In the ever-evolving world of cryptocurrency, there’s a buzz around one particular token that’s capturing the attention of investors and enthusiasts alike: the UTYA Token. With recent developments and a controversial price prediction from a notable critic, the UTYA Token has become a focal point of discussion. As we dive into the intricacies of this digital asset, let’s explore whether UTYA can truly surge to new heights in 2025 and what this could mean for your investment strategy.

The UTYA Token, a community-driven memecoin on The Open Network (TON) blockchain, has been inspired by Telegram’s beloved Duck Emoji. Its mission? To foster joy and unity among users. But beyond its charming origins, what makes UTYA a compelling investment? Let’s break it down.

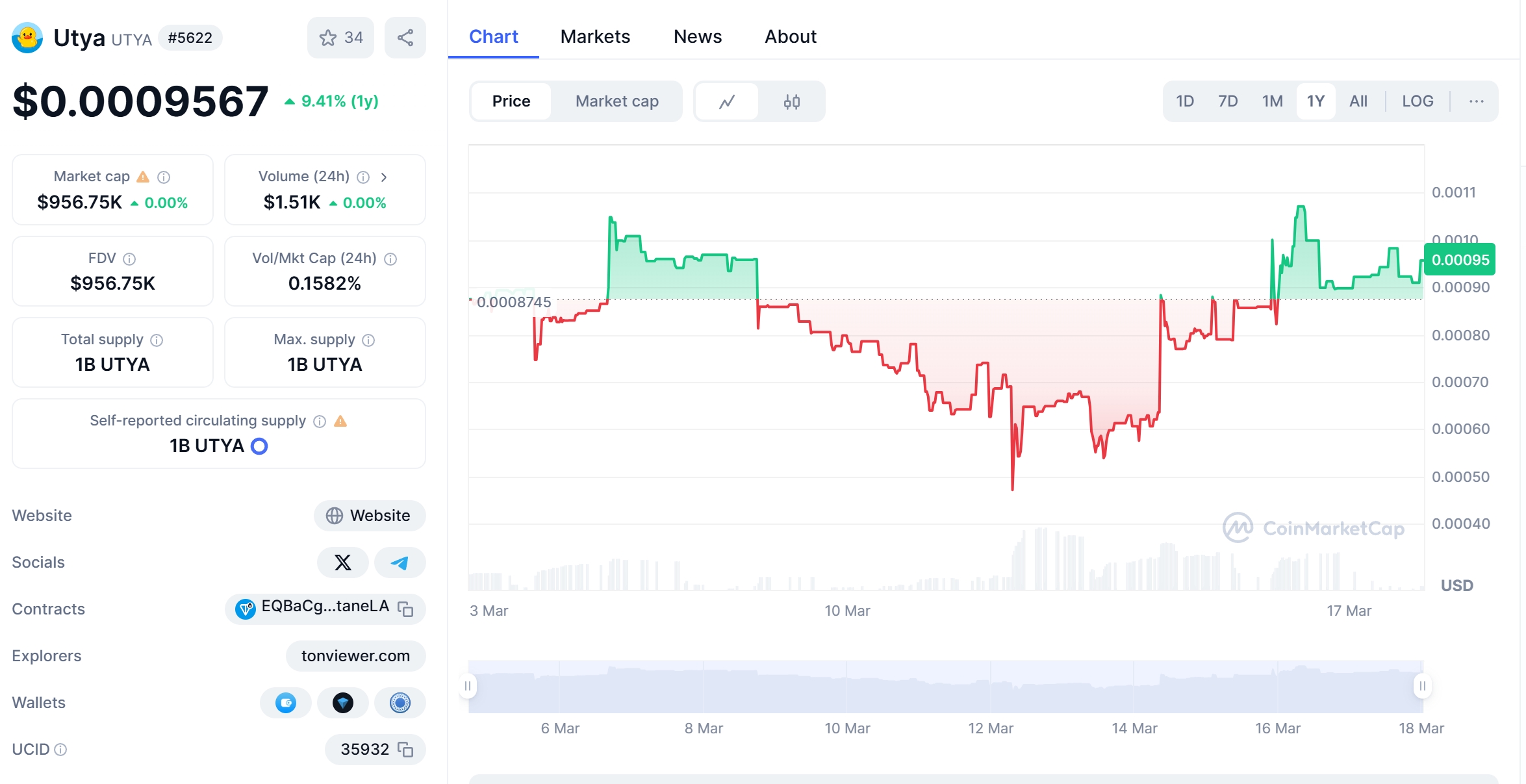

UTYA’s recent price movements have been nothing short of a rollercoaster. From a high of $0.007776 on April 22, 2024, to a low of $0.000222 on September 4, 2024, the token has experienced significant volatility. As of March 2025, UTYA is trading at around $0.001142, a 21.4% increase in the last 24 hours. This surge is particularly interesting given the backdrop of a critic’s unexpected prediction of a massive price increase.

