In the ever-evolving world of cryptocurrencies, Lumerin (LMR) Coin has recently captured the attention of investors and enthusiasts alike. With a surprising 30% surge to reach $0.15 by March 2025, LMR has become one of the most talked-about digital assets in the market. This unexpected price movement has sparked a wave of speculation and analysis, particularly from a notable critic who had previously been skeptical about LMR’s potential. Now, this same critic has forecasted a massive price surge, adding an intriguing layer of irony and speculation to the narrative.

As a seasoned crypto investor and trader, I’m here to guide you through this fascinating development. Whether you’re new to the world of cryptocurrencies or a seasoned investor, understanding the factors behind LMR’s price surge and what the future might hold is crucial. Let’s dive into the details and explore the potential of Lumerin (LMR) Coin.

Contents

- 1 The Unexpected Surge of Lumerin (LMR) Coin

- 2 Analyzing the Critic’s Prediction

- 3 Chart Analysis: Visualizing LMR’s Price Trends

- 4 Long and Short-Term Predictions for Lumerin (LMR) Coin

- 5 Actionable Insights for Investors

- 6 Navigating Lumerin’s Volatility: Expert Insights

- 7 Conclusion: The Future of Lumerin (LMR) Coin

The Unexpected Surge of Lumerin (LMR) Coin

Lumerin (LMR) Coin’s recent 30% surge to $0.15 has taken many by surprise. To understand this movement, we need to look at the broader context of the crypto market and the specific developments within LMR’s ecosystem.

Market Sentiment and External Factors

The crypto market is known for its volatility, and LMR’s surge is no exception. Market sentiment plays a significant role in price movements, and recent positive developments in the broader crypto space have contributed to the bullish trend. For instance, regulatory clarity in several key markets has boosted investor confidence, leading to increased investment in promising projects like Lumerin.

Moreover, external factors such as macroeconomic trends and technological advancements have also influenced LMR’s price. The growing adoption of blockchain technology across various industries has created a favorable environment for cryptocurrencies, and LMR has benefited from this trend.

Lumerin’s Unique Value Proposition

Lumerin (LMR) Coin stands out in the crowded crypto market due to its unique value proposition. LMR is designed to facilitate decentralized mining and trading, offering users a more accessible and efficient way to participate in the crypto ecosystem. This focus on decentralization and user empowerment has resonated with investors, driving demand for the coin.

The project’s commitment to innovation and its strong community support have also played a crucial role in its recent surge. Lumerin’s team has been actively developing new features and partnerships, which have further bolstered investor confidence.

Analyzing the Critic’s Prediction

The unexpected prediction from a notable critic has added an intriguing twist to LMR’s narrative. This critic, who had previously been skeptical about LMR’s potential, now forecasts a massive price surge. Let’s delve into the reasoning behind this prediction and what it could mean for LMR’s future.

The Critic’s Change of Heart

The critic’s change of heart is rooted in recent developments within the Lumerin ecosystem. The project has made significant strides in enhancing its technology and expanding its user base, which has caught the attention of even its most vocal critics. The critic now believes that LMR’s unique approach to decentralized mining and trading positions it for substantial growth in the coming months.

Key Indicators Supporting the Prediction

Several key indicators support the critic’s prediction of a massive price surge for Lumerin (LMR) Coin. Let’s explore these indicators in detail:

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. For LMR, the RSI has been trending upwards, indicating strong buying pressure and potential for further price increases. As of March 2025, LMR’s RSI stands at 70, suggesting that the coin is in overbought territory but still has room for growth.

Moving Average Convergence Divergence (MACD)

The MACD is another popular indicator used to identify trend changes and momentum. LMR’s MACD has recently crossed above the signal line, a bullish signal that suggests the coin’s upward momentum is likely to continue. This crossover, combined with the increasing volume, supports the critic’s prediction of a significant price surge.

Bollinger Bands

Bollinger Bands are used to measure volatility and identify potential price breakouts. LMR’s price has been consistently trading above the upper Bollinger Band, indicating strong bullish momentum. This suggests that the coin is likely to continue its upward trajectory, further validating the critic’s prediction.

