNB over time.

Imagine a world where the BNB Price Prediction & Forecasts play out with mass adoption—BNB powering payments, smart contracts, and more. The BNB coin price might not just reflect market hype but real-world use. Yet, risks loom: competition from Ethereum or Solana, regulatory shifts, or tech disruptions. Still, the Binance BNB price has a knack for defying odds, making long-term BNB Price Prediction & Forecasts a rollercoaster worth riding.

What Drives the Binance BNB Price?

So, what fuels these BNB Price Prediction & Forecasts? It’s a mix of factors:

- Ecosystem Growth: More users, more dApps, more demand for Binance Token BNB.

- Token Burns: Shrinking supply pumps the **BNB coin price **.

- Market Sentiment: Bull runs lift the BNB token; bear markets test its floor.

- Innovation: Binance’s moves—like zero-fee trading—could jolt the Binance BNB price.

The BNB Price Prediction & Forecasts aren’t crystal balls—they’re educated bets on these drivers. Keep an eye on news, X chatter, and Binance updates to tweak your own take on the BNB coin price.

Wrapping Up: Navigating the Future of BNB

The journey of BNB Price Prediction & Forecasts is a wild one, full of twists and turns. Today’s Binance BNB price is just the starting line—where it goes depends on market magic and Binance’s muscle. Whether you’re in it for the short-term flip or the long-term haul, the BNB token offers a front-row seat to crypto’s evolution. So, buckle up, track those BNB Price Prediction & Forecasts, and see where the Binance Token BNB takes us next!

What’s your take on the BNB coin price? Are you banking on a breakout or playing it cautious? The future of BNB Price Prediction & Forecasts is yours to navigate!