In the ever-evolving world of cryptocurrencies, few stories capture the imagination quite like the meteoric rise of BSC Layer (BSC) Coin. As of March 2025, BSC has surged to a price of $0.002706, marking an astonishing 412.65% increase in just one day. This dramatic price movement has left many investors and enthusiasts buzzing with excitement and speculation about what the future holds for this promising blockchain platform. Let’s dive into the details of this surge, explore the underlying factors, and consider what might be on the horizon for BSC Layer.

Contents

- 1 The Surge of BSC Layer: A Closer Look

- 2 Understanding BSC Layer’s Ecosystem

- 3 Factors Behind the Price Surge

- 4 Technical Analysis: Key Indicators and Trends

- 5 Support and Resistance Levels

- 6 Comparing BSC Layer to Other Cryptocurrencies

- 7 Long-Term Predictions for BSC Layer

- 8 Navigating BSC Layer’s Volatility: Tips for Investors

- 9 The Future of BSC Layer: Opportunities and Challenges

- 10 Conclusion: Embracing the Potential of BSC Layer

The Surge of BSC Layer: A Closer Look

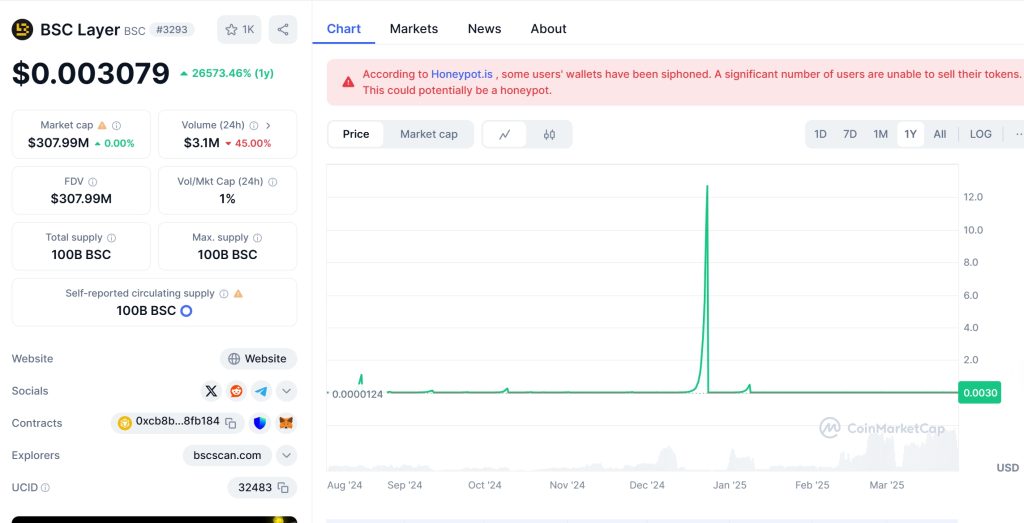

The recent price surge of BSC Layer to $0.002706 is nothing short of remarkable. To put this into perspective, just a day ago, BSC was trading at a significantly lower price, and now it has catapulted to new heights. This kind of volatility is not uncommon in the crypto market, but the magnitude of this increase is certainly noteworthy.

One of the key aspects to consider is the volume of trading that accompanied this surge. With a 24-hour trading volume of $3.49 million, it’s clear that there was significant interest and activity around BSC Layer. This high volume suggests that the price movement was not just a fluke but rather a reflection of strong market sentiment and possibly new developments within the BSC Layer ecosystem.

Understanding BSC Layer’s Ecosystem

BSC Layer, built on the Binance Smart Chain (BNB Smart Chain), is a decentralized platform that facilitates seamless transactions and interactions within its network. It’s designed as a layer-1 blockchain, which means it operates independently and supports smart contracts, enabling a wide range of applications from decentralized exchanges (DEXs) to non-fungible tokens (NFTs) and decentralized applications (dApps).

The platform’s native cryptocurrency, BSC, serves as the essential bridge connecting BSC Layer protocols with users. This connectivity is crucial for the ecosystem’s growth, enabling a cohesive and integrated blockchain environment. BSC Layer’s versatility and scalability make it an attractive option for developers and users looking to leverage blockchain technology for various use cases.

