Hey, everyone! Let’s take a moment to unpack a wild story shaking up the crypto world—Hyperliquid’s rollercoaster ride with Jelly Jelly coin (JELLYJELLY). On March 26, 2025, this Solana-based meme token spiked 429% in an hour, nearly dragging Hyperliquid’s $230 million liquidity vault into oblivion. The Jelly Jelly token price soared from $0.0095 to $0.62, then crashed to $0.25, all while Binance and OKX piled on with futures listings. Hyperliquid delisted the token, settled positions at a controversial $0.0095, and left the crypto community buzzing. For beginners like you, this might sound like chaos, but it’s a goldmine of lessons and opportunities. So, can Hyperliquid recover? What’s the future of Jelly Jelly Hyperliquid ties? And what do investors need to know from this mess? Let’s dive deep.

Hyperliquid’s a decentralized perpetual futures platform built for speed and leverage—up to 50x—powered by its HLP (Hyperliquid Liquidity Provider) vault. It’s the brainchild of Jeff Yan and iliensinc, Harvard grads with roots in high-frequency trading and crypto market-making. Think of it as a sleek, community-driven engine for traders, not beholden to venture capital. But this Jelly Jelly saga exposed cracks in its armor, and it’s got folks like Bitget’s CEO Gracy Chen warning it could be “FTX 2.0.” Dramatic? Maybe. But there’s truth in the chaos worth exploring.

Contents

Jelly Jelly Coin’s Wild Ride: What Happened?

Picture this: a trader opens a $6 million short on Jelly Jelly coin—a meme token launched by Venmo co-founder Sam Lessin on Pump.fun. Then, they pump the price on-chain, forcing their own liquidation. Hyperliquid’s HLP vault inherits the position, staring down a $12 million unrealized loss as JELLYJELLY’s market cap balloons from $10 million to $50 million. If it hit $150 million—or $0.15374 per token—the vault’s entire $230 million could’ve evaporated. Posts on X lit up with speculation: was this a whale’s gambit or a rival exchange’s sabotage?

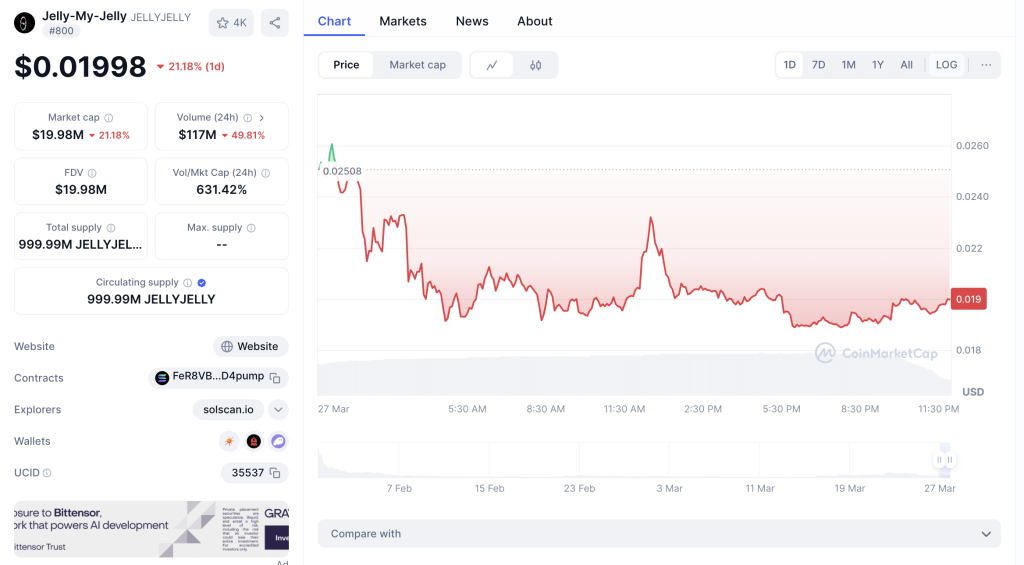

Binance and OKX didn’t help, listing JELLYJELLY perpetuals just as Hyperliquid scrambled. The price hit $0.62—a 380% leap—before tanking to $0.25. Hyperliquid’s validators stepped in, delisting the contract and settling at $0.0095, flipping a $703K profit for HLP. They promised to reimburse users (except flagged manipulators) via the Hyper Foundation. But the damage was done: $140 million in USDC fled the platform in hours, per Parsec data, and HYPE, its native token, dropped 10%-20%.

This wasn’t Hyperliquid’s first rodeo. On March 12, a whale’s $306 million ETH long position liquidated, costing HLP $4 million while the trader pocketed $1.86 million. Both incidents spotlight a flaw: Hyperliquid’s oracle-based pricing and unrestricted position sizes can’t always handle extreme volatility or manipulation. For beginners, it’s a stark reminder—decentralized doesn’t mean invincible.

Hyperliquid’s Future: Can Jelly Jelly Coin Bounce Back?

