In the rapidly evolving world of cryptocurrency, few companies have made as bold a statement about Bitcoin as MicroStrategy, now known as Strategy. As the largest corporate holder of Bitcoin, Strategy’s aggressive accumulation strategy continues to capture the attention of investors and crypto enthusiasts alike. In 2025, the company’s actions are more scrutinized than ever, with recent developments suggesting another major Bitcoin acquisition on the horizon. This article delves into the implications of these moves for $MSTR stock, offering price predictions and forecasts for the coming years.

Trade MSTR USDT on WEEX.

Contents

- 1 Can $MSTR Recover After Dropping to $43?

- 2 What Caused $MSTR’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Ethereum: Could $MSTR Follow a Similar Path?

- 4 How to Navigate $MSTR’s Volatility: Expert Insights

- 5 MicroStrategy’s Bitcoin Holdings and Future Acquisitions

- 6 $MSTR Price Predictions for 2025, 2030, and Beyond

- 7 Chart Analysis: Visualizing $MSTR’s Price Trends

- 8 Conclusion

Can $MSTR Recover After Dropping to $43?

$MSTR’s recent price drop from $65 to $43 has left many investors questioning the company’s future trajectory. The decline, which occurred amidst a broader market correction, has sparked debates about Strategy’s resilience and its Bitcoin-centric strategy. To understand this better, let’s compare $MSTR’s situation to another cryptocurrency that experienced a similar downturn: Ethereum.

In 2022, Ethereum saw a significant price drop due to the broader crypto market slump and the fallout from the Terra/LUNA debacle. However, Ethereum managed to recover, thanks to its strong fundamentals and the Ethereum Merge, which transitioned the network to proof-of-stake. Similarly, $MSTR’s recovery could hinge on Strategy’s continued commitment to Bitcoin and any positive developments in the broader crypto market.

The key question is whether $MSTR can follow Ethereum’s recovery path. Given Strategy’s history of doubling down on Bitcoin during downturns, there’s reason to believe it might. However, the company’s stock is also influenced by factors beyond cryptocurrency, such as its performance in the software analytics sector. Investors should keep an eye on these elements as they consider $MSTR’s potential rebound.

What Caused $MSTR’s Price Drop, and Will It Bounce Back?

Several factors contributed to $MSTR’s recent price drop. Firstly, the overall crypto market experienced a correction, with Bitcoin and other major cryptocurrencies seeing significant declines. Given Strategy’s heavy investment in Bitcoin, this naturally affected $MSTR’s stock price. Secondly, concerns about Strategy’s liquidity and its ability to manage its Bitcoin holdings during a downturn added to investor anxiety.

Despite these challenges, there’s optimism about $MSTR’s potential to bounce back. Michael Saylor, the company’s co-founder, has consistently expressed bullish sentiments about Bitcoin, and his recent social media posts suggest another major Bitcoin purchase might be imminent. Such a move could bolster investor confidence and drive $MSTR’s stock price higher.

To understand the potential for recovery, let’s look at key indicators like the Relative Strength Index (RSI) and Moving Averages. These tools provide insights into whether $MSTR is oversold and due for a rebound. For instance, if the RSI drops below 30, it’s often seen as a signal that a stock is oversold and might be poised for a recovery.

Lessons From Ethereum: Could $MSTR Follow a Similar Path?

Ethereum’s recovery from its 2022 lows offers valuable lessons for $MSTR investors. Ethereum’s success was driven by its fundamental value and the network’s significant upgrades, like the Ethereum Merge. Similarly, Strategy’s focus on Bitcoin could position it for a recovery if Bitcoin’s fundamentals strengthen.

One key difference is that $MSTR is tied not just to Bitcoin’s performance but also to Strategy’s broader business operations. If Strategy can demonstrate strong performance in its software analytics business alongside its Bitcoin holdings, this could provide a dual engine for $MSTR’s recovery.

Investors should also consider the broader market sentiment towards Bitcoin. If institutional adoption continues to grow and Bitcoin’s role as a store of value becomes more widely accepted, this could further support $MSTR’s recovery.

