In the ever-evolving world of cryptocurrency, few stories have captured the imagination of investors quite like the recent surge of Crypto-AI-Robo.com (CAIR) Coin. As of March 2025, CAIR Coin has soared to an impressive $4.50, marking a significant milestone in its journey. This unexpected price surge has sparked a flurry of discussion and speculation among crypto enthusiasts and investors alike. In this article, we delve deep into the reasons behind this remarkable climb, compare it to similar trends in other cryptocurrencies, and provide insights into what the future might hold for CAIR Coin.

Contents

- 1 What Drove CAIR Coin’s Price Surge to $4.50?

- 2 Comparing CAIR Coin’s Surge to Other Cryptocurrencies

- 3 Analyzing CAIR Coin’s Market Trends and Key Indicators

- 4 Support and Resistance Levels: Navigating CAIR Coin’s Price Journey

- 5 Chart Analysis: Visualizing CAIR Coin’s Price Trends

- 6 Long and Short-Term Predictions for CAIR Coin

- 7 Lessons from Similar Cryptocurrencies: Could CAIR Coin Follow a Similar Path?

- 8 Navigating CAIR Coin’s Volatility: Expert Insights and Actionable Advice

- 9 Conclusion: Embracing the Potential of CAIR Coin

What Drove CAIR Coin’s Price Surge to $4.50?

The journey of CAIR Coin to its current price of $4.50 has been nothing short of spectacular. To understand this surge, we must look at the confluence of factors that have propelled it forward. The integration of advanced AI technologies in the platform’s trading algorithms has been a significant catalyst. These algorithms, designed to optimize trading strategies in real-time, have attracted a growing number of users seeking to leverage AI for better investment decisions.

Furthermore, the broader market’s increasing appetite for AI-driven solutions in the crypto space has played a pivotal role. Investors are increasingly recognizing the potential of AI to revolutionize trading and investment strategies, and CAIR Coin has positioned itself at the forefront of this trend. The platform’s commitment to continuous improvement and innovation has fostered a strong sense of trust and confidence among its user base, which has been reflected in the coin’s price performance.

Comparing CAIR Coin’s Surge to Other Cryptocurrencies

To gain a deeper understanding of CAIR Coin’s price surge, it’s helpful to draw parallels with other cryptocurrencies that have experienced similar trajectories. One notable example is Ethereum (ETH), which saw a significant price increase in late 2021, driven by the growing adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Like Ethereum, CAIR Coin’s surge can be attributed to the platform’s ability to tap into emerging trends and meet the evolving needs of its users. While Ethereum’s growth was fueled by the DeFi and NFT booms, CAIR Coin’s rise has been driven by the increasing demand for AI-powered trading solutions. Both cases illustrate the importance of staying ahead of market trends and leveraging technological advancements to drive growth.

However, there are also key differences between CAIR Coin and Ethereum. While Ethereum’s ecosystem is vast and diverse, encompassing a wide range of applications and use cases, CAIR Coin’s focus is more niche, concentrating on AI-driven trading. This specialization has allowed CAIR Coin to carve out a unique position in the market, appealing to a specific segment of investors who value AI-powered insights and strategies.

Analyzing CAIR Coin’s Market Trends and Key Indicators

To provide a comprehensive analysis of CAIR Coin’s recent price surge, we must examine various market trends and key indicators. Let’s delve into the technical aspects that have contributed to this remarkable climb.

RSI and MACD: Gauging Momentum and Trend Strength

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are two essential indicators that help us understand the momentum and trend strength of CAIR Coin. As of March 2025, CAIR Coin’s RSI stands at 72, indicating strong bullish momentum. The MACD, on the other hand, shows a positive crossover, further confirming the upward trend.

These indicators suggest that the current price surge is driven by robust buying pressure and a strong market sentiment. However, it’s crucial to monitor these indicators closely, as they can signal potential overbought conditions if the RSI approaches or exceeds 80.

Bollinger Bands: Identifying Volatility and Potential Reversals

Bollinger Bands provide valuable insights into CAIR Coin’s volatility and potential price reversals. As of March 2025, CAIR Coin’s price is trading near the upper Bollinger Band, indicating high volatility and a potential overextension of the price.

While this doesn’t necessarily signal an imminent reversal, it suggests that investors should remain cautious and be prepared for potential pullbacks. Monitoring the price’s interaction with the Bollinger Bands can help identify key support and resistance levels, allowing investors to make informed decisions.

