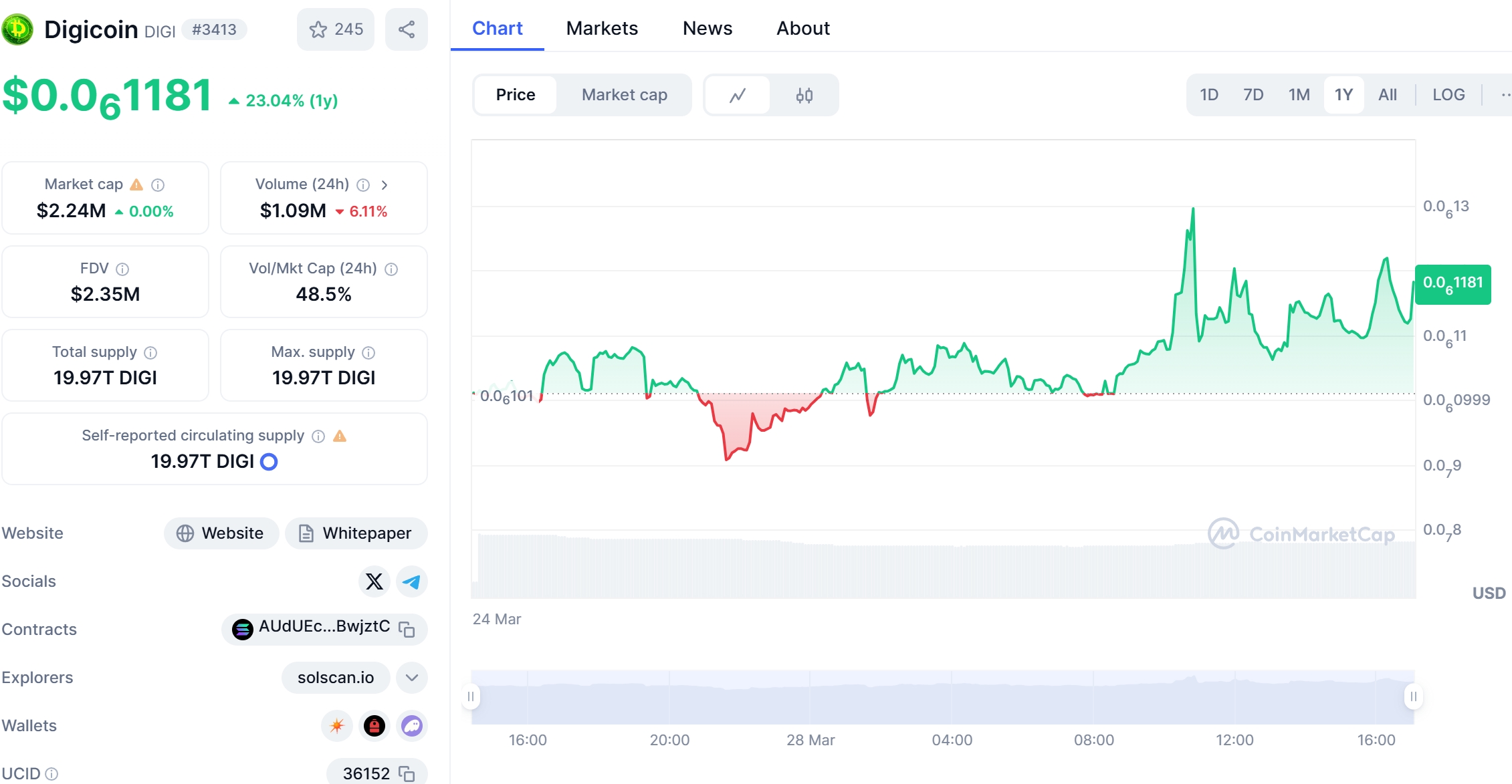

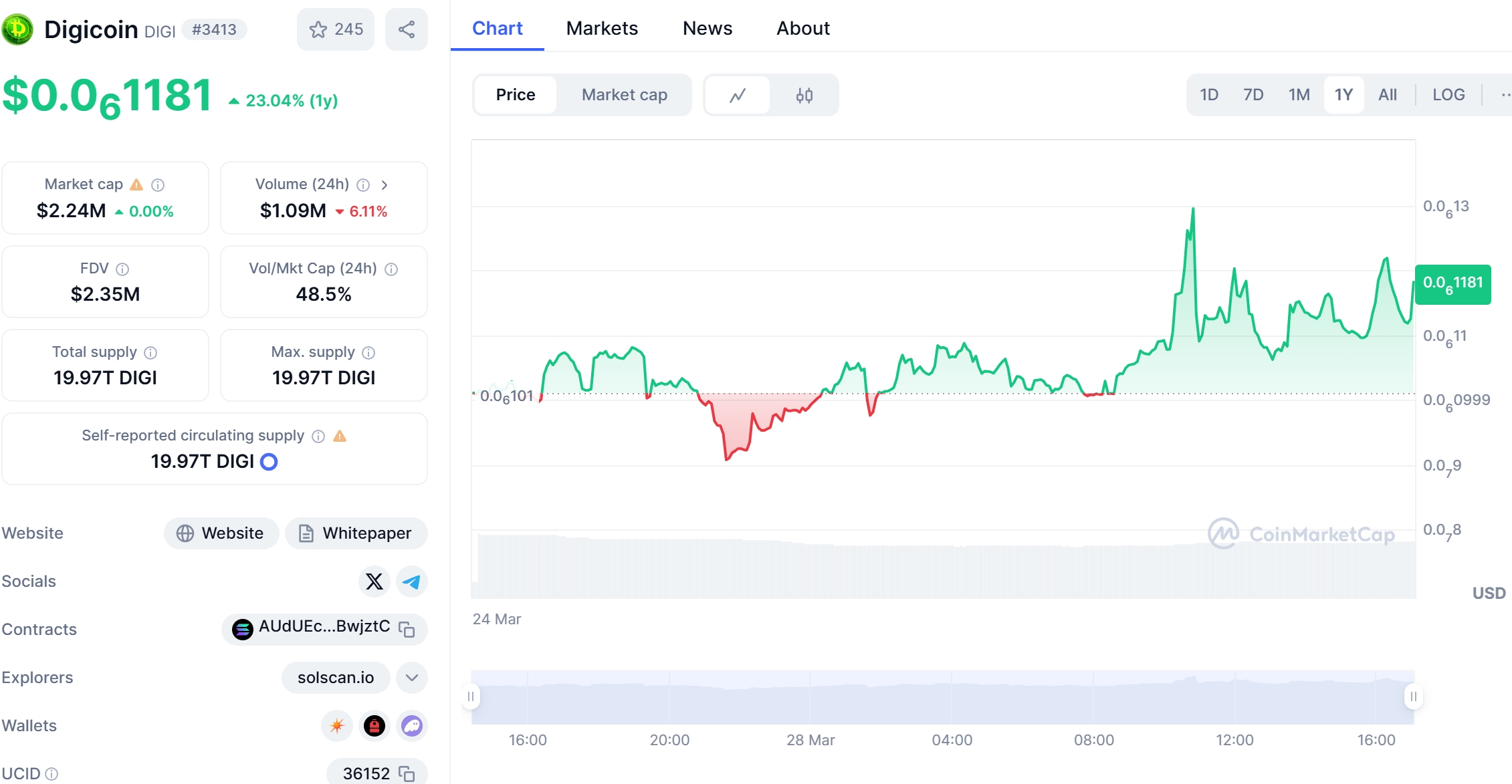

In the ever-evolving world of cryptocurrencies, there’s arguably no hotter topic right now than Digicoin(DIGI) Coin. It’s now up more than 150% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 20%, making it one of the top-performing cryptocurrencies. This unexpected surge has caught the attention of investors and enthusiasts alike, sparking discussions about its potential and future trajectory.

Digicoin(DIGI) Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with significant price swings and intriguing developments. On March 15, 2025, the token surged to a multi-year high of $0.05, fueled by strong market sentiment. However, the rally was short-lived, and the coin experienced a slight dip before stabilizing. This volatility has left many wondering about the factors driving these movements and what the future holds for Digicoin(DIGI) Coin.

Digicoin(DIGI) Coin price prediction remains a hot topic as investors scrutinize every price movement, and today we dive deep into how these forecasts compare with the emerging promise of new blockchain solutions. In a landscape filled with volatile digital assets, many wonder, “Would you buy Digicoin(DIGI) Coin at $0.05?” Let’s explore the reasons behind the recent surge, analyze the market trends, and provide insights into what might lie ahead for this intriguing cryptocurrency.

Contents

The Unexpected Surge of Digicoin(DIGI) Coin

The recent surge of Digicoin(DIGI) Coin to $0.05 has been nothing short of remarkable. This unexpected price movement can be attributed to several factors, including increased adoption, positive market sentiment, and strategic partnerships. Let’s delve into these elements to understand what’s driving the surge.

