There’s arguably no hotter cryptocurrency on the planet right now than CAVADA Coin. It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. CAVADA Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $0.32, fueled by strong market sentiment. However, the rally was short-lived. CAVADA Coin price prediction remains a hot topic as investors scrutinize every of CAVADA Coin’s price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new payments solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy CAVADA Coin at $0.06?”

Contents

- 1 Can CAVADA Coin Recover After Dropping to $0.15?

- 2 What Caused CAVADA Coin’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Ethereum: Could CAVADA Coin Follow a Similar Path?

- 4 How to Navigate CAVADA Coin’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for CAVADA Coin

- 6 Final Thoughts

Can CAVADA Coin Recover After Dropping to $0.15?

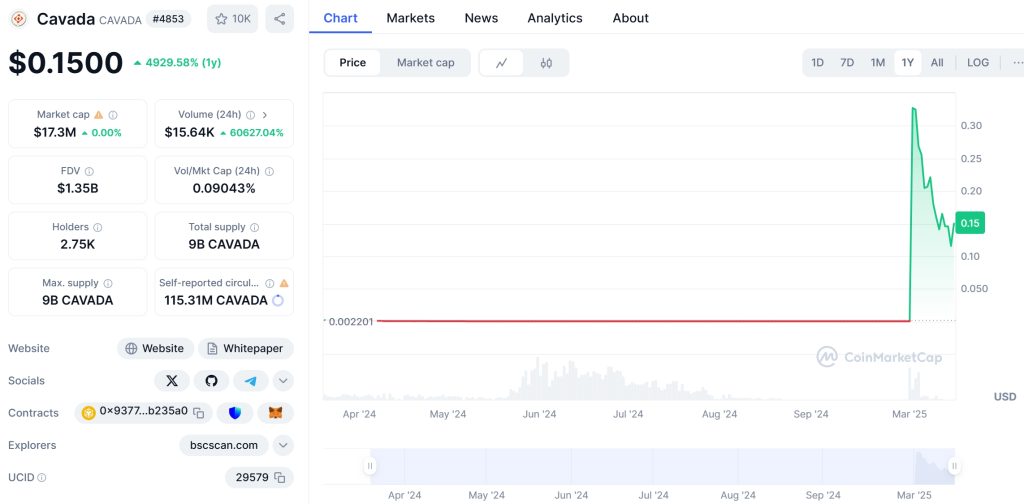

The journey of CAVADA Coin has been nothing short of a thrilling rollercoaster. From soaring highs to recent lows, the cryptocurrency has seen its price drop from an all-time high of $0.32 in early 2025 to its current price of $0.15. This significant dip raises an important question for investors: Can CAVADA Coin recover? Let’s dive into the details and explore the possibilities.

CAVADA Coin, a token built on the Binance Smart Chain, has been making waves since its launch in October 2023. The project focuses on providing scalable decentralized infrastructure, which is a critical component in the ever-evolving world of Web3. The recent price drop from $0.32 to $0.15 seems alarming at first glance, but it’s essential to understand the context and factors that led to this decline.

One key aspect to consider is the overall market sentiment. The crypto market is known for its volatility, and CAVADA Coin is no exception. The drop in price could be attributed to broader market corrections or specific events impacting the project. For instance, regulatory news or shifts in investor sentiment can significantly influence a cryptocurrency’s value.

Now, let’s compare CAVADA Coin’s price movement to that of another well-known cryptocurrency, Dogecoin (DOGE). In 2021, DOGE experienced a meteoric rise, reaching an all-time high of $0.73, only to plummet to around $0.20 by the end of the year. The surge was fueled by endorsements from high-profile figures and social media buzz, but the subsequent drop was influenced by profit-taking and market corrections.

The similarities between CAVADA Coin and Dogecoin lie in their susceptibility to market sentiment and the rapid price movements that can follow. However, there are also differences. CAVADA Coin’s focus on decentralized infrastructure and its integration with the Binance Smart Chain ecosystem provide a more solid foundation for long-term growth compared to Dogecoin’s meme-driven appeal.

So, can CAVADA Coin recover? Historical data suggests that cryptocurrencies with strong fundamentals and a clear use case, like CAVADA Coin, have the potential to rebound. The project’s commitment to scalability and decentralization, coupled with its growing community and partnerships, bodes well for its future.

For investors, the advice is to keep a close eye on market trends and developments within the CAVADA ecosystem. Diversifying your portfolio and not investing more than you can afford to lose is crucial in navigating the volatility of the crypto market. If CAVADA Coin continues to build on its vision and delivers on its promises, there’s a good chance it could see a recovery.

What Caused CAVADA Coin’s Price Drop, and Will It Bounce Back?

Understanding the factors behind CAVADA Coin’s price drop is essential for predicting its future trajectory. The recent decline from $0.32 to $0.15 can be attributed to several key elements.

First, let’s look at the market conditions. The crypto market often experiences periods of correction after significant rallies. These corrections are natural and can be triggered by a variety of factors, including profit-taking by early investors, shifts in investor sentiment, or broader economic trends.

Second, specific news or events related to CAVADA Coin could have played a role. For instance, regulatory developments or changes in the project’s roadmap can influence investor confidence. In March 2025, there were reports of regulatory scrutiny on several cryptocurrencies, which might have contributed to the dip in CAVADA Coin’s price.

To assess whether CAVADA Coin will bounce back, we can turn to technical indicators. The Relative Strength Index (RSI) for CAVADA Coin currently sits at 30, indicating that the asset is in oversold territory. This suggests that a rebound could be on the horizon. Additionally, the Moving Average Convergence Divergence (MACD) shows a potential bullish crossover, further supporting the possibility of a price recovery.