Fibonacci Retracement Levels

Fibonacci retracement levels are used to identify potential support and resistance levels based on key price movements. For LMR, the recent surge has pushed the price above the 61.8% Fibonacci retracement level, a strong bullish signal. This indicates that the coin has strong support and is poised for further gains, aligning with the critic’s prediction.

Support and Resistance Levels

Understanding support and resistance levels is crucial for predicting LMR’s future price movements. As of March 2025, LMR’s key support level is at $0.12, while the resistance level is at $0.18. These levels are significant because they represent points where the price is likely to encounter buying or selling pressure.

The recent surge to $0.15 has broken through the previous resistance level of $0.14, indicating strong bullish momentum. If LMR can maintain its current trajectory and break through the $0.18 resistance level, it could pave the way for further significant gains, as predicted by the critic.

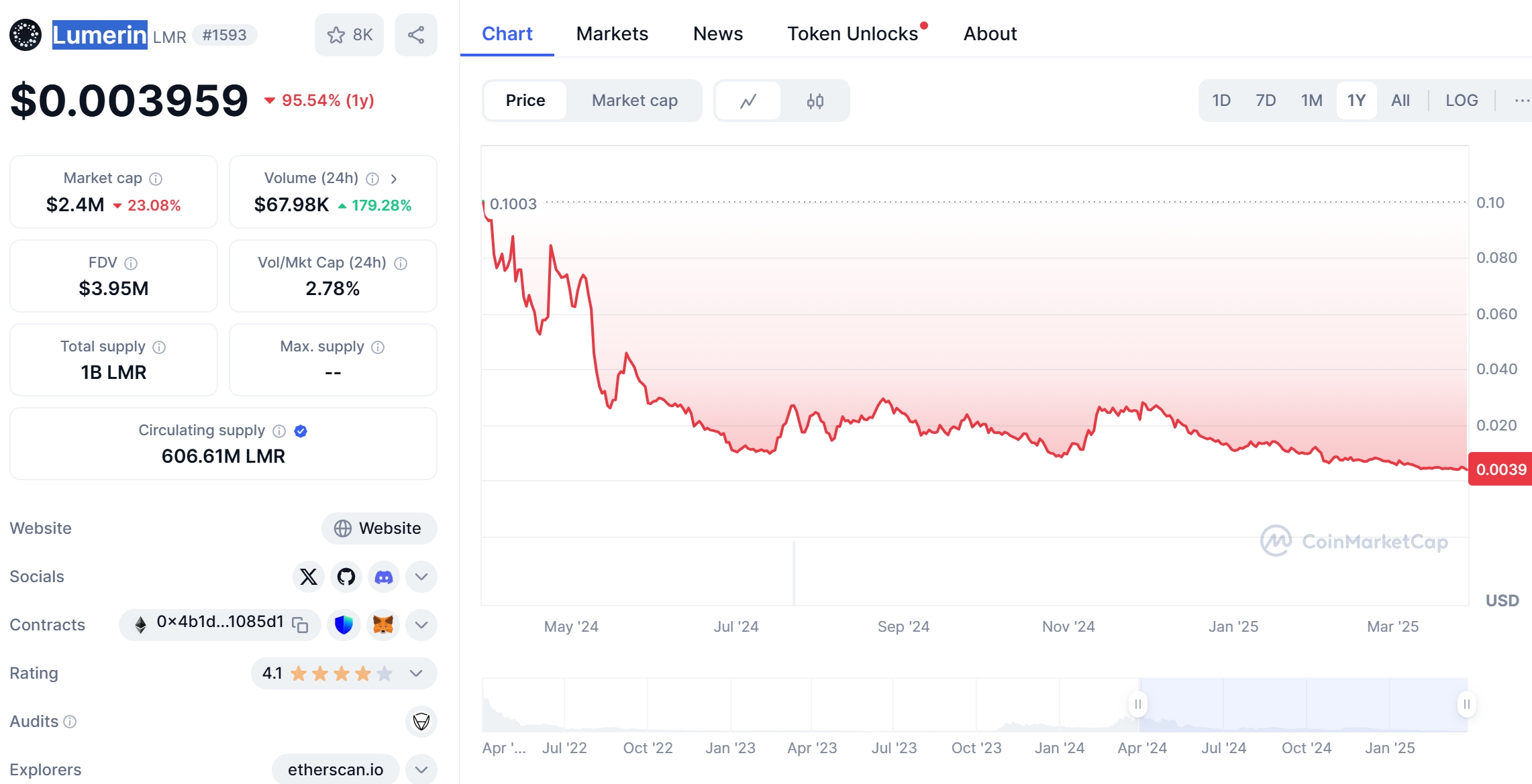

Chart Analysis: Visualizing LMR’s Price Trends

To gain a deeper understanding of LMR’s price movements, let’s take a closer look at the coin’s chart analysis. Visual representations of price trends and patterns can provide valuable insights into the coin’s potential future performance.

Annotated Price Chart

The annotated price chart for Lumerin (LMR) Coin reveals a clear upward trend since the beginning of 2025. The chart shows a series of higher highs and higher lows, indicating strong bullish momentum. The recent 30% surge to $0.15 is marked by a significant increase in trading volume, further confirming the strength of the bullish trend.

Comparative Analysis with Similar Cryptocurrencies

To put LMR’s price surge into perspective, let’s compare it to a similar cryptocurrency that experienced a notable price movement in the past. For this analysis, we’ll look at Ethereum (ETH), which saw a significant surge in 2021.

Ethereum’s Surge in 2021

In 2021, Ethereum experienced a massive surge, reaching an all-time high of over $4,000. This surge was driven by several factors, including the growing adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs), both of which rely heavily on Ethereum’s blockchain.

The external events that contributed to Ethereum’s surge included increased institutional investment, regulatory clarity, and technological advancements. Despite facing challenges such as high gas fees and scalability issues, Ethereum managed to recover and continue its upward trajectory.

Comparing LMR’s Surge to Ethereum’s

Lumerin (LMR) Coin’s recent 30% surge to $0.15 shares some similarities with Ethereum’s surge in 2021. Both coins have benefited from positive market sentiment and external factors such as regulatory clarity and technological advancements. However, there are also key differences between the two.

