In the dynamic world of cryptocurrencies, Moonbeam GLMR (GLMR) Token has been a topic of much interest and speculation. Recently, the GLMR token experienced a notable price drop from its previous highs to $0.09497 as of March 2025. For those new to the crypto scene, understanding these fluctuations can be daunting, but don’t worry—I’m here to guide you through the intricacies of GLMR’s current market situation and what the future might hold.

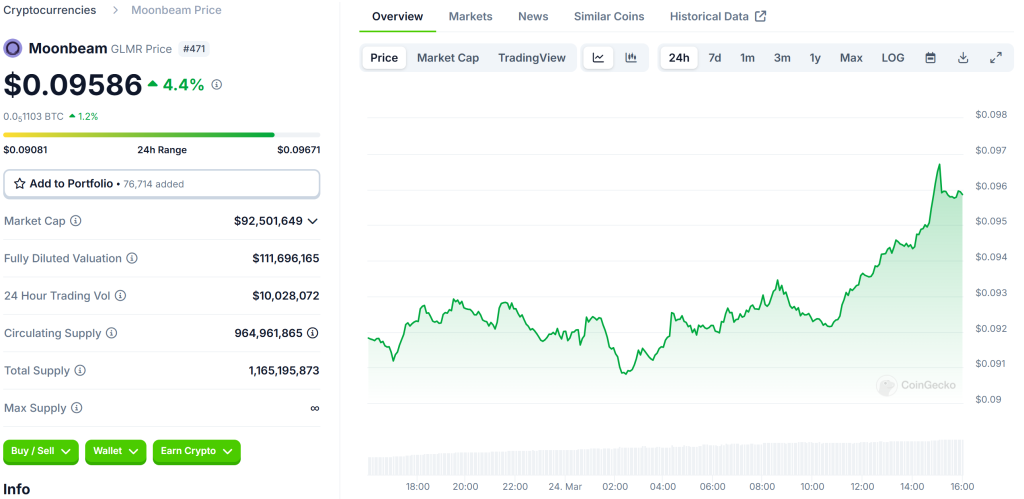

Let’s dive into the world of Moonbeam GLMR (GLMR) Token, a smart contract platform that’s part of the burgeoning Polkadot ecosystem. Moonbeam’s unique selling point is its ability to mirror Ethereum’s Web3 RPC, making it an attractive option for developers and users alike. With a circulating supply of about 960 million tokens and a market cap of $91,612,592 as of the latest data, GLMR has been making waves in the crypto market.

Contents

- 1 Can Moonbeam GLMR (GLMR) Token Recover After Dropping to $0.09497?

- 2 What Caused Moonbeam GLMR (GLMR) Token’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Ethereum: Could Moonbeam GLMR (GLMR) Token Follow a Similar Path?

- 4 How to Navigate Moonbeam GLMR (GLMR) Token’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for Moonbeam GLMR (GLMR) Token

Can Moonbeam GLMR (GLMR) Token Recover After Dropping to $0.09497?

The recent dip in GLMR’s price to $0.09497 has left many investors wondering about the token’s recovery potential. To understand this better, let’s look at the broader market context and some key indicators.

First off, the crypto market as a whole experienced a 3.70% increase over the last week, which suggests a generally bullish trend. However, GLMR has outperformed this average with an 8.30% rise in the same period, indicating strong interest and potential for recovery. The token’s trading volume has also surged by 97.70% in the last 24 hours, reaching $9,611,706, which is a clear sign of heightened market activity.

When we delve into technical indicators, the Relative Strength Index (RSI) for GLMR is currently at a moderate level, suggesting that the token is neither overbought nor oversold. The Moving Average Convergence Divergence (MACD) also shows a positive crossover, hinting at a possible upward trend in the near future. These indicators, combined with the increased trading volume, provide a hopeful outlook for GLMR’s recovery.

What Caused Moonbeam GLMR (GLMR) Token’s Price Drop, and Will It Bounce Back?

Understanding the factors behind GLMR’s price drop is crucial for predicting its future trajectory. The price drop from its previous highs to $0.09497 can be attributed to several factors, including broader market corrections and shifts in investor sentiment towards riskier assets.

