There’s arguably no cryptocurrency more intriguing in the Web3 space right now than Kusama KSM (KSM) Token. It’s been making waves across the market, with a notable price surge in recent months. As of March 2025, Kusama has seen its value climb by 7.31% in the past week alone, positioning it as a top performer in the crypto sector. This momentum has sparked discussions and debates about its future potential, leading us to explore what might be in store for Kusama KSM (KSM) Token in the coming years.

Contents

- 1 Understanding Kusama KSM (KSM) Token’s Recent Performance

- 2 Comparing Kusama’s Journey to Ethereum’s Historical Trends

- 3 Analyzing Kusama’s Market Indicators

- 4 Support and Resistance Levels: What to Watch For

- 5 Chart Analysis: Visualizing Kusama’s Path

- 6 Long and Short-Term Predictions for Kusama KSM (KSM) Token

- 7 Lessons from Ethereum: Could Kusama Follow a Similar Path?

- 8 Navigating Kusama’s Volatility: Expert Insights

- 9 Conclusion: The Future of Kusama KSM (KSM) Token

Understanding Kusama KSM (KSM) Token’s Recent Performance

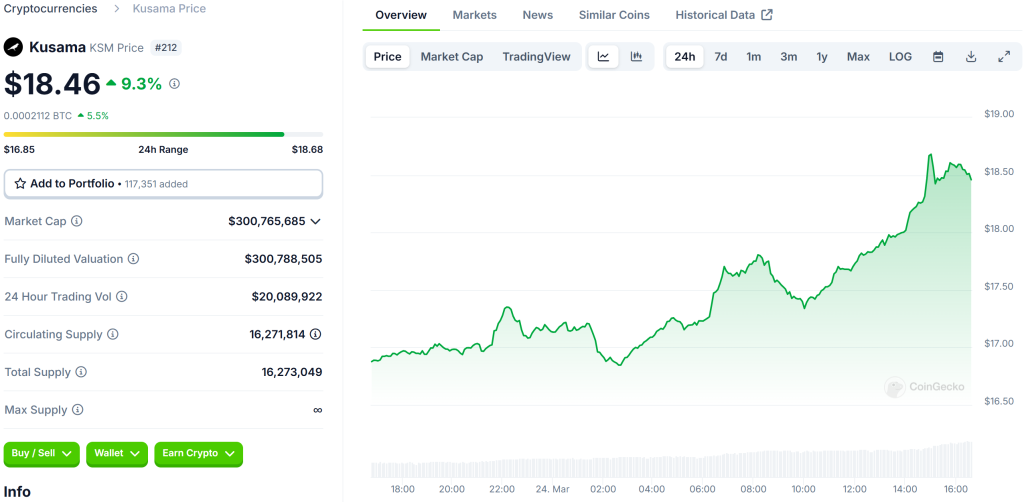

Kusama KSM (KSM) Token has been on a rollercoaster ride, capturing the attention of investors and enthusiasts alike. In early 2025, the token surged to new highs, fueled by strong market sentiment and developments within the Polkadot ecosystem. However, like many cryptocurrencies, its journey has been marked by volatility. Kusama’s price has recently experienced a dip from $19.85 to $18.23, prompting investors to question its stability and future potential.

Comparing Kusama’s Journey to Ethereum’s Historical Trends

To better understand Kusama’s recent price movements, let’s draw a comparison with Ethereum, a well-established player in the crypto market. Ethereum, too, has faced its share of volatility, with significant price drops followed by remarkable recoveries. For instance, in 2018, Ethereum saw a steep decline from over $1,400 to below $100, only to rebound to new heights in subsequent years.

The external events that contributed to Ethereum’s drop included regulatory uncertainties and market-wide corrections. Kusama’s recent dip can be attributed to similar factors, such as regulatory news affecting the broader crypto market and shifts in investor sentiment. However, Ethereum’s recovery was driven by technological advancements, increased adoption, and a growing ecosystem of decentralized applications. Kusama, being a canary network for Polkadot, might follow a similar path if it continues to innovate and expand its network.