Navigating $MSTR’s volatility requires a strategic approach. Here are some expert insights for investors:

-

Diversification: Given $MSTR’s strong correlation with Bitcoin, diversifying your portfolio can help manage risk. Consider investing in other sectors or cryptocurrencies to balance your exposure.

-

Long-term Perspective: If you believe in Strategy’s Bitcoin strategy, adopting a long-term perspective can be beneficial. Historically, Bitcoin has shown significant growth over the long term, which could positively impact $MSTR.

-

Stay Informed: Keep an eye on Strategy’s announcements and Bitcoin’s market trends. Michael Saylor’s insights and Strategy’s Bitcoin acquisition plans can provide critical signals for $MSTR’s future movements.

-

Technical Analysis: Use tools like Bollinger Bands and Fibonacci retracements to identify potential entry and exit points. For instance, if $MSTR’s price touches the lower Bollinger Band, it might be a buying opportunity for those expecting a rebound.

MicroStrategy’s Bitcoin Holdings and Future Acquisitions

Strategy’s Bitcoin holdings are a central part of its investment strategy. As of February 2025, the company holds over 200,000 BTC, making it the largest corporate holder of Bitcoin. This aggressive accumulation strategy has not only boosted Strategy’s stock performance but also influenced other firms to consider similar moves.

Recent speculation about another major Bitcoin purchase stems from Michael Saylor’s social media post, hinting at Strategy’s readiness to continue its Bitcoin-first approach. Community members have speculated that Strategy might be looking to purchase an additional $2 billion worth of Bitcoin, based on its latest stock offerings.

This bold strategy has implications for $MSTR’s stock price. If Strategy announces another significant Bitcoin acquisition, it could signal strong confidence in Bitcoin’s future, potentially driving $MSTR’s stock higher. However, investors should also be aware of the risks, such as potential liquidity issues if Bitcoin’s price experiences another significant drop.

$MSTR Price Predictions for 2025, 2030, and Beyond

Predicting $MSTR’s future price involves considering various factors, including Bitcoin’s performance, Strategy’s business operations, and broader market trends. Here’s a detailed analysis:

-

2025: Given the recent price drop to $43, a recovery to around $60-$70 seems plausible if Bitcoin rebounds and Strategy continues its aggressive Bitcoin accumulation. This would represent a 35-63% increase from current levels.

-

2030: Looking further ahead, if Bitcoin continues to gain acceptance as a store of value and Strategy’s software analytics business thrives, $MSTR could reach $150-$200. This long-term prediction assumes a sustained bullish trend for Bitcoin and successful execution of Strategy’s dual strategy.

-

2040 and Beyond: By 2040, if Bitcoin becomes a widely accepted global asset, $MSTR could see significant growth, potentially reaching $300-$500. This forecast is speculative and depends on numerous variables, including regulatory developments and technological advancements in the crypto space.

These predictions are based on current trends and Strategy’s commitment to Bitcoin. However, investors should remain vigilant and adapt to changing market conditions.

