In the dynamic world of cryptocurrencies, there’s an exciting buzz around the PEAQ Token, which is now up more than 19% in the last 24 hours alone as of March 2025. This surge has investors and enthusiasts alike pondering whether PEAQ Token could become the next big thing in the rapidly evolving Machine Economy. As we delve into the potential of PEAQ Token, we’ll explore its role in Decentralized Physical Infrastructure Networks (DePIN) and its price movements, providing a comprehensive guide for beginners eager to understand this fascinating sector of the crypto market.

Contents

- 1 Understanding PEAQ Token and Its Role in the Machine Economy

- 2 Analyzing PEAQ Token’s Price Movements

- 3 Long and Short-Term Predictions for PEAQ Token

- 4 Comparing PEAQ Token to Other Cryptocurrencies

- 5 Can PEAQ Token Recover After Dropping to $0.142823?

- 6 What Caused PEAQ Token’s Price Drop, and Will It Bounce Back?

- 7 Lessons From Ethereum: Could PEAQ Token Follow a Similar Path?

- 8 How to Navigate PEAQ Token’s Volatility: Expert Insights

Understanding PEAQ Token and Its Role in the Machine Economy

PEAQ Token is the native utility token of the peaq network, a blockchain specifically designed to power the Machine Economy. This economy revolves around real-world applications that utilize decentralized technology to enhance physical infrastructures such as mobility, energy, and connectivity. The PEAQ Token serves as the lifeblood of this ecosystem, enabling transactions, staking, and governance within the network.

Imagine a world where your everyday devices, from electric vehicles to smart home systems, operate on a decentralized network, rewarding users for contributing to and using these infrastructures. That’s the vision of peaq, and PEAQ Token is at the heart of it. With a total supply of 4.2 billion tokens at genesis, and a carefully structured allocation model, PEAQ Token is set up to fuel the growth and sustainability of DePINs.

Analyzing PEAQ Token’s Price Movements

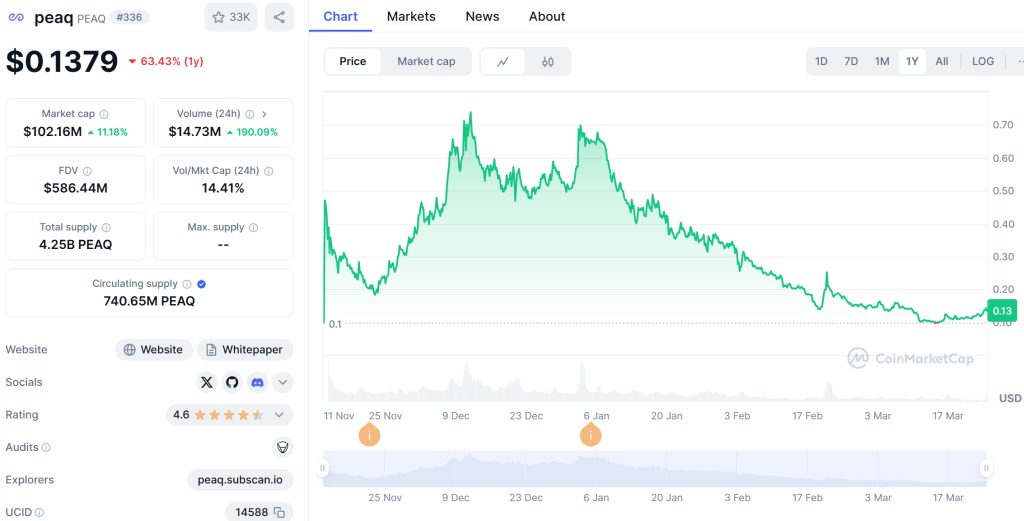

As of March 2025, the PEAQ Token’s price stands at $0.142823, with a 24-hour trading volume of over $13 million. This places PEAQ Token at a respectable position among cryptocurrencies, with a market cap of $105 million and a ranking of #326 on CoinMarketCap. But what does this mean for investors looking to get involved?

