There’s arguably no hotter cryptocurrency on the planet right now than the BSR (BTC Strategic Reserve) Coin. It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. The buzz around BTC Strategic Reserve is palpable, and it’s not just about the numbers. It’s about the potential to reshape the future of finance in ways we’re only beginning to understand.

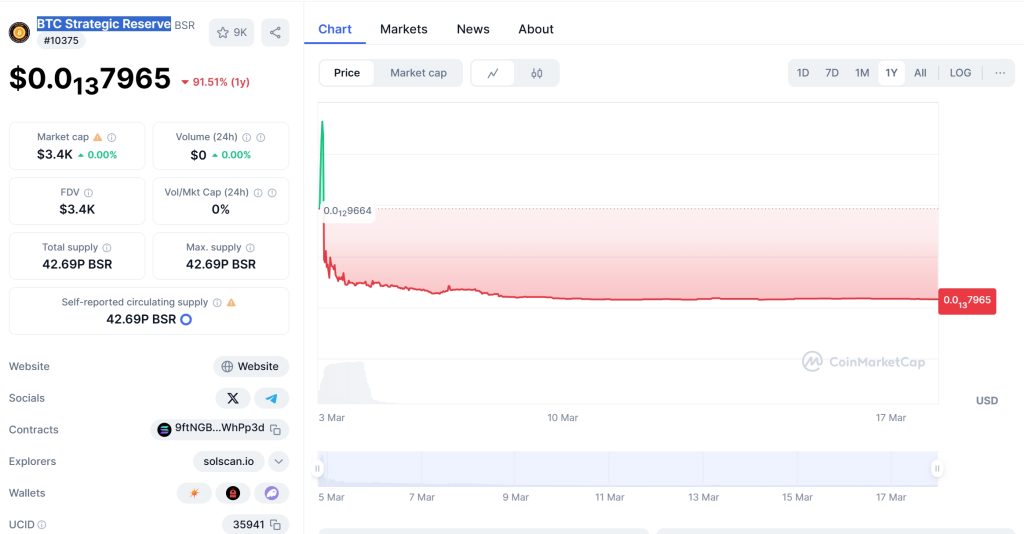

BSR Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $0.0₁₂2310, fueled by strong market sentiment. However, the rally was short-lived, and the coin has since experienced a significant drop from its peak. This has left many investors wondering what the future holds for BSR Coin.

BSR Coin Price Prediction remains a hot topic as investors scrutinize every price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new financial reserve solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy BSR Coin at its current price?” Let’s explore the potential trajectory of this fascinating crypto asset.

Contents

Can BSR Coin Recover After Dropping to $0.0₁₃7206?

The recent price drop of BSR Coin from $0.0₁₂2310 to $0.0₁₃7206 has sparked concern among investors. To understand this better, let’s compare BSR Coin’s trend to that of Ethereum, another cryptocurrency that has experienced significant price fluctuations in the past. Ethereum saw a similar drop in 2022, triggered by regulatory uncertainty and market sell-offs. However, it managed to recover, reaching new highs by mid-2024 due to increased adoption and positive developments in its ecosystem.

BSR Coin’s recent decline can be attributed to several factors, including broader market corrections and specific events like the introduction of new regulations in some countries. Despite this, the fundamentals of BSR Coin remain strong. The project’s focus on creating a strategic reserve for Bitcoin, aimed at stabilizing the market and providing a safety net, is still highly relevant. The potential ROI for BSR Coin by April 17, 2025, is predicted to be 227.55%, suggesting a robust recovery potential if market conditions stabilize.

Historical data and technical indicators suggest that BSR Coin might follow a similar recovery pattern to Ethereum. The current sentiment is bearish, with the Fear & Greed Index showing 34 (Fear), but this could be an opportunity for investors to buy at a lower price. The 14-Day RSI of 31.29 indicates that the coin is currently oversold, which often precedes a price rebound.

What Caused BSR Coin’s Price Drop, and Will It Bounce Back?

The primary cause of BSR Coin’s price drop can be traced back to broader market trends and specific regulatory news. The cryptocurrency market as a whole has been experiencing volatility due to macroeconomic factors and regulatory developments. For BSR Coin, news of potential regulatory scrutiny on crypto reserves led to a sell-off among investors, causing the price to tumble.

However, the long-term outlook for BSR Coin remains positive. The project’s goal of creating a strategic reserve for Bitcoin is an innovative approach to stabilizing the market. By holding a reserve of Bitcoin, BSR Coin aims to mitigate the risks associated with market fluctuations, making it an attractive option for investors seeking stability in the crypto space.

The forecasts for BSR Coin in 2025 are bullish. Analysts expect the price to rise by 97.64% in March, reaching a high of $0.0₁₂2393. This prediction comes after a poor market performance in the last 30 days, indicating a possible reversal of the trend. The potential ROI stands at 232.07%, suggesting a profitable opportunity for long traders.

Lessons From Ethereum: Could BSR Coin Follow a Similar Path?

Ethereum’s journey from its price drop in 2022 to its recovery in 2024 offers valuable lessons for BSR Coin. Ethereum’s recovery was driven by increased adoption, the launch of new features like Ethereum 2.0, and a growing ecosystem of decentralized applications. BSR Coin, with its focus on Bitcoin reserve stability, could follow a similar path if it continues to develop its infrastructure and gain broader market acceptance.

One key indicator to watch is the Relative Strength Index (RSI), which currently stands at 31.29 for BSR Coin. An RSI below 30 is typically considered oversold, suggesting that a price rebound may be imminent. Additionally, the Moving Average Convergence Divergence (MACD) and Bollinger Bands can provide further insights into potential price movements.

BSR Coin’s long-term predictions are optimistic. By 2026, the coin is forecasted to trade in a price channel between $0.0₁₃5886 and $0.0₁₂1951, with an average price of $0.0₁₂1372. This represents a potential ROI of 170.70%, indicating a bullish trend over the next year.

Navigating the volatility of BSR Coin requires a strategic approach. For beginners, it’s essential to understand the key indicators and market trends that can influence price movements. The current bearish sentiment, as indicated by the Fear & Greed Index, suggests caution. However, the potential for a significant ROI in the coming months could make BSR Coin an attractive investment.

One strategy is to use dollar-cost averaging, investing a fixed amount at regular intervals to mitigate the impact of volatility. This approach can help investors take advantage of lower prices without trying to time the market. Additionally, staying informed about regulatory developments and market news can provide valuable insights into potential price movements.

For those considering investing in BSR Coin, it’s crucial to conduct thorough research and understand the project’s fundamentals. The goal of creating a strategic reserve for Bitcoin is a unique proposition that sets BSR Coin apart from other cryptocurrencies. By focusing on stability and long-term growth, BSR Coin has the potential to offer significant returns for patient investors.

In conclusion, the journey of BSR Coin from its recent price drop to its potential future growth is a fascinating story of resilience and innovation. As the cryptocurrency market continues to evolve, BSR Coin’s focus on creating a strategic reserve for Bitcoin could position it as a key player in the quest for a more stable and secure financial future. Whether you’re a seasoned investor or just starting your crypto journey, understanding the potential of BSR Coin is essential for making informed investment decisions.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.