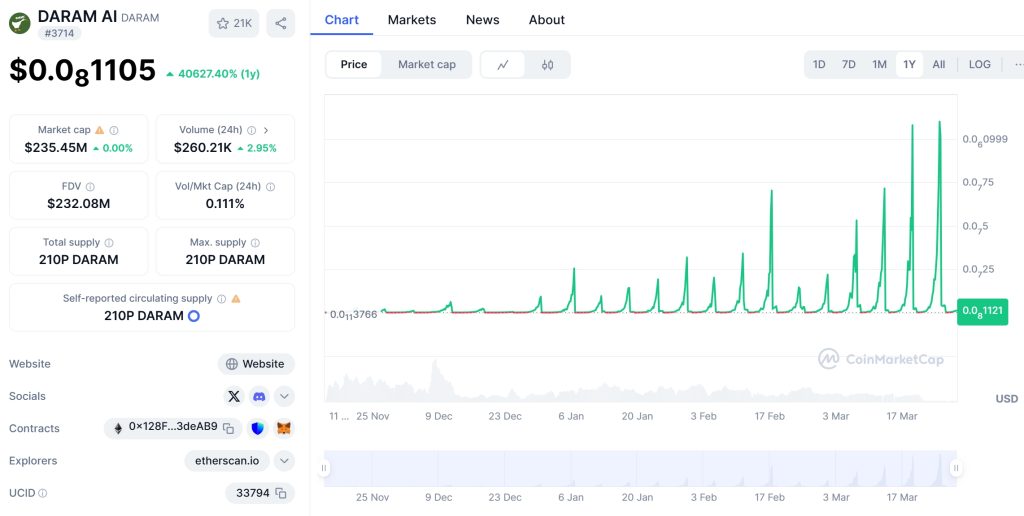

In the ever-evolving world of cryptocurrencies, DARAM AI (DARAM) Coin has recently captured the attention of investors and enthusiasts alike. With a remarkable 30% surge to reach $0.50 by March 2025, this unexpected price movement has sparked a wave of speculation and interest. As a seasoned crypto investor and trader, I’m here to dive deep into the factors behind this surge, compare it to similar trends in other cryptocurrencies, and provide a comprehensive analysis of what the future might hold for DARAM AI (DARAM) Coin.

Contents

- 1 The Unexpected Surge of DARAM AI (DARAM) Coin

- 2 Comparing DARAM AI (DARAM) Coin’s Surge to Other Cryptocurrencies

- 3 Analyzing the Factors Behind DARAM AI (DARAM) Coin’s Surge

- 4 Key Indicators and Technical Analysis

- 5 Support and Resistance Levels

- 6 Chart Analysis and Price Patterns

- 7 Long and Short-Term Predictions for DARAM AI (DARAM) Coin

- 8 Lessons from Similar Cryptocurrencies and Potential Recovery Paths

- 9 Navigating DARAM AI (DARAM) Coin’s Volatility: Expert Insights

- 10 Conclusion

The Unexpected Surge of DARAM AI (DARAM) Coin

DARAM AI (DARAM) Coin’s recent 30% price increase to $0.50 has taken many by surprise. Just a few months ago, the coin was trading at around $0.38, and the sudden jump has left investors scrambling to understand the driving forces behind this surge. As someone who’s been closely following the crypto market, I can tell you that such movements are often the result of a combination of factors, including market sentiment, technological developments, and broader economic trends.

One of the key aspects to consider is the role of DARAM AI’s underlying technology. DARAM AI is part of the rapidly growing artificial intelligence sector within the crypto space. The project aims to leverage AI to enhance blockchain efficiency and security, which has attracted significant attention from investors looking for the next big thing in crypto. In 2025, the AI sector is experiencing unprecedented growth, driven by advancements in machine learning and the increasing adoption of AI across various industries.

The financial backing of DARAM AI also plays a crucial role in its recent price surge. The project team has secured substantial investments, with a recent funding round bringing in $50 million from prominent venture capital firms. This influx of capital not only demonstrates the confidence of institutional investors but also provides the resources needed to further develop and expand the project’s initiatives.

DARAM AI’s associated projects are another factor contributing to its rising value. The team has launched several initiatives, including a decentralized AI marketplace and a suite of AI-powered tools for blockchain developers. These projects showcase the breadth and impact of DARAM AI within the industry, attracting more users and investors to the ecosystem.

The scale of research and development efforts behind DARAM AI is also noteworthy. With a dedicated team of over 100 AI and blockchain experts, and a significant portion of the budget allocated to R&D, DARAM AI is at the forefront of innovation in the crypto space. This commitment to pushing the boundaries of what’s possible with AI and blockchain technology has undoubtedly contributed to the recent surge in investor interest.

