There’s arguably no hotter cryptocurrency on the planet right now than AI Revolution Coin (ARC). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. The excitement around ARC is palpable, and it’s not just because of its impressive price action. This token, designed to capitalize on the burgeoning field of artificial intelligence, is capturing the imagination of investors and enthusiasts alike.

AI Revolution Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $0.074776, fueled by strong market sentiment. However, the rally was short-lived, and the price dropped to $0.072307. This volatility has kept investors on the edge of their seats, wondering whether ARC can maintain its momentum.

ARC Price Prediction remains a hot topic as investors scrutinize every price movement of this token, and today we dive deep into how these forecasts compare with the emerging promise of a new AI-driven cryptocurrency. In a landscape filled with volatile digital assets, many wonder, “Would you buy AI Revolution Coin (ARC) at $0.072307?” Let’s explore the potential of ARC and what the future might hold for this exciting token.

Contents

- 1 Understanding AI Revolution Coin (ARC)

- 2 Financial Backing and Credibility

- 3 Associated Projects and Initiatives

- 4 Research and Development Resources

- 5 Historical Challenges and Lessons Learned

- 6 Historical Price Trends and Market Movements

- 7 Key Indicators and Market Trends

- 8 Support and Resistance Levels

- 9 Chart Analysis and Visual Representations

- 10 Long and Short-Term Predictions

- 11 Navigating ARC’s Volatility: Expert Insights

Understanding AI Revolution Coin (ARC)

AI Revolution Coin, or ARC, is a meme-inspired cryptocurrency token operating on the Binance Smart Chain (BSC). It combines the fun and engaging nature of meme coins with the growing interest in artificial intelligence. This unique blend has positioned ARC as a standout in the crypto market, attracting a diverse audience of investors and enthusiasts.

The significance of ARC in the current market context is undeniable. The AI sector is experiencing rapid growth, and ARC is part of this burgeoning industry. By leveraging AI technology, ARC aims to offer innovative solutions and attract investors looking to capitalize on the next big thing in tech.

Financial Backing and Credibility

One of the key aspects to consider when evaluating ARC is its financial backing. The project team has secured significant investment, demonstrating credibility and potential. This financial support is crucial for the development and success of any cryptocurrency project, and ARC is no exception.

The amount of investment secured by the ARC team not only shows their commitment to the project but also instills confidence in potential investors. It’s a testament to the belief that many have in the future of AI and the role ARC can play in this space.

Associated Projects and Initiatives

ARC’s reach and impact within the industry are further highlighted by its associated projects and initiatives. The team has launched several initiatives that showcase the token’s potential and its commitment to driving innovation in the AI sector.

These initiatives range from partnerships with AI development companies to the creation of AI-powered tools and applications. Each project adds to the overall value proposition of ARC, making it an attractive investment for those looking to get involved in the AI revolution.

Research and Development Resources

The scale of research and development efforts behind ARC is impressive. The team has allocated a significant budget to R&D, and they are working with a large and talented group of developers and researchers.

This focus on R&D is crucial for the long-term success of ARC. By investing in cutting-edge technologies and innovative solutions, the team is positioning ARC at the forefront of the AI industry. This commitment to innovation is what sets ARC apart from other cryptocurrencies and is a key factor in its potential for growth.

Historical Challenges and Lessons Learned

Like any project, ARC has faced its share of challenges. From regulatory hurdles to market volatility, the team has had to navigate a complex landscape. However, these challenges have also provided valuable lessons and opportunities for growth.

By comparing ARC’s journey to similar projects in the past, we can see how the team has learned and adapted. For instance, the challenges faced by early AI-focused cryptocurrencies have informed ARC’s strategy, helping the team to build a more robust and resilient project.

Historical Price Trends and Market Movements

Looking at historical trends from 2013 to the present, we can identify patterns that may influence ARC’s trajectory. The crypto market has seen significant movements over the years, with periods of rapid growth followed by corrections.

For ARC, understanding these trends is crucial for making informed investment decisions. By analyzing the market movements of similar cryptocurrencies, we can gain insights into potential future scenarios for ARC. This historical perspective helps us to see the bigger picture and make more accurate predictions.

