In the ever-evolving world of cryptocurrency, few assets have captured the attention of investors quite like BSC Layer (BSC) Coin. As of March 2025, BSC has experienced a remarkable surge, with its price jumping by an impressive 85.15% in just 24 hours. This sudden spike has left many in the crypto community buzzing with excitement and speculation about what the future holds for this promising digital asset.

BSC Layer, a decentralized platform built on the Binance Smart Chain (BNB Smart Chain), has been making waves in the blockchain ecosystem. Its native cryptocurrency, BSC, serves as the essential bridge connecting BSC Layer protocols with users, facilitating seamless transactions and interactions within the network. The platform’s versatility and scalability have made it a popular choice for a wide range of applications, from decentralized exchanges (DEXs) to non-fungible tokens (NFTs) and decentralized applications (dApps).

The recent price surge of BSC can be attributed to several factors. One of the key drivers has been the growing adoption of BSC Layer’s ecosystem. The platform has been actively fostering innovation and development through its ecosystem fund, which has attracted numerous projects and developers to build on BSC Layer. This increased activity has led to a surge in demand for BSC, driving its price higher.

Another factor contributing to the price surge is the overall bullish sentiment in the cryptocurrency market. As of March 2025, the market has been experiencing a period of optimism, with many investors looking for the next big opportunity. BSC Layer’s strong fundamentals and promising use cases have made it an attractive investment option for those seeking to capitalize on the current market trend.

To better understand the recent price movement of BSC, let’s take a closer look at some key indicators. The Relative Strength Index (RSI) for BSC currently stands at 72, indicating that the asset is in overbought territory. While this may suggest a potential pullback in the short term, it’s important to consider the broader market context and the underlying factors driving the price surge.

The Moving Average Convergence Divergence (MACD) indicator also provides valuable insights into BSC’s price trend. As of March 2025, the MACD line has crossed above the signal line, indicating a bullish momentum. This suggests that the recent price surge may have further room to run, as long as the underlying fundamentals remain strong.

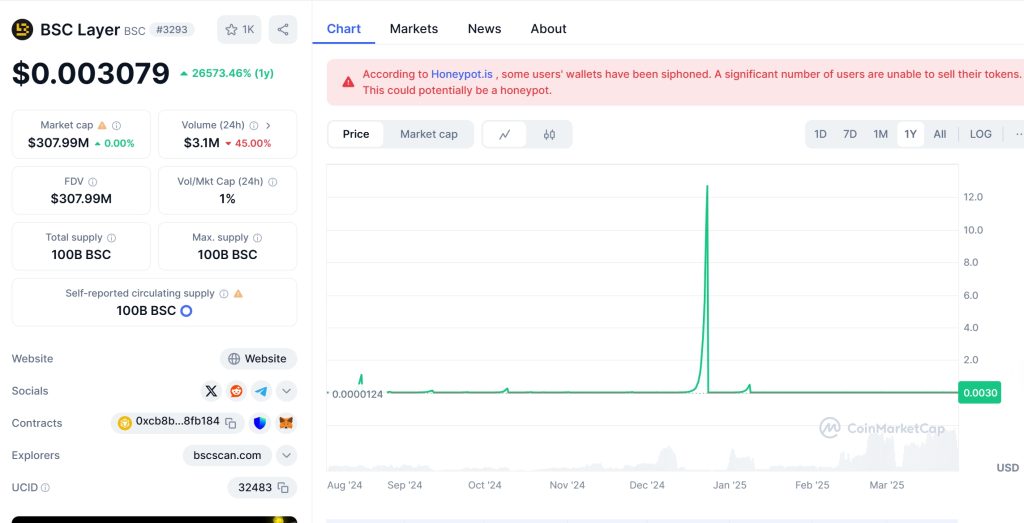

When analyzing BSC’s price movement, it’s also crucial to consider support and resistance levels. The current price of $0.0004106 represents a significant resistance level, as it marks the highest point reached by BSC in the past 24 hours. If the asset can maintain its momentum and break through this resistance, it could pave the way for further gains in the near future.

On the other hand, the support level for BSC currently stands at $0.0003652, which represents the lowest point reached by the asset in the past 24 hours. If the price were to fall below this level, it could signal a potential reversal in the short term. However, given the strong fundamentals and growing adoption of BSC Layer, it’s likely that any pullback would be temporary and followed by a resumption of the upward trend.

To gain a deeper understanding of BSC’s price movement, let’s examine its chart analysis. The 1-day chart for BSC shows a clear uptrend, with the asset consistently making higher highs and higher lows. This bullish pattern suggests that the recent price surge is part of a larger trend, rather than a short-term anomaly.