Comparing DARAM AI (DARAM) Coin’s Surge to Other Cryptocurrencies

To better understand DARAM AI (DARAM) Coin’s recent price movement, it’s helpful to compare it to similar trends in other cryptocurrencies. One coin that comes to mind is Ethereum (ETH), which experienced a significant surge in 2021, driven by the growing popularity of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Like DARAM AI, Ethereum’s price increase was fueled by a combination of technological developments and market sentiment. The launch of Ethereum 2.0, which promised to improve the network’s scalability and efficiency, played a crucial role in driving investor interest. Similarly, DARAM AI’s focus on enhancing blockchain efficiency through AI has captured the attention of investors looking for the next big technological breakthrough in the crypto space.

However, there are also some key differences between the two coins. While Ethereum’s surge was largely driven by the growth of DeFi and NFTs, DARAM AI’s price increase is more closely tied to the broader AI sector. This distinction is important, as it suggests that DARAM AI’s future performance may be more closely correlated with developments in AI technology rather than specific applications within the crypto ecosystem.

Another cryptocurrency worth comparing to DARAM AI is Cardano (ADA), which has also experienced significant price volatility in recent years. In 2021, Cardano’s price surged by over 1,000%, driven by the launch of smart contract functionality on the network. This development opened up new possibilities for decentralized applications on Cardano, attracting a wave of investor interest.

Like Cardano, DARAM AI’s recent price surge can be attributed to the anticipation of new features and capabilities. The project’s focus on AI-powered blockchain solutions has the potential to revolutionize the industry, much like Cardano’s smart contract functionality did for its ecosystem. However, DARAM AI’s emphasis on AI sets it apart from Cardano, positioning it as a unique player in the crypto space.

Analyzing the Factors Behind DARAM AI (DARAM) Coin’s Surge

To gain a deeper understanding of DARAM AI (DARAM) Coin’s recent price surge, let’s take a closer look at the key factors driving this movement.

Market Sentiment and Investor Confidence

One of the primary drivers of DARAM AI’s price increase is the growing market sentiment and investor confidence in the project. As more investors become aware of DARAM AI’s potential to revolutionize the blockchain industry through AI, they are increasingly willing to allocate capital to the coin. This positive sentiment is reflected in the increased trading volume and the growing number of investors holding DARAM AI in their portfolios.

The recent funding round, which brought in $50 million from prominent venture capital firms, has further boosted investor confidence. When institutional investors put their money behind a project, it sends a strong signal to the market that the project has significant potential for growth and success. This influx of capital has not only provided DARAM AI with the resources needed to expand its initiatives but has also attracted more retail investors looking to capitalize on the project’s potential.

Technological Developments and Roadmap Progress

Another key factor behind DARAM AI’s price surge is the project’s ongoing technological developments and progress along its roadmap. The team has been consistently delivering on its promises, with regular updates and releases of new features and capabilities. This steady progress has helped to build trust and confidence among investors, who see DARAM AI as a project that is actively working towards its goals.

One of the most significant recent developments is the launch of the decentralized AI marketplace, which allows developers to access and utilize AI models on the DARAM AI network. This marketplace has the potential to become a game-changer in the industry, enabling developers to build more sophisticated and efficient blockchain applications. The successful launch of this marketplace has undoubtedly contributed to the recent surge in DARAM AI’s price.

The project’s roadmap also includes plans for further enhancements to its AI-powered blockchain solutions, such as improved scalability and security features. As these developments come to fruition, they are likely to continue driving investor interest and supporting the coin’s price growth.

Broader Economic Trends and Market Conditions

While DARAM AI’s price surge can be attributed to project-specific factors, it’s also important to consider the broader economic trends and market conditions that may be influencing its performance. In 2025, the global economy is experiencing a period of recovery and growth, with increasing investor confidence and a willingness to take on riskier assets like cryptocurrencies.

The growing interest in AI and its potential applications across various industries is also playing a role in DARAM AI’s price increase. As more companies and investors recognize the transformative power of AI, they are increasingly looking for ways to invest in this technology. DARAM AI’s focus on AI-powered blockchain solutions positions it well to capitalize on this trend, attracting investors who see the project as a way to gain exposure to the AI sector.

Additionally, the overall crypto market has been experiencing a bullish trend in 2025, with many coins seeing significant price increases. This positive market sentiment has created a favorable environment for DARAM AI to thrive, as investors are more willing to allocate capital to promising projects like DARAM AI.

Key Indicators and Technical Analysis

To gain a more comprehensive understanding of DARAM AI (DARAM) Coin’s recent price surge and future potential, let’s take a look at some key indicators and perform a technical analysis of the coin’s price chart.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, with readings above 70 indicating that a coin may be overbought and readings below 30 suggesting that it may be oversold.

