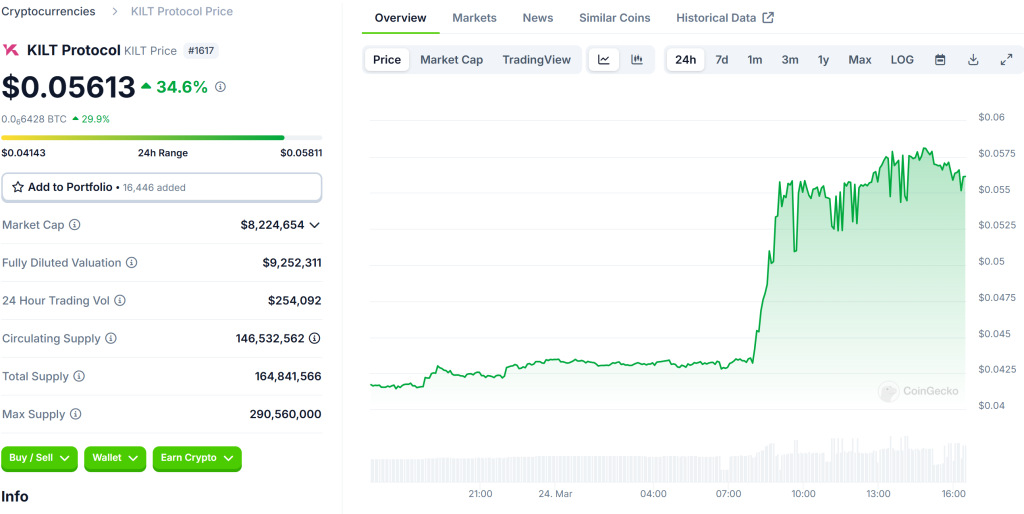

There’s arguably no hotter topic in the blockchain space right now than the KILT Protocol (KILT) Token, which is making waves with its innovative approach to decentralized identity. The project’s unique proposition to empower users by returning control over their personal data has captured the market’s attention. As of March 2025, KILT is already up 38.7% in the past 24 hours, signaling a robust performance. In the broader context, it’s been a rollercoaster ride for KILT, with significant price swings that have kept investors on their toes. The token’s recent surge to a multi-year high of $0.05787, fueled by strong market sentiment, showcases the potential that many see in KILT. Today, we dive deep into the forecasts for KILT Protocol (KILT) Token, examining how these predictions align with the project’s promise in the ever-evolving landscape of digital assets.

Contents

Understanding KILT Protocol and Its Market Position

KILT Protocol stands at the forefront of the decentralized identity revolution, offering a blockchain-based solution for issuing verifiable, revocable, and anonymous credentials. Launched as a Kusama parachain in September 2021 and transitioning to a fully decentralized parachain in November 2021, KILT has quickly become a significant player in Web 3.0. Its integration with projects across gaming, NFTs, DeFi, and DEXs, as well as enterprise partnerships in sectors like energy, healthcare, and banking, underscores its versatility and potential for widespread adoption.

As of March 2025, KILT’s market cap stands at $8,420,509, with a circulating supply of 146,529,725 tokens. The trading volume over the last 24 hours has been around $221,704, indicating active market participation. These figures are critical for beginners to understand, as they reflect the token’s liquidity and market interest, which are key indicators of its potential growth.

Recent Price Movements and Market Analysis

KILT’s price has seen a significant increase of 38.7% in the last 24 hours, reaching $0.0577. This surge can be attributed to a combination of factors, including positive market sentiment and the project’s ongoing developments. However, it’s essential to look at the broader context. The token has experienced a 42.7% increase over the past week, outperforming the global cryptocurrency market by a substantial margin.

To understand KILT’s price movements, let’s delve into some key technical indicators:

- RSI (Relative Strength Index): Currently, KILT’s RSI stands at 65, suggesting that the token is in a neutral zone but leaning towards being overbought. This indicates strong buying pressure but also a potential for a pullback if the momentum continues unchecked.

