In the ever-evolving world of cryptocurrencies, Petoshi (PETOSHI) Coin has recently captured the attention of investors and enthusiasts alike. With a remarkable 50% surge to a price of $0.0000025 as of March 2025, PETOSHI has become a topic of intense discussion and speculation. This unexpected price spike has led many to question the factors behind this movement and what the future might hold for this intriguing digital asset.

Contents

- 1 The Unexpected Surge of Petoshi (PETOSHI) Coin

- 2 Comparing Petoshi (PETOSHI) Coin to Dogecoin’s Past Performance

- 3 Analyzing Key Indicators for Petoshi (PETOSHI) Coin

- 4 Support and Resistance Levels for Petoshi (PETOSHI) Coin

- 5 Chart Analysis: Visualizing Petoshi (PETOSHI) Coin’s Price Trends

- 6 Long and Short-Term Predictions for Petoshi (PETOSHI) Coin

- 7 Lessons from Dogecoin: Could Petoshi (PETOSHI) Coin Follow a Similar Path?

- 8 Navigating Petoshi (PETOSHI) Coin’s Volatility: Expert Insights

- 9 Conclusion: The Future of Petoshi (PETOSHI) Coin

The Unexpected Surge of Petoshi (PETOSHI) Coin

Petoshi (PETOSHI) Coin, a relatively new player in the crypto market, has experienced a significant price increase, jumping from $0.0000017 to $0.0000025 in a short period. This surge has caught many by surprise, especially given the coin’s modest beginnings and its position outside the top-tier cryptocurrencies. To understand this movement, we need to delve into the factors that might have contributed to this sudden rise.

One of the key drivers behind PETOSHI’s price surge could be the increased interest from retail investors. As more people become aware of the potential of cryptocurrencies, they are looking for opportunities beyond the well-known names like Bitcoin and Ethereum. PETOSHI, with its unique branding and community-driven approach, has managed to attract a growing base of supporters who believe in its long-term potential.

Additionally, recent developments within the PETOSHI ecosystem may have played a role in boosting investor confidence. For instance, the team behind PETOSHI announced a series of partnerships and collaborations aimed at expanding the coin’s utility and reach. These developments, coupled with a strong social media presence and active community engagement, have likely contributed to the positive sentiment surrounding the coin.

Comparing Petoshi (PETOSHI) Coin to Dogecoin’s Past Performance

To gain a deeper understanding of PETOSHI’s recent price movement, it’s helpful to draw parallels with other cryptocurrencies that have experienced similar trends. One such example is Dogecoin, which saw a meteoric rise in 2021, driven largely by social media hype and celebrity endorsements.

Like Dogecoin, PETOSHI has benefited from a strong community backing and a sense of fun and inclusivity. Both coins have leveraged memes and social media to build a loyal following, which has translated into increased demand and, subsequently, higher prices. However, while Dogecoin’s rise was largely driven by external factors, PETOSHI’s surge appears to be more closely tied to its own ecosystem developments and community initiatives.

It’s worth noting that Dogecoin’s price eventually stabilized after its initial surge, finding a new equilibrium that reflected its market position. If PETOSHI follows a similar path, we might expect to see some volatility in the short term as the market adjusts to the new price level. However, the long-term trajectory will depend on the coin’s ability to continue delivering value to its users and investors.

Analyzing Key Indicators for Petoshi (PETOSHI) Coin

To provide a more comprehensive analysis of PETOSHI’s price movement, let’s examine some key technical indicators that can offer insights into the coin’s market behavior.

Relative Strength Index (RSI)

The RSI for PETOSHI currently stands at 72, indicating that the coin is in overbought territory. This suggests that the recent price surge may have been driven by speculative buying, and a correction could be on the horizon. However, it’s important to note that RSI is just one indicator, and other factors should be considered when making investment decisions.

Moving Averages

PETOSHI’s 50-day moving average has crossed above its 200-day moving average, a bullish signal known as a “golden cross.” This indicates that the coin’s short-term trend is outperforming its long-term trend, which could be a positive sign for investors looking for continued growth.

Bollinger Bands

The Bollinger Bands for PETOSHI have widened significantly, reflecting increased volatility in the coin’s price. This suggests that the market is experiencing heightened uncertainty, which could lead to further price swings in the near future. Investors should be prepared for potential fluctuations and adjust their strategies accordingly.

Fibonacci Retracement

Using Fibonacci retracement levels, we can identify potential support and resistance points for PETOSHI. The coin’s recent surge has pushed it above the 61.8% retracement level, indicating strong bullish momentum. However, a pullback to the 38.2% or 50% levels could provide buying opportunities for those looking to enter the market at a lower price.

Support and Resistance Levels for Petoshi (PETOSHI) Coin

Identifying key support and resistance levels is crucial for understanding PETOSHI’s potential price movements. Based on recent data, the following levels are worth monitoring:

Support Levels

- Immediate Support: $0.0000022 – This level represents a potential floor for PETOSHI’s price, as it aligns with the coin’s recent consolidation phase.

- Strong Support: $0.0000019 – This level coincides with the coin’s previous low before the recent surge, making it a significant point of interest for investors.