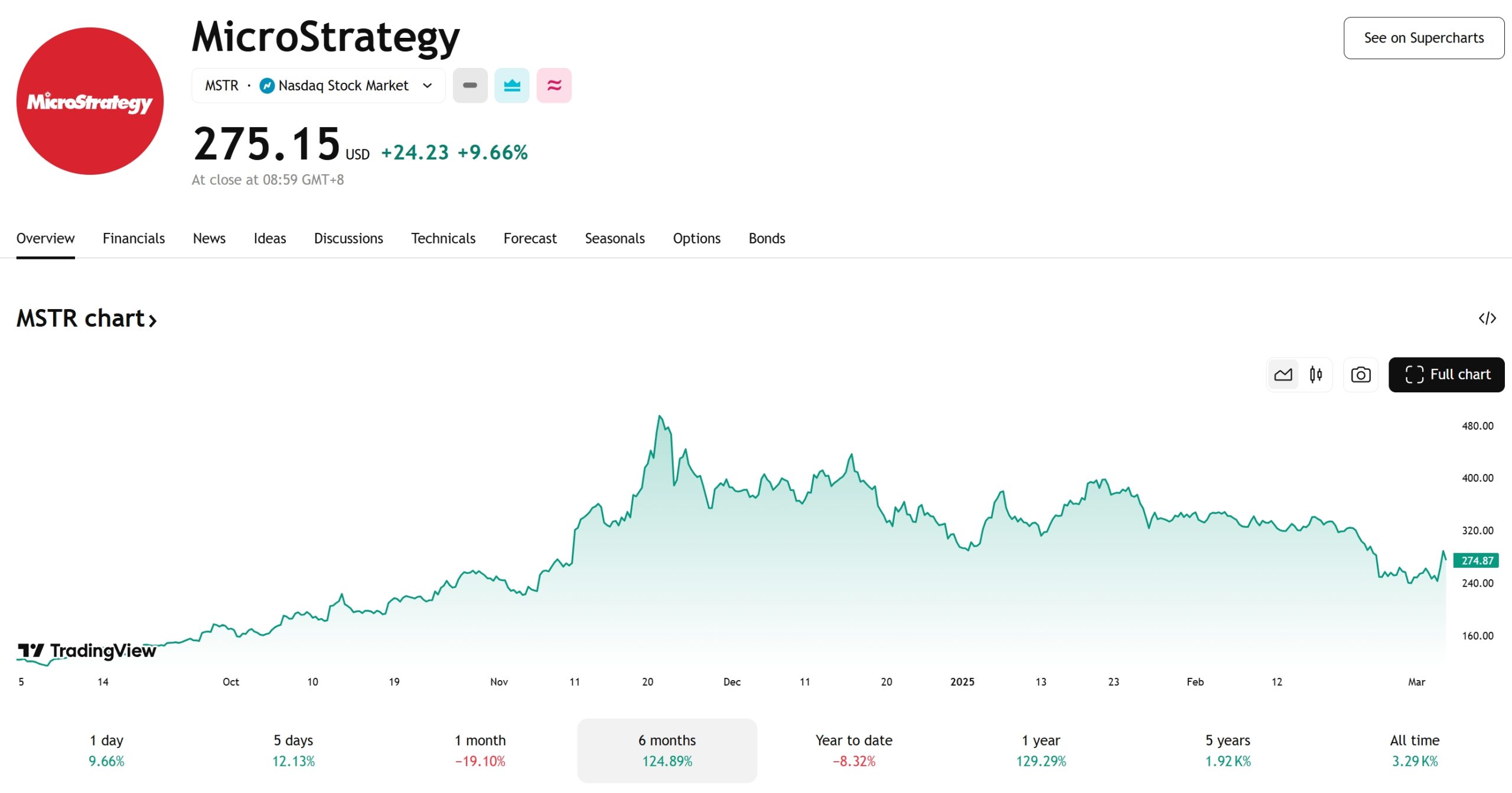

Chart Analysis: Visualizing $MSTR’s Price Trends

This chart is placed directly after the discussion on $MSTR’s price predictions to provide a visual representation of the historical data and future projections.

This chart is placed directly after the discussion on $MSTR’s price predictions to provide a visual representation of the historical data and future projections.

Conclusion

Strategy’s bold Bitcoin strategy continues to be a focal point for investors and crypto enthusiasts. The recent price drop to $43 has raised questions about $MSTR’s future, but historical trends and expert insights suggest a potential recovery. By understanding the factors influencing $MSTR’s stock and staying informed about Strategy’s Bitcoin acquisitions, investors can navigate the volatility and potentially capitalize on future opportunities.

As we look towards 2025, 2030, and beyond, $MSTR’s trajectory will be closely tied to Bitcoin’s performance and Strategy’s broader business success. Whether you’re a seasoned crypto investor or just starting your journey, keeping an eye on $MSTR could offer valuable insights into the intersection of traditional finance and the burgeoning world of cryptocurrency.

Michael Owen joins WEEX as an ambassador—experience the future of crypto trading! Learn more