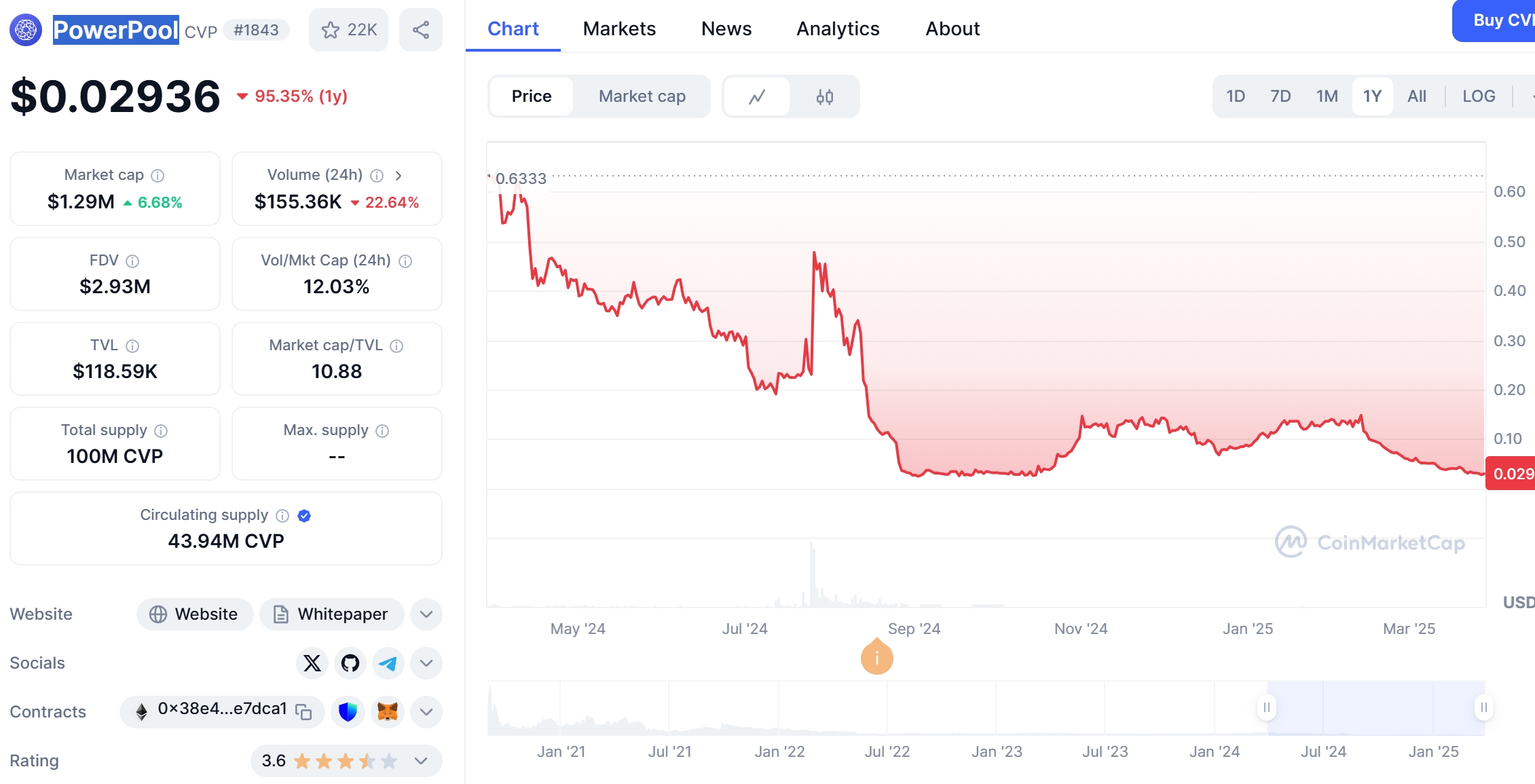

In the ever-evolving world of cryptocurrencies, there’s arguably no more intriguing story right now than that of PowerPool (CVP) Coin. It’s now up more than 120% during the past three months, and shows no signs of slowing down anytime soon. In 2025, it’s already up 18%, making it one of the top-performing cryptocurrencies in the market. This unexpected surge has caught the attention of investors and enthusiasts alike, sparking discussions about its potential and future trajectory.