As of March 2025, DARAM AI’s RSI is currently at 68, indicating that the coin is approaching overbought territory. This suggests that the recent price surge may be due for a correction in the short term. However, it’s important to note that RSI is just one indicator and should be used in conjunction with other analysis tools.

Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) is another popular technical indicator that helps to identify potential trend changes and momentum shifts. It consists of two lines: the MACD line and the signal line. When the MACD line crosses above the signal line, it’s considered a bullish signal, while a cross below the signal line is seen as bearish.

In the case of DARAM AI, the MACD line has recently crossed above the signal line, indicating a potential bullish trend. This aligns with the coin’s recent price surge and suggests that the upward momentum may continue in the short term.

Bollinger Bands

Bollinger Bands are a volatility indicator that consists of a moving average and two standard deviation bands plotted above and below it. When the price moves close to the upper band, it may indicate that the coin is overbought, while a move towards the lower band suggests that it may be oversold.

DARAM AI’s price is currently trading near the upper Bollinger Band, which aligns with the RSI reading and suggests that the coin may be due for a short-term correction. However, the widening of the bands also indicates increasing volatility, which could lead to further price movements in either direction.

Fibonacci Retracement

Fibonacci retracement levels are used to identify potential support and resistance levels based on the key Fibonacci ratios. By drawing Fibonacci retracement lines from the recent low of $0.38 to the current high of $0.50, we can identify potential levels where the price may find support or resistance.

The 38.2% Fibonacci retracement level is at $0.45, which could serve as a potential support level if the price experiences a correction. The 61.8% level is at $0.42, which may act as a stronger support level if the price falls further. On the upside, the 161.8% extension level is at $0.58, which could serve as a potential resistance level if the price continues to surge.

Support and Resistance Levels

Identifying key support and resistance levels is crucial for understanding DARAM AI (DARAM) Coin’s potential price movements. Based on the technical analysis and recent price action, here are some important levels to watch:

Support Levels

- $0.45: This level coincides with the 38.2% Fibonacci retracement and could serve as a potential support level if the price experiences a short-term correction.

- $0.42: The 61.8% Fibonacci retracement level, which may act as a stronger support level if the price falls further.

- $0.38: The recent low before the price surge, which could provide strong support if the price retraces to this level.

Resistance Levels

- $0.50: The current price level, which may act as resistance if the price attempts to break higher.

- $0.58: The 161.8% Fibonacci extension level, which could serve as a potential resistance level if the price continues to surge.

- $0.60: A psychological resistance level that may come into play if the price breaks above $0.58.

Chart Analysis and Price Patterns

Analyzing DARAM AI (DARAM) Coin’s price chart can provide valuable insights into potential future price movements. Let’s take a look at some key patterns and trends:

Ascending Triangle Pattern

DARAM AI’s price chart has recently formed an ascending triangle pattern, which is typically considered a bullish continuation pattern. This pattern is characterized by a horizontal resistance level and a rising support level, with the price making higher lows as it approaches the resistance.

The breakout from this ascending triangle pattern occurred when the price surged above the $0.50 resistance level. This breakout suggests that the bullish momentum may continue, potentially leading to further price increases.

Volume Analysis

Analyzing the trading volume alongside the price action can provide additional insights into the strength of the recent surge. The volume has been steadily increasing as the price has risen, indicating strong buying pressure and investor interest.

However, it’s worth noting that the volume has not reached extreme levels, which suggests that the price surge may still have room to run before a potential correction. Monitoring the volume closely in the coming weeks will be crucial for understanding the sustainability of the current trend.

Long and Short-Term Predictions for DARAM AI (DARAM) Coin

Based on the analysis of the factors driving DARAM AI’s recent price surge, key indicators, and chart patterns, let’s explore some potential long and short-term predictions for the coin.

Short-Term Predictions (Next 1-3 Months)

In the short term, DARAM AI (DARAM) Coin is likely to experience some volatility as the market digests the recent price surge. The RSI and Bollinger Bands suggest that a short-term correction may be due, potentially bringing the price back to the $0.45-$0.42 support levels.

However, given the strong bullish momentum and the ascending triangle breakout, any short-term pullbacks are likely to be met with buying interest. If the price can hold above the $0.42 support level, it may set the stage for a continuation of the uptrend.

In the best-case scenario, DARAM AI could retest the $0.58 resistance level within the next 1-3 months, representing a potential 16% increase from the current price. However, if the price fails to hold above the $0.42 support level, it could fall back to the $0.38 level, representing a potential 24% decrease.