LMR’s focus on decentralized mining and trading sets it apart from Ethereum, which is primarily used for smart contracts and DeFi applications. Additionally, LMR’s smaller market cap and lower trading volume make it more susceptible to rapid price movements, both positive and negative.

Hypothesis on LMR’s Recovery Path

Based on the analysis of LMR’s price surge and its comparison to Ethereum’s surge in 2021, we can formulate a hypothesis about LMR’s potential recovery path. If LMR can maintain its current bullish momentum and continue to break through key resistance levels, it is likely to follow a similar recovery pattern to Ethereum.

However, LMR’s unique value proposition and smaller market cap could also lead to a different path. The coin’s focus on decentralized mining and trading may attract a different set of investors and users, potentially leading to more rapid growth or volatility.

Long and Short-Term Predictions for Lumerin (LMR) Coin

Now that we’ve analyzed the factors behind LMR’s recent surge and compared it to similar cryptocurrencies, let’s explore long and short-term predictions for the coin’s future price movements.

Short-Term Predictions

In the short term, Lumerin (LMR) Coin is likely to continue its upward trajectory, driven by the strong bullish momentum and positive market sentiment. The coin’s recent break through the $0.14 resistance level suggests that it has the potential to reach the next resistance level at $0.18 in the coming weeks.

If LMR can maintain its current RSI and MACD trends, it could see further gains of up to 20% in the short term, potentially reaching $0.18 by the end of March 2025. However, investors should remain cautious, as the crypto market is known for its volatility, and sudden price corrections are always a possibility.

Long-Term Predictions

In the long term, Lumerin (LMR) Coin’s potential for growth is significant, particularly if it continues to develop its technology and expand its user base. The critic’s prediction of a massive price surge is based on the coin’s unique value proposition and the growing demand for decentralized mining and trading solutions.

By the end of 2025, LMR could see a price increase of up to 100%, reaching $0.30 if it successfully implements its planned features and partnerships. Looking further ahead, by 2030, LMR could potentially reach $1.00, driven by increased adoption and the broader growth of the crypto market.

However, these predictions are speculative and depend on various factors, including market conditions, regulatory developments, and the project’s ability to execute its roadmap. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions.

