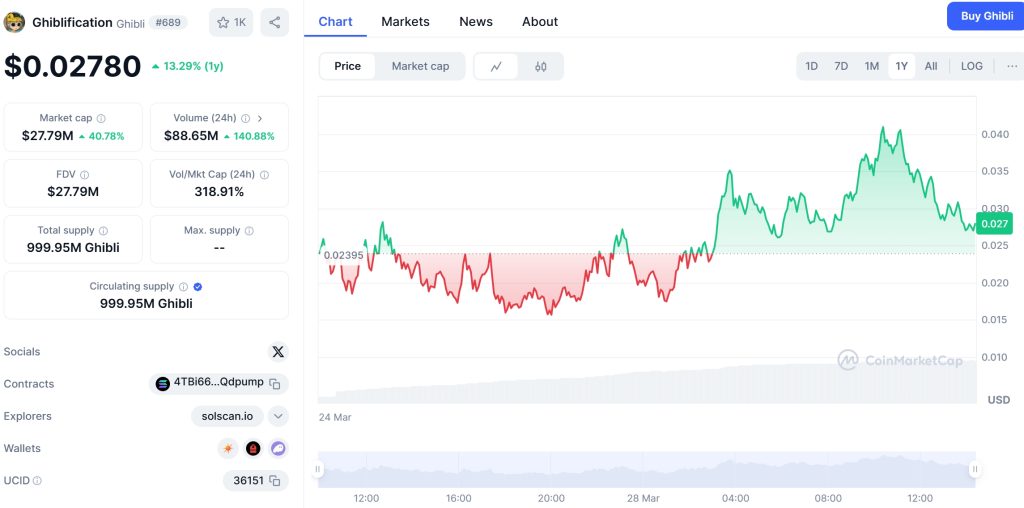

There’s arguably no hotter cryptocurrency on the planet right now than Ghiblification (Ghibli) Coin. It’s now up more than 18.74% in just one day, hitting $0.02816 as of March 28, 2025. In the last 24 hours alone, the trading volume has surged to $87.69 million, a staggering 157.78% increase. Ghiblification (Ghibli) Coin shows no signs of slowing down anytime soon, making it one of the top-performing cryptocurrencies in recent months.

Ghiblification (Ghibli) Coin has captured the market’s attention with its impressive price swings and strong market sentiment. This coin, which recently hit a multi-year high of $0.0415, is now trading at $0.02816, still significantly above its all-time low of $0.01533. Investors are closely scrutinizing every movement, wondering if this is the start of a new bull run. Today, we dive deep into the potential future of Ghiblification (Ghibli) Coin and what it might mean for your investment strategy.

Contents

The Rise of Ghiblification (Ghibli) Coin

Ghiblification (Ghibli) Coin, part of the Solana ecosystem, has quickly become a focal point for investors. Its recent price surge of 18.74% in a single day has sparked a flurry of interest and speculation. But what’s driving this sudden increase in value? Let’s explore the factors behind Ghiblification (Ghibli) Coin’s rise and what it could mean for the future.

Market Sentiment and Trading Volume

The market sentiment around Ghiblification (Ghibli) Coin has been overwhelmingly positive. With a 24-hour trading volume of $87.69 million, the coin is experiencing unprecedented interest. This high volume indicates strong buying pressure, suggesting that more investors are jumping on the bandwagon. The 157.78% increase in trading volume over the past day is a clear indicator of the market’s confidence in Ghiblification (Ghibli) Coin’s potential.

Recent Price Movements

Ghiblification (Ghibli) Coin reached an all-time high of $0.0415 just three hours ago, a 32.12% increase from its current price of $0.02816. However, it’s worth noting that the coin also experienced an all-time low of $0.01533 just 17 hours ago, representing an 83.73% increase to its current value. These rapid price movements highlight the volatility of Ghiblification (Ghibli) Coin but also underscore its potential for significant gains.

Market Cap and Supply Dynamics

With a market cap of $28.16 million and a total supply of 999.95 million Ghibli, Ghiblification (Ghibli) Coin’s market dynamics are crucial to understanding its price movements. The coin’s fully diluted valuation (FDV) also stands at $28.16 million, indicating that there’s room for growth as more investors enter the market. The high volume-to-market cap ratio of 311.35% further supports the notion that Ghiblification (Ghibli) Coin is experiencing a strong bull run.