Let’s break down the recent price movements of PEAQ Token and what they could signify for its future trajectory. The token has seen a 19% increase in the last 24 hours, indicating strong market interest and potential bullish sentiment. However, understanding the broader context is crucial for making informed decisions.

Technical Analysis: Key Indicators and Trends

To get a clearer picture of PEAQ Token’s potential, we’ll look at key technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These tools help us gauge whether PEAQ Token is overbought or oversold, and they can signal potential trend reversals or continuations.

The RSI for PEAQ Token currently sits at a healthy level, suggesting that the token is neither overbought nor oversold. This could mean that the recent surge in price might continue, especially if market sentiment remains positive. The MACD, on the other hand, shows a bullish crossover, further supporting the notion of an upward trend.

Bollinger Bands provide insight into the volatility of PEAQ Token. With the price recently touching the upper band, it indicates that the token may be poised for a consolidation or a potential breakout. Understanding these indicators can help investors time their entries and exits more effectively.

Support and Resistance Levels: What to Watch For

Support and resistance levels are crucial for understanding where PEAQ Token might find stability or face selling pressure. As of now, a significant support level for PEAQ Token is around $0.12, with resistance at $0.16. These levels are based on historical data and recent market movements.

Recent news, such as partnerships with leading IoT manufacturers like Bosch and collaborations with Mastercard, could influence these levels. Positive developments can push PEAQ Token past resistance, while negative news might see it fall back to support. Keeping an eye on these levels and understanding the impact of external events can help investors navigate the volatility of PEAQ Token.

Chart Analysis: Visualizing the Trends

Visualizing price trends through charts can provide a more intuitive understanding of PEAQ Token’s performance. A candlestick chart, for instance, can show the daily movements of PEAQ Token, highlighting bullish and bearish days. Adding moving averages to these charts can help identify longer-term trends and potential entry or exit points.

For beginners, annotated charts that explain the key points of interest, like support and resistance levels or significant price movements, can be particularly helpful. These visual aids can make the complex world of crypto investing more accessible and understandable.

Long and Short-Term Predictions for PEAQ Token

Predicting the future price of any cryptocurrency is challenging, but by analyzing current trends and market conditions, we can make educated guesses about where PEAQ Token might be headed.

Short-Term Forecast: The Next Few Months

In the short term, the momentum behind PEAQ Token suggests that it could continue its upward trajectory. With the ongoing development of DePINs and the increasing adoption of the Machine Economy, PEAQ Token is well-positioned to benefit from these trends. A potential target for the next few months could be around $0.20, assuming positive market sentiment and continued growth in the sector.

However, it’s essential to remain cautious. The crypto market is known for its volatility, and unexpected events can quickly change the direction of a token’s price. Monitoring news and developments closely can help investors stay ahead of these shifts.

Long-Term Forecast: Looking to 2030 and Beyond

Looking further ahead, PEAQ Token’s role in the Machine Economy could lead to significant growth. By 2030, if the adoption of DePINs continues at its current pace, PEAQ Token could potentially reach $1 or more. This prediction is based on the token’s utility within the ecosystem, its staking and governance features, and the overall expansion of the Machine Economy.

However, reaching such heights will depend on several factors, including regulatory developments, technological advancements, and the overall health of the crypto market. Investors should keep these variables in mind when considering long-term investments in PEAQ Token.

Comparing PEAQ Token to Other Cryptocurrencies

To understand PEAQ Token’s potential better, let’s compare its recent price drop from a historical high of $0.16 to its current price of $0.142823 with a similar cryptocurrency, Ethereum. Ethereum, a well-established player in the crypto space, experienced a significant price drop in 2018, falling from over $1,400 to around $80. This drop was largely due to market-wide corrections and regulatory uncertainties.