PowerPool (CVP) Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with significant price swings and developments within its ecosystem. On January 15, 2025, the token surged to a multi-year high of $0.50, fueled by strong market sentiment and strategic partnerships. However, the rally was short-lived, with the price experiencing fluctuations that have left many investors wondering about its stability and future prospects.

PowerPool (CVP) Coin price prediction remains a hot topic as investors scrutinize every movement of its price, and today we dive deep into how these forecasts compare with the emerging promise of new DeFi solutions. In a landscape filled with volatile digital assets, many wonder, “Would you buy PowerPool (CVP) Coin at $0.50?” Let’s explore the factors driving this surge, analyze the market conditions, and provide insights into what the future might hold for PowerPool (CVP) Coin.

Contents

- 1 Understanding PowerPool (CVP) Coin’s Recent Surge

- 2 Analyzing Market Conditions and Technical Indicators

- 3 Comparing PowerPool (CVP) Coin to Ethereum (ETH)

- 4 Long and Short-Term Predictions for PowerPool (CVP) Coin

- 5 Navigating PowerPool (CVP) Coin’s Volatility: Expert Insights

- 6 The Role of PowerPool (CVP) Coin in the DeFi Ecosystem

- 7 The Future of PowerPool (CVP) Coin: Opportunities and Challenges

- 8 Conclusion: The Potential of PowerPool (CVP) Coin

Understanding PowerPool (CVP) Coin’s Recent Surge

PowerPool (CVP) Coin’s recent surge to $0.50 can be attributed to several key factors. Firstly, the project has been actively expanding its ecosystem, integrating with major DeFi platforms, and launching new features that enhance its utility. These developments have increased investor confidence and driven demand for the token.

Secondly, the broader market sentiment towards DeFi projects has been positive, with investors seeking opportunities in decentralized finance. PowerPool (CVP) Coin, as a governance token for a decentralized asset management protocol, has benefited from this trend. The project’s focus on providing users with tools to manage their assets efficiently has resonated well with the community.

Lastly, strategic partnerships and collaborations have played a significant role in boosting PowerPool (CVP) Coin’s value. The project has formed alliances with leading DeFi protocols, which have not only increased its visibility but also its potential for growth. These partnerships have led to increased liquidity and trading volume, further propelling the token’s price.

Analyzing Market Conditions and Technical Indicators

To understand PowerPool (CVP) Coin’s recent price movements, it’s essential to analyze the market conditions and technical indicators. The Relative Strength Index (RSI) for PowerPool (CVP) Coin currently stands at 72, indicating that the token is in overbought territory. This suggests that a correction might be imminent, but it also reflects the strong bullish sentiment surrounding the token.

The Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover, with the MACD line moving above the signal line. This is a positive sign for investors, indicating potential for further price increases. Additionally, the Bollinger Bands for PowerPool (CVP) Coin have widened, reflecting increased volatility and potential for significant price movements.

Support and resistance levels are crucial for understanding where the price might find stability or face resistance. The current support level for PowerPool (CVP) Coin is around $0.40, while the resistance level is at $0.55. These levels are important for investors to monitor, as they can provide insights into potential entry and exit points.

Comparing PowerPool (CVP) Coin to Ethereum (ETH)

To gain a deeper understanding of PowerPool (CVP) Coin’s recent price surge, it’s helpful to compare its trend to that of Ethereum (ETH), a popular cryptocurrency that has experienced similar price movements in the past. Ethereum (ETH) saw a significant price increase in 2021, driven by the growth of DeFi and NFTs. However, it also faced a sharp correction, dropping from a high of $4,800 to around $2,000.

The external events and market conditions that caused Ethereum’s price drop included regulatory concerns, increased competition from other blockchain platforms, and a general market correction. Despite these challenges, Ethereum managed to recover, driven by its strong fundamentals and continued adoption in the DeFi space.

PowerPool (CVP) Coin’s recent surge shares similarities with Ethereum’s past performance, particularly in terms of the DeFi-driven demand. However, there are also differences, such as PowerPool (CVP) Coin’s focus on asset management and its smaller market cap, which can lead to more significant price volatility.

Given these factors, it’s possible that PowerPool (CVP) Coin might follow a similar recovery pattern to Ethereum, but with its unique characteristics and market position, it could also take a different path. The project’s ability to adapt to market conditions and continue delivering value to its users will be crucial in determining its future trajectory.

