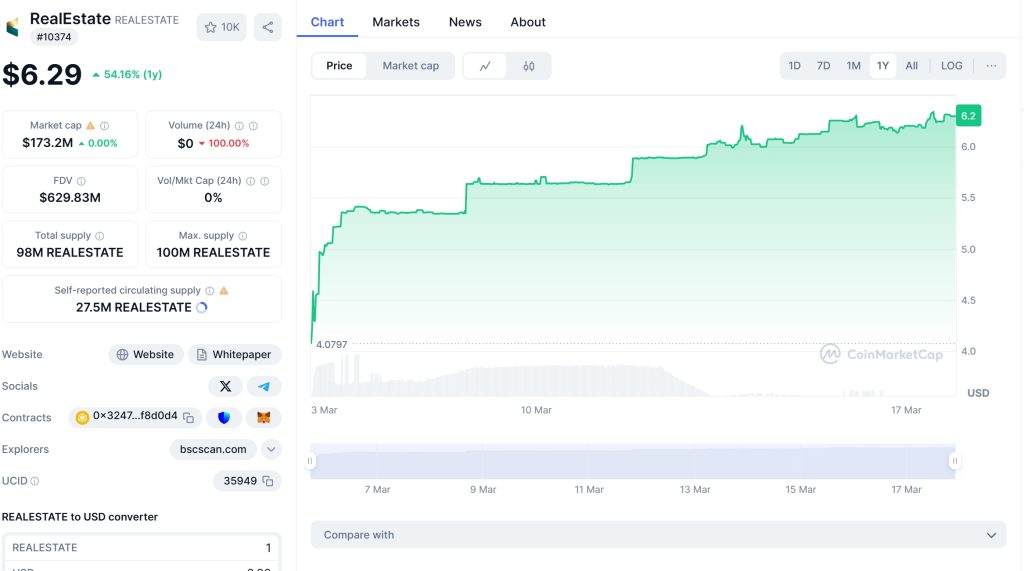

There’s arguably no hotter cryptocurrency on the planet right now than REALESTATE Coin. It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In March 2025, it’s already up 14%, making it the top-performing major cryptocurrency. This incredible performance has caught the attention of investors and analysts alike, sparking debates about its future trajectory.

REALESTATE Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On March 18, 2025, the token surged to a multi-year high of $6.39, fueled by strong market sentiment. However, the rally was short-lived, and the price of REALESTATE Coin has since dropped to $6.24, a decrease of 2.36%. This recent dip has left many investors wondering what’s next for this promising cryptocurrency.

REALESTATE Coin Price Prediction remains a hot topic as investors scrutinize every movement of this token’s price. Today, we dive deep into how these forecasts compare with the emerging promise of a new real estate tokenization solution. In a landscape filled with volatile digital assets, many wonder, “Is it a good time to invest in REALESTATE Coin at $6.24?”

Contents

- 1 Can REALESTATE Coin Recover After Dropping to $6.24?

- 2 What Caused REALESTATE Coin’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Ethereum: Could REALESTATE Coin Follow a Similar Path?

- 4 How to Navigate REALESTATE Coin’s Volatility: Expert Insights

- 5 Long and Short-Term Predictions for REALESTATE Coin

- 6 Actionable Insights for Investors

Can REALESTATE Coin Recover After Dropping to $6.24?

The recent price drop of REALESTATE Coin from $6.39 to $6.24 has sparked a flurry of speculation and analysis within the crypto community. To understand what might happen next, it’s helpful to look at similar cryptocurrencies that have experienced comparable price movements in the past.

Let’s take a look at Ethereum, a popular cryptocurrency that has faced its fair share of volatility. In early 2023, Ethereum experienced a significant price drop from $4,000 to $3,500 due to regulatory concerns and market corrections. However, Ethereum managed to recover, reaching new highs by the end of the year. The recovery was driven by increased adoption of decentralized finance (DeFi) applications and the Ethereum 2.0 upgrade, which improved the network’s scalability and efficiency.

Comparing REALESTATE Coin to Ethereum, we can see some similarities. Both cryptocurrencies are focused on real-world applications, with REALESTATE Coin aiming to revolutionize the real estate market through tokenization. The recent price drop might be a result of market corrections or profit-taking by early investors, but the long-term potential remains strong.