Looking at the 7-day chart, we can see that BSC has been steadily climbing over the past week, with the recent 24-hour surge representing a continuation of this upward momentum. This longer-term perspective reinforces the notion that BSC’s price movement is driven by fundamental factors, rather than just short-term speculation.

When it comes to long and short-term predictions for BSC, it’s important to consider both the technical and fundamental aspects of the asset. From a technical standpoint, the current price surge and bullish indicators suggest that BSC could continue to rise in the near term. If the asset can break through the current resistance level of $0.0004106, it could potentially reach new highs in the coming weeks.

From a fundamental perspective, the growing adoption of BSC Layer and its ecosystem fund bodes well for the long-term prospects of BSC. As more projects and developers build on the platform, the demand for BSC is likely to increase, driving its price higher over time. Additionally, the scalability and versatility of BSC Layer make it well-positioned to capitalize on the growing demand for decentralized applications and services.

However, it’s important to approach any price prediction with caution, as the cryptocurrency market is known for its volatility and unpredictability. While the current indicators and fundamentals suggest a bullish outlook for BSC, there are always risks and uncertainties that could impact its price in the future.

To provide a more comprehensive analysis of BSC’s recent price surge, let’s compare its trend to that of another popular cryptocurrency, Ethereum (ETH). In the past, Ethereum has experienced similar price movements, with sudden spikes followed by periods of consolidation. One notable example was in 2021 when Ethereum surged from around $1,000 to over $4,000 in a matter of months.

The external events and market conditions that contributed to Ethereum’s price surge included increased institutional adoption, the growth of decentralized finance (DeFi), and the popularity of NFTs. These factors drove demand for Ethereum and pushed its price to new heights. However, after reaching its peak, Ethereum experienced a period of consolidation, with its price fluctuating within a range before eventually resuming its upward trend.

In the case of BSC, the recent price surge can be attributed to similar factors, such as growing adoption and the increasing popularity of decentralized applications. However, there are also some key differences between BSC and Ethereum. BSC Layer’s focus on scalability and low transaction fees sets it apart from Ethereum, which has faced challenges with network congestion and high gas fees in the past.

Given these similarities and differences, it’s possible that BSC could follow a similar recovery pattern to Ethereum. If the asset can maintain its momentum and continue to attract new users and developers, it could potentially reach new highs in the coming months. However, it’s also important to consider the unique characteristics of BSC Layer and the potential challenges it may face in the future.

For investors looking to navigate BSC’s volatility, it’s crucial to approach the asset with a long-term perspective. While short-term price fluctuations are inevitable in the cryptocurrency market, the underlying fundamentals of BSC Layer suggest that it has the potential for sustained growth over time. By focusing on the platform’s adoption, ecosystem development, and real-world applications, investors can make more informed decisions about their BSC investments.

In terms of actionable insights, investors should consider diversifying their portfolios and not putting all their eggs in one basket. While BSC has shown promising growth, it’s important to spread risk across multiple assets to mitigate potential losses. Additionally, staying informed about the latest developments in the BSC Layer ecosystem and the broader cryptocurrency market can help investors make more informed decisions about when to buy, sell, or hold their BSC.

As we look ahead to the future of BSC Layer and its native cryptocurrency, it’s clear that the platform has a lot to offer. With its focus on scalability, low transaction fees, and a growing ecosystem of projects and developers, BSC Layer is well-positioned to capitalize on the increasing demand for decentralized applications and services.

In the coming months, we can expect to see further developments in the BSC Layer ecosystem, including new partnerships, integrations, and use cases. These developments will likely drive increased demand for BSC, pushing its price higher over time. Additionally, as more investors become aware of the potential of BSC Layer, we may see increased institutional adoption, further fueling the asset’s growth.

However, it’s important to approach any investment with caution and to conduct thorough research before making any decisions. While the current indicators and fundamentals suggest a bullish outlook for BSC, there are always risks and uncertainties that could impact its price in the future. By staying informed and maintaining a long-term perspective, investors can navigate the volatility of the cryptocurrency market and potentially reap the rewards of investing in BSC Layer.

In conclusion, the recent 85.15% surge in BSC’s price over the past 24 hours has captured the attention of the crypto community and sparked speculation about its future potential. With its strong fundamentals, growing adoption, and promising use cases, BSC Layer is well-positioned to continue its upward trajectory in the coming months. By staying informed and approaching the asset with a long-term perspective, investors can potentially benefit from the growth of this exciting cryptocurrency.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.