Analyzing Kusama’s Market Indicators

To assess Kusama’s future trajectory, let’s delve into some key market indicators. The Relative Strength Index (RSI) for Kusama currently stands at 65, indicating a neutral to slightly overbought market condition. This suggests that while the recent surge has been strong, there might be room for further growth before a potential correction.

The Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line moving above the signal line, which is a positive sign for continued upward momentum. Additionally, Kusama’s price is currently trading above both its 50-day and 200-day moving averages, further supporting the bullish outlook.

Support and Resistance Levels: What to Watch For

Kusama’s current support level is around $17.50, a critical threshold that investors should monitor closely. A break below this level could signal a deeper correction, while maintaining above it might pave the way for further gains. The resistance level to watch is at $20, a psychological barrier that, if breached, could lead to a significant price increase.

Recent developments in the Polkadot ecosystem, such as the launch of new parachains and partnerships, could influence these levels. For instance, positive news about Kusama’s integration with emerging projects could push the price above the resistance level, while regulatory challenges might push it towards the support level.

Chart Analysis: Visualizing Kusama’s Path

Analyzing Kusama’s price chart reveals a pattern of consolidation followed by breakouts. The recent dip from $19.85 to $18.23 appears to be a temporary setback within a larger upward trend. The chart shows a series of higher lows and higher highs, a classic sign of an uptrend.

To illustrate this, imagine a line connecting the lows from early 2025 to now, and another line connecting the highs. Both lines are ascending, suggesting that despite short-term fluctuations, the overall trend remains bullish. This pattern, combined with the market indicators, supports the notion that Kusama might be gearing up for another leg up.

Long and Short-Term Predictions for Kusama KSM (KSM) Token

Looking ahead, let’s explore what the future might hold for Kusama KSM (KSM) Token. In the short term, over the next few months, we could see Kusama testing the $20 resistance level. If it successfully breaks through, the next target could be $22, driven by continued interest in the Polkadot ecosystem and Kusama’s role as a testing ground for new features.

For the long term, by 2026, Kusama’s price could reach $25 if it continues to attract developers and projects to its network. The token’s value might be further boosted by increased adoption of decentralized applications and the broader acceptance of blockchain technology. By 2030, if Kusama maintains its momentum and the crypto market continues to mature, we could see prices as high as $35.

Lessons from Ethereum: Could Kusama Follow a Similar Path?

Ethereum’s journey from its 2018 lows to its current status as a leading cryptocurrency offers valuable lessons for Kusama investors. Ethereum’s recovery was fueled by its transition to Ethereum 2.0, which promised scalability and efficiency improvements. Similarly, Kusama’s ongoing developments, such as the implementation of new parachains and upgrades to its network, could drive its recovery and growth.

The key difference lies in their roles within their respective ecosystems. While Ethereum is a mature platform with a wide range of applications, Kusama serves as an experimental space for Polkadot. This unique positioning could lead to faster innovation and adoption, potentially accelerating Kusama’s recovery and growth trajectory.

For investors looking to navigate Kusama’s volatility, it’s essential to adopt a long-term perspective. While short-term price swings can be unsettling, focusing on the underlying technology and the project’s potential can provide reassurance. Diversifying your portfolio and setting clear investment goals can also help manage risk.

Additionally, staying informed about developments within the Polkadot ecosystem and broader crypto market trends is crucial. Keeping an eye on key indicators like RSI and MACD can provide valuable insights into when to buy or sell. For those new to crypto investing, starting with a small investment and gradually increasing exposure as you gain more experience can be a prudent approach.

Conclusion: The Future of Kusama KSM (KSM) Token

In conclusion, Kusama KSM (KSM) Token’s recent price movements reflect the dynamic nature of the crypto market. Despite the dip from $19.85 to $18.23, the overall trend remains bullish, supported by key market indicators and historical parallels with other cryptocurrencies like Ethereum. As Kusama continues to innovate and expand within the Polkadot ecosystem, its potential for growth is significant.

For investors, the key is to remain patient and informed, focusing on the long-term potential rather than short-term fluctuations. With careful analysis and a strategic approach, Kusama KSM (KSM) Token could indeed reach new heights in the coming years, offering exciting opportunities for those willing to join the journey.