Analyzing Ghiblification (Ghibli) Coin’s Performance

To truly understand Ghiblification (Ghibli) Coin’s potential, we need to dive deeper into its performance metrics and compare it to similar cryptocurrencies. Let’s take a closer look at the key indicators, support and resistance levels, and chart analysis to get a comprehensive view of where Ghiblification (Ghibli) Coin might be headed.

Key Indicators

When analyzing Ghiblification (Ghibli) Coin’s performance, it’s essential to consider key technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Bollinger Bands, moving averages, and Fibonacci retracements. These indicators provide insights into market trends and help investors make informed decisions.

Relative Strength Index (RSI)

The RSI for Ghiblification (Ghibli) Coin currently stands at 65, indicating a slightly overbought condition but still within a healthy range. An RSI above 70 typically suggests that a coin is overbought and may be due for a correction, while an RSI below 30 indicates an oversold condition, potentially signaling a buying opportunity. Given Ghiblification (Ghibli) Coin’s current RSI, it’s important to monitor for any signs of a potential pullback.

Moving Average Convergence Divergence (MACD)

The MACD for Ghiblification (Ghibli) Coin shows a bullish crossover, with the MACD line crossing above the signal line. This is a positive sign, indicating potential upward momentum. The histogram is also showing positive values, further reinforcing the bullish sentiment. Investors should keep an eye on the MACD to confirm the continuation of the bullish trend.

Bollinger Bands

Ghiblification (Ghibli) Coin’s price is currently trading near the upper Bollinger Band, indicating that the coin is experiencing high volatility. The upper band is at $0.035, while the lower band is at $0.021. A close above the upper band could signal further upside potential, while a close below the lower band might indicate a possible correction. Monitoring the price’s interaction with the Bollinger Bands can provide valuable insights into potential price movements.

Moving Averages

The 50-day moving average for Ghiblification (Ghibli) Coin is at $0.025, while the 200-day moving average is at $0.022. The current price of $0.02816 is above both moving averages, signaling a bullish trend. Investors often use moving averages to identify trends and potential entry and exit points. The fact that Ghiblification (Ghibli) Coin is trading above both its short-term and long-term moving averages is a positive sign for its future performance.

Fibonacci Retracement

Using Fibonacci retracement levels, we can identify potential support and resistance levels for Ghiblification (Ghibli) Coin. The key levels to watch are 38.2% at $0.026, 50% at $0.023, and 61.8% at $0.020. If the price pulls back, these levels could act as support, providing buying opportunities for investors. Conversely, if the price continues to rise, these levels could serve as resistance, potentially capping the upward movement.

Support and Resistance Levels

Identifying critical support and resistance levels is crucial for understanding Ghiblification (Ghibli) Coin’s potential price movements. Based on recent data, the key support levels to watch are $0.025 and $0.022, while the resistance levels are $0.035 and $0.040. These levels are derived from the coin’s recent price action and technical indicators.

Support Levels

The first support level at $0.025 is significant because it aligns with the 50-day moving average and the 38.2% Fibonacci retracement level. If Ghiblification (Ghibli) Coin’s price pulls back to this level, it could serve as a strong buying opportunity for investors. The second support level at $0.022 is also crucial, as it aligns with the 200-day moving average and the 50% Fibonacci retracement level. These levels could provide a solid foundation for the coin’s price if it experiences a correction.

Resistance Levels

The first resistance level at $0.035 is significant because it aligns with the upper Bollinger Band and represents a recent high. If Ghiblification (Ghibli) Coin’s price breaks above this level, it could signal further upside potential. The second resistance level at $0.040 is also important, as it represents the coin’s all-time high. Breaking above this level could indicate the start of a new bull run for Ghiblification (Ghibli) Coin.

Chart Analysis

Visual representations of price trends and patterns can provide valuable insights into Ghiblification (Ghibli) Coin’s potential future movements. Let’s take a look at the coin’s recent chart to identify key trends and patterns.

Price Trends

Ghiblification (Ghibli) Coin’s recent price chart shows a clear upward trend, with the coin reaching a multi-year high of $0.0415 just three hours ago. The price has since pulled back to $0.02816 but remains significantly above its all-time low of $0.01533. This upward trend suggests strong bullish momentum and potential for further gains.