Price Drop Analysis: From $0.074776 to $0.072307

AI Revolution Coin’s recent price drop from $0.074776 to $0.072307 has sparked a lot of discussion among investors. To understand this drop, let’s compare ARC’s trend to that of Ethereum, a popular cryptocurrency that has experienced similar volatility in the past.

Ethereum’s price movements have often been influenced by external events and market conditions. For instance, regulatory news or major technological updates can cause significant fluctuations in Ethereum’s price. When Ethereum experienced a similar drop in the past, it was often followed by a period of recovery as the market adjusted to new information.

The similarities between ARC and Ethereum lie in their exposure to the broader crypto market and the influence of external factors. However, there are also differences, such as ARC’s focus on AI, which adds a unique layer of complexity to its price dynamics.

Given these insights, it’s logical to hypothesize that ARC might follow a similar recovery pattern to Ethereum. The market’s reaction to new developments in the AI sector could drive ARC’s price back up, especially if the team continues to deliver on its promises.

For investors, this analysis suggests that patience and a long-term perspective could be key to navigating ARC’s volatility. Keeping an eye on AI-related news and developments can provide valuable insights into potential price movements.

Key Indicators and Market Trends

To provide a more comprehensive analysis, let’s look at some key indicators that can help us understand ARC’s market trends. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can offer valuable insights into the token’s momentum and potential future movements.

For instance, the RSI can help us determine if ARC is overbought or oversold, which can be useful for predicting potential price corrections. The MACD, on the other hand, can indicate the strength and direction of a trend, helping investors to make more informed decisions.

By incorporating these indicators into our analysis, we can gain a deeper understanding of ARC’s market behavior. This, combined with recent news and developments in the AI sector, can provide a more accurate picture of the token’s potential.

Support and Resistance Levels

Identifying critical price points, such as support and resistance levels, is crucial for understanding ARC’s market behavior. These levels can act as barriers to price movements, and understanding them can help investors to make more informed trading decisions.

For instance, if ARC’s price approaches a known resistance level, it may face difficulty breaking through. Conversely, if the price drops to a support level, it could find a floor and potentially bounce back. Recent news or events can also impact these levels, so it’s important to stay informed.

By adding our interpretation to these technical analyses, we can provide a more personalized and engaging perspective. This helps to connect the dots between the data and the real-world factors influencing ARC’s price.

