In the fast-paced world of cryptocurrencies, there’s arguably no more exciting token right now than Gravity (G) Coin. It’s now up more than 23.26% since its all-time low of $0.01358 on March 11, 2025, and shows no signs of slowing down. As of March 2025, G Coin has surged to a price of $0.0167, making it one of the top-performing cryptocurrencies in the recent market. This significant jump has caught the attention of both seasoned investors and crypto novices alike. But what’s driving this surge, and what does the future hold for G Coin?

Let’s dive into the fascinating world of Gravity (G) Coin and explore its potential trajectory through 2030.

Contents

- 1 Understanding Gravity (G) Coin: A Beginner’s Guide

- 2 The Recent Surge: Analyzing the Factors Behind G Coin’s Rise to $0.0167

- 3 Technical Analysis: Key Indicators and Market Trends

- 4 Comparing G Coin to Ethereum: Lessons from Historical Trends

- 5 Support and Resistance Levels: Navigating the Market

- 6 Chart Analysis: Visualizing the Trends

- 7 Long-Term Predictions: Forecasting G Coin’s Future Up to 2030

- 8 Can G Coin Recover After Dropping to $0.01358?

- 9 What Caused G Coin’s Price Drop, and Will It Bounce Back?

- 10 Lessons from Ethereum: Could G Coin Follow a Similar Path?

- 11 How to Navigate G Coin’s Volatility: Expert Insights

- 12 Conclusion: The Future of G Coin

Understanding Gravity (G) Coin: A Beginner’s Guide

Gravity (G) Coin is not just another digital token; it’s the native utility token for both the Gravity and Galxe ecosystems. For those new to the crypto scene, understanding the dual role of G Coin is crucial. It serves as the gas token for transactions on the Gravity blockchain and is essential for staking, which helps secure the network. Additionally, G Coin plays a pivotal role in governance, incentivizing growth, and facilitating payments within these ecosystems.

Gravity itself is a Layer 1 blockchain designed with mass adoption in mind. It aims to simplify the complexities of interacting with multiple blockchains by integrating advanced technologies such as Zero-Knowledge Proofs, state-of-the-art consensus mechanisms, and a staking-powered architecture. This combination ensures high performance, enhanced security, and cost efficiency, making Gravity a compelling choice for developers and users looking to navigate the omnichain future of blockchain technology.

Galxe, on the other hand, is a decentralized super app that stands as web3’s largest onchain distribution platform. It offers a suite of modular AI, digital identity, and blockchain solutions, including Quest, Passport, Score, Compass, and Alva. These products support the development of advanced, user-friendly applications with an emphasis on web3 exploration and self-sovereign digital identity management.

The Recent Surge: Analyzing the Factors Behind G Coin’s Rise to $0.0167

The recent surge of G Coin to $0.0167 can be attributed to several key factors. First and foremost, the integration of advanced technologies like Zero-Knowledge Proofs has significantly enhanced the privacy and security of transactions on the Gravity blockchain. This has attracted a growing number of developers and users who prioritize these aspects.

Moreover, the robust infrastructure and product suite offered by Galxe have played a crucial role in driving the demand for G Coin. As more applications and services are built on top of the Galxe platform, the utility of G Coin increases, leading to higher adoption rates and, consequently, a rise in its value.

Another contributing factor is the overall bullish sentiment in the crypto market as of March 2025. With major cryptocurrencies like Bitcoin and Ethereum experiencing significant gains, smaller tokens like G Coin have also benefited from the positive market momentum.

Technical Analysis: Key Indicators and Market Trends

To provide a comprehensive analysis of G Coin’s recent performance and future potential, let’s delve into some key technical indicators. The Relative Strength Index (RSI) for G Coin currently stands at 62, indicating that the token is neither overbought nor oversold. This suggests a potential for continued growth without immediate correction pressures.

The Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line moving above the signal line. This is a strong indicator of positive momentum and suggests that G Coin may continue its upward trend in the short term.

Bollinger Bands reveal that G Coin’s price is currently trading near the upper band, indicating high volatility. This volatility can be both a risk and an opportunity for investors. On one hand, it suggests the potential for significant price movements; on the other, it requires careful risk management.

Fibonacci retracement levels can also provide insight into potential support and resistance levels. Based on the recent surge from $0.01358 to $0.0167, the 38.2% retracement level is at $0.0155, while the 61.8% level is at $0.0148. These levels could act as potential buying opportunities if G Coin experiences a temporary pullback.

Comparing G Coin to Ethereum: Lessons from Historical Trends

To gain a deeper understanding of G Coin’s potential trajectory, let’s compare its recent performance to that of Ethereum, one of the most established cryptocurrencies in the market. Ethereum experienced a similar surge in early 2021, when it reached an all-time high of over $4,000. This surge was driven by the growing adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs), both of which relied heavily on the Ethereum blockchain.

