In the ever-evolving world of cryptocurrency, Cerebrum (CBM) has been making waves with its recent price fluctuations. As an AI agent creator platform on the Solana network, CBM has sparked interest among investors and enthusiasts alike. But what does the future hold for this innovative token? Let’s dive into a detailed analysis of Cerebrum (CBM) Token’s price prediction and forecasts, exploring its potential for recovery and growth by March 2025.

Contents

- 1 Understanding Cerebrum (CBM) Token’s Recent Price Drop

- 2 Analyzing CBM’s Market Position and Potential for Recovery

- 3 Key Indicators and Technical Analysis for CBM

- 4 Support and Resistance Levels for CBM

- 5 Chart Analysis: Visualizing CBM’s Price Trends

- 6 Long and Short-Term Predictions for CBM

- 7 Lessons from Dogecoin: Could CBM Follow a Similar Path?

- 8 Navigating CBM’s Volatility: Expert Insights

- 9 Conclusion: The Future of Cerebrum (CBM) Token

Understanding Cerebrum (CBM) Token’s Recent Price Drop

Cerebrum (CBM) has seen its price drop from its all-time high of $0.0138 on January 27, 2025, to its current price of $0.000532. This decline of approximately 96% from its peak is significant and has left many investors wondering about the token’s future. But before we look ahead, let’s take a closer look at what might have caused this drop and how it compares to other cryptocurrencies.

When we examine the price movement of CBM, it’s helpful to draw parallels with other well-known cryptocurrencies like Dogecoin (DOGE). DOGE, known for its volatility, experienced a similar price drop in the past, falling from its all-time high of $0.7376 in May 2021 to around $0.06 by the end of that year—a decline of about 92%. The drop in DOGE’s value was attributed to a combination of factors, including market corrections, regulatory concerns, and shifts in investor sentiment.

In the case of Cerebrum (CBM), the recent price drop can be attributed to a few key factors. One, the broader crypto market experienced a correction after a period of rapid growth, affecting many altcoins, including CBM. Two, specific to CBM, there may have been concerns about the project’s development pace or the competitive landscape within the AI and blockchain space. Understanding these factors helps us gauge CBM’s potential for recovery.

Analyzing CBM’s Market Position and Potential for Recovery

Despite the recent price drop, Cerebrum (CBM) remains an intriguing project within the crypto space. As an AI agent creator platform on the Solana network, CBM is uniquely positioned to capitalize on the growing interest in artificial intelligence and decentralized technologies. Let’s explore how CBM might navigate its way back to growth.

To understand CBM’s potential for recovery, it’s essential to look at its market position and the broader trends in the crypto industry. The Solana ecosystem, where CBM operates, has been gaining traction, with its fast transaction speeds and low fees attracting developers and users. This could serve as a strong foundation for CBM’s recovery, as it leverages the strengths of Solana’s infrastructure.

Furthermore, the AI sector within blockchain is still in its early stages, presenting ample opportunities for growth. CBM’s focus on creating AI agents could resonate well with investors looking for innovative projects with real-world applications. If CBM can showcase strong development progress and partnerships within the AI and blockchain communities, it could regain investor confidence and see its price rebound.

Key Indicators and Technical Analysis for CBM

To predict where CBM might go, we need to look at some key technical indicators. These tools can help us understand the market’s momentum and potential turning points. Let’s break down some of the most relevant indicators for CBM’s price analysis.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. For CBM, the RSI has recently been in the oversold territory, indicating that the token might be due for a rebound. When an asset’s RSI falls below 30, it often signals that the selling pressure may be exhausted, paving the way for a potential price increase.

Another useful indicator is the Moving Average Convergence Divergence (MACD), which can help identify trend changes. For CBM, the MACD line has recently crossed below the signal line, suggesting a bearish trend. However, if the MACD line starts to move back above the signal line, it could signal a potential bullish reversal.

Bollinger Bands are another tool that can provide insights into CBM’s volatility. When the price of CBM touches the lower Bollinger Band, it could indicate that the token is undervalued and might be due for a price increase. Conversely, if the price breaks above the upper band, it could signal a continuation of the upward trend.

Support and Resistance Levels for CBM

Identifying support and resistance levels is crucial for understanding where CBM’s price might find stability or face further challenges. Let’s examine these levels and their significance for CBM’s future price movements.

Currently, CBM has found a support level around $0.000532, its recent low. If the token can hold above this level, it could signal a potential bottoming out of the price. On the other hand, if CBM breaks below this support, it might indicate further downward pressure.

As for resistance, CBM faces a significant level around $0.000662, its recent high. Breaking above this resistance could signal a strong bullish move and potentially lead to further price increases. Understanding these levels helps investors make informed decisions about when to buy or sell CBM.