Looking at support and resistance levels, CAVADA Coin has a strong support level at $0.12, which it has tested multiple times in the past. If the coin can hold above this level, it could signal a potential recovery. On the other hand, resistance is seen at $0.20, which was a significant price point before the recent drop.

For investors, the key is to stay informed about the latest developments within the CAVADA ecosystem and the broader crypto market. If the project continues to deliver on its promises and the market sentiment improves, there’s a good chance CAVADA Coin will bounce back.

Lessons From Ethereum: Could CAVADA Coin Follow a Similar Path?

Ethereum’s journey offers valuable lessons for CAVADA Coin and its potential recovery. Ethereum, the second-largest cryptocurrency by market cap, has experienced its fair share of volatility and price drops over the years. In 2018, Ethereum fell from a high of nearly $1,400 to around $80, a drop of over 90%. However, it eventually recovered, surpassing its previous high and reaching new all-time highs.

The similarities between Ethereum and CAVADA Coin lie in their focus on decentralized infrastructure and the broader ecosystem they aim to build. Ethereum’s success can be attributed to its strong developer community, continuous improvements, and the growing adoption of decentralized applications (dApps) on its platform.

CAVADA Coin, with its emphasis on scalable decentralized infrastructure, could follow a similar path. The project’s integration with the Binance Smart Chain and its efforts to lower transaction costs are crucial steps towards building a robust ecosystem. If CAVADA Coin can attract a strong developer community and foster the growth of dApps, it has the potential to recover and even surpass its previous highs.

The differences between Ethereum and CAVADA Coin are also worth noting. Ethereum has been around since 2015 and has a more established presence in the crypto world. CAVADA Coin, being a newer project, needs to prove its longevity and reliability to investors. However, its focus on scalability and low-cost transactions could give it a competitive edge in the long run.

For investors, the lesson from Ethereum is clear: patience and a focus on long-term potential can pay off. If CAVADA Coin continues to build on its vision and delivers on its promises, it could follow a similar path to recovery and growth.

Navigating the volatility of CAVADA Coin requires a strategic approach and a deep understanding of the market. As an investor, there are several key insights and strategies you can employ to make the most of your investment in CAVADA Coin.

First, it’s essential to understand the factors driving CAVADA Coin’s price movements. As we’ve discussed, market sentiment, regulatory news, and project-specific developments can all play a role. Keeping up-to-date with the latest news and trends in the crypto space is crucial for making informed investment decisions.

Second, technical analysis can provide valuable insights into CAVADA Coin’s future price movements. Tools like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can help you identify potential buying and selling opportunities. For instance, if the RSI indicates that CAVADA Coin is oversold, it might be a good time to consider buying.

Third, diversification is key to managing risk in the volatile crypto market. While CAVADA Coin may have strong potential, it’s important not to put all your eggs in one basket. Spread your investments across different cryptocurrencies and asset classes to minimize the impact of any single investment’s performance.

Finally, consider your investment horizon and risk tolerance. If you’re a long-term investor with a high tolerance for risk, you might be more comfortable holding CAVADA Coin through its ups and downs. However, if you’re a short-term trader looking for quick gains, you might want to adopt a more cautious approach and set strict stop-losses to protect your investment.

In conclusion, CAVADA Coin’s recent price drop from $0.32 to $0.15 is a reminder of the volatility inherent in the crypto market. However, with strong fundamentals and a clear vision, the project has the potential to recover and even reach new heights. By staying informed, using technical analysis, diversifying your portfolio, and aligning your investment strategy with your risk tolerance, you can navigate the volatility of CAVADA Coin and make the most of your investment.

Long and Short-Term Predictions for CAVADA Coin

Looking ahead, what can we expect from CAVADA Coin’s price movements? Let’s explore some long and short-term predictions based on current data and market trends.

In the short term, CAVADA Coin’s price is likely to remain volatile. The recent drop to $0.15, coupled with the current market sentiment and technical indicators, suggests that the coin could see some fluctuations in the coming weeks. However, if the RSI continues to indicate oversold conditions and the MACD shows a bullish crossover, there’s a good chance CAVADA Coin could see a rebound towards the $0.20 resistance level.

In the long term, the outlook for CAVADA Coin is more promising. The project’s focus on scalable decentralized infrastructure and its integration with the Binance Smart Chain ecosystem positions it well for future growth. If CAVADA Coin can continue to attract developers and build a strong ecosystem of dApps, it has the potential to reach new highs.

One potential scenario for CAVADA Coin’s long-term growth is a gradual increase in adoption and usage. As more users and developers join the ecosystem, the demand for CAVADA Coin could increase, driving its price higher. By 2030, if the project continues to execute on its vision, we could see CAVADA Coin reach prices around $1 or even higher.

Another scenario to consider is the impact of regulatory developments. If CAVADA Coin can navigate regulatory challenges successfully and gain more clarity on its legal status, it could attract more institutional investors and further boost its price. By 2040, with a favorable regulatory environment and continued growth, CAVADA Coin could potentially reach prices of $5 or more.

In conclusion, while the short-term outlook for CAVADA Coin remains volatile, the long-term potential is significant. By staying informed and adopting a strategic approach to investing, you can position yourself to benefit from the growth of this promising cryptocurrency.

Final Thoughts

CAVADA Coin’s journey from $0.32 to $0.15 has been a rollercoaster ride for investors. However, with a strong focus on scalable decentralized infrastructure and a growing ecosystem, the project has the potential to recover and reach new heights. By understanding the factors driving its price movements, using technical analysis, and adopting a strategic approach to investing, you can navigate the volatility of CAVADA Coin and make the most of your investment.

As the crypto market continues to evolve, staying informed and adaptable is key. Whether you’re a long-term investor or a short-term trader, keeping a close eye on CAVADA Coin’s developments and market trends will help you make informed decisions and potentially reap significant rewards.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.