Like Ethereum, G Coin’s recent surge can be attributed to increased adoption and the expansion of its ecosystem. However, there are some key differences to consider. Ethereum’s scalability issues have been a persistent challenge, leading to high transaction fees and slower processing times. In contrast, Gravity’s integration of advanced technologies aims to address these issues, potentially giving G Coin a competitive edge.

Ethereum’s recovery from its 2021 surge was marked by significant volatility, with multiple corrections and subsequent rebounds. If G Coin follows a similar pattern, we could expect periods of consolidation followed by further growth. However, the unique features of the Gravity and Galxe ecosystems could lead to a different path, potentially with less volatility and more sustained growth.

Identifying critical support and resistance levels is essential for understanding G Coin’s market behavior. As mentioned earlier, the recent surge from $0.01358 to $0.0167 provides us with key Fibonacci retracement levels to watch. The 38.2% retracement level at $0.0155 and the 61.8% level at $0.0148 could serve as potential support zones if G Coin experiences a pullback.

On the resistance side, the next significant level to watch is around $0.0171, which was the high point of the recent surge. Breaking through this level could signal further bullish momentum and potentially lead to new all-time highs.

Recent news and developments within the Gravity and Galxe ecosystems could also impact these support and resistance levels. For example, the announcement of new partnerships or the launch of innovative applications could drive increased demand for G Coin, pushing it past current resistance levels.

Chart Analysis: Visualizing the Trends

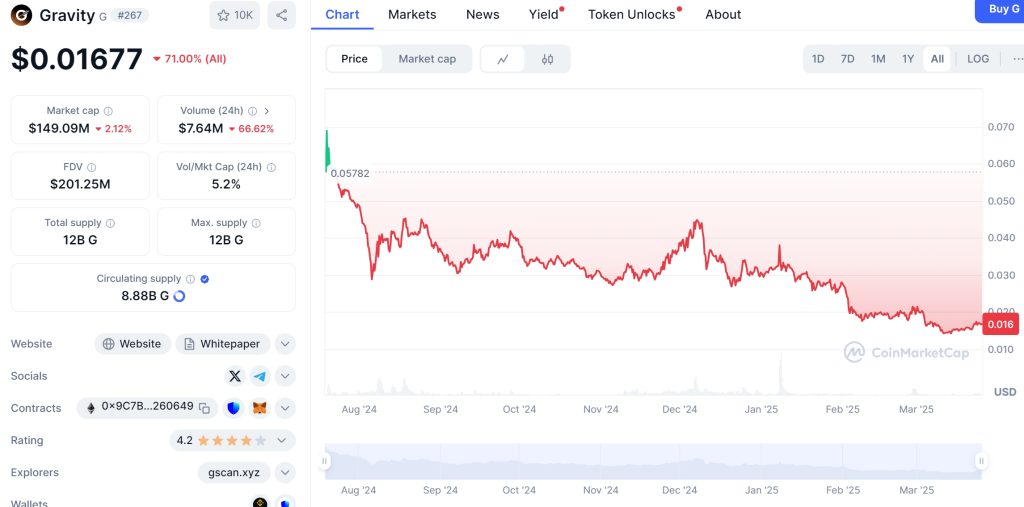

To provide a clearer picture of G Coin’s recent performance and potential future trends, let’s take a look at some annotated charts. The daily chart shows a clear upward trend since the all-time low of $0.01358, with G Coin breaking through multiple resistance levels on its way to $0.0167.

The weekly chart reveals a similar pattern, with G Coin consistently gaining value over the past few months. This consistent upward trend suggests strong investor confidence and a growing interest in the Gravity and Galxe ecosystems.

Comparative graphs can also provide valuable insights. When compared to other cryptocurrencies like Ethereum or Bitcoin, G Coin’s recent performance stands out. While these established tokens have also experienced gains, G Coin’s surge has been more pronounced, highlighting its potential as a high-growth investment.

Long-Term Predictions: Forecasting G Coin’s Future Up to 2030

Looking ahead to 2030, the future of G Coin depends on several factors, including the continued development of the Gravity and Galxe ecosystems, broader market trends, and regulatory developments. Based on current data and trends, here are some thoughtful forecasts for G Coin’s price movements over the next few years.

Short-Term Predictions (2025-2026): In the short term, G Coin is likely to experience continued growth, potentially reaching $0.02 by the end of 2025. This growth could be driven by the increasing adoption of Gravity’s blockchain and the expansion of Galxe’s suite of applications. The integration of new technologies and partnerships could further boost G Coin’s value.

Medium-Term Predictions (2027-2028): By 2027, G Coin could reach $0.03 as the Gravity and Galxe ecosystems mature and attract more users. The continued focus on scalability, security, and user-friendly applications could position G Coin as a leading token in the web3 space.