Factors Behind the Price Surge

Several factors could have contributed to the recent price surge of BSC Layer. One potential catalyst is the growing interest in decentralized finance (DeFi) and the increasing adoption of BSC Layer for DeFi applications. As more projects and users flock to the platform, the demand for BSC naturally increases, driving up its price.

Another factor could be the recent developments within the BSC Layer ecosystem. For instance, the launch of new dApps or the integration of BSC Layer with other blockchain networks could have sparked renewed interest and investment in the platform. Additionally, positive news or announcements from the BSC Layer team, such as partnerships or technological upgrades, could have also played a role in boosting investor confidence and driving the price higher.

Technical Analysis: Key Indicators and Trends

To gain a deeper understanding of BSC Layer’s price movement, let’s take a look at some key technical indicators. The Relative Strength Index (RSI) is currently at a high level, indicating that BSC may be overbought in the short term. However, this doesn’t necessarily mean a reversal is imminent, as strong bullish momentum can sometimes push the RSI to extreme levels.

The Moving Average Convergence Divergence (MACD) is showing a bullish crossover, with the MACD line moving above the signal line. This suggests that the upward momentum in BSC’s price is likely to continue in the near term. Additionally, the Bollinger Bands are expanding, indicating increased volatility and potential for further price movement.

When we look at the chart, we can see that BSC has broken out of a consolidation pattern, which often precedes significant price movements. The breakout above the resistance level of $0.002706 is a strong bullish signal, suggesting that BSC could continue to climb higher in the coming days.

Support and Resistance Levels

Identifying critical support and resistance levels is essential for understanding BSC Layer’s price behavior. The current price of $0.002706 represents a new resistance level that BSC has just broken through. If the price can maintain above this level, it could signal further upward momentum.

On the downside, the next significant support level is around $0.0004289, which was the low point in the last 24 hours. If BSC were to fall back to this level, it could indicate a potential reversal or consolidation period. However, given the strong bullish sentiment and recent developments, it’s more likely that BSC will continue to test higher resistance levels in the near future.

Comparing BSC Layer to Other Cryptocurrencies

To put BSC Layer’s price surge into context, let’s compare it to the performance of other cryptocurrencies. One notable comparison is with Dogecoin (DOGE), which experienced a similar rapid price increase in the past. In May 2021, DOGE surged by over 100% in a single day, driven by social media hype and endorsements from high-profile figures.

While the factors behind BSC Layer’s surge may differ from those of Dogecoin, the pattern of rapid price movement is similar. Both cryptocurrencies experienced significant volatility and attracted a lot of attention from investors and traders. However, unlike Dogecoin, which is often seen as a meme coin, BSC Layer has a more robust technological foundation and a clear use case within the DeFi ecosystem.

Another comparison can be made with Ethereum (ETH), which has also seen significant price movements in the past. In November 2021, Ethereum surged to an all-time high of over $4,800, driven by the growing adoption of DeFi and NFTs on its platform. Like Ethereum, BSC Layer is positioning itself as a scalable and efficient blockchain for decentralized applications, which could contribute to its long-term growth potential.

Long-Term Predictions for BSC Layer

Looking ahead to the rest of 2025 and beyond, what can we expect from BSC Layer? Given the recent price surge and the underlying fundamentals of the platform, there are several factors that could influence its future trajectory.

First, the continued growth of the DeFi sector is likely to benefit BSC Layer. As more projects and users turn to decentralized finance for lending, borrowing, and trading, the demand for BSC as a utility token within the ecosystem is expected to increase. This could drive the price higher over the long term.

Second, the scalability and efficiency of BSC Layer could attract more developers and projects to build on the platform. The ability to handle high transaction volumes and support complex smart contracts is a significant advantage over other blockchains, which could lead to increased adoption and investment in BSC Layer.

Third, the integration of BSC Layer with other blockchain networks could further enhance its utility and value. By serving as a bridge between different ecosystems, BSC Layer could become a crucial component of the broader blockchain infrastructure, driving demand for its native token.

