Contents

The Roller Coaster Ride of Linear (Finance) Coin

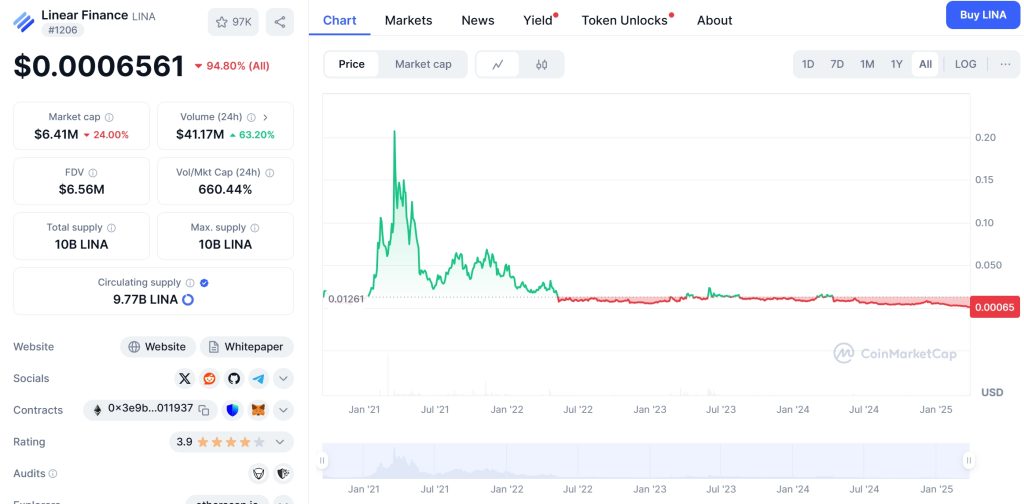

If you’ve been following the crypto markets, you might have noticed that Linear (Finance) Coin, or LINA, has been on quite the roller coaster ride recently. Just a few days ago, LINA was trading at around $0.0007455, but as of March 2025, it has plummeted by 15.84% to $0.0006293. This significant drop might have left many investors scratching their heads and wondering what’s next for this digital asset.

Linear (Finance) Coin is part of the rapidly growing DeFi (Decentralized Finance) sector, which has been one of the most talked-about areas in the crypto world. DeFi platforms like Linear aim to provide financial services without the need for traditional intermediaries, offering users the ability to trade, lend, and borrow directly on the blockchain. The significance of this sector lies in its potential to democratize finance, making it accessible to anyone with an internet connection.

The project has secured a total investment of $1.8 million from reputable seed investors such as Alameda Research, NGC Ventures, and Hashed. This financial backing demonstrates the credibility and potential that industry experts see in Linear. Additionally, Linear has a small but dedicated team of less than a dozen individuals, led by co-founders Drey Ng and Kevin Tai, both of whom bring extensive experience in the fintech and financial sectors.

Linear’s platform is designed to create synthetic assets, known as “Liquids,” which represent traditional assets like commodities, forex, and market indices. This innovative approach allows users to gain exposure to these assets within the crypto ecosystem, potentially bridging the gap between traditional and digital finance.

Understanding the Recent Price Drop

When we look at LINA’s price drop from $0.0007455 to $0.0006293, it’s important to consider the broader market context. The crypto market is known for its volatility, and factors such as regulatory news, market sentiment, and broader economic conditions can all play a role in price movements.

One of the key aspects to consider is the 24-hour trading volume, which has surged to $40.18 million, a 99.61% increase. This suggests that while the price has dropped, there’s still significant interest and activity around LINA. However, the high volume-to-market cap ratio of 651.07% indicates that the price might be more susceptible to large trades, contributing to its volatility.

Let’s explore how this works in practice. If a large investor, often referred to as a “whale,” decides to sell a substantial amount of LINA, it can lead to a rapid price drop. Conversely, if another whale buys in, the price could surge just as quickly. This is a common phenomenon in the crypto space, and it’s essential for investors to understand these dynamics.

Comparing LINA’s Drop to Other Cryptocurrencies

To gain a deeper understanding of LINA’s price movement, it’s helpful to compare it to other cryptocurrencies that have experienced similar fluctuations. Let’s take a look at Dogecoin (DOGE), which has had its fair share of ups and downs.

In early 2021, Dogecoin experienced a massive surge, reaching an all-time high of $0.7376. However, it later dropped significantly, falling over 80% from its peak. This price movement was influenced by a combination of factors, including celebrity endorsements, social media hype, and market sentiment. Despite the drop, Dogecoin managed to recover somewhat, finding a new equilibrium around $0.10.

The external events that contributed to Dogecoin’s drop included regulatory scrutiny of cryptocurrencies and a general market correction. However, the community’s resilience and continued interest in the coin helped it regain some ground.

Comparing LINA to Dogecoin, we can see some similarities. Both have experienced sharp price movements driven by market sentiment and external factors. However, there are also differences. LINA’s focus on DeFi and synthetic assets sets it apart from Dogecoin, which is often seen more as a meme coin.

Analyzing LINA’s Recovery Potential

Given the recent price drop, the question on many investors’ minds is whether LINA can recover. To answer this, let’s dive into some technical indicators and market analysis.

