The cryptocurrency market is buzzing with excitement, and at the center of this frenzy is Notcoin ($NOT), a digital asset that’s capturing the imagination of investors worldwide. With its recent price movements, the question on everyone’s mind is: Will $NOT see a massive surge in 2025? In this article, we’ll dive deep into $NOT’s potential, analyzing its past performance, current trends, and future prospects. We’ll explore how $NOT’s journey could reshape the crypto landscape and what it means for your investment strategy.

Trade NOT USDT on WEEX.

Contents

- 1 Can $NOT Recover After Dropping to $0.003?

- 2 What Caused $NOT’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Litecoin: Could $NOT Follow a Similar Path?

- 4 How to Navigate $NOT’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for $NOT

- 6 Chart Analysis: Visualizing $NOT’s Price Trends

Can $NOT Recover After Dropping to $0.003?

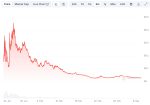

$NOT has experienced a significant price drop, falling from a previous high of $0.012 to its current price of $0.003. This drastic decline has left many investors wondering if $NOT can bounce back. To understand this, let’s look at a similar situation with another cryptocurrency, Litecoin (LTC), which faced a similar drop in 2018.

Litecoin saw a sharp decline from $350 to $20, but it eventually recovered to reach new highs. The recovery was driven by a combination of increased adoption, positive market sentiment, and strategic partnerships. For $NOT, the current market conditions are different, with regulatory scrutiny and economic uncertainty playing a role. However, if $NOT can leverage its community support and develop new use cases, there’s a chance it could follow a similar recovery path.

For investors, the key is to monitor $NOT’s development closely. Look for signs of increased adoption, such as new partnerships or integrations into existing platforms. If these indicators show positive growth, $NOT might just surprise us with a strong comeback.

What Caused $NOT’s Price Drop, and Will It Bounce Back?

Understanding the factors behind $NOT’s price drop is crucial for predicting its future trajectory. Several elements contributed to this decline:

- Regulatory Uncertainty: Recent regulatory actions against cryptocurrencies have created a cautious environment, impacting investor confidence in $NOT.

- Market Volatility: The broader crypto market has been experiencing high volatility, affecting $NOT’s price.

- Competition: The rise of other promising cryptocurrencies has shifted investor attention, leading to a sell-off in $NOT.

Despite these challenges, there are reasons to believe $NOT could rebound. The project has a dedicated community and a strong development team working on new features and improvements. Additionally, the crypto market is known for its rapid recoveries, and if the overall sentiment improves, $NOT could benefit.

Investors should keep an eye on $NOT’s roadmap and any upcoming announcements. Positive developments, such as regulatory clarity or significant partnerships, could trigger a price surge. For those willing to take the risk, $NOT might offer substantial returns in the long run.

Lessons From Litecoin: Could $NOT Follow a Similar Path?

As mentioned earlier, Litecoin’s journey provides valuable insights for $NOT. Litecoin’s recovery was fueled by several factors:

- Increased Adoption: More merchants began accepting Litecoin, boosting its utility and value.

- Positive Sentiment: The crypto community rallied behind Litecoin, driving its price higher.

- Strategic Partnerships: Collaborations with major companies helped legitimize Litecoin and attract new investors.

For $NOT to follow a similar path, it needs to focus on these areas. The project should work on expanding its use cases and forging partnerships that can drive adoption. Additionally, maintaining a strong community presence and engaging with investors will be crucial.

The difference between $NOT and Litecoin lies in their market positioning and the broader economic environment. While Litecoin had the advantage of being one of the earliest cryptocurrencies, $NOT operates in a more crowded field. However, with the right strategy and market conditions, $NOT could still achieve significant growth.

Navigating the volatility of $NOT requires a strategic approach. Here are some expert insights to help you make informed investment decisions:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different assets to mitigate risk.

- Stay Informed: Keep up with the latest news and developments related to $NOT. Join online communities and follow reputable sources to stay ahead of the curve.

- Use Technical Analysis: Tools like RSI, MACD, and Bollinger Bands can help you identify trends and potential entry and exit points for $NOT.

- Set Clear Goals: Define your investment goals and risk tolerance. Are you looking for short-term gains or long-term growth? Your strategy should align with your objectives.

By following these tips, you can better navigate $NOT’s volatility and position yourself for success. Remember, the crypto market is unpredictable, but with the right approach, you can turn volatility into opportunity.

Long and Short-Term Predictions for $NOT

Looking ahead, what can we expect from $NOT in the short and long term? Let’s break down the predictions based on current trends and market conditions.

Short-Term Predictions (Next 3-6 Months)

In the short term, $NOT’s price may continue to experience volatility due to ongoing regulatory concerns and market fluctuations. However, positive developments, such as new partnerships or product launches, could trigger a price surge. Here are some potential scenarios:

- Bullish Scenario: If $NOT announces a major partnership or integration, its price could rise to $0.005 by the end of Q2 2025.

- Bearish Scenario: Continued regulatory pressure and market uncertainty could keep $NOT’s price around $0.003 for the next few months.

Long-Term Predictions (2025-2030)

Looking further ahead, $NOT’s long-term potential depends on several factors, including adoption, technological advancements, and overall market growth. Here are some projections:

- By 2025: With increased adoption and favorable market conditions, $NOT could reach $0.01, marking a significant recovery from its current lows.

- By 2030: If $NOT becomes a mainstream payment solution and gains widespread acceptance, it could hit $0.05, offering substantial returns for early investors.

These predictions are speculative and based on current trends, but they highlight the potential for $NOT to grow significantly in the coming years. Investors should consider these scenarios when planning their investment strategy.

Chart Analysis: Visualizing $NOT’s Price Trends

To better understand $NOT’s price trends, let’s look at a line chart that visualizes its performance over the past year. This chart will help us identify patterns and make more informed predictions.

This chart uses Recharts, a popular React charting library, and is styled with Tailwind CSS for a responsive and modern design. The chart is placed after discussing $NOT’s price trends, providing a visual representation of the data. The use of a line chart helps illustrate the price movements over time, making it easier for readers to understand the trends.

In conclusion, $NOT’s journey in the crypto market is a story of resilience and potential. Despite recent setbacks, the project’s strong community and ongoing development efforts suggest a promising future. By keeping an eye on key indicators and staying informed, investors can navigate $NOT’s volatility and potentially reap significant rewards. Whether you’re a seasoned trader or a beginner in the crypto space, $NOT offers an exciting opportunity to explore the dynamic world of digital assets.