One of the key aspects to consider is the impact of regulatory news and market sentiment on cryptocurrencies. For instance, recent regulatory developments in major economies could have temporarily spooked investors, leading to sell-offs in various tokens, including GLMR. However, with the market cap still robust at over $91 million and the token’s unique position within the Polkadot ecosystem, there’s a strong foundation for a rebound.

Looking at historical trends, we can see that GLMR has experienced significant volatility in the past. It reached an all-time high of $19.50 and an all-time low of $0.07944. The current price of $0.09497 is 19.44% above its lowest point, which is a positive sign. Moreover, the token’s integration with Ethereum’s ecosystem and its focus on cross-chain applications could drive future growth as the demand for interoperability solutions continues to rise.

Lessons From Ethereum: Could Moonbeam GLMR (GLMR) Token Follow a Similar Path?

To gain insights into GLMR’s potential recovery, let’s compare its recent performance to that of Ethereum, a well-established cryptocurrency that has faced its fair share of volatility. Ethereum experienced a significant price drop in 2018, falling from its peak of around $1,400 to below $100. The recovery took time, but Ethereum’s fundamental value and ongoing development eventually led to a resurgence, reaching new highs in subsequent years.

Similarly, GLMR’s current position within the Polkadot ecosystem and its focus on smart contract functionality could pave the way for a similar recovery. The token’s ability to leverage Ethereum’s tools and infrastructure while offering additional features like on-chain governance and staking sets it apart. If GLMR can continue to demonstrate its utility and attract developers and users, it could follow a path akin to Ethereum’s.

The key difference lies in the scale and maturity of the projects. Ethereum has been around longer and has a more established ecosystem, whereas GLMR is still growing. However, GLMR’s integration with Polkadot, a platform known for its interoperability, could accelerate its adoption and growth, potentially leading to a more rapid recovery compared to Ethereum’s timeline.

Navigating the volatility of cryptocurrencies like GLMR requires a strategic approach, especially for beginners. Here are some expert insights to help you make informed decisions:

Firstly, understanding the token’s fundamentals is crucial. GLMR’s role in the Polkadot ecosystem, its integration with Ethereum, and its focus on smart contract platforms are all factors that contribute to its potential value. Keeping an eye on these developments can help you gauge the token’s long-term prospects.

Secondly, staying updated with market trends and news is essential. The recent surge in trading volume and positive technical indicators suggest a favorable environment for GLMR. However, external factors like regulatory changes or shifts in market sentiment can impact prices, so staying informed is key.

Lastly, consider diversifying your portfolio. While GLMR shows promise, it’s wise to spread your investments across different assets to mitigate risk. As a beginner, starting with a small investment in GLMR and gradually increasing your stake as you gain more confidence and knowledge can be a prudent strategy.

Long and Short-Term Predictions for Moonbeam GLMR (GLMR) Token

Looking ahead, let’s explore some long and short-term predictions for GLMR based on current trends and market data.

In the short term, the token is likely to see continued volatility, but the recent increase in trading volume and positive technical indicators suggest a potential upward trend. If GLMR can maintain its momentum and capitalize on its unique features within the Polkadot ecosystem, we could see it reach $0.12 by the end of 2025.

For the long term, the outlook is even more promising. As the demand for cross-chain solutions and smart contract platforms grows, GLMR’s position as a bridge between Ethereum and Polkadot could drive significant adoption. By 2030, if the project continues to develop and expand its ecosystem, we could see GLMR reaching $0.50 or higher.

These predictions are based on current data and trends, but it’s important to remember that the crypto market is inherently unpredictable. Staying informed and adapting your strategy as needed will be crucial for navigating GLMR’s journey.

In conclusion, while the recent drop in Moonbeam GLMR (GLMR) Token’s price to $0.09497 may have caused concern, the token’s strong fundamentals, positive market indicators, and potential for growth within the Polkadot ecosystem suggest a promising path to recovery. As a beginner, keeping these insights in mind and approaching your investment with caution and knowledge can help you make the most of GLMR’s potential.