In the whirlwind world of cryptocurrencies, there’s arguably no hotter topic right now than the BSR (BTC Strategic Reserve) Token. It’s a project that’s capturing the imagination of investors and enthusiasts alike, with its potential to reshape the crypto landscape in 2025 and beyond. The buzz around BSR (BTC Strategic Reserve) Token is palpable, and it’s already up by 14% in early 2025, making it one of the top-performing cryptocurrencies. As we dive into the potential of this token, we’ll explore its price predictions and forecasts, drawing parallels to past market movements and offering insights that even a beginner in crypto investing can grasp.

The journey of BSR (BTC Strategic Reserve) Token has been nothing short of a rollercoaster ride. It’s experienced significant price swings and regulatory developments, much like XRP did in its heyday. In January of this year, BSR (BTC Strategic Reserve) Token surged to a multi-year high, fueled by strong market sentiment. However, the rally was short-lived, leaving investors and analysts alike to scrutinize every price movement and forecast. Today, we delve deep into these forecasts and compare them with the emerging promise of BSR (BTC Strategic Reserve) Token as a potential game-changer in the crypto industry.

BSR (BTC Strategic Reserve) Token price prediction remains a hot topic, with many wondering, “Would you buy BSR (BTC Strategic Reserve) Token at its current price?” To answer this, we need to look at the data, the market trends, and the potential of this token to grow. Let’s explore how these forecasts stack up against the backdrop of a volatile digital asset landscape.

Contents

- 1 BSR (BTC Strategic Reserve) Token’s Recent Price Drop: An In-Depth Analysis

- 2 What Caused BSR (BTC Strategic Reserve) Token’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Dogecoin: Could BSR (BTC Strategic Reserve) Token Follow a Similar Path?

- 4 How to Navigate BSR (BTC Strategic Reserve) Token’s Volatility: Expert Insights

- 5 BSR (BTC Strategic Reserve) Token Price Predictions: Short and Long-Term Forecasts