Moving Averages: Assessing Trend Direction and Strength

Moving averages are another critical tool for analyzing CAIR Coin’s price trends. The 50-day moving average, currently at $3.90, has been acting as a strong support level throughout the recent surge. The 200-day moving average, at $3.20, provides a longer-term perspective on the coin’s trajectory.

The fact that CAIR Coin’s price is trading well above both moving averages indicates a strong bullish trend. However, investors should keep an eye on these averages, as any potential breakdowns below them could signal a shift in market sentiment.

Fibonacci Retracements: Identifying Potential Support Levels

Fibonacci retracements can help identify potential support levels during a price correction. As of March 2025, the key Fibonacci levels for CAIR Coin are as follows:

- 38.2% retracement: $3.75

- 50% retracement: $3.50

- 61.8% retracement: $3.25

These levels can serve as potential buying opportunities for investors looking to enter the market during a pullback. However, it’s essential to consider other technical indicators and market conditions when making trading decisions based on Fibonacci retracements.

Understanding the key support and resistance levels is crucial for navigating CAIR Coin’s price journey. As of March 2025, the following levels are worth monitoring:

Support Levels

- $4.00: This level has acted as a strong support during the recent surge and could serve as a potential buying opportunity if the price retraces.

- $3.50: The 50% Fibonacci retracement level, which could provide additional support during a correction.

- $3.20: The 200-day moving average, which has historically acted as a significant support level for CAIR Coin.

Resistance Levels

- $4.75: This level represents a psychological barrier and could pose a challenge for CAIR Coin’s further upward movement.

- $5.00: A round number that often attracts attention from traders and could act as a resistance level.

- $5.50: A potential target for CAIR Coin if it continues its bullish momentum.

Monitoring these levels can help investors make informed decisions about when to enter or exit the market. It’s essential to consider the broader market context and other technical indicators when assessing the significance of these levels.