To understand UTYA’s potential, let’s compare its trajectory to that of Dogecoin, another memecoin that has seen its fair share of ups and downs. Dogecoin, which experienced a significant price drop in early 2023 due to regulatory concerns and market corrections, managed to recover through community support and strategic partnerships. UTYA, similarly, has a strong community backing and is part of the rapidly growing TON ecosystem, which could provide the necessary momentum for a similar recovery.

One of the key aspects to consider is the market sentiment surrounding UTYA. The Fear & Greed Index currently stands at 32, indicating fear among investors. However, the sentiment around UTYA remains neutral, suggesting that there’s room for optimistic shifts. If the community rallies behind UTYA as they did with Dogecoin, we could see a significant price surge.

Let’s delve into some technical analysis to provide a clearer picture of UTYA’s potential. The Relative Strength Index (RSI) for UTYA currently sits at a moderate level, indicating neither overbought nor oversold conditions. This suggests that there’s potential for further growth without immediate risk of a sharp correction. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, which is a positive sign for short-term price movements.

Support and resistance levels are crucial in understanding where UTYA might be heading. The current price of $0.001142 is well above the recent low of $0.000222, indicating a strong support level at that point. If UTYA can maintain its current momentum, the next resistance level to watch is around $0.0015, a point where the token previously struggled to break through. Breaking this level could signal a strong bullish trend.

For those interested in chart analysis, UTYA’s price chart shows a pattern of consolidation followed by a breakout, similar to what we’ve seen with Ethereum in its early days. Ethereum, after consolidating around $100 in late 2016, broke out to reach new highs, fueled by technological developments and increased adoption. If UTYA can leverage its community and the TON ecosystem’s growth, it could follow a similar path.

Now, let’s talk about long and short-term predictions. In the short term, UTYA could see a 20% to 30% increase if it breaks through the $0.0015 resistance level. This prediction is based on current market trends and the token’s volatility. For the long term, if UTYA continues to gain traction and the TON ecosystem expands, we could see a potential increase of up to 100% by the end of 2025. This is speculative, of course, but it’s grounded in the project’s potential and market conditions.

So, what caused UTYA’s recent price drop, and will it bounce back? The drop from $0.007776 to $0.000222 was largely due to broader market corrections and a lack of significant news or developments to support the token. However, with the recent surge to $0.001142, it’s clear that UTYA has the potential to rebound. The key will be continuous community engagement and strategic partnerships within the TON ecosystem.

Lessons from Dogecoin’s recovery show us that memecoins can indeed bounce back with the right support. UTYA could follow a similar path if it continues to build its community and leverage the strengths of the TON blockchain. The token’s current market cap is not available due to undisclosed circulating supply, but its fully diluted valuation stands at $1,142,453, indicating room for growth.

Navigating UTYA’s volatility requires a strategic approach. For new investors, it’s essential to understand the risks and rewards. Diversifying your portfolio and setting clear investment goals can help manage the ups and downs. Additionally, staying informed about developments within the TON ecosystem and UTYA’s community initiatives will be crucial in making informed decisions.

In conclusion, the UTYA Token’s journey is one of intrigue and potential. Whether it can surge to new heights in 2025 depends on several factors, including market sentiment, technical indicators, and community support. As an investor, keeping a close eye on these elements will be key to capitalizing on UTYA’s potential. Remember, the crypto market is unpredictable, but with the right knowledge and strategy, you can navigate its volatility with confidence.

By understanding UTYA’s unique position in the market and its potential for growth, you’re better equipped to make informed investment decisions. Whether you’re a seasoned investor or just starting your crypto journey, UTYA offers an exciting opportunity to be part of a community-driven project with significant upside potential.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.