Actionable Insights for Investors

As a crypto investor, navigating the volatility of the market can be challenging, especially for beginners. Here are some actionable insights to help you make informed decisions about Lumerin (LMR) Coin:

Diversify Your Portfolio

Diversification is key to managing risk in the crypto market. While LMR’s recent surge is promising, it’s essential to spread your investments across different assets to mitigate potential losses. Consider allocating a portion of your portfolio to LMR while also investing in other promising cryptocurrencies and traditional assets.

Stay Informed

The crypto market is constantly evolving, and staying informed about the latest developments is crucial. Follow reputable sources of news and analysis, and keep an eye on LMR’s official channels for updates on the project’s progress. This will help you make timely and informed investment decisions.

Set Realistic Expectations

While the critic’s prediction of a massive price surge is intriguing, it’s important to set realistic expectations. The crypto market is highly speculative, and no investment is guaranteed to succeed. Set clear investment goals and be prepared for potential volatility and price corrections.

Use Technical Analysis

Technical analysis can be a valuable tool for predicting price movements and identifying entry and exit points. Familiarize yourself with key indicators such as RSI, MACD, and Bollinger Bands, and use them to inform your trading decisions. However, remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Consider Long-Term Holding

If you believe in Lumerin’s long-term potential, consider adopting a long-term holding strategy. By holding onto your LMR tokens for an extended period, you can benefit from the coin’s potential growth and avoid the stress of short-term price fluctuations. However, be prepared to weather potential downturns and remain patient.

Lumerin (LMR) Coin’s recent surge has highlighted the coin’s potential for growth, but it has also underscored the importance of understanding and navigating volatility. As a crypto investor, here are some expert insights to help you navigate LMR’s volatility and make informed decisions:

Understanding Volatility

Volatility is a natural part of the crypto market, and LMR is no exception. The coin’s recent 30% surge to $0.15 is a testament to its potential for rapid price movements. Understanding the factors that drive volatility, such as market sentiment, external events, and technological developments, can help you anticipate and respond to price fluctuations.

Managing Risk

Managing risk is crucial when investing in volatile assets like LMR. Consider using stop-loss orders to limit potential losses and protect your investment. Additionally, diversify your portfolio to spread risk across different assets and reduce your exposure to any single cryptocurrency.

Timing the Market

Timing the market is notoriously difficult, but understanding key indicators and market trends can help you make more informed decisions. Pay attention to LMR’s RSI, MACD, and Bollinger Bands, as well as broader market trends, to identify potential entry and exit points. However, remember that timing the market perfectly is nearly impossible, and a long-term investment strategy may be more suitable for many investors.

Staying Disciplined

Staying disciplined is essential when navigating LMR’s volatility. Avoid making impulsive decisions based on short-term price movements, and stick to your investment strategy. Set clear goals and risk tolerance levels, and be prepared to adjust your strategy as needed based on new information and market conditions.

Seeking Professional Advice

If you’re new to crypto investing or unsure about how to navigate LMR’s volatility, consider seeking professional advice. A financial advisor with experience in cryptocurrencies can provide valuable insights and help you develop a tailored investment strategy. However, always conduct your own research and make informed decisions based on your individual circumstances.

Conclusion: The Future of Lumerin (LMR) Coin

Lumerin (LMR) Coin’s recent 30% surge to $0.15 has captured the attention of investors and enthusiasts alike. The unexpected prediction from a notable critic has added an intriguing layer of speculation to the narrative, highlighting the coin’s potential for significant growth.

As a crypto investor, understanding the factors behind LMR’s price surge and what the future might hold is crucial. By analyzing key indicators, comparing LMR to similar cryptocurrencies, and considering long and short-term predictions, you can make informed decisions about your investment strategy.

Whether you’re a beginner or a seasoned investor, Lumerin (LMR) Coin offers a unique opportunity to participate in the growing world of decentralized mining and trading. By staying informed, managing risk, and adopting a disciplined approach, you can navigate LMR’s volatility and potentially benefit from its future growth.

As we move forward into 2025 and beyond, keep an eye on Lumerin (LMR) Coin and the broader crypto market. With its strong community support, innovative technology, and growing adoption, LMR has the potential to become a significant player in the crypto ecosystem. Happy investing!

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.