Increased Adoption and Use Cases

One of the primary drivers behind the surge of Digicoin(DIGI) Coin is its increased adoption across various sectors. The cryptocurrency has been gaining traction as a payment solution for online transactions, particularly in the gaming and e-commerce industries. This increased utility has led to a higher demand for the coin, pushing its price upward.

For instance, a recent partnership with a leading online gaming platform has allowed users to purchase in-game items using Digicoin(DIGI) Coin. This integration has not only increased the coin’s visibility but also its practical use, attracting more users to the ecosystem. Similarly, several e-commerce platforms have started accepting Digicoin(DIGI) Coin as a payment method, further boosting its adoption.

Positive Market Sentiment

Market sentiment plays a crucial role in the price movements of cryptocurrencies, and Digicoin(DIGI) Coin is no exception. The positive sentiment surrounding the coin can be attributed to several factors, including favorable media coverage, endorsements from influential figures in the crypto space, and a growing community of supporters.

Recent news articles and social media posts have highlighted the potential of Digicoin(DIGI) Coin, emphasizing its low transaction fees and fast processing times. These features have resonated with investors looking for efficient and cost-effective payment solutions. Additionally, endorsements from well-known crypto influencers have further fueled the positive sentiment, encouraging more people to invest in the coin.

Strategic Partnerships and Developments

Strategic partnerships and ongoing developments have also contributed to the surge of Digicoin(DIGI) Coin. The project team has secured significant investments from venture capital firms, demonstrating confidence in the coin’s long-term potential. These investments have enabled the team to expand their development efforts and launch new features that enhance the coin’s functionality.

One notable development is the integration of Digicoin(DIGI) Coin with a popular blockchain platform, allowing for seamless interoperability with other cryptocurrencies. This integration has opened up new use cases for the coin, such as cross-chain transactions and decentralized finance (DeFi) applications. The team’s commitment to continuous improvement and innovation has been a key factor in driving the coin’s price upward.

Analyzing Market Trends and Indicators

To gain a deeper understanding of Digicoin(DIGI) Coin’s recent surge and future potential, it’s essential to analyze market trends and technical indicators. These tools provide valuable insights into the coin’s price movements and help investors make informed decisions.

Key Indicators

Several key indicators can be used to analyze the market trends of Digicoin(DIGI) Coin. These include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, moving averages, and Fibonacci retracements. Let’s explore how these indicators can provide insights into the coin’s price movements.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is typically used to identify overbought or oversold conditions. An RSI above 70 indicates that the coin may be overbought, while an RSI below 30 suggests that it may be oversold.

As of March 2025, the RSI for Digicoin(DIGI) Coin is hovering around 65, indicating that the coin is approaching overbought territory. This suggests that the recent surge may be due for a correction, but it also reflects the strong momentum behind the coin’s price movements.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. It consists of the MACD line, the signal line, and the histogram. When the MACD line crosses above the signal line, it’s considered a bullish signal, while a cross below the signal line is seen as bearish.

For Digicoin(DIGI) Coin, the MACD line has recently crossed above the signal line, indicating a bullish trend. This aligns with the coin’s recent surge and suggests that the upward momentum may continue in the short term. However, investors should remain cautious and monitor the MACD for any signs of a potential reversal.

Bollinger Bands

Bollinger Bands are a volatility indicator that consists of a middle band (usually a simple moving average) and two outer bands that are standard deviations away from the middle band. When the price moves close to the upper band, it may indicate that the coin is overbought, while a move near the lower band suggests it may be oversold.

The Bollinger Bands for Digicoin(DIGI) Coin have recently expanded, reflecting increased volatility. The price has been trading near the upper band, indicating that the coin may be overbought. However, the expansion of the bands also suggests that there is potential for further price movement, either upward or downward.

Moving Averages

Moving averages are used to smooth out price data and identify trends. The most common types are the simple moving average (SMA) and the exponential moving average (EMA). When the price is above the moving average, it’s considered a bullish signal, while a price below the moving average is seen as bearish.

For Digicoin(DIGI) Coin, the 50-day SMA is currently below the 200-day SMA, indicating a bullish crossover. This suggests that the coin’s recent surge is part of a longer-term uptrend. However, investors should monitor the moving averages for any signs of a potential reversal, as a bearish crossover could signal a change in the trend.

Fibonacci Retracements

Fibonacci retracements are used to identify potential support and resistance levels based on the Fibonacci sequence. These levels are calculated by taking the high and low points of a price movement and dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 100%.

For Digicoin(DIGI) Coin, the recent surge has pushed the price above the 61.8% Fibonacci retracement level, indicating strong bullish momentum. However, the coin may face resistance at the 100% level, which could lead to a potential pullback. Investors should monitor these levels closely to identify potential entry and exit points.

