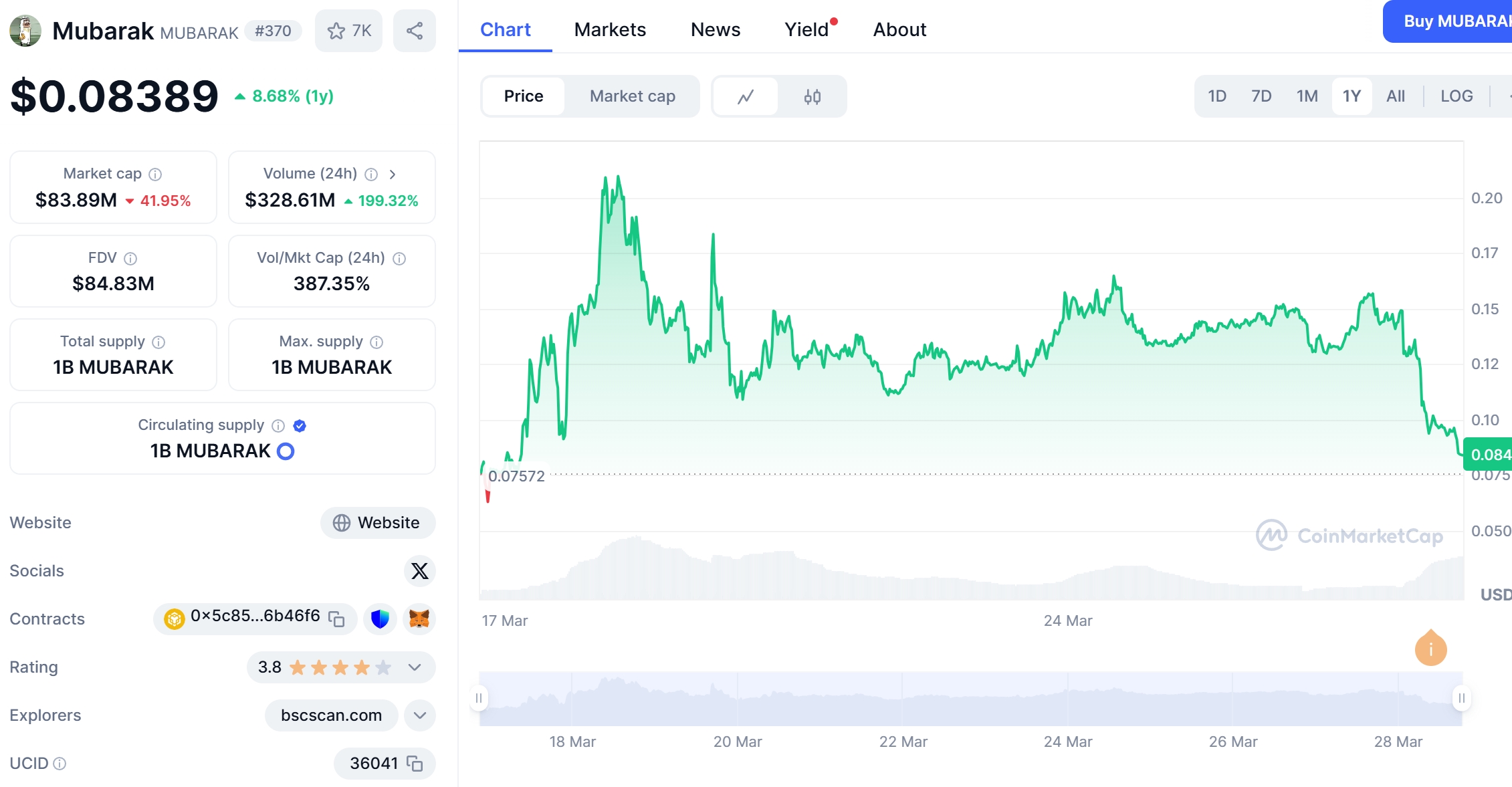

In the ever-evolving world of cryptocurrency, Mubarak(MUBARAK) Coin has been making headlines with its recent price movements. As of March 2025, the coin has experienced a significant drop from its previous high of $0.15 to a current low of $0.05. This dramatic shift has left many investors wondering if Mubarak(MUBARAK) Coin can stage a comeback and surge back to $0.10 or beyond. Let’s dive into the details and explore the potential for recovery.

Contents

- 1 The Recent Price Drop: What Happened?

- 2 Comparing Mubarak(MUBARAK) Coin to Ethereum: Lessons from the Past

- 3 Technical Analysis: Key Indicators and Trends

- 4 Support and Resistance Levels: What to Watch

- 5 Chart Analysis: Visualizing the Trends

- 6 Long and Short-Term Predictions: What Lies Ahead?

- 7 Actionable Insights for Investors

- 8 Navigating Mubarak(MUBARAK) Coin’s Volatility: Expert Insights

The Recent Price Drop: What Happened?

Mubarak(MUBARAK) Coin’s journey from $0.15 to $0.05 has been a rollercoaster ride for investors. The coin, which had been steadily climbing in value, suddenly faced a sharp decline. Several factors contributed to this drop, including market sentiment shifts, regulatory news, and broader economic conditions. Understanding these elements is crucial for predicting the coin’s future trajectory.