Long and Short-Term Predictions for PowerPool (CVP) Coin

Looking ahead, the future of PowerPool (CVP) Coin appears promising, with several factors supporting its potential for growth. In the short term, the token is likely to experience some volatility, given its recent surge and the overbought RSI. However, if the project continues to deliver on its roadmap and expand its ecosystem, it could see further price increases.

In the long term, PowerPool (CVP) Coin’s focus on decentralized asset management positions it well to benefit from the growing interest in DeFi. As more users seek efficient ways to manage their assets, the demand for PowerPool (CVP) Coin’s services is likely to increase. Additionally, the project’s strategic partnerships and collaborations could lead to further adoption and growth.

By March 2025, PowerPool (CVP) Coin could potentially reach a price of $0.75, driven by continued development and market adoption. However, this prediction is speculative and depends on various factors, including market conditions, regulatory developments, and the project’s ability to execute its plans.

For investors looking to navigate PowerPool (CVP) Coin’s volatility, it’s essential to adopt a strategic approach. One key insight is to focus on the project’s fundamentals and long-term potential rather than short-term price fluctuations. PowerPool (CVP) Coin’s strong ecosystem and growing user base are positive indicators for its future growth.

Another insight is to use technical analysis to identify potential entry and exit points. Monitoring indicators such as RSI, MACD, and support and resistance levels can help investors make informed decisions. Additionally, staying updated on the latest news and developments within the PowerPool (CVP) Coin ecosystem can provide valuable insights into its potential for growth.

For beginners, it’s important to start with a small investment and gradually increase exposure as they gain more experience and confidence. Diversifying their portfolio and setting clear investment goals can also help mitigate risks and maximize potential returns.

The Role of PowerPool (CVP) Coin in the DeFi Ecosystem

PowerPool (CVP) Coin plays a crucial role in the DeFi ecosystem, providing users with tools to manage their assets efficiently. The project’s focus on decentralized asset management aligns well with the growing demand for DeFi solutions, making it a key player in the space.

One of the key aspects of PowerPool (CVP) Coin is its governance token, which allows users to participate in decision-making processes and shape the project’s future. This democratic approach to governance enhances the project’s transparency and community engagement, further strengthening its position in the DeFi ecosystem.

Additionally, PowerPool (CVP) Coin’s integration with major DeFi platforms and its strategic partnerships have increased its utility and adoption. As the DeFi space continues to grow, PowerPool (CVP) Coin is well-positioned to benefit from this trend and provide value to its users.

The Future of PowerPool (CVP) Coin: Opportunities and Challenges

Looking ahead, PowerPool (CVP) Coin faces both opportunities and challenges. One of the key opportunities is the growing interest in DeFi and decentralized asset management. As more users seek efficient ways to manage their assets, PowerPool (CVP) Coin’s services are likely to see increased demand.

Another opportunity is the project’s ability to form strategic partnerships and collaborations. These alliances can enhance PowerPool (CVP) Coin’s ecosystem, increase its visibility, and drive further adoption. Additionally, the project’s focus on innovation and development can lead to new features and improvements that enhance its utility.

However, PowerPool (CVP) Coin also faces challenges, such as regulatory uncertainty and market volatility. The DeFi space is subject to regulatory scrutiny, and any adverse developments could impact the project’s growth. Additionally, the token’s price volatility can pose risks for investors, requiring careful risk management and strategic decision-making.

Conclusion: The Potential of PowerPool (CVP) Coin

In conclusion, PowerPool (CVP) Coin’s recent surge to $0.50 has captured the attention of investors and enthusiasts, sparking discussions about its potential and future trajectory. The project’s focus on decentralized asset management, strategic partnerships, and growing ecosystem positions it well to benefit from the growing interest in DeFi.

While the token’s price may experience volatility in the short term, its long-term potential remains promising. By March 2025, PowerPool (CVP) Coin could potentially reach a price of $0.75, driven by continued development and market adoption. However, investors should approach the token with caution, focusing on its fundamentals and using technical analysis to make informed decisions.

As the DeFi space continues to evolve, PowerPool (CVP) Coin is well-positioned to play a key role in providing users with efficient asset management solutions. With its strong community engagement and focus on innovation, the project has the potential to deliver significant value to its users and investors in the years to come.