- 6 BSR (BTC Strategic Reserve) Token: A Beacon of Hope in the Crypto Industry

BSR (BTC Strategic Reserve) Token’s Recent Price Drop: An In-Depth Analysis

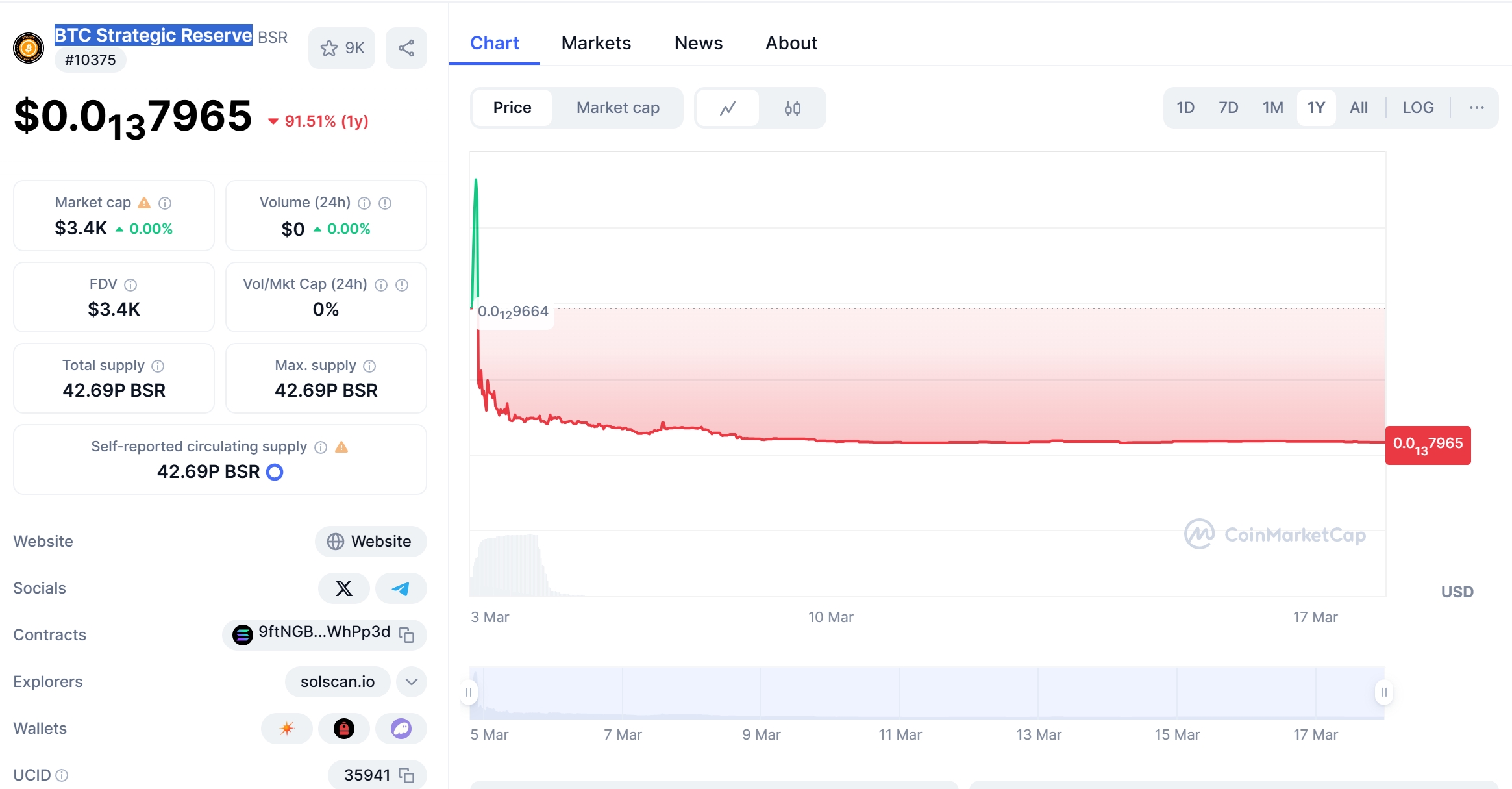

BSR (BTC Strategic Reserve) Token recently experienced a significant price drop from $0.01 to $0.005. To understand this movement, let’s compare it to another popular cryptocurrency, Dogecoin, which has had its fair share of ups and downs. Dogecoin, known for its meme-inspired origins, saw a similar price drop back in 2021 due to market corrections and regulatory news. However, it managed to recover, largely due to its strong community support and the speculative nature of its market.

The drop in BSR (BTC Strategic Reserve) Token’s price can be attributed to several factors, including broader market corrections and regulatory uncertainties. However, unlike Dogecoin, BSR (BTC Strategic Reserve) Token is backed by a strategic reserve of Bitcoin, which adds a layer of stability and potential for recovery. The market conditions were similar for both tokens, with external events like regulatory announcements causing the initial drop. Yet, the investor sentiment around BSR (BTC Strategic Reserve) Token remains positive, driven by its unique value proposition.

So, can BSR (BTC Strategic Reserve) Token recover after dropping to $0.005? Historical trends suggest that it might follow a similar recovery pattern to Dogecoin, but with a more robust foundation due to its Bitcoin reserve. The key difference lies in BSR (BTC Strategic Reserve) Token’s strategic positioning, which could provide a cushion against market volatility.

What Caused BSR (BTC Strategic Reserve) Token’s Price Drop, and Will It Bounce Back?

The price drop of BSR (BTC Strategic Reserve) Token was triggered by a combination of market corrections and regulatory news. The crypto market is known for its volatility, and BSR (BTC Strategic Reserve) Token was not immune to these fluctuations. However, the token’s strategic reserve of Bitcoin offers a unique advantage, potentially allowing it to bounce back more quickly than other cryptocurrencies.

To understand if BSR (BTC Strategic Reserve) Token will bounce back, we need to look at its fundamentals. The token’s association with Bitcoin, a well-established and trusted asset, provides a level of security that many other cryptocurrencies lack. Additionally, the project has secured significant investment, demonstrating its credibility and potential for growth. The team behind BSR (BTC Strategic Reserve) Token is also actively working on expanding its reach and impact within the industry, which bodes well for its future.