One of the key aspects to consider is the impact of market sentiment. Cryptocurrency markets are highly sensitive to news and social media trends. A negative tweet from a prominent figure or a sudden shift in investor confidence can lead to rapid price drops. In the case of Mubarak(MUBARAK) Coin, a series of negative reports about the project’s development progress and potential security vulnerabilities may have triggered the initial decline.

Additionally, regulatory news can significantly affect cryptocurrency prices. In early 2025, several countries announced stricter regulations on digital assets, causing a ripple effect across the market. Mubarak(MUBARAK) Coin, like many other cryptocurrencies, felt the pressure as investors became more cautious about their holdings.

Broader economic conditions also play a role. The global economy in March 2025 is facing uncertainties, with inflation rates fluctuating and geopolitical tensions affecting investor confidence. These macroeconomic factors can lead to a flight to safety, with investors moving their funds from volatile assets like cryptocurrencies to more stable investments.

Comparing Mubarak(MUBARAK) Coin to Ethereum: Lessons from the Past

To gain insights into Mubarak(MUBARAK) Coin’s potential recovery, it’s helpful to compare its current situation to that of another well-known cryptocurrency, Ethereum. Ethereum experienced a similar price drop in the past, dropping from a high of $4,000 to around $2,000 in a matter of weeks. This drop was triggered by a combination of factors, including a major network upgrade that caused temporary disruptions and a broader market correction.

Despite the initial panic, Ethereum managed to recover and eventually surpassed its previous high. The recovery was driven by several factors, including increased adoption of decentralized applications (dApps) built on the Ethereum network, positive regulatory developments, and a growing interest in decentralized finance (DeFi).

For Mubarak(MUBARAK) Coin, the path to recovery might follow a similar pattern. The project has been working on several new features and partnerships that could drive increased adoption and investor interest. For instance, the recent announcement of a collaboration with a major blockchain platform to enhance the coin’s interoperability could be a significant catalyst for growth.

However, there are also differences between Mubarak(MUBARAK) Coin and Ethereum that need to be considered. Ethereum has a more established ecosystem and a larger user base, which can provide a more stable foundation for recovery. Mubarak(MUBARAK) Coin, on the other hand, is still in its early stages and may face more challenges in regaining investor confidence.

Technical Analysis: Key Indicators and Trends

To better understand Mubarak(MUBARAK) Coin’s potential for recovery, let’s delve into some key technical indicators. These tools can provide valuable insights into market trends and help investors make informed decisions.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. As of March 2025, Mubarak(MUBARAK) Coin’s RSI is hovering around 30, indicating that the coin is currently in oversold territory. This suggests that the recent price drop may have been overdone, and a rebound could be on the horizon.

Moving Averages

Moving averages are another useful tool for analyzing price trends. The 50-day moving average for Mubarak(MUBARAK) Coin is currently at $0.08, while the 200-day moving average is at $0.12. The coin’s price is well below both of these averages, indicating a bearish trend. However, if the price can break above the 50-day moving average, it could signal the start of a recovery.

Bollinger Bands

Bollinger Bands are a volatility indicator that can help identify potential price breakouts. Currently, Mubarak(MUBARAK) Coin’s price is trading near the lower Bollinger Band, suggesting that the coin is at a potential support level. A move back towards the middle or upper Bollinger Band could indicate a strengthening of the price.

Fibonacci Retracement

Fibonacci retracement levels can help identify potential support and resistance levels. For Mubarak(MUBARAK) Coin, the 38.2% retracement level from the recent high to the current low is around $0.08, while the 61.8% level is at $0.11. If the coin can hold above the 38.2% level, it could signal a potential recovery towards the 61.8% level and beyond.

Support and Resistance Levels: What to Watch

Identifying key support and resistance levels is crucial for understanding Mubarak(MUBARAK) Coin’s potential price movements. As of March 2025, the coin is facing significant support at the $0.05 level, which has held firm despite the recent drop. If this level can be maintained, it could serve as a foundation for a potential recovery.

On the upside, the first major resistance level is at $0.07, which was a previous support level before the recent drop. Breaking above this level could signal a shift in market sentiment and pave the way for further gains. The next significant resistance level is at $0.10, which was the coin’s price before the recent decline. A move back to this level would represent a significant recovery and could boost investor confidence.

Recent news and developments can also impact these support and resistance levels. For instance, the announcement of a new partnership or a successful project milestone could provide the necessary catalyst for a price breakout. Conversely, negative news or regulatory setbacks could push the price back towards the lower support levels.

Chart Analysis: Visualizing the Trends

Visual representations of price trends can provide a clearer picture of Mubarak(MUBARAK) Coin’s potential recovery. Let’s take a look at some annotated charts to better understand the coin’s recent performance and future prospects.

Price Chart

The price chart for Mubarak(MUBARAK) Coin shows a clear downtrend from the recent high of $0.15 to the current low of $0.05. However, there are signs of potential reversal, such as the formation of a double bottom pattern at the $0.05 level. This pattern could indicate that the coin is finding strong support and may be poised for a rebound.

