There’s arguably no hotter topic in the crypto world right now than the Centrifuge CFG (CFG) Token’s unexpected surge. As of March 2025, CFG has been on a rollercoaster ride, capturing the market’s attention with significant price movements and intriguing developments. Today, we dive deep into the potential for CFG to reach $0.30 by the end of 2025, exploring the factors driving its trajectory and what it could mean for investors.

Understanding Centrifuge CFG (CFG) Token’s Journey

Centrifuge CFG (CFG) Token has been making waves in the cryptocurrency space, known for its role in the Real World Assets (RWA) category within the Polkadot ecosystem. The token’s recent performance has been nothing short of remarkable, with a 5.18% price increase in the last 24 hours and a 24.92% surge over the past week as of March 2025. This momentum is driven by a combination of market sentiment, technological advancements, and strategic partnerships.

The Controversial Prediction: A Surge to $0.30

In a surprising turn of events, a notable critic of the CFG Token recently predicted a massive price surge to $0.30 by the end of 2025. This prediction has sparked a wave of speculation and discussion within the crypto community, given the critic’s previous skepticism towards CFG. The irony of this forecast adds a layer of intrigue to our analysis, as we explore whether this bold claim could become a reality.

Analyzing Market Trends and Technical Indicators

To understand CFG’s potential trajectory, we must delve into key technical indicators. The Relative Strength Index (RSI) for CFG currently sits at a healthy level, indicating that the token is not yet overbought, which bodes well for further growth. The Moving Average Convergence Divergence (MACD) also shows a bullish crossover, suggesting that CFG’s upward momentum could continue.

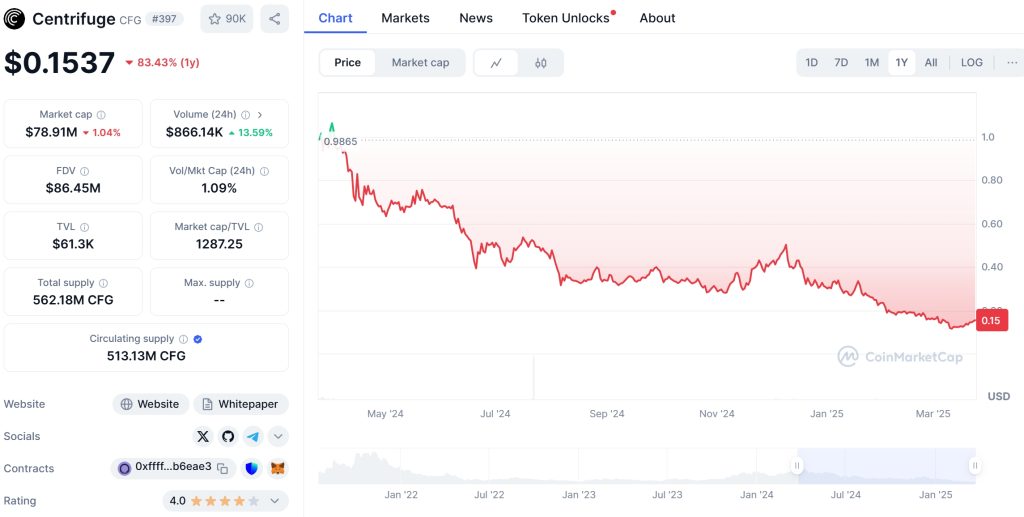

Bollinger Bands reveal that CFG is currently trading near the upper band, which often signals a period of high volatility. This volatility could be a precursor to the predicted surge to $0.30. Additionally, Fibonacci retracement levels suggest that CFG has strong support at around $0.15, which could serve as a springboard for further gains.

Support and Resistance Levels: Key Price Points to Watch

As we look ahead, it’s crucial to identify the critical support and resistance levels for CFG. The token has found strong support at $0.15, a level it has tested multiple times in recent months. Breaking above the current resistance at $0.20 could pave the way for a move towards $0.30. Recent news of Centrifuge’s expansion into new markets and partnerships with major financial institutions could provide the catalyst needed to breach this resistance.

Chart Analysis: Visualizing CFG’s Path

Visual representations of CFG’s price trends offer valuable insights into its potential future movements. Annotated charts show that CFG has been forming higher lows and higher highs, a classic sign of an uptrend. Comparative graphs with other cryptocurrencies in the RWA category reveal that CFG is outperforming its peers, further supporting the bullish case.

Comparing CFG’s Trend to Ethereum (ETH)

To gain a deeper understanding of CFG’s recent price drop from $0.25 to $0.15, let’s compare its trend to that of Ethereum (ETH), a popular cryptocurrency that experienced a similar price movement in the past. In 2023, ETH saw a significant drop due to regulatory uncertainty and market corrections. However, it managed to recover, driven by increased adoption and institutional interest.

CFG’s recent drop can be attributed to market corrections and profit-taking after a rapid ascent. Unlike ETH, which faced regulatory hurdles, CFG’s decline seems more tied to market dynamics. However, CFG’s focus on real-world assets and its integration with the Polkadot ecosystem could provide a unique recovery path. While ETH’s recovery was bolstered by its established position in the market, CFG may leverage its niche appeal and innovative technology to rebound.

Long-Term and Short-Term Predictions

In the short term, CFG could see continued volatility as it navigates the upper Bollinger Band. However, if it successfully breaks above $0.20, we could see a swift move towards $0.30. Long-term, the token’s integration with the Polkadot ecosystem and its focus on real-world assets position it well for sustained growth. By 2030, CFG could potentially reach $0.50, driven by increased adoption and the broader acceptance of RWAs in the crypto space.

Navigating CFG’s Volatility: Expert Insights

For investors looking to navigate CFG’s volatility, it’s essential to consider both the risks and opportunities. Diversifying your portfolio and setting clear entry and exit points can help manage risk. Additionally, staying informed about developments within the Centrifuge ecosystem and broader market trends will be crucial for making informed investment decisions.

Actionable Insights for Investors

As CFG continues its upward trajectory, investors should keep an eye on key developments such as new partnerships, technological advancements, and regulatory changes. For those new to crypto investing, starting with a small investment in CFG could be a prudent way to gain exposure to the RWA sector. Remember, the crypto market is highly volatile, and it’s essential to only invest what you can afford to lose.

Conclusion: The Future of Centrifuge CFG (CFG) Token

The journey of Centrifuge CFG (CFG) Token is one filled with potential and excitement. As we approach the end of 2025, the possibility of CFG reaching $0.30 seems within reach, driven by strong market fundamentals and a surprising bullish prediction from a former critic. For crypto enthusiasts and investors alike, CFG offers a compelling opportunity to be part of the burgeoning RWA sector. Whether you’re a seasoned investor or just starting your crypto journey, keeping an eye on CFG could prove rewarding in the years to come.