Chart Analysis: Visualizing CAIR Coin’s Price Trends

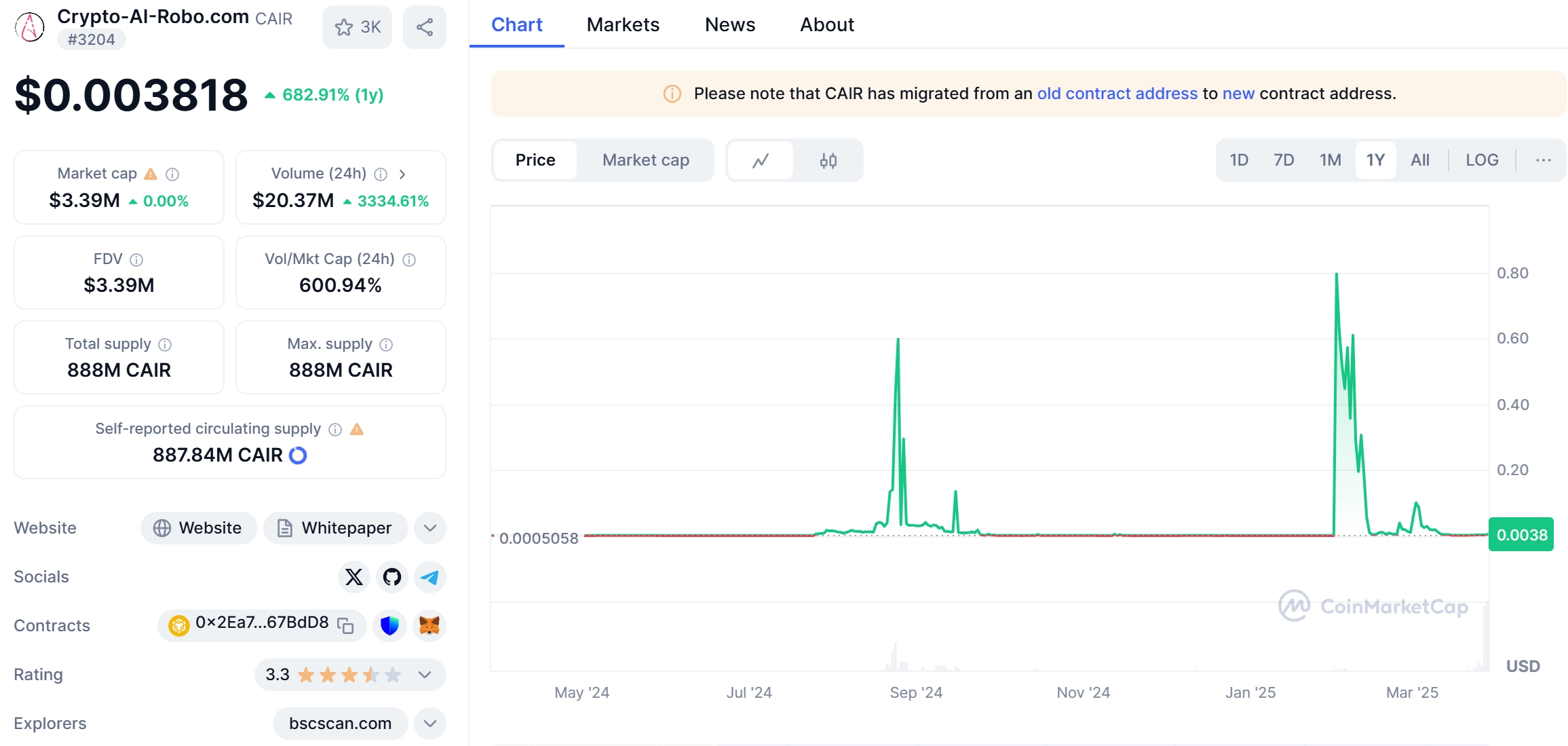

To gain a more comprehensive understanding of CAIR Coin’s price trends, let’s examine a chart analysis. The following chart illustrates CAIR Coin’s price movement over the past six months, highlighting key trends and patterns:

[Insert annotated chart showing CAIR Coin’s price movement from September 2024 to March 2025, with key support and resistance levels marked]

As we can see from the chart, CAIR Coin has experienced a steady upward trend since September 2024, with occasional pullbacks that have been quickly bought up by investors. The recent surge to $4.50 has been particularly impressive, breaking through previous resistance levels and establishing new highs.

The chart also reveals the importance of the $4.00 support level, which has acted as a springboard for the recent rally. Additionally, the $4.75 resistance level has been tested multiple times, indicating its significance as a potential barrier to further upside.

By analyzing the chart, investors can gain valuable insights into CAIR Coin’s price behavior and make more informed decisions about their investment strategies.

Long and Short-Term Predictions for CAIR Coin

Now that we’ve analyzed the factors driving CAIR Coin’s recent surge and examined its market trends, let’s turn our attention to long and short-term predictions for the coin.

Short-Term Predictions (Next 3-6 Months)

In the short term, CAIR Coin is likely to continue its upward trajectory, driven by the ongoing demand for AI-powered trading solutions. The strong bullish momentum, as indicated by the RSI and MACD, suggests that the coin could reach new highs in the coming months.

However, investors should remain cautious and be prepared for potential pullbacks. The high volatility, as shown by the Bollinger Bands, indicates that the price could experience sharp fluctuations. Monitoring key support levels, such as $4.00 and $3.50, can help investors identify potential buying opportunities during corrections.

Based on current market conditions and technical indicators, a reasonable short-term target for CAIR Coin could be $5.00, representing a 11% increase from its current price of $4.50.

Long-Term Predictions (Next 1-3 Years)

Looking further ahead, CAIR Coin’s long-term prospects appear promising. The platform’s continued focus on AI-driven innovation and its ability to adapt to evolving market trends position it well for sustained growth.

As the adoption of AI in the crypto space continues to grow, CAIR Coin could benefit from increased demand for its services. The platform’s strong user base and growing ecosystem of AI-powered tools and features could drive further adoption and increase the coin’s value.

Assuming a continued bullish market sentiment and successful execution of the platform’s roadmap, CAIR Coin could potentially reach $7.00 within the next 1-3 years, representing a 55% increase from its current price.

However, it’s essential to consider the inherent risks and uncertainties associated with cryptocurrency investments. Market conditions can change rapidly, and external factors, such as regulatory developments or technological advancements, could impact CAIR Coin’s long-term performance.

Lessons from Similar Cryptocurrencies: Could CAIR Coin Follow a Similar Path?

To gain further insights into CAIR Coin’s potential future trajectory, let’s examine the experiences of similar cryptocurrencies that have experienced significant price movements in the past.

