If you’ve been following the crypto scene lately, you might have noticed the buzz around MNT coin. There’s a palpable excitement in the air, and it’s not just because of the recent price movements; it’s also about the unexpected prediction from a notable critic who once doubted the potential of Mint Blockchain. Yet, here we are, in March 2025, discussing whether MNT could truly surge to new heights. Let’s dive in and explore this intriguing narrative of irony and speculation.

Mint Blockchain, or MNT, has been making waves in the crypto community. It’s a Layer-2 solution built on the Ethereum network, designed to enhance scalability and reduce transaction fees. The project’s vision is to create a sustainable hub for on-chain finance, leveraging blockchain to revolutionize banking for the next generation. With a market cap of around $3.19 million as of early 2025, MNT is positioned as a promising player in the blockchain space.

Now, let’s talk about that controversial prediction. A well-known critic, who had previously dismissed the potential of Mint Blockchain, recently made a U-turn, forecasting a massive price surge for MNT. This unexpected endorsement has sparked a flurry of discussions and speculation among crypto enthusiasts. Why the sudden change of heart? Some speculate it’s due to the project’s strong performance and the growing interest in Layer-2 solutions.

To understand MNT’s potential, it’s crucial to look at its recent price movements. As of March 2025, MNT coin experienced a price drop from $0.02134 to $0.01902. While this might seem concerning at first glance, it’s essential to consider the broader context and compare it to similar cryptocurrencies like XRP. XRP, for instance, faced significant volatility due to regulatory developments, but it managed to recover thanks to strong market sentiment and adoption.

One of the key aspects to consider when analyzing MNT’s price drop is the market conditions at play. The crypto market is notorious for its volatility, influenced by factors like regulatory news, technological developments, and overall market sentiment. In MNT’s case, the price drop could be attributed to broader market corrections rather than issues specific to the project itself.

Let’s explore how this works in practice. Technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can provide insights into MNT’s market trends. For instance, if the RSI indicates that MNT is oversold, it might suggest a potential rebound. Similarly, a bullish crossover in the MACD could signal a buying opportunity for investors.

Support and resistance levels are also critical in understanding MNT’s price behavior. Around the $0.019 mark, MNT has found strong support, which could act as a springboard for a potential recovery. On the other hand, resistance levels near $0.02134 might pose challenges for a swift upward movement. Recent news or events, such as partnerships or updates from the Mint Blockchain team, could significantly impact these levels.

