In the ever-evolving world of cryptocurrencies, there’s arguably no more exciting development than the recent surge of Loom Network (LOOM) Coin. As of March 2025, LOOM has experienced a remarkable 22.99% increase in the last 24 hours, reaching a price of $0.052. This surge has captured the attention of investors and crypto enthusiasts alike, sparking discussions about the potential future of this promising digital asset. In this article, we’ll dive deep into the factors driving LOOM’s price movement, analyze its market position, and explore what the future might hold for this innovative cryptocurrency.

Contents

- 1 Understanding Loom Network (LOOM) Coin

- 2 The Recent Price Surge: What’s Driving It?

- 3 Analyzing LOOM’s Market Position

- 4 Support and Resistance Levels

- 5 Chart Analysis

- 6 Long and Short-Term Predictions

- 7 Lessons from Ethereum: Could LOOM Follow a Similar Path?

- 8 Navigating LOOM’s Volatility: Expert Insights

- 9 Conclusion

Understanding Loom Network (LOOM) Coin

Loom Network is a platform as a service built on top of Ethereum, designed to enable developers to run large-scale decentralized applications (DApps). Launched on October 1st, 2017, Loom Network aims to provide smart contract developers with the ability to access more computing power when needed or maintain the same power at lower costs. This is particularly useful for applications that don’t require the full security of the blockchain or for onboarding new users.

The platform allows developers to interact with off-chain APIs developed by third parties, making it easier to integrate applications with the outside world. Loom Network operates on Plasma, a scaling solution that facilitates faster transactions across the network. The LOOM token, which follows the ERC-20 standard, serves as a membership token, granting access to all applications running on the Loom Network and enabling the transfer of digital assets and data between Ethereum and Loom DAppChains.

The Recent Price Surge: What’s Driving It?

The recent 22.99% surge in LOOM’s price to $0.052 has been a significant event in the crypto market. Several factors have contributed to this impressive growth:

Increased Adoption and Partnerships

One of the key drivers behind LOOM’s price surge is the increased adoption of the platform by developers and the formation of strategic partnerships. As of March 2025, Loom Network has seen a surge in the number of DApps built on its platform, ranging from gaming to social media applications. These developments have not only increased the utility of LOOM but also boosted investor confidence in the project’s long-term potential.

Positive Market Sentiment

The overall positive sentiment in the cryptocurrency market has also played a role in LOOM’s price increase. With Bitcoin and other major cryptocurrencies experiencing significant gains, investors are looking for promising altcoins to diversify their portfolios. LOOM’s strong fundamentals and growth potential have made it an attractive option for many.

Technological Advancements

Loom Network has continued to innovate and improve its technology, which has contributed to the recent price surge. In early 2025, the platform introduced new features that enhance scalability and security, making it more appealing to developers and users. These advancements have been well-received by the crypto community, further driving demand for LOOM.

Analyzing LOOM’s Market Position

To better understand LOOM’s market position, let’s take a closer look at its key metrics and compare it to other cryptocurrencies.

Market Cap and Trading Volume

As of March 2025, LOOM has a market capitalization of $40.75 million, with a 24-hour trading volume of $15.99 million. While these figures may seem modest compared to larger cryptocurrencies, they represent significant growth for LOOM, especially considering its recent price surge. The high trading volume indicates strong interest and liquidity in the market, which is a positive sign for investors.

Comparison to Similar Cryptocurrencies

To gain further insight into LOOM’s market position, let’s compare it to a similar cryptocurrency, such as Ethereum (ETH). While Ethereum is a much larger and more established platform, LOOM offers unique advantages, such as its focus on scalability and ease of use for developers. This has allowed LOOM to carve out a niche in the market and attract a dedicated user base.

Technical Analysis

Using technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, we can gain a better understanding of LOOM’s price trends and potential future movements. As of March 2025, LOOM’s RSI is at 65, indicating that the cryptocurrency is in a neutral position and not overbought or oversold. The MACD is showing a bullish crossover, suggesting that the upward momentum may continue. Additionally, the price is currently trading above the upper Bollinger Band, which could indicate a potential pullback in the short term.

Support and Resistance Levels

Identifying key support and resistance levels is crucial for understanding LOOM’s price behavior and potential future movements. As of March 2025, LOOM has a strong support level at $0.04, which has held firm during previous price corrections. On the other hand, the current resistance level is at $0.06, which the cryptocurrency has struggled to break through in the past. If LOOM can surpass this resistance, it could signal further upward momentum.

Recent news and developments, such as the introduction of new features and partnerships, have the potential to impact these support and resistance levels. For example, a major partnership announcement could provide the catalyst needed for LOOM to break through the $0.06 resistance level and continue its upward trajectory.