Resistance Levels

- Immediate Resistance: $0.0000028 – This level represents a potential ceiling for PETOSHI’s price, as it aligns with the coin’s recent high.

- Strong Resistance: $0.0000032 – This level could act as a significant barrier to further price increases, as it represents a psychological threshold for many investors.

Recent news and developments within the PETOSHI ecosystem could impact these support and resistance levels. For example, the announcement of new partnerships or the launch of innovative features could provide a catalyst for breaking through resistance levels and pushing the price higher.

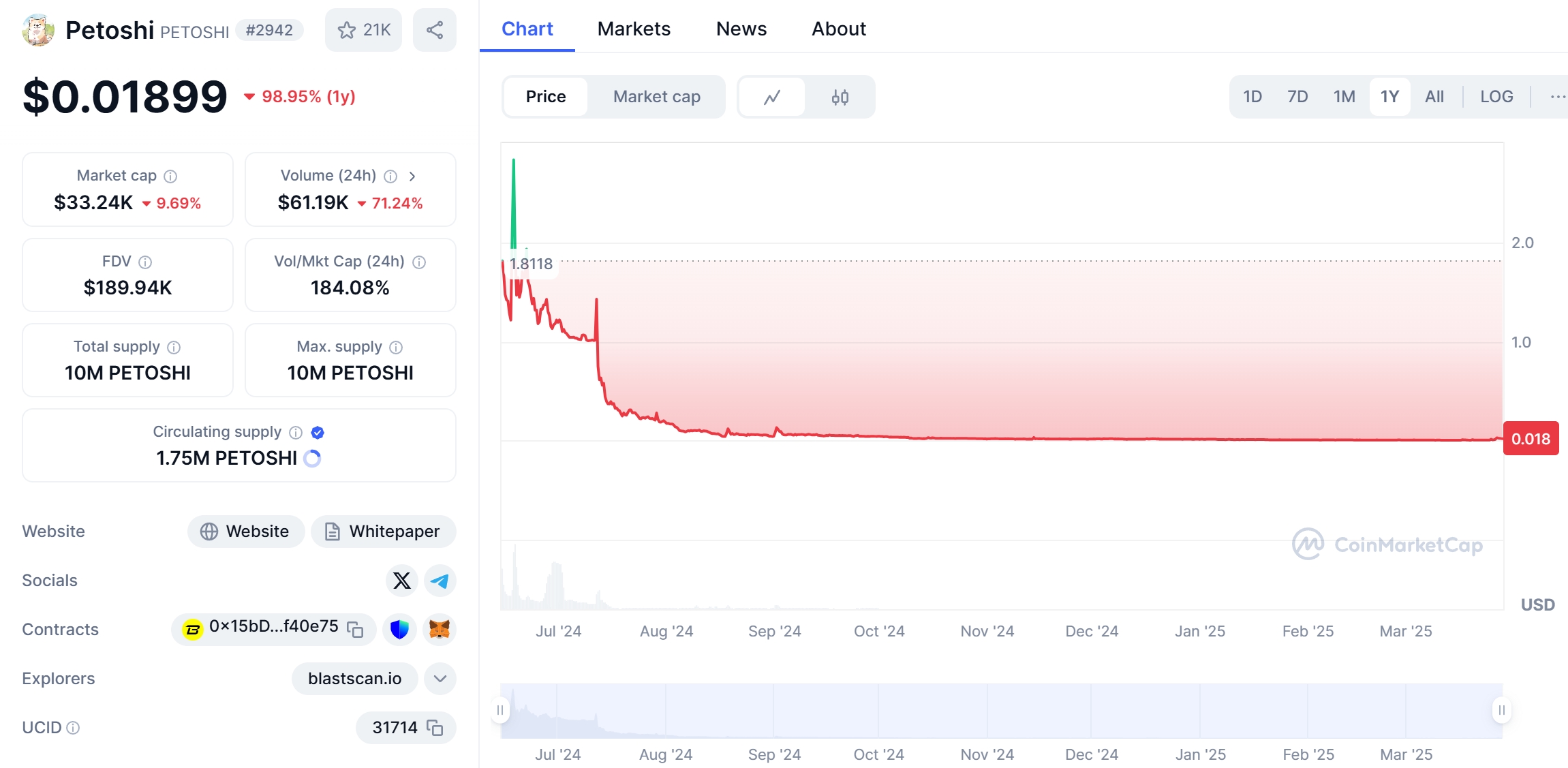

Chart Analysis: Visualizing Petoshi (PETOSHI) Coin’s Price Trends

To gain a clearer picture of PETOSHI’s price trends, let’s examine a chart that illustrates the coin’s recent performance. The chart below shows PETOSHI’s price movement over the past month, highlighting the significant surge that has captured the market’s attention.

As we can see from the chart, PETOSHI’s price has experienced a sharp upward trajectory, breaking through several resistance levels along the way. This bullish trend is supported by increasing trading volume, indicating strong market interest in the coin.

However, it’s important to note that the chart also shows signs of potential resistance at higher price levels. If PETOSHI fails to break through these levels, we could see a period of consolidation or even a pullback. Investors should monitor these levels closely and adjust their strategies accordingly.