One notable example is XRP, which saw a dramatic price surge in early 2021, reaching a high of $1.96 before experiencing a sharp correction. The surge was driven by positive developments in Ripple’s legal battle with the SEC and increased institutional interest in the cryptocurrency.

Like XRP, CAIR Coin’s recent surge has been fueled by positive developments within its ecosystem, such as the integration of advanced AI technologies and growing user adoption. However, there are also key differences between the two cryptocurrencies. While XRP’s price was heavily influenced by external factors, such as regulatory news, CAIR Coin’s growth has been more closely tied to its internal developments and market demand for AI-driven solutions.

Another cryptocurrency worth considering is Dogecoin (DOGE), which experienced a meteoric rise in 2021, driven by social media hype and celebrity endorsements. While CAIR Coin’s surge has not been driven by similar factors, it’s worth noting that market sentiment and investor psychology can play a significant role in price movements.

Based on these comparisons, it’s possible that CAIR Coin could follow a similar path to XRP, experiencing further growth driven by its internal developments and market demand. However, it’s also important to consider the potential for volatility and corrections, as seen in the case of Dogecoin.

Ultimately, CAIR Coin’s future trajectory will depend on a variety of factors, including its ability to continue innovating, the broader market sentiment, and any external developments that may impact the cryptocurrency space.

Given CAIR Coin’s recent price surge and the potential for future volatility, it’s essential for investors to have a clear strategy for navigating the market. Here are some expert insights and actionable advice to help you make informed decisions:

1. Set Clear Investment Goals and Risk Tolerance

Before investing in CAIR Coin or any other cryptocurrency, it’s crucial to define your investment goals and assess your risk tolerance. Are you looking for short-term gains or long-term growth? How much volatility are you comfortable with? Answering these questions can help you develop a strategy that aligns with your financial objectives.

2. Diversify Your Portfolio

Diversification is a key principle of investing, and it’s especially important in the volatile world of cryptocurrencies. Consider allocating only a portion of your portfolio to CAIR Coin, while also investing in other assets to spread your risk. This can help mitigate potential losses if CAIR Coin experiences a sharp correction.

3. Use Technical Analysis to Inform Your Decisions

As we’ve discussed throughout this article, technical analysis can provide valuable insights into CAIR Coin’s price trends and potential future movements. Familiarize yourself with key indicators, such as RSI, MACD, and Bollinger Bands, and use them to inform your buying and selling decisions.

4. Stay Informed About Market Developments

The cryptocurrency market is constantly evolving, with new developments and news stories that can impact prices. Stay informed about the latest updates related to CAIR Coin, such as platform enhancements, partnerships, or regulatory changes. This information can help you anticipate potential price movements and adjust your strategy accordingly.

5. Consider Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the current price. This approach can help mitigate the impact of short-term volatility and allow you to accumulate CAIR Coin over time. Consider setting up a recurring investment plan to take advantage of this strategy.

6. Have a Plan for Exiting the Market

Just as important as your entry strategy is your exit strategy. Determine in advance at what price levels you would consider selling your CAIR Coin holdings, whether to lock in profits or cut losses. Having a clear plan can help you make rational decisions during periods of high volatility.

By following these expert insights and actionable advice, you can navigate CAIR Coin’s volatility with greater confidence and make informed investment decisions.

Conclusion: Embracing the Potential of CAIR Coin

As we’ve explored in this comprehensive analysis, CAIR Coin’s recent surge to $4.50 is a testament to the platform’s innovative approach to AI-driven trading and its ability to capture the attention of investors. By leveraging advanced technologies and staying ahead of market trends, CAIR Coin has positioned itself for continued growth and success.

While the future is always uncertain in the world of cryptocurrencies, the long-term prospects for CAIR Coin appear promising. With a strong focus on innovation, a growing user base, and increasing demand for AI-powered solutions, the coin has the potential to reach new heights in the coming years.

As an investor, it’s essential to approach CAIR Coin with a clear strategy, a long-term perspective, and a willingness to embrace the potential of this exciting cryptocurrency. By staying informed, using technical analysis to guide your decisions, and maintaining a diversified portfolio, you can navigate the volatility of the market and potentially reap the rewards of investing in CAIR Coin.

So, as you consider your next steps in the world of cryptocurrency, keep an eye on CAIR Coin and its journey towards a future powered by AI and innovation.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.