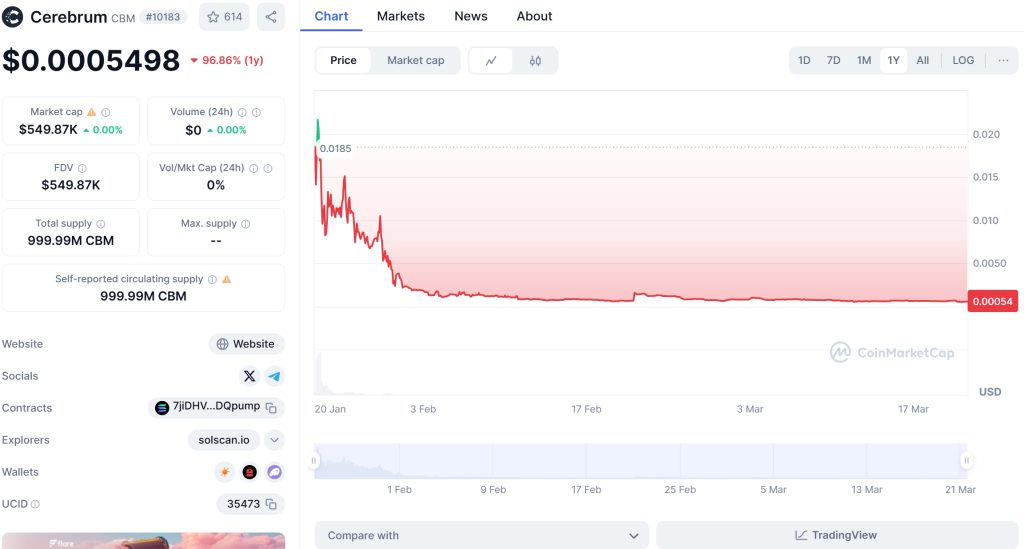

Chart Analysis: Visualizing CBM’s Price Trends

To better understand CBM’s price trends, let’s take a look at some visual representations of its price movements. Charts can provide valuable insights into patterns and potential future movements.

When we look at CBM’s price chart over the past few months, we can see a clear downtrend following its all-time high. However, there are signs of potential reversal, such as bullish divergence on the RSI and a possible double bottom pattern. These patterns suggest that CBM might be gearing up for a recovery.

Additionally, comparing CBM’s chart to that of other cryptocurrencies can provide further context. For instance, if we overlay CBM’s chart with that of Ethereum, which has also experienced volatility, we can see how CBM’s movements align with broader market trends. This comparison can help us identify whether CBM’s price movements are driven by its own fundamentals or by broader market sentiment.

Long and Short-Term Predictions for CBM

Now, let’s look at what the future might hold for CBM. We’ll explore both long-term and short-term predictions, backed by data and trends, to provide a comprehensive outlook for potential investors.

In the short term, CBM’s price could see a rebound if it can break above the $0.000662 resistance level. If this happens, we might see CBM’s price climb to around $0.0008 or even $0.001. However, if CBM fails to break this resistance, it could continue to trade within its current range, with potential dips back to the $0.000532 support level.

Looking further ahead, CBM’s long-term potential depends on several factors, including the development of its AI agent platform, partnerships within the Solana ecosystem, and the overall growth of the AI sector in blockchain. If CBM can showcase strong progress in these areas, it could see its price recover to around $0.005 by the end of 2025. In a more optimistic scenario, if the project gains significant traction and the crypto market continues to grow, CBM could potentially reach $0.01 or higher by 2026.

Lessons from Dogecoin: Could CBM Follow a Similar Path?

Drawing lessons from Dogecoin’s recovery can provide valuable insights into what CBM might do next. Let’s explore how CBM could follow a similar path to recovery and growth.

After its significant drop in 2021, Dogecoin managed to recover by leveraging its strong community support and partnerships with major companies. This recovery was not immediate but rather a gradual process that took several months. Similarly, CBM could benefit from building a strong community around its AI agent platform and forging strategic partnerships within the Solana ecosystem.

One key difference between CBM and DOGE is their underlying technology and use cases. While DOGE is primarily a meme coin, CBM has a clear focus on AI and blockchain integration. This could provide CBM with a more sustainable path to growth, as it taps into the growing demand for AI solutions within the crypto space.

For investors looking to navigate CBM’s volatility, it’s important to consider expert insights and strategies. Let’s explore some actionable advice for those interested in CBM.

First, it’s crucial to stay informed about CBM’s development progress and any news related to the Solana ecosystem. Following the project’s social media channels and joining its community can provide valuable insights into its future plans and potential partnerships.

Second, consider using technical analysis tools like RSI, MACD, and Bollinger Bands to identify potential entry and exit points. These indicators can help you make more informed trading decisions and manage risk effectively.

Finally, diversify your portfolio to mitigate the impact of CBM’s volatility. While CBM has significant potential, it’s essential to spread your investments across different assets to protect against market downturns.

Conclusion: The Future of Cerebrum (CBM) Token

In conclusion, Cerebrum (CBM) Token’s recent price drop presents both challenges and opportunities for investors. By understanding the factors behind the drop, analyzing key technical indicators, and drawing lessons from other cryptocurrencies like Dogecoin, we can gain valuable insights into CBM’s potential for recovery and growth.

As we look ahead to March 2025 and beyond, CBM’s future depends on its ability to leverage the strengths of the Solana ecosystem, build a strong community, and showcase progress in its AI agent platform. If CBM can achieve these goals, it could see its price rebound and potentially reach new highs in the coming years.

For those interested in CBM, staying informed, using technical analysis, and diversifying your portfolio can help you navigate its volatility and capitalize on its potential. As always, remember to do your own research and invest responsibly in the exciting world of cryptocurrency.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.