Based on these factors, it’s reasonable to predict that BSC Layer could continue to experience significant growth in the coming years. While short-term volatility is to be expected, the long-term outlook for BSC appears promising, with potential price targets ranging from $0.01 to $0.10 by the end of 2025, depending on market conditions and adoption rates.

For investors looking to capitalize on BSC Layer’s potential, it’s important to approach the market with caution and a clear strategy. Here are some tips to help navigate the volatility and make informed investment decisions:

- Do Your Research: Before investing in BSC Layer or any other cryptocurrency, take the time to understand the project’s fundamentals, team, and roadmap. Look for credible sources of information and stay updated on the latest developments within the ecosystem.

- Diversify Your Portfolio: While BSC Layer shows promise, it’s essential to diversify your investments across different assets to mitigate risk. Consider allocating a portion of your portfolio to BSC while also investing in other cryptocurrencies and traditional assets.

- Set Clear Goals and Risk Tolerance: Determine your investment goals and risk tolerance before entering the market. Are you looking for short-term gains or long-term growth? How much are you willing to risk? Having a clear plan in place can help you make more rational decisions during periods of volatility.

- Use Technical Analysis: While not a crystal ball, technical analysis can provide valuable insights into market trends and potential price movements. Use tools like RSI, MACD, and Bollinger Bands to identify entry and exit points for your trades.

- Stay Informed: The crypto market is constantly evolving, with new developments and news impacting prices. Stay informed by following reputable sources, joining online communities, and participating in discussions about BSC Layer and the broader crypto ecosystem.

- Consider Dollar-Cost Averaging: Instead of investing a lump sum, consider using a dollar-cost averaging strategy to spread out your investments over time. This can help reduce the impact of short-term volatility and potentially lead to better long-term returns.

By following these tips and staying disciplined, investors can navigate the exciting but challenging world of BSC Layer and potentially reap the rewards of its growth.

The Future of BSC Layer: Opportunities and Challenges

As BSC Layer continues to evolve and grow, it faces both opportunities and challenges on its path to mainstream adoption. One of the key opportunities is the increasing demand for scalable and efficient blockchain solutions. As more businesses and individuals turn to decentralized technologies, BSC Layer’s ability to handle high transaction volumes and support complex applications positions it well for future growth.

Another opportunity lies in the expanding DeFi sector. With the rise of decentralized lending, borrowing, and trading platforms, BSC Layer’s role as a utility token within the ecosystem could become increasingly valuable. By providing a secure and efficient infrastructure for DeFi applications, BSC Layer could attract more users and drive demand for its native token.

However, there are also challenges that BSC Layer must overcome. One of the main challenges is competition from other blockchain platforms. With the likes of Ethereum, Solana, and Polkadot vying for market share, BSC Layer will need to continue innovating and differentiating itself to stand out in the crowded field.

Another challenge is regulatory uncertainty. As governments around the world grapple with how to regulate cryptocurrencies and blockchain technology, BSC Layer may face legal and compliance hurdles that could impact its growth and adoption. Navigating these regulatory challenges will be crucial for the platform’s long-term success.

Despite these challenges, the future looks bright for BSC Layer. With a strong technological foundation, a growing ecosystem of applications, and a dedicated community of supporters, BSC Layer is well-positioned to capitalize on the opportunities in the blockchain space. As the platform continues to evolve and expand, it could play a significant role in shaping the future of decentralized finance and beyond.

Conclusion: Embracing the Potential of BSC Layer

In conclusion, the recent surge of BSC Layer to $0.002706 is a testament to the platform’s potential and the growing interest in decentralized technologies. With a robust ecosystem, strong fundamentals, and a clear vision for the future, BSC Layer is poised to continue its upward trajectory in the coming years.

For investors and enthusiasts alike, BSC Layer offers an exciting opportunity to be part of the next wave of blockchain innovation. By staying informed, conducting thorough research, and approaching the market with a disciplined strategy, you can navigate the volatility and potentially reap the rewards of BSC Layer’s growth.

As we look to the future, it’s clear that BSC Layer has the potential to revolutionize the way we think about decentralized finance, digital assets, and blockchain technology. Whether you’re a seasoned investor or just starting your crypto journey, BSC Layer is a project worth keeping an eye on as it continues to surge forward in the ever-evolving world of cryptocurrencies.