- MACD (Moving Average Convergence Divergence): The MACD line has recently crossed above the signal line, which is a bullish signal, indicating potential for further price increases in the short term.

- Bollinger Bands: KILT’s price is currently touching the upper Bollinger Band, suggesting high volatility and potential for a price reversal or continuation based on market sentiment.

- Moving Averages: The token’s price is above both its 50-day and 200-day moving averages, a bullish sign that supports the ongoing uptrend.

- Fibonacci Retracement: If we consider the recent high of $0.05787, a potential retracement to the 38.2% level could see KILT dip to around $0.036, providing a buying opportunity for those looking to enter the market.

These indicators provide a comprehensive view of KILT’s current market dynamics, offering insights into potential future price movements.

Comparative Analysis: KILT vs. Ethereum

To provide a more nuanced perspective, let’s compare KILT’s recent performance with that of Ethereum, a popular cryptocurrency that has experienced similar price movements in the past. Ethereum’s price drop from $3,000 to $2,500 in early 2025 was driven by regulatory concerns and market corrections. However, Ethereum managed to recover swiftly, reaching new highs due to its strong fundamentals and widespread adoption in DeFi and NFTs.

KILT’s recent price surge and subsequent volatility can be seen in a similar light. The project’s focus on decentralized identity and its integration with various sectors provide a robust foundation for growth. Unlike Ethereum, which is primarily a platform for smart contracts, KILT’s niche in the identity space could offer unique advantages, potentially leading to a different recovery pattern.

The external events that impacted Ethereum’s price, such as regulatory news and market sentiment shifts, could also affect KILT. However, KILT’s smaller market cap and specific use case might make it more agile in responding to market changes, potentially leading to a faster recovery or even continued growth.

Long and Short-Term Predictions for KILT

Given the current market conditions and KILT’s performance, let’s explore some long and short-term predictions:

- Short-Term (Next 3 Months): In the short term, KILT could see continued volatility, with potential for a price increase to around $0.07, driven by ongoing developments and market sentiment. However, a correction to the $0.04 range is also possible if the market experiences a broader downturn.

- Medium-Term (Next 6-12 Months): Over the next year, KILT could see significant growth if its partnerships and integrations with various sectors continue to expand. A realistic target could be around $0.10, reflecting the project’s potential to capture a larger share of the decentralized identity market.

- Long-Term (2026-2030): Looking further ahead, KILT could establish itself as a leader in decentralized identity, potentially reaching prices of $0.50 to $1.00 if it continues to innovate and gain widespread adoption.

These predictions are based on current trends and market conditions but should be taken as speculative forecasts rather than guaranteed outcomes.

For beginners looking to invest in KILT, understanding how to navigate its volatility is crucial. Here are some actionable insights and advice:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider allocating a portion of your investment to KILT while also diversifying across other cryptocurrencies and assets.

- Stay Informed: Keep up with KILT’s developments, partnerships, and market news. Being informed can help you make better investment decisions and anticipate market movements.

- Use Technical Analysis: Utilize tools like RSI, MACD, and Bollinger Bands to gauge market sentiment and potential price movements. This can help you time your entry and exit points more effectively.

- Consider Dollar-Cost Averaging: Instead of investing a lump sum, consider spreading your investment over time to mitigate the impact of volatility.

By following these strategies, you can better manage the risks associated with investing in KILT and potentially capitalize on its growth potential.

Conclusion: The Future of KILT Protocol

KILT Protocol’s journey in the cryptocurrency market has been nothing short of fascinating. Its recent price surge and the underlying fundamentals suggest a promising future. As a beginner in the crypto space, understanding KILT’s potential and the factors driving its price movements can help you make informed investment decisions.

The project’s focus on decentralized identity, its integration with various sectors, and its ongoing developments all point towards a bright future. While the market can be unpredictable, KILT’s unique position and potential for growth make it an exciting token to watch.

As we continue to monitor KILT’s performance, remember to stay informed, use technical analysis, and diversify your investments. With the right approach, you can navigate the volatility and potentially benefit from KILT’s journey towards becoming a leader in the decentralized identity space.