Support and Resistance Levels

Identifying critical support and resistance levels is essential for understanding the potential price movements of Digicoin(DIGI) Coin. These levels can act as barriers that the price may struggle to break through, providing valuable insights into market behavior.

Support Levels

Support levels are price points where the demand for a cryptocurrency is strong enough to prevent the price from falling further. For Digicoin(DIGI) Coin, the recent surge has pushed the price above several key support levels, including $0.03 and $0.04. These levels may act as potential areas of support if the price experiences a pullback.

The $0.03 level, in particular, has been a strong support level for Digicoin(DIGI) Coin in the past. If the price were to drop to this level, it could attract buyers looking to enter the market at a perceived discount. However, investors should remain cautious, as a break below this level could signal a more significant downturn.

Resistance Levels

Resistance levels are price points where the supply of a cryptocurrency is strong enough to prevent the price from rising further. For Digicoin(DIGI) Coin, the recent surge has pushed the price close to the $0.06 resistance level. Breaking through this level could signal further bullish momentum and potentially lead to new highs.

However, the $0.06 level has acted as a strong resistance level for Digicoin(DIGI) Coin in the past. If the price struggles to break through this level, it could lead to a period of consolidation or a potential pullback. Investors should monitor the price action around this level closely to gauge the coin’s future direction.

Chart Analysis

Chart analysis is a powerful tool for understanding the price trends and patterns of Digicoin(DIGI) Coin. By examining historical price data and identifying key patterns, investors can gain valuable insights into the coin’s potential future movements.

Price Trends

The recent surge of Digicoin(DIGI) Coin has formed a clear uptrend on the price chart. The coin has been making higher highs and higher lows, indicating strong bullish momentum. This uptrend has been supported by increasing trading volumes, further confirming the strength of the move.

However, investors should remain cautious, as uptrends can be subject to pullbacks and corrections. A break below the recent lows could signal a potential reversal, while a continuation of the uptrend could lead to new highs. Monitoring the price action and volume will be crucial for identifying the coin’s future direction.

Chart Patterns

Several chart patterns can be identified on the Digicoin(DIGI) Coin price chart, providing valuable insights into potential future movements. One notable pattern is the “cup and handle” formation, which is considered a bullish continuation pattern.

The cup and handle pattern consists of a rounded bottom (the cup) followed by a smaller consolidation period (the handle). A breakout above the handle can signal a continuation of the uptrend. For Digicoin(DIGI) Coin, the recent surge has formed a cup and handle pattern, suggesting that the coin may be poised for further upside.

Another pattern to watch is the “ascending triangle,” which is also considered a bullish continuation pattern. This pattern is formed by a horizontal resistance level and a rising support level. A breakout above the resistance level can signal a continuation of the uptrend. Digicoin(DIGI) Coin has recently formed an ascending triangle pattern, indicating potential for further upside.

Long and Short-Term Predictions

Based on the analysis of market trends, technical indicators, and chart patterns, we can make some thoughtful predictions about the future price movements of Digicoin(DIGI) Coin. These predictions are based on data and trends and should be considered speculative in nature.

Short-Term Predictions

In the short term, Digicoin(DIGI) Coin is likely to experience some volatility as it consolidates around the $0.05 level. The coin may face resistance at the $0.06 level, which could lead to a period of consolidation or a potential pullback. However, if the coin can break through this level, it could signal further bullish momentum and potentially lead to new highs.

The RSI and MACD indicators suggest that the coin may be due for a correction, but the strong momentum behind the recent surge could help support the price. Investors should monitor the price action and volume closely to gauge the coin’s short-term direction.

Long-Term Predictions

In the long term, Digicoin(DIGI) Coin has the potential to continue its upward trajectory, driven by increased adoption, positive market sentiment, and ongoing developments. The coin’s integration with popular blockchain platforms and its growing use cases in the gaming and e-commerce industries could help drive demand and push the price higher.

The cup and handle and ascending triangle patterns on the price chart suggest that the coin may be poised for further upside. If the coin can break through the $0.06 resistance level, it could signal a continuation of the uptrend and potentially lead to new highs.

However, investors should remain cautious, as the cryptocurrency market is known for its volatility and unpredictability. A break below key support levels could signal a potential reversal, and investors should be prepared for potential pullbacks and corrections.