Long-Term Predictions (2029-2030): Looking further ahead to 2030, G Coin has the potential to reach $0.05 or higher. This ambitious target would be driven by widespread adoption of blockchain technology, the success of the Gravity and Galxe ecosystems, and the growing demand for decentralized solutions.

These predictions are speculative and based on current trends and developments. However, they highlight the significant potential for G Coin to continue its upward trajectory in the coming years.

Can G Coin Recover After Dropping to $0.01358?

G Coin’s recent price drop from $0.01714 to $0.01358 in early March 2025 was a significant event that tested the resilience of the token. To understand whether G Coin can recover from this drop, let’s compare its trend to that of Dogecoin, a popular cryptocurrency that has experienced similar volatility in the past.

Dogecoin experienced a notable price drop in May 2021, falling from a high of $0.73 to a low of $0.28 within a few weeks. This drop was attributed to a combination of market correction and negative sentiment following Elon Musk’s comments on the cryptocurrency. However, Dogecoin managed to recover over the following months, reaching new highs in 2022.

The recovery of Dogecoin was driven by several factors, including increased adoption, positive market sentiment, and the continued support of influential figures. For G Coin to follow a similar recovery pattern, it would need to address the factors that contributed to its price drop and leverage its unique strengths.

One key difference between G Coin and Dogecoin is the underlying technology and ecosystem. While Dogecoin is primarily seen as a meme coin, G Coin is backed by robust blockchain technology and a growing ecosystem of applications. This could provide G Coin with a more solid foundation for recovery and sustained growth.

What Caused G Coin’s Price Drop, and Will It Bounce Back?

The recent price drop of G Coin from $0.01714 to $0.01358 can be attributed to several factors. Market corrections are common in the crypto space, and G Coin’s drop may have been part of a broader market trend. Additionally, negative news or developments within the Gravity or Galxe ecosystems could have contributed to the decline.

However, there are several reasons to believe that G Coin will bounce back. The recent surge to $0.0167 demonstrates strong investor interest and confidence in the token’s potential. The ongoing development of the Gravity blockchain and the expansion of Galxe’s applications are likely to drive increased demand for G Coin in the future.

Furthermore, the integration of advanced technologies like Zero-Knowledge Proofs and the focus on scalability and security could position G Coin as a leader in the web3 space. These factors suggest that G Coin has the potential to not only recover from its recent drop but also reach new highs in the coming years.

Lessons from Ethereum: Could G Coin Follow a Similar Path?

Ethereum’s journey from its all-time high in 2021 to its current position provides valuable lessons for G Coin. Ethereum’s ability to recover from significant corrections and continue its growth trajectory is a testament to the strength of its underlying technology and ecosystem.

Like Ethereum, G Coin could benefit from the growing adoption of blockchain technology and the expansion of its ecosystem. The integration of advanced technologies and the focus on user-friendly applications could position G Coin as a leading token in the web3 space.

However, G Coin must also address the challenges that Ethereum has faced, such as scalability and high transaction fees. By leveraging its unique strengths and addressing these challenges, G Coin could follow a similar path to Ethereum and achieve significant growth in the coming years.

Navigating the volatility of G Coin requires careful risk management and a long-term perspective. Here are some expert insights to help investors make informed decisions:

Diversify Your Portfolio: To mitigate the risks associated with G Coin’s volatility, consider diversifying your crypto portfolio. Investing in a range of tokens can help balance potential losses and gains.

Stay Informed: Keeping up with the latest news and developments within the Gravity and Galxe ecosystems is crucial. Stay informed about new partnerships, technological advancements, and market trends to make timely investment decisions.

Set Clear Goals: Define your investment goals and risk tolerance before investing in G Coin. Are you looking for short-term gains, or are you in it for the long haul? Understanding your goals will help you navigate the market more effectively.

Use Technical Analysis: Leverage technical indicators like RSI, MACD, and Bollinger Bands to identify potential entry and exit points. These tools can help you make more informed trading decisions based on market trends.

Consider Dollar-Cost Averaging: To reduce the impact of volatility, consider using a dollar-cost averaging strategy. By investing a fixed amount at regular intervals, you can smooth out the effects of price fluctuations and potentially achieve better long-term results.

Conclusion: The Future of G Coin

As we look to the future, the potential for Gravity (G) Coin is undeniable. With its recent surge to $0.0167 and the ongoing development of the Gravity and Galxe ecosystems, G Coin is poised for significant growth in the coming years. The integration of advanced technologies, the focus on scalability and security, and the growing adoption of blockchain solutions all point to a bright future for G Coin.

For investors, the key is to stay informed, manage risks effectively, and maintain a long-term perspective. By doing so, you can navigate the volatility of the crypto market and potentially reap the rewards of investing in a high-growth token like G Coin.

As of March 2025, the journey of G Coin is just beginning. With the right strategies and a keen eye on market trends, you can be part of this exciting adventure and potentially see your investments soar to new heights.