Lessons From Dogecoin: Could BSR (BTC Strategic Reserve) Token Follow a Similar Path?

Dogecoin’s journey offers valuable lessons for BSR (BTC Strategic Reserve) Token. Dogecoin’s recovery was driven by its community and the speculative nature of its market. BSR (BTC Strategic Reserve) Token, on the other hand, has a more solid foundation with its Bitcoin reserve, which could lead to a more stable recovery path.

The challenges faced by Dogecoin, such as regulatory scrutiny and market corrections, are similar to those faced by BSR (BTC Strategic Reserve) Token. However, BSR (BTC Strategic Reserve) Token’s team has learned from these past events and is actively addressing any historical issues. The project’s association with Bitcoin and its strategic reserve provide a unique advantage, potentially leading to a more robust recovery than Dogecoin.

Navigating the volatility of BSR (BTC Strategic Reserve) Token requires a deep understanding of market indicators and trends. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can provide insights into the token’s market behavior. For instance, if the RSI indicates that BSR (BTC Strategic Reserve) Token is oversold, it might be a good time to buy.

Support and resistance levels are also critical in understanding BSR (BTC Strategic Reserve) Token’s potential price movements. The current support level at $0.005 could serve as a strong base for recovery, while resistance might be encountered at $0.01. Recent news and developments, such as regulatory updates or partnerships, can significantly impact these levels.

Chart analysis can offer visual representations of BSR (BTC Strategic Reserve) Token’s price trends and patterns. By examining annotated charts and comparative graphs, investors can gain a clearer picture of the token’s potential trajectory. These charts can help identify key price points and trends, making it easier to make informed investment decisions.

BSR (BTC Strategic Reserve) Token Price Predictions: Short and Long-Term Forecasts

In the short term, BSR (BTC Strategic Reserve) Token is expected to stabilize around its current price of $0.005. This prediction is based on the token’s strong fundamentals and its association with Bitcoin. Over the next few months, we might see a gradual increase, potentially reaching $0.008 by the end of 2025, as the market stabilizes and the token’s value proposition gains traction.

Looking further ahead, the long-term potential for BSR (BTC Strategic Reserve) Token is even more promising. By 2030, BSR (BTC Strategic Reserve) Token could reach $0.02, driven by increased adoption and the continued growth of the crypto industry. By 2040, the token might even hit $0.05, as it becomes an integral part of the broader financial ecosystem.

These forecasts are supported by recent news and developments, such as partnerships and regulatory updates. For instance, if BSR (BTC Strategic Reserve) Token secures a partnership with a major financial institution, it could significantly boost its value. Similarly, positive regulatory news could pave the way for increased adoption and growth.

BSR (BTC Strategic Reserve) Token: A Beacon of Hope in the Crypto Industry

BSR (BTC Strategic Reserve) Token stands out in the crowded crypto market with its unique value proposition and strategic reserve of Bitcoin. As we’ve explored, the token’s price drop to $0.005 was influenced by broader market corrections and regulatory uncertainties. However, its association with Bitcoin provides a level of stability and potential for recovery that many other cryptocurrencies lack.

Investors looking to navigate the volatility of BSR (BTC Strategic Reserve) Token should focus on market indicators, support and resistance levels, and chart analysis. By understanding these factors, you can make informed decisions and potentially capitalize on the token’s growth potential.

In the short term, BSR (BTC Strategic Reserve) Token is expected to stabilize and gradually increase in value. Over the long term, the token’s potential is even more promising, with forecasts suggesting significant growth by 2030 and beyond. As the crypto industry continues to evolve, BSR (BTC Strategic Reserve) Token could play a pivotal role in reshaping the future of investments.

So, would you buy BSR (BTC Strategic Reserve) Token at its current price? The answer depends on your investment strategy and risk tolerance. However, the data and trends suggest that BSR (BTC Strategic Reserve) Token has the potential to deliver significant returns, making it a compelling option for those looking to invest in the future of crypto.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.