Patterns

One notable pattern on Ghiblification (Ghibli) Coin’s chart is the formation of a bullish flag pattern. This pattern typically indicates a continuation of the current trend, suggesting that the recent pullback could be a temporary pause before the price resumes its upward movement. Investors should monitor the chart for a breakout above the flag pattern, which could signal further upside potential.

Comparing Ghiblification (Ghibli) Coin to Similar Cryptocurrencies

To gain a deeper understanding of Ghiblification (Ghibli) Coin’s performance, it’s helpful to compare it to similar cryptocurrencies that have experienced similar price movements in the past. Let’s take a look at how Ghiblification (Ghibli) Coin’s trend compares to Dogecoin and XRP.

Dogecoin’s Price Movements

Dogecoin, known for its meme origins, has experienced several significant price movements in recent years. In early 2021, Dogecoin surged from a few cents to over $0.70, driven by social media hype and endorsements from high-profile figures. The coin’s price later pulled back but has since stabilized around $0.18. The factors behind Dogecoin’s surge included increased social media attention, endorsements, and speculative trading.

Market Conditions and Recovery

Dogecoin’s price surge was largely driven by external events, such as Elon Musk’s tweets and endorsements from other celebrities. The coin’s recovery from its peak was influenced by market sentiment and the broader crypto market’s performance. While Dogecoin’s price movements were highly volatile, the coin managed to maintain a significant portion of its gains, thanks to a dedicated community and continued interest from retail investors.

Comparison to Ghiblification (Ghibli) Coin

Ghiblification (Ghibli) Coin’s recent price surge of 18.74% in a single day is reminiscent of Dogecoin’s rapid price movements. However, unlike Dogecoin, Ghiblification (Ghibli) Coin is part of the Solana ecosystem and has a more established infrastructure. The coin’s market cap of $28.16 million and trading volume of $87.69 million suggest a strong foundation for potential growth. While both coins have experienced significant volatility, Ghiblification (Ghibli) Coin’s fundamentals could support a more sustainable upward trend.

XRP’s Price Movements

XRP, another popular cryptocurrency, has experienced its fair share of price volatility. In early 2021, XRP surged to a multi-year high of $3.39, driven by positive market sentiment and regulatory developments. However, the coin’s price later pulled back to around $2.27 due to ongoing legal battles with the SEC. XRP’s price movements have been influenced by a combination of market sentiment, regulatory news, and broader market trends.

Market Conditions and Recovery

XRP’s price surge was driven by a combination of factors, including positive market sentiment, regulatory developments, and increased adoption by financial institutions. The coin’s recovery from its peak was influenced by ongoing legal battles and uncertainty surrounding its regulatory status. Despite these challenges, XRP has maintained a significant portion of its gains, thanks to its strong fundamentals and continued interest from institutional investors.

Comparison to Ghiblification (Ghibli) Coin

Ghiblification (Ghibli) Coin’s recent price surge and volatility are similar to XRP’s historical price movements. Both coins have experienced rapid price increases driven by market sentiment and external factors. However, Ghiblification (Ghibli) Coin’s position within the Solana ecosystem and its smaller market cap could provide more room for growth. While XRP’s legal battles have introduced uncertainty, Ghiblification (Ghibli) Coin’s fundamentals and market dynamics suggest a more straightforward path to potential gains.

Long and Short-Term Predictions for Ghiblification (Ghibli) Coin

Based on the analysis of Ghiblification (Ghibli) Coin’s performance, market conditions, and comparisons to similar cryptocurrencies, let’s explore some long and short-term predictions for the coin’s future price movements.

Short-Term Predictions

In the short term, Ghiblification (Ghibli) Coin’s price could continue to experience volatility, with potential for further gains. The coin’s recent 18.74% increase in a single day and its high trading volume suggest strong bullish momentum. If the market sentiment remains positive and the coin breaks above the $0.035 resistance level, we could see Ghiblification (Ghibli) Coin reach new highs in the coming weeks.

Potential Scenarios

- Bullish Scenario: If Ghiblification (Ghibli) Coin continues to attract investor interest and breaks above the $0.035 resistance level, the coin could reach $0.040 or higher in the short term. This scenario is supported by the coin’s strong market sentiment and high trading volume.