Volume Chart

Volume is another important indicator to consider. The volume chart for Mubarak(MUBARAK) Coin shows a spike in trading volume during the recent price drop, suggesting that there was significant selling pressure. However, the volume has since decreased, which could indicate that the selling pressure is subsiding. A subsequent increase in volume could signal a potential recovery.

Comparative Chart

Comparing Mubarak(MUBARAK) Coin’s performance to that of other cryptocurrencies can provide additional insights. For instance, a comparative chart with Ethereum shows that both coins experienced similar price drops, but Ethereum has since recovered more strongly. This comparison can help investors gauge the potential for Mubarak(MUBARAK) Coin to follow a similar path.

Long and Short-Term Predictions: What Lies Ahead?

Predicting the future price movements of Mubarak(MUBARAK) Coin involves considering both short-term and long-term factors. Let’s explore some potential scenarios and their implications for investors.

Short-Term Predictions

In the short term, Mubarak(MUBARAK) Coin’s price could be influenced by several factors, including market sentiment, regulatory news, and project developments. If the coin can hold above the $0.05 support level and break above the $0.07 resistance level, it could signal the start of a recovery. A move back to $0.10 in the next few months is possible if these positive developments materialize.

However, there are also risks to consider. Negative news or regulatory setbacks could push the price back towards the lower support levels. Investors should remain cautious and monitor the market closely for any signs of a potential reversal.

Long-Term Predictions

In the long term, Mubarak(MUBARAK) Coin’s potential for growth depends on several factors, including the success of its development roadmap, adoption by users and businesses, and the overall health of the cryptocurrency market. If the project can deliver on its promises and gain traction in the market, a price surge to $0.20 or beyond by the end of 2025 is within the realm of possibility.

However, achieving such growth will require overcoming significant challenges. The cryptocurrency market is highly competitive, and Mubarak(MUBARAK) Coin will need to differentiate itself from other projects to attract and retain investors. Additionally, regulatory developments and macroeconomic conditions will continue to play a role in shaping the coin’s long-term trajectory.

Actionable Insights for Investors

For investors looking to navigate Mubarak(MUBARAK) Coin’s volatility, here are some actionable insights and advice:

Diversify Your Portfolio

Diversification is key to managing risk in the cryptocurrency market. Instead of putting all your funds into Mubarak(MUBARAK) Coin, consider spreading your investments across different assets. This can help mitigate the impact of any single coin’s price movements on your overall portfolio.

Stay Informed

Keeping up with the latest news and developments related to Mubarak(MUBARAK) Coin is crucial for making informed investment decisions. Follow reputable sources, join community forums, and stay updated on the project’s progress. This will help you anticipate potential price movements and adjust your strategy accordingly.

Set Clear Goals and Risk Tolerance

Before investing in Mubarak(MUBARAK) Coin, set clear goals for your investment and assess your risk tolerance. Are you looking for short-term gains, or are you in it for the long haul? Understanding your investment objectives and risk tolerance will help you make more informed decisions and avoid emotional trading.

Use Technical Analysis

Technical analysis can be a valuable tool for predicting price movements. Use indicators like RSI, moving averages, and Bollinger Bands to identify potential entry and exit points. However, remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Consider Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the coin’s price. This can help reduce the impact of volatility and allow you to build a position over time. Consider using this strategy to invest in Mubarak(MUBARAK) Coin, especially if you believe in its long-term potential.

Navigating the volatility of Mubarak(MUBARAK) Coin requires a combination of technical analysis, market awareness, and a clear investment strategy. As an investor, it’s important to stay informed about the latest developments and use tools like RSI, moving averages, and Bollinger Bands to identify potential entry and exit points.

One of the key aspects to consider is the project’s development roadmap. Mubarak(MUBARAK) Coin has been working on several new features and partnerships that could drive increased adoption and investor interest. For instance, the recent announcement of a collaboration with a major blockchain platform to enhance the coin’s interoperability could be a significant catalyst for growth.

Additionally, regulatory developments and macroeconomic conditions will continue to play a role in shaping the coin’s trajectory. In early 2025, several countries announced stricter regulations on digital assets, causing a ripple effect across the market. Mubarak(MUBARAK) Coin, like many other cryptocurrencies, felt the pressure as investors became more cautious about their holdings.

Despite these challenges, there are reasons to be optimistic about Mubarak(MUBARAK) Coin’s future. The project has a dedicated team and a clear vision for growth. If it can deliver on its promises and gain traction in the market, a price surge to $0.20 or beyond by the end of 2025 is within the realm of possibility.

In conclusion, Mubarak(MUBARAK) Coin’s recent price drop to $0.05 has left many investors wondering about its potential for recovery. By understanding the factors that contributed to the drop, comparing the coin’s performance to that of other cryptocurrencies, and using technical analysis to identify key trends, investors can make more informed decisions. Whether Mubarak(MUBARAK) Coin can surge back to $0.10 or beyond by March 2025 remains to be seen, but with the right strategy and a long-term perspective, there are opportunities for growth and success.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.