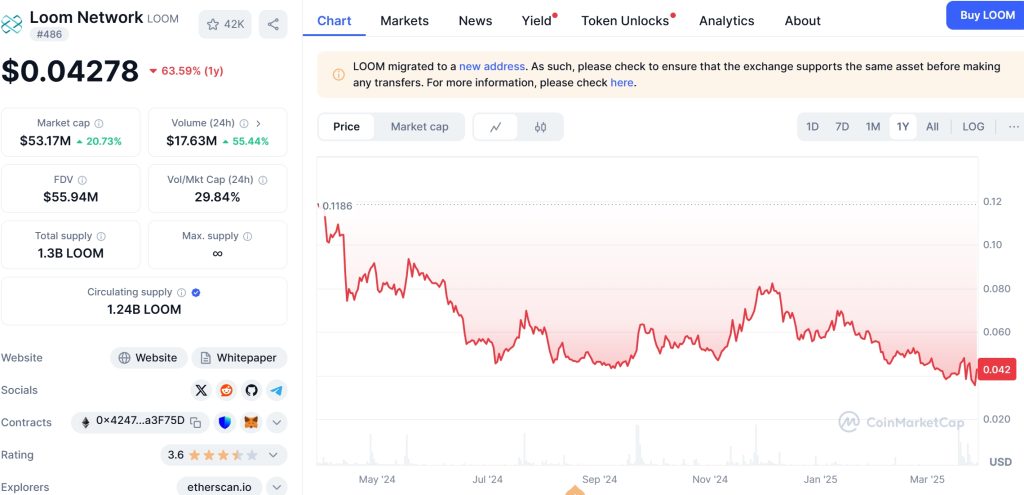

Chart Analysis

To visualize LOOM’s price trends and patterns, let’s take a look at its price chart as of March 2025. The chart shows a clear upward trend over the past few months, with the recent surge pushing the price to new highs. The volume has also increased significantly, indicating strong buying pressure.

One notable pattern on the chart is the formation of a bullish flag, which suggests that the upward trend may continue. Additionally, the price has been consistently forming higher highs and higher lows, further supporting the bullish outlook.

Long and Short-Term Predictions

Based on the current market conditions and technical analysis, let’s explore some potential long and short-term predictions for LOOM’s price.

Short-Term Predictions

In the short term, LOOM is likely to experience some volatility as it consolidates its recent gains. However, given the strong bullish indicators and positive market sentiment, it’s possible that the cryptocurrency could continue its upward trajectory. If LOOM can break through the $0.06 resistance level, it could potentially reach $0.07 or even $0.08 in the coming weeks.

Long-Term Predictions

Looking further ahead, LOOM’s long-term potential is promising. With the continued growth of the decentralized application ecosystem and the platform’s focus on scalability and developer-friendly features, LOOM could see significant adoption and price appreciation. By the end of 2025, it’s possible that LOOM could reach $0.10 or higher, depending on market conditions and the success of its ongoing development efforts.

Lessons from Ethereum: Could LOOM Follow a Similar Path?

To gain further insight into LOOM’s potential future, let’s compare its trajectory to that of Ethereum, a cryptocurrency that has experienced significant growth and adoption over the years. Ethereum, like LOOM, is a platform for building decentralized applications, and its success can provide valuable lessons for LOOM’s future.

Ethereum’s price journey has been marked by periods of significant growth, driven by increased adoption, technological advancements, and positive market sentiment. In 2017, Ethereum experienced a massive bull run, reaching an all-time high of over $1,400. This was largely due to the popularity of initial coin offerings (ICOs) and the growing interest in decentralized applications.

Similarly, LOOM has the potential to follow a similar path, albeit on a smaller scale. As more developers build on the Loom Network and the platform continues to innovate, LOOM could see increased demand and price appreciation. However, it’s important to note that LOOM’s market cap and trading volume are significantly smaller than Ethereum’s, which could impact its potential for growth.

Given the inherent volatility of the cryptocurrency market, it’s essential for investors to have a strategy for navigating LOOM’s price fluctuations. Here are some expert insights to help you make informed decisions:

Diversify Your Portfolio

One of the key aspects to consider when investing in LOOM is diversification. By spreading your investments across different cryptocurrencies and asset classes, you can mitigate the risk associated with LOOM’s volatility. This approach can help you weather potential price downturns and capitalize on the growth potential of other assets.

Set Clear Investment Goals

Before investing in LOOM, it’s crucial to set clear investment goals and risk tolerance levels. Are you looking for short-term gains, or are you in it for the long haul? Understanding your investment objectives will help you make more informed decisions and avoid emotional trading.

Stay Informed

Keeping up with the latest news and developments in the crypto space is essential for making informed investment decisions. Stay updated on LOOM’s partnerships, technological advancements, and market trends to gain a better understanding of its potential future movements.

Use Technical Analysis

Technical analysis can be a valuable tool for navigating LOOM’s volatility. By studying price charts, indicators, and patterns, you can identify potential entry and exit points and make more informed trading decisions. However, it’s important to remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Conclusion

In conclusion, the recent surge of Loom Network (LOOM) Coin to $0.052 has captured the attention of investors and crypto enthusiasts alike. With increased adoption, positive market sentiment, and ongoing technological advancements, LOOM has the potential for further growth and price appreciation. By understanding its market position, analyzing key indicators, and staying informed, investors can navigate LOOM’s volatility and make informed decisions.

As we look to the future, LOOM’s focus on scalability and developer-friendly features positions it well for continued growth in the decentralized application ecosystem. While the cryptocurrency market is inherently unpredictable, LOOM’s strong fundamentals and promising outlook make it an exciting investment opportunity for those willing to take on the associated risks.

So, whether you’re a seasoned crypto investor or just starting your journey, keep an eye on Loom Network (LOOM) Coin. With its recent price surge and potential for future growth, LOOM could be a valuable addition to your investment portfolio.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.