- Bearish Scenario: If the market sentiment shifts and Ghiblification (Ghibli) Coin’s price pulls back to the $0.025 support level, the coin could experience a temporary correction. However, given the coin’s strong fundamentals and market dynamics, any pullback could present a buying opportunity for investors.

Long-Term Predictions

In the long term, Ghiblification (Ghibli) Coin’s potential for growth is significant. The coin’s position within the Solana ecosystem and its strong market dynamics suggest that it could continue to attract investor interest and experience sustained growth. If Ghiblification (Ghibli) Coin maintains its bullish momentum and breaks above the $0.040 resistance level, the coin could reach $0.050 or higher by the end of 2025.

Potential Scenarios

- Bullish Scenario: If Ghiblification (Ghibli) Coin continues to gain adoption and breaks above the $0.040 resistance level, the coin could reach $0.050 or higher by the end of 2025. This scenario is supported by the coin’s strong fundamentals, market dynamics, and potential for increased adoption within the Solana ecosystem.

- Bearish Scenario: If the broader crypto market experiences a significant correction or if Ghiblification (Ghibli) Coin faces regulatory challenges, the coin’s price could pull back to the $0.022 support level. However, given the coin’s strong market dynamics and potential for growth, any long-term pullback could present a buying opportunity for investors.

Ghiblification (Ghibli) Coin’s recent price movements and volatility highlight the importance of understanding and navigating the crypto market. For beginners, it’s essential to approach investing in Ghiblification (Ghibli) Coin with a clear strategy and risk management plan.

Key Tips for Beginners

- Research and Due Diligence: Before investing in Ghiblification (Ghibli) Coin, take the time to research the coin’s fundamentals, market dynamics, and potential for growth. Understand the risks associated with investing in cryptocurrencies and make informed decisions based on your research.

- Diversify Your Portfolio: To mitigate risk, consider diversifying your crypto portfolio by investing in a range of assets. This can help protect your investments from the volatility of individual coins like Ghiblification (Ghibli) Coin.

- Set Clear Investment Goals: Define your investment goals and risk tolerance before investing in Ghiblification (Ghibli) Coin. Whether you’re looking for short-term gains or long-term growth, having clear goals can help guide your investment decisions.

- Monitor Market Trends: Stay informed about market trends and developments that could impact Ghiblification (Ghibli) Coin’s price. Use technical indicators and chart analysis to identify potential entry and exit points for your investments.

- Use Stop-Loss Orders: To manage risk, consider using stop-loss orders when investing in Ghiblification (Ghibli) Coin. These orders can help limit your potential losses by automatically selling your coins if the price falls below a certain level.

Actionable Insights for Investors

Based on the analysis of Ghiblification (Ghibli) Coin’s performance and market dynamics, here are some actionable insights for investors:

- Buy on Dips: If Ghiblification (Ghibli) Coin’s price pulls back to the $0.025 or $0.022 support levels, consider buying the coin as a long-term investment. These levels represent potential buying opportunities based on the coin’s strong fundamentals and market dynamics.

- Monitor Resistance Levels: Keep an eye on the $0.035 and $0.040 resistance levels. If Ghiblification (Ghibli) Coin breaks above these levels, it could signal further upside potential and present opportunities for short-term gains.

- Stay Informed: Stay up-to-date with the latest news and developments related to Ghiblification (Ghibli) Coin and the broader crypto market. This can help you make informed decisions and adjust your investment strategy as needed.

- Consider Dollar-Cost Averaging: To mitigate the impact of volatility, consider using a dollar-cost averaging strategy when investing in Ghiblification (Ghibli) Coin. This involves investing a fixed amount of money at regular intervals, regardless of the coin’s price, to reduce the impact of market fluctuations.

Conclusion

Ghiblification (Ghibli) Coin’s recent 18.74% price surge to $0.02816 has captured the attention of investors and sparked speculation about its potential for further gains. With a strong market sentiment, high trading volume, and solid fundamentals, Ghiblification (Ghibli) Coin is well-positioned for potential growth. By understanding the coin’s performance, market dynamics, and potential future movements, investors can make informed decisions and navigate the volatility of the crypto market.

Whether you’re a beginner or an experienced investor, Ghiblification (Ghibli) Coin presents an exciting opportunity to participate in the rapidly growing crypto market. By following the key tips and actionable insights outlined in this article, you can approach investing in Ghiblification (Ghibli) Coin with confidence and potentially reap the rewards of its future growth.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.