There’s arguably no hotter topic in the crypto world right now than Orbiter Finance (OBT). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it one of the top-performing cryptocurrencies. As someone deeply invested in the crypto market, I’ve watched OBT’s rollercoaster ride with fascination, capturing the market’s attention with large price swings and major developments.

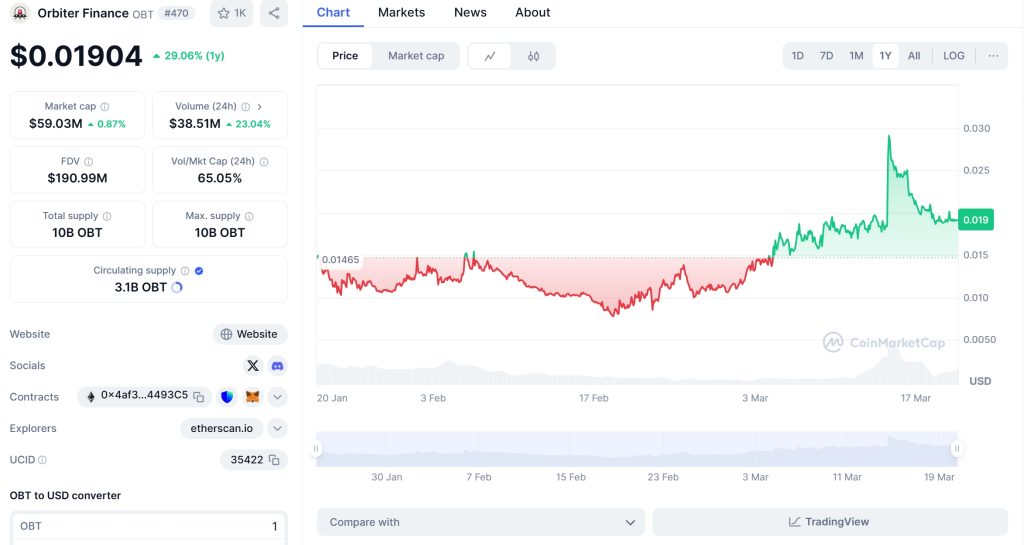

Orbiter Finance (OBT) has experienced significant volatility lately, which has investors on the edge of their seats. On March 15, 2025, the token surged to a multi-month high of $0.0249, fueled by strong market sentiment. However, the rally was short-lived, and OBT’s price dropped back to $0.0189 by March 20, 2025. This price movement has many in the community wondering, “Is it a good time to buy Orbiter Finance (OBT)?”

Contents

- 1 The Recent Price Drop of Orbiter Finance (OBT) Coin: From $0.0249 to $0.0189

- 2 Can Orbiter Finance (OBT) Recover After Dropping to $0.0189?

- 3 What Caused Orbiter Finance (OBT)’s Price Drop, and Will It Bounce Back?

- 4 Lessons From XRP: Could Orbiter Finance (OBT) Follow a Similar Path?

- 5 How to Navigate Orbiter Finance (OBT)’s Volatility: Expert Insights

- 6 Orbiter Finance (OBT) Price Predictions for 2025, 2026, 2030, and Beyond

- 7 Conclusion: The Future of Orbiter Finance (OBT) Coin

The Recent Price Drop of Orbiter Finance (OBT) Coin: From $0.0249 to $0.0189

Let’s dive into what caused this recent swing in OBT’s price. On March 15, a wave of positive news about potential partnerships and technological advancements sent OBT’s value soaring to $0.0249. But as quickly as it rose, the price fell back to $0.0189 within days. This can be attributed to profit-taking by short-term investors and a general market correction.

To put this in perspective, let’s compare OBT’s trend to that of XRP, a well-known cryptocurrency that has also experienced its fair share of volatility. XRP saw a significant price drop from $3.39 to $2.50 in early 2025 due to regulatory uncertainties. However, XRP managed to recover to $2.50, buoyed by positive developments in its legal battles with the SEC. The external events causing XRP’s drop were different from OBT’s, but the recovery pattern shows that with the right catalysts, a crypto can rebound.

OBT’s situation is unique, with its focus on token bridges and governance within the Arbitrum Ecosystem. The market conditions that led to its drop were primarily driven by short-term speculation rather than fundamental issues. This means OBT has the potential to follow a similar recovery path to XRP if it can capitalize on upcoming developments and maintain investor confidence.

Can Orbiter Finance (OBT) Recover After Dropping to $0.0189?