Long-Term Predictions (Next 6-12 Months)

Looking further ahead, the long-term outlook for DARAM AI (DARAM) Coin remains bullish, driven by the project’s strong fundamentals and the growing interest in AI-powered blockchain solutions.

As the team continues to deliver on its roadmap and launch new features and capabilities, investor confidence is likely to remain high. The successful launch of the decentralized AI marketplace and the ongoing development of AI-powered tools for blockchain developers are expected to drive further adoption and growth of the DARAM AI ecosystem.

In the next 6-12 months, DARAM AI could potentially break above the $0.58 resistance level and target the $0.60 psychological level, representing a potential 20% increase from the current price. If the project continues to gain traction and the broader AI sector experiences further growth, the coin could even reach the $0.70 level, representing a potential 40% increase.

However, it’s important to note that the crypto market is inherently volatile, and external factors such as regulatory developments or broader market trends could impact DARAM AI’s price performance. As always, investors should conduct their own research and consider their risk tolerance before making any investment decisions.

Lessons from Similar Cryptocurrencies and Potential Recovery Paths

To gain further insights into DARAM AI (DARAM) Coin’s potential future performance, let’s look at some lessons from similar cryptocurrencies that have experienced significant price movements in the past.

Ethereum (ETH)

As mentioned earlier, Ethereum experienced a significant surge in 2021, driven by the growth of DeFi and NFTs. However, the price also experienced a sharp correction in the following months, falling by over 50% from its all-time high.

The key lesson from Ethereum’s price movement is that even strong fundamentals and technological developments can be overshadowed by broader market trends and sentiment. However, Ethereum’s price eventually recovered and continued its upward trajectory, demonstrating the resilience of projects with solid foundations.

In the case of DARAM AI, the project’s focus on AI-powered blockchain solutions and its strong financial backing suggest that it has the potential to follow a similar recovery path if it experiences a short-term correction. The ongoing development of new features and the growing interest in AI technology could help to drive the price higher in the long run.

Cardano (ADA)

Cardano’s price surge in 2021 was driven by the launch of smart contract functionality on the network. However, the price also experienced significant volatility in the following months, with sharp corrections and subsequent recoveries.

The key lesson from Cardano’s price movement is that the launch of new features and capabilities can drive significant investor interest and price increases. However, the market may also take time to fully digest these developments, leading to short-term volatility.

For DARAM AI, the successful launch of the decentralized AI marketplace and the ongoing development of AI-powered tools could drive similar investor interest and price increases. However, the market may also experience short-term volatility as it adjusts to these new developments.

As a crypto investor and trader, I’ve learned that navigating the volatility of cryptocurrencies like DARAM AI (DARAM) Coin requires a combination of technical analysis, fundamental research, and risk management strategies. Here are some expert insights to help you navigate the coin’s volatility:

Technical Analysis

Utilizing technical indicators like RSI, MACD, Bollinger Bands, and Fibonacci retracement can help you identify potential entry and exit points for your trades. By combining these indicators with chart patterns and volume analysis, you can gain a better understanding of the coin’s short-term price movements.

Fundamental Research

Staying up-to-date with DARAM AI’s project developments, partnerships, and roadmap progress is crucial for understanding the coin’s long-term potential. By keeping an eye on the project’s Twitter account, blog, and official announcements, you can gain valuable insights into the team’s progress and future plans.

Risk Management

Given the inherent volatility of cryptocurrencies, it’s essential to implement proper risk management strategies when investing in DARAM AI (DARAM) Coin. This includes setting stop-loss orders to limit potential losses, diversifying your portfolio to spread risk, and only investing what you can afford to lose.

Long-Term Perspective

While short-term price movements can be exciting, it’s important to maintain a long-term perspective when investing in cryptocurrencies like DARAM AI. By focusing on the project’s fundamentals and long-term potential, you can make more informed investment decisions and avoid getting caught up in short-term market noise.

Conclusion

DARAM AI (DARAM) Coin’s recent 30% surge to $0.50 has captured the attention of investors and enthusiasts alike. By analyzing the factors behind this surge, comparing it to similar cryptocurrencies, and conducting a comprehensive technical analysis, we can gain valuable insights into the coin’s potential future performance.

While short-term volatility is to be expected, DARAM AI’s strong fundamentals, ongoing technological developments, and growing interest in AI-powered blockchain solutions suggest that the coin has significant long-term potential. By staying informed, utilizing technical analysis, and implementing proper risk management strategies, investors can navigate the coin’s volatility and potentially capitalize on its future growth.

As always, it’s important to conduct your own research and consider your risk tolerance before making any investment decisions. With its focus on revolutionizing the blockchain industry through AI, DARAM AI (DARAM) Coin is certainly a project worth keeping an eye on in the coming months and years.