Let’s talk recovery. Hyperliquid’s HYPE token sits at $14.84 today, March 27, 2025, down from $16 pre-crisis. Its total value locked (TVL) dipped from $283 million to $190 million, and USDC balances slid from $2.5 billion to $2.07 billion over 30 days. That’s a hit, but not a knockout. The platform’s core strengths—low latency, high throughput, and a loyal trader base—still shine. Its response to Jelly Jelly Hyperliquid drama, settling losses and upgrading margins to 20% by March 15, shows grit.

Technically, HYPE’s RSI is 45, signaling it’s oversold but not screaming “buy” yet. The 50-day moving average is $15.20, and breaking past $16 resistance could spark a rally to $20— a 35% jump—if trust rebuilds. Posts on X suggest a Q2 bull run could lift it to $25 if Bitcoin tops $100K. Long-term, by 2030, $50 isn’t crazy if Hyperliquid nails its niche against Binance and OKX. But here’s the catch: it must fix its vulnerabilities.

The Jelly Jelly token price fiasco exposed HLP’s limits. When a single trader’s move can threaten $230 million, you’ve got a systemic risk. Mixed vaults pool user funds, amplifying exposure, and oracle pricing lags in thin markets like JELLYJELLY’s. Chen’s “FTX 2.0” jab stings because FTX’s collapse came from opacity and mismanagement—Hyperliquid’s manual delisting and price override echo that centralization vibe. Yet, its transparency (pre-crisis) and reimbursement plan argue resilience, not ruin.

Opportunities for Jelly Jelly Coin Investors: Where’s the Edge?

For you, the crypto newbie, Hyperliquid’s turbulence is a chance. HYPE at $14.84 is a dip—buying 10-100 coins via WEEX (low fees, beginner-friendly) could pay off if it rebounds to $20 by summer. Short-term traders might scalp between $14 and $16, with $12.50 support as a safety net. Long-term, holding through 2028’s Bitcoin halving could see $30-$50 if Hyperliquid thrives.

Jelly Jelly coin itself? It’s at $0.02078, per CoinMarketCap, down 89.5% from its $0.198 peak but up 520% from its $0.0033 low. Its 55.9% daily bounce shows meme coin chaos still draws crowds. Buying 100 JELLYJELLY for $2 might net $20 if it revisits $0.20—a 900% gain—but it’s a lottery ticket. The Hyperliquid delisting killed its perp market there, but Binance and OKX listings keep it alive. Watch volume: $289 million daily says speculators aren’t done.

The real play? Learn from this. Hyperliquid’s edge is its tech—50x leverage, no KYC/AML hassles—but that’s a double-edged sword. Platforms like WEEX offer safer entry points for beginners, with tight spreads and clear UX. Diversify—mix HYPE with stables like USDT—and track X sentiment for whale moves. If Hyperliquid shores up HLP and oracle flaws, it could dominate DeFi futures. If not, it’s prey for CEX giants.

Lessons From the Jelly Jelly Hyperliquid Case

What do we take away? First, decentralization’s a spectrum. Hyperliquid’s validator vote to delist JELLYJELLY wasn’t pure DeFi—it was a centralized fix to a decentralized mess. Second, meme coins like Jelly Jelly coin are manipulation magnets. Low liquidity plus high leverage equals chaos—think Mango Markets’ 2022 exploit, where a trader gamed oracles for $100 million. Third, trust is king. Hyperliquid’s reimbursement pledge saved face, but $140 million in outflows scream FUD.

For investors, timing’s everything. The Jelly Jelly token price pump was a whale’s trap—don’t chase 400% spikes blind. Use RSI (below 30 is oversold), moving averages, and support ($0.015 for JELLYJELLY) to gauge entries. Hyperliquid’s HLP needs stress-testing—watch for upgrades. And rival CEX moves? Binance and OKX listing JELLYJELLY mid-crisis wasn’t random—X posts hint at sabotage, with wallets tied to Binance funding the whale. Competition’s cutthroat.

Hyperliquid vs. the World: What’s Next?

Hyperliquid’s future hinges on adaptation. If it tweaks HLP to cap position sizes and sync oracles with order book depth, it could hit $20 by Q3 2025 and $50 by 2030, riding altcoin cycles. Jelly Jelly Hyperliquid ties are dead—focus shifts to HYPE’s recovery. But Binance and OKX loom large, with deeper pockets and less scrutiny. Hyperliquid’s DIY ethos—self-funded, elite team—could be its edge or its Achilles’ heel.

For you, the opportunity’s in the dip. HYPE at $14.84 or JELLYJELLY at $0.02078 via WEEX offers upside if you stomach the risk. The case screams caution: vet platforms, watch leverage, and trust data over hype. Hyperliquid’s not FTX 2.0 yet—it’s a phoenix with singed wings. Will it soar? That’s your call, friends. What do you think—ready to bet on the bounce? Let’s chat!