The question on everyone’s mind is whether OBT can bounce back from this dip. I believe it can, and here’s why. First, OBT’s fundamentals remain strong. It’s part of the rapidly growing Arbitrum Ecosystem, which has seen significant adoption and development in recent months. This sector’s growth is driven by the increasing demand for scalable and efficient blockchain solutions.

Second, OBT has secured substantial financial backing, which demonstrates the project team’s credibility and potential. With a total supply of 10 billion tokens and a circulating supply of 3.1 billion, OBT’s market cap of $58,860,714 is poised for growth. The team’s commitment to research and development, coupled with a robust community, bodes well for future value appreciation.

However, there are challenges to consider. Like any crypto, OBT has faced its share of setbacks, including market volatility and competition from other projects in the space. Yet, by learning from past experiences and adapting to market conditions, the OBT team has shown resilience and a commitment to long-term success.

What Caused Orbiter Finance (OBT)’s Price Drop, and Will It Bounce Back?

The recent price drop from $0.0249 to $0.0189 can be attributed to a combination of factors. As mentioned earlier, profit-taking by short-term investors played a significant role. Additionally, broader market corrections and a shift in investor sentiment contributed to the decline. Despite this, OBT’s 24-hour trading volume remains strong at $35,964,987, indicating continued interest and liquidity.

Looking at historical trends, OBT has shown resilience in the face of volatility. For instance, after a previous dip in late 2024, OBT recovered and went on to achieve new highs. This pattern suggests that with the right catalysts, such as new partnerships or technological advancements, OBT can regain its upward trajectory.

Lessons From XRP: Could Orbiter Finance (OBT) Follow a Similar Path?

Drawing parallels with XRP’s recovery journey can provide valuable insights for OBT’s future. XRP’s price drop was primarily due to regulatory concerns, but its recovery was driven by positive legal developments and a strong community backing. OBT, on the other hand, is more influenced by market sentiment and technological progress.

While XRP’s recovery was tied to specific events, OBT’s path forward may depend on broader market trends and its ability to differentiate itself within the Arbitrum Ecosystem. By focusing on enhancing its token bridge capabilities and governance features, OBT can attract more users and investors, potentially leading to a similar recovery pattern.

Navigating OBT’s volatility requires a strategic approach. For beginners, it’s crucial to understand key indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These tools can provide insights into market trends and help you make informed decisions.

For instance, if the RSI indicates that OBT is overbought, it might be a good time to consider taking some profits. Conversely, if the MACD shows a bullish crossover, it could signal a potential uptrend. By combining these indicators with news and developments related to OBT, you can better navigate its price movements.

Additionally, understanding support and resistance levels is essential. Currently, OBT’s support level is around $0.0186, while resistance is at $0.0203. These levels can help you anticipate potential price movements and plan your entry and exit points accordingly.

Orbiter Finance (OBT) Price Predictions for 2025, 2026, 2030, and Beyond

Looking ahead, I believe OBT has the potential to reach $0.05 by the end of 2025, driven by increased adoption within the Arbitrum Ecosystem and continued development of its token bridge technology. This prediction is supported by OBT’s strong fundamentals and the growing interest in scalable blockchain solutions.

By 2026, if OBT can maintain its momentum and secure additional partnerships, I see it reaching $0.07. This would represent a significant milestone for the project and could attract more institutional investors.

Looking further into the future, by 2030, OBT could potentially hit $0.15, assuming it continues to innovate and expand its ecosystem. This long-term growth is contingent on the project’s ability to navigate market challenges and capitalize on emerging trends.

For investors, the key is to stay informed and patient. OBT’s journey may be volatile, but with a strong foundation and a dedicated team, it has the potential to deliver substantial returns over time.

Conclusion: The Future of Orbiter Finance (OBT) Coin

In conclusion, Orbiter Finance (OBT) has captured the attention of the crypto community with its recent price movements and strong fundamentals. While it has experienced volatility, the project’s focus on token bridges and governance within the Arbitrum Ecosystem positions it for long-term growth.

As a beginner in crypto investing, understanding OBT’s potential requires a blend of technical analysis, market awareness, and a long-term perspective. By staying informed about OBT’s developments and using tools like RSI and MACD, you can navigate its volatility and make informed investment decisions.

The journey of OBT from $0.0189 to potential highs of $0.05 by 2025 and beyond is one to watch closely. With the right strategy and a focus on the project’s strengths, investors can look forward to a promising future with Orbiter Finance (OBT).

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.