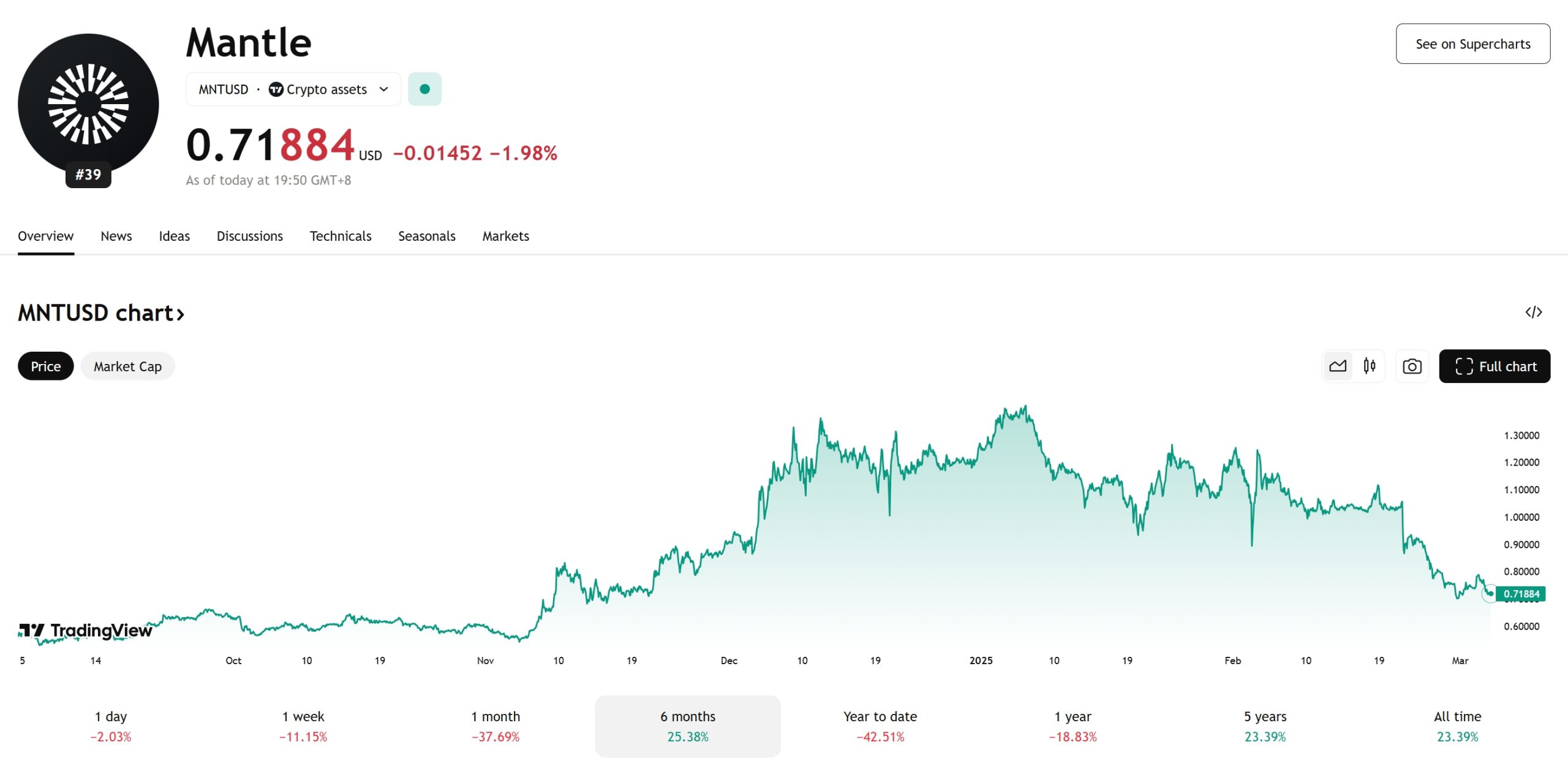

When it comes to chart analysis, visualizing MNT’s price trends can offer valuable insights. By examining annotated charts and comparative graphs, we can identify patterns and potential turning points. For beginners, understanding these charts might seem daunting, but they’re crucial tools for making informed investment decisions.

Now, let’s talk about the future. What does the next few months hold for MNT? Short-term predictions suggest that if MNT can break through the resistance at $0.02134, it might see a surge towards $0.03. This is based on the project’s ongoing development efforts and growing adoption within the Ethereum ecosystem. Long-term, MNT could potentially reach $0.05 by the end of 2025, driven by its role in scaling Ethereum and the increasing demand for its services.

But will MNT follow a recovery pattern similar to XRP? While there are similarities, such as both being part of the broader Ethereum ecosystem, MNT’s path might be different. Unlike XRP, which faced significant regulatory hurdles, MNT’s challenges are more related to market adoption and competition within the Layer-2 space. However, with strong backing from its community and ongoing development, MNT has the potential to carve out its own unique trajectory.

For investors, navigating MNT’s volatility requires a strategic approach. One key piece of advice is to keep an eye on the project’s development roadmap and community sentiment. As a beginner, it’s essential to start with small investments and gradually increase your exposure as you gain more experience and confidence in the market. Remember, crypto investing is a marathon, not a sprint.

In the world of cryptocurrencies, the story of MNT coin is one of resilience and potential. Despite the recent price drop, the unexpected prediction from a former critic has reignited interest and speculation about its future. As we move forward into 2025, the journey of MNT coin is one to watch closely, not just for the potential financial gains but for the broader impact it could have on the blockchain ecosystem.

So, can MNT recover after dropping to $0.01902? What caused this price drop, and will it bounce back? These are questions that resonate deeply with crypto enthusiasts, and the answers lie in understanding the intricate dance of market dynamics, technological advancements, and community support. As we continue to explore these themes, remember that the world of crypto is ever-evolving, and with it, the opportunities for those willing to dive in and learn.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.