Comparing Digicoin(DIGI) Coin to Other Cryptocurrencies

To gain a deeper understanding of Digicoin(DIGI) Coin’s recent surge and future potential, it’s helpful to compare its trend to other cryptocurrencies that have experienced similar or popular price movements in the past. Let’s examine how Digicoin(DIGI) Coin compares to Ethereum (ETH), a well-known and widely adopted cryptocurrency.

Ethereum’s Price Movement

Ethereum, one of the most popular cryptocurrencies, experienced a significant price surge in 2021, reaching an all-time high of over $4,000. This surge was driven by increased adoption of decentralized finance (DeFi) applications and non-fungible tokens (NFTs), which are built on the Ethereum blockchain.

However, Ethereum’s price experienced a sharp correction in 2022, dropping to around $1,000. This correction was attributed to several factors, including regulatory concerns, increased competition from other blockchain platforms, and a broader market downturn.

Despite the correction, Ethereum managed to recover and has since reached new highs, driven by ongoing developments and increased adoption. The Ethereum team has been working on scaling solutions, such as Ethereum 2.0, which aims to improve the network’s performance and reduce transaction fees.

Similarities and Differences

There are several similarities and differences between Digicoin(DIGI) Coin’s recent surge and Ethereum’s price movement in the past. Both cryptocurrencies have experienced significant price surges driven by increased adoption and positive market sentiment. Additionally, both coins have faced resistance at key levels, leading to periods of consolidation or pullbacks.

However, there are also some key differences between the two cryptocurrencies. Digicoin(DIGI) Coin is primarily focused on payment solutions, while Ethereum is a more versatile platform that supports a wide range of applications, including DeFi and NFTs. Additionally, Ethereum has a larger market capitalization and a more established ecosystem, which can provide more stability and support during market downturns.

Potential Recovery Path

Based on the comparison to Ethereum, Digicoin(DIGI) Coin may follow a similar recovery path if it experiences a significant correction. The coin’s strong fundamentals, including its growing adoption and ongoing developments, could help support its price and drive a recovery.

However, Digicoin(DIGI) Coin may also take a different path, depending on market conditions and external events. The cryptocurrency market is highly influenced by factors such as regulatory developments, macroeconomic trends, and investor sentiment, which can impact the coin’s price movements.

Investors should remain cautious and monitor the market closely to identify potential entry and exit points. Diversifying their portfolio and setting clear risk management strategies can help mitigate potential losses and maximize returns.

Actionable Insights for Investors

Based on the analysis of Digicoin(DIGI) Coin’s recent surge and future potential, here are some actionable insights for investors:

Monitor Key Indicators and Levels

Investors should closely monitor key indicators, such as the RSI, MACD, Bollinger Bands, moving averages, and Fibonacci retracements, to gain insights into the coin’s price movements. Additionally, identifying critical support and resistance levels can help investors make informed decisions about potential entry and exit points.

Stay Informed About Market Developments

Staying informed about market developments, such as new partnerships, integrations, and regulatory changes, can provide valuable insights into the coin’s future potential. Investors should follow reputable news sources and engage with the Digicoin(DIGI) Coin community to stay up-to-date on the latest developments.

Diversify Your Portfolio

Diversifying your portfolio can help mitigate potential losses and maximize returns. Investors should consider allocating a portion of their portfolio to Digicoin(DIGI) Coin while also investing in other cryptocurrencies and assets to spread their risk.

Set Clear Risk Management Strategies

Setting clear risk management strategies, such as stop-loss orders and position sizing, can help investors manage their risk and protect their capital. Investors should determine their risk tolerance and set appropriate risk management strategies before entering the market.

Stay Patient and Disciplined

The cryptocurrency market can be highly volatile and unpredictable, and investors should remain patient and disciplined in their approach. Avoiding emotional decision-making and sticking to a well-defined investment strategy can help investors navigate the market’s ups and downs.

Conclusion

Digicoin(DIGI) Coin’s recent surge to $0.05 has captured the attention of investors and enthusiasts alike, sparking discussions about its potential and future trajectory. The coin’s increased adoption, positive market sentiment, and ongoing developments have driven its price upward, but investors should remain cautious and monitor the market closely.

By analyzing market trends, technical indicators, and chart patterns, investors can gain valuable insights into the coin’s potential future movements. Comparing Digicoin(DIGI) Coin to other cryptocurrencies, such as Ethereum, can also provide valuable context and help investors make informed decisions.

Ultimately, investing in Digicoin(DIGI) Coin requires careful consideration and a well-defined strategy. By staying informed, diversifying their portfolio, setting clear risk management strategies, and remaining patient and disciplined, investors can navigate the market’s volatility and potentially capitalize on the coin’s future potential.