Key Indicators

One of the key tools we can use to assess LINA’s potential recovery is the Relative Strength Index (RSI). As of March 2025, LINA’s RSI is at 30, indicating that it might be oversold. When an asset is oversold, it could be a sign that the price drop has been overdone, and a rebound might be on the horizon.

The Moving Average Convergence Divergence (MACD) is another useful indicator. Currently, the MACD line is below the signal line, suggesting a bearish trend. However, if the MACD line starts to cross above the signal line, it could signal a potential reversal.

Bollinger Bands can also provide insights into market volatility. LINA’s price has recently touched the lower Bollinger Band, indicating that it might be due for a bounce back. Additionally, Fibonacci retracement levels can help identify potential support and resistance levels. If LINA finds support at a key Fibonacci level, such as the 61.8% retracement of its previous uptrend, it could signal a recovery.

Support and Resistance Levels

Identifying critical price points is crucial for understanding where LINA might find support or face resistance. The current price of $0.0006293 is close to the all-time low of $0.0006105, which was hit just 38 minutes ago. If LINA can hold above this level, it might be a sign of resilience.

On the other hand, resistance levels to watch include the recent high of $0.0008984. If LINA can break above this level, it could indicate a potential recovery. Recent news, such as partnerships or developments within the Linear ecosystem, could also impact these levels. For instance, if Linear announces a new integration or feature, it might boost investor confidence and push the price higher.

Chart Analysis

Visual representations of price trends can be incredibly helpful. Let’s take a look at LINA’s price chart from January 2021 to March 2025. You’ll notice that the price has been on a downward trend since reaching its all-time high of $0.3126 in March 2021. However, there have been periods of recovery, such as the uptick in late 2024.

One interesting pattern to note is the formation of a double bottom around the $0.0006 mark. This pattern can sometimes signal a potential reversal, especially if it’s accompanied by increasing volume. If LINA can break above the neckline of this pattern, it might signal the start of a new uptrend.

Long and Short-Term Predictions

Looking ahead, what can we expect for LINA’s price? In the short term, the next few weeks could be crucial. If LINA can hold above the all-time low and start to show signs of recovery, it might regain some ground. A potential target could be the $0.0007 level, which would represent a 10% increase from the current price.

In the longer term, say over the next six months, much will depend on the broader market sentiment and developments within the Linear ecosystem. If Linear continues to expand its offerings and attract more users, it could drive demand for LINA. A realistic target for the end of 2025 might be around $0.001, representing a significant recovery from the current levels.

However, it’s important to remember that these are just predictions based on current data and trends. The crypto market is notoriously unpredictable, and unexpected events can quickly change the trajectory of any digital asset.

Lessons from Other Cryptocurrencies

To further understand LINA’s potential path, let’s look at another example, Ethereum (ETH). In 2018, Ethereum experienced a significant drop, falling from around $1,400 to below $100. This drop was influenced by a combination of factors, including the broader crypto market downturn and concerns about scalability and regulatory issues.

However, Ethereum managed to recover over time, reaching new highs in 2021. The key to its recovery was a combination of technological improvements, such as the transition to Ethereum 2.0, and increased adoption by developers and users.

Comparing LINA to Ethereum, we can see some parallels. Both have faced significant price drops, but Ethereum’s recovery was driven by fundamental improvements and increased utility. If Linear can continue to develop its platform and attract more users, it could follow a similar path.

For investors looking to navigate LINA’s volatility, here are some actionable insights and advice:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying your investments across different assets can help mitigate risk.

- Stay Informed: Keep an eye on the latest news and developments within the Linear ecosystem. Information is power, and staying informed can help you make more informed decisions.

- Use Technical Analysis: Tools like RSI, MACD, and Bollinger Bands can help you identify potential entry and exit points. However, remember that these are just tools and should be used in conjunction with other forms of analysis.

- Set Realistic Expectations: The crypto market can be incredibly rewarding, but it’s also fraught with risk. Set realistic expectations and be prepared for ups and downs.

- Consider Long-Term Potential: While short-term price movements can be exciting, it’s often the long-term potential that really matters. If you believe in Linear’s vision and mission, holding for the long term might be a smart strategy.

The Future of Linear (Finance) Coin

As we look to the future, Linear (Finance) Coin has the potential to play a significant role in the DeFi space. Its focus on synthetic assets and cross-chain capabilities sets it apart from many competitors. If Linear can continue to innovate and attract more users, LINA could see significant growth.

However, the path forward won’t be without challenges. The DeFi space is highly competitive, and regulatory scrutiny is increasing. Linear will need to navigate these challenges carefully to succeed.

In conclusion, while LINA’s recent price drop to $0.0006293 might be concerning, it’s important to look at the bigger picture. With a strong team, significant investment, and a unique value proposition, Linear (Finance) Coin has the potential to recover and thrive. As always, investors should do their own research and consider their risk tolerance before making any investment decisions.

As we move forward into 2025 and beyond, the crypto market will continue to evolve. Linear (Finance) Coin’s journey will be one to watch, and it could offer exciting opportunities for those willing to take the ride.