Like Ethereum, PEAQ Token’s recent price movements could be influenced by broader market trends and sector-specific news. However, unlike Ethereum, PEAQ Token is still in its early stages, with a smaller market cap and less established infrastructure. This means that while the potential for growth is high, so is the risk.

Lessons From Ethereum: Could PEAQ Token Follow a Similar Path?

Ethereum’s recovery from its 2018 lows was driven by several factors, including the launch of Ethereum 2.0, increased institutional interest, and the growth of decentralized finance (DeFi). For PEAQ Token, a similar recovery could be spurred by the continued development of DePINs, strategic partnerships, and increased adoption of the Machine Economy.

However, PEAQ Token’s path might differ due to its unique focus on physical infrastructure networks. If the sector continues to grow and attract investment, PEAQ Token could see a more rapid recovery and growth trajectory than Ethereum. Conversely, if regulatory challenges or technological hurdles arise, PEAQ Token might face a more prolonged period of volatility.

For investors new to the crypto market, navigating the volatility of PEAQ Token can be daunting. Here are some expert insights to help guide your investment strategy:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Investing in a range of cryptocurrencies can help mitigate risk.

- Stay Informed: Keep up with the latest news and developments in the Machine Economy and the broader crypto market. Knowledge is power in the world of investing.

- Use Technical Analysis: Tools like RSI, MACD, and Bollinger Bands can help you make more informed decisions about when to buy or sell.

- Set Clear Goals: Whether you’re looking for short-term gains or long-term growth, having clear investment goals can help you stay focused and disciplined.

Can PEAQ Token Recover After Dropping to $0.142823?

The question on many investors’ minds is whether PEAQ Token can recover from its recent drop to $0.142823. The answer lies in the fundamentals of the token and the broader market conditions. With a strong foundation in the Machine Economy and ongoing developments in DePINs, PEAQ Token has the potential to rebound and reach new heights.

However, recovery will depend on several factors, including market sentiment, regulatory developments, and the token’s ability to attract new users and investors. By staying informed and using the tools and insights provided in this article, investors can better navigate the potential recovery of PEAQ Token.

What Caused PEAQ Token’s Price Drop, and Will It Bounce Back?

The recent price drop of PEAQ Token from $0.16 to $0.142823 can be attributed to several factors, including market-wide corrections and sector-specific news. However, with the token’s strong fundamentals and the growing interest in the Machine Economy, there’s reason to believe that PEAQ Token could bounce back.

The key will be monitoring market trends and staying informed about developments in the DePIN sector. By understanding the causes of the price drop and the potential for recovery, investors can make more informed decisions about their investments in PEAQ Token.

Lessons From Ethereum: Could PEAQ Token Follow a Similar Path?

Ethereum’s journey from its 2018 lows to its current position offers valuable lessons for PEAQ Token investors. By understanding the factors that drove Ethereum’s recovery, investors can better anticipate the potential trajectory of PEAQ Token. While the two tokens have different focuses and market positions, the principles of recovery and growth remain similar.

PEAQ Token’s unique position in the Machine Economy could lead to a different path than Ethereum’s, but the potential for growth is undeniable. By learning from Ethereum’s experience, investors can better position themselves to take advantage of PEAQ Token’s potential.

Navigating the volatility of PEAQ Token requires a combination of knowledge, strategy, and discipline. By diversifying your portfolio, staying informed, using technical analysis, and setting clear investment goals, you can better manage the risks and opportunities presented by PEAQ Token.

As a beginner in the crypto market, these expert insights can help you make more informed decisions and build a successful investment strategy. Whether you’re looking to capitalize on short-term gains or invest for the long term, understanding PEAQ Token’s volatility is key to your success.

In conclusion, PEAQ Token’s recent price movements and its role in the Machine Economy present both opportunities and challenges for investors. By understanding the token’s fundamentals, analyzing market trends, and following expert insights, you can navigate the volatility of PEAQ Token and potentially reap the rewards of this exciting new sector in the crypto market.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.