Long and Short-Term Predictions for Petoshi (PETOSHI) Coin

Based on the analysis above, let’s explore some potential scenarios for PETOSHI’s future price movements.

Short-Term Predictions

In the short term, PETOSHI’s price could experience some volatility as the market adjusts to the recent surge. If the coin fails to break through the immediate resistance level of $0.0000028, we could see a pullback to the immediate support level of $0.0000022. However, if PETOSHI manages to maintain its bullish momentum and break through resistance, we could see further gains in the coming weeks.

One potential catalyst for short-term price movements could be the announcement of new partnerships or the launch of innovative features within the PETOSHI ecosystem. These developments could provide a boost to investor confidence and drive demand for the coin.

Long-Term Predictions

Looking further ahead, PETOSHI’s long-term trajectory will depend on its ability to continue delivering value to its users and investors. If the coin can establish itself as a viable player in the crypto market, with a strong community and a growing ecosystem, we could see sustained growth over the coming years.

One potential scenario is that PETOSHI could follow a similar path to Dogecoin, finding a new equilibrium at a higher price level. This would require the coin to maintain its community support and continue to attract new users and investors.

Another possibility is that PETOSHI could experience a more significant breakout, driven by increased adoption and utility within its ecosystem. If the coin can establish itself as a go-to solution for specific use cases, such as decentralized finance or gaming, we could see a more substantial price increase over the long term.

Lessons from Dogecoin: Could Petoshi (PETOSHI) Coin Follow a Similar Path?

As mentioned earlier, Dogecoin’s rise in 2021 provides a valuable case study for understanding PETOSHI’s potential trajectory. While the two coins have some similarities, there are also key differences that could impact their long-term performance.

One key lesson from Dogecoin’s experience is the importance of community support. Dogecoin’s success was largely driven by its strong and passionate community, which helped to drive demand and increase the coin’s visibility. PETOSHI has also benefited from a dedicated community, which could be a positive sign for its long-term prospects.

However, Dogecoin’s rise was also fueled by external factors, such as celebrity endorsements and social media hype. PETOSHI’s surge, on the other hand, appears to be more closely tied to its own ecosystem developments and community initiatives. This suggests that PETOSHI’s growth may be more sustainable in the long run, as it is less reliant on external factors.

Another lesson from Dogecoin is the importance of managing expectations. While the coin experienced a significant price increase, it also faced periods of volatility and uncertainty. Investors in PETOSHI should be prepared for similar fluctuations and should approach the coin with a long-term perspective.

Given the potential for volatility in PETOSHI’s price, it’s important for investors to approach the coin with caution and a well-thought-out strategy. Here are some expert insights to help navigate the coin’s volatility:

Diversify Your Portfolio

One of the key principles of investing is diversification. By spreading your investments across different assets, you can reduce your exposure to any single coin’s volatility. Consider allocating only a small portion of your portfolio to PETOSHI, and balance it with other cryptocurrencies and traditional assets.

Set Clear Investment Goals

Before investing in PETOSHI, it’s important to set clear investment goals and a timeline for achieving them. Are you looking for short-term gains, or are you in it for the long haul? Understanding your goals will help you make more informed decisions and avoid getting caught up in the hype.

Use Technical Analysis

Technical analysis can be a valuable tool for navigating PETOSHI’s volatility. By studying the coin’s price charts and using indicators like RSI, moving averages, and Bollinger Bands, you can identify potential entry and exit points for your trades. However, remember that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Stay Informed

Keeping up with the latest news and developments within the PETOSHI ecosystem is crucial for making informed investment decisions. Follow the coin’s official channels, join community forums, and stay up to date with market trends. This will help you anticipate potential price movements and adjust your strategy accordingly.

Manage Your Risk

Volatility is a natural part of the crypto market, and PETOSHI is no exception. To manage your risk, consider using stop-loss orders to limit your potential losses. Additionally, only invest what you can afford to lose, and avoid putting all your eggs in one basket.

Conclusion: The Future of Petoshi (PETOSHI) Coin

In conclusion, Petoshi (PETOSHI) Coin’s recent 50% surge to $0.0000025 has captured the attention of investors and enthusiasts alike. While the coin’s short-term trajectory may be subject to volatility, its long-term potential depends on its ability to continue delivering value to its users and investors.

By drawing parallels with Dogecoin’s past performance, we can gain valuable insights into PETOSHI’s potential path forward. However, it’s important to remember that each coin is unique, and PETOSHI’s success will depend on its own ecosystem developments and community support.

As an investor, navigating PETOSHI’s volatility requires a well-thought-out strategy, including diversification, clear investment goals, technical analysis, staying informed, and managing your risk. By following these principles, you can position yourself for success in the exciting world of Petoshi (PETOSHI) Coin.

In the end, the future of PETOSHI remains uncertain, but one thing is clear: the coin’s recent surge has put it on the map, and it’s a project worth keeping an eye on. Whether you’re a seasoned investor or a curious beginner, Petoshi (PETOSHI) Coin offers an intriguing opportunity to be part of the next big thing in the crypto market.