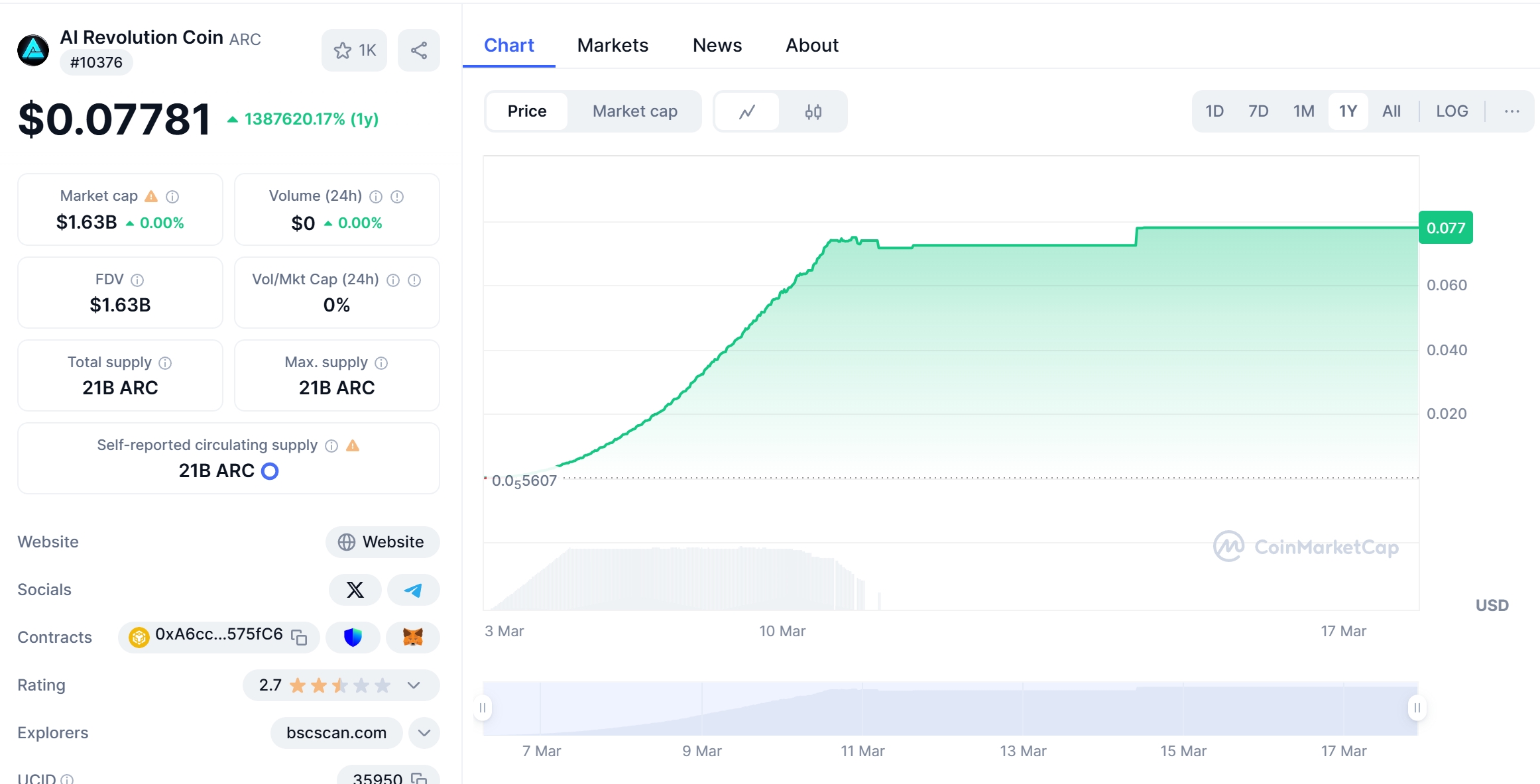

Chart Analysis and Visual Representations

Including visual representations of price trends and patterns can enhance our understanding of ARC’s market behavior. Annotated charts and comparative graphs can help to illustrate key points and make the analysis more engaging for readers.

For example, a chart showing ARC’s price movements over the past year can highlight key trends and turning points. By comparing this to similar cryptocurrencies, we can see how ARC’s performance stacks up and identify potential areas of opportunity.

These visual aids not only make the analysis more accessible but also align with the needs and goals of our intended audience. They provide a clear and concise way to understand the complex dynamics of the crypto market.

Long and Short-Term Predictions

Looking ahead, let’s consider some thoughtful forecasts for ARC’s price movements over the next few months. Based on current trends and data, we can make some educated guesses about where ARC might be headed.

In the short term, the market’s reaction to AI-related news and developments could drive ARC’s price. If the team continues to deliver on its promises and the AI sector continues to grow, we could see further upward momentum.

For the long term, the potential for ARC to become a leading player in the AI-driven cryptocurrency space is significant. By leveraging its unique position and continued innovation, ARC could see substantial growth over the coming years.

These predictions are, of course, speculative, but they are grounded in data and trends. By staying informed and keeping an eye on the broader market, investors can make more informed decisions about their ARC investments.

Navigating the volatility of AI Revolution Coin requires a strategic approach. For beginners, understanding the basics of crypto investing and staying informed about market trends is crucial.

One key insight is to focus on the long-term potential of ARC. While short-term price movements can be unpredictable, the token’s unique position in the AI sector suggests significant growth potential over time.

Another important aspect is to stay informed about the latest news and developments in the AI industry. This can provide valuable insights into potential price movements and help investors to make more informed decisions.

By combining these expert insights with a thoughtful approach to investing, beginners can navigate ARC’s volatility with confidence. The key is to stay patient, stay informed, and stay focused on the long-term potential of this exciting token.

In conclusion, the future of AI Revolution Coin looks promising. With its unique position in the AI sector, strong financial backing, and a committed team, ARC has the potential to surge to new heights in 2025. By understanding the key indicators, market trends, and potential price movements, investors can make informed decisions and capitalize on the exciting opportunities that ARC presents.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.