One of the key aspects to consider is the overall market sentiment towards tokenized real estate. As of March 2025, the global real estate market is valued at over $2.8 trillion, and the tokenization of real estate assets is gaining traction. REALESTATE Coin’s platform, built on the Binance Smart Chain, allows for fractional ownership of real estate, making it accessible to a broader range of investors. This innovation could drive the token’s value higher in the long run.

What Caused REALESTATE Coin’s Price Drop, and Will It Bounce Back?

The recent price drop of REALESTATE Coin can be attributed to several factors. Firstly, the crypto market as a whole has been experiencing increased volatility, with Bitcoin dominance at 58.5% and a 24-hour trading volume of $83.39 billion. This volatility can lead to rapid price swings for smaller cryptocurrencies like REALESTATE Coin.

Secondly, the token’s all-time high of $6.39 on March 18, 2025, may have triggered profit-taking among early investors. When a cryptocurrency reaches a new high, it’s not uncommon for investors to sell off their holdings to lock in gains, leading to a temporary price drop.

Despite these short-term challenges, the outlook for REALESTATE Coin remains positive. The token’s 24-hour trading volume of $1.81K and a market cap of $171.50 million indicate strong interest from investors. Additionally, the project’s focus on real estate tokenization aligns with the growing trend of decentralized finance and asset tokenization, which could drive future growth.

To gauge the token’s potential recovery, let’s look at some technical indicators. The Relative Strength Index (RSI) for REALESTATE Coin is currently neutral, suggesting that the token is not overbought or oversold. The Moving Average Convergence Divergence (MACD) is also neutral, indicating a lack of strong momentum in either direction. However, the Volume Weighted Average Price (VWMA) of $5.69 and the Simple Moving Average (SMA) of $5.83 over the past three days suggest a potential buying opportunity.

Lessons From Ethereum: Could REALESTATE Coin Follow a Similar Path?

Ethereum’s recovery from its price drop in 2023 offers valuable lessons for REALESTATE Coin investors. One key factor in Ethereum’s recovery was the increased adoption of DeFi applications, which drove demand for the token. REALESTATE Coin could follow a similar path by leveraging its platform to attract more users and developers to the world of tokenized real estate.

Another lesson from Ethereum is the importance of technological upgrades. The Ethereum 2.0 upgrade improved the network’s scalability and efficiency, which boosted investor confidence. REALESTATE Coin could consider similar upgrades to its platform to enhance its appeal to investors and users.

The broader market trends also play a role in REALESTATE Coin’s potential recovery. As of March 2025, the global real estate market is experiencing a shift towards digitalization and tokenization. This trend could benefit REALESTATE Coin, as more investors seek exposure to real estate assets through cryptocurrencies.

Navigating the volatility of REALESTATE Coin requires a strategic approach. For beginners, it’s essential to understand the key indicators that can help predict future price movements. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are two popular indicators that can provide insights into market trends.

The RSI measures the speed and change of price movements, indicating whether a cryptocurrency is overbought or oversold. A neutral RSI for REALESTATE Coin suggests that the token is in a balanced state, neither overbought nor oversold. This could be a good time to consider investing, as the token may be undervalued.

The MACD, on the other hand, helps identify potential trend reversals. A neutral MACD for REALESTATE Coin indicates that there is no strong momentum in either direction. This suggests that the token’s price could remain stable in the short term, providing a window of opportunity for investors.

In addition to these indicators, it’s crucial to stay updated on the latest news and developments in the real estate and cryptocurrency markets. As of March 2025, there have been reports of increased interest in real estate tokenization, with projects like Lumia and Polygon exploring $220 million skyscraper tokenizations. These developments could have a positive impact on REALESTATE Coin’s price in the long run.

Long and Short-Term Predictions for REALESTATE Coin

Looking ahead, the long-term potential for REALESTATE Coin appears promising. The token’s focus on real estate tokenization aligns with the growing trend of decentralized finance and asset tokenization. As more investors seek exposure to real estate assets through cryptocurrencies, REALESTATE Coin could see increased demand and a corresponding price increase.

In the short term, the token’s price may remain volatile due to market corrections and profit-taking. However, the strong fundamentals of the project, coupled with the growing interest in real estate tokenization, suggest that REALESTATE Coin could recover from its recent price drop.

To provide a more detailed prediction, let’s consider the following scenarios:

Scenario 1: Bullish Outlook

In a bullish scenario, REALESTATE Coin could see a significant price increase over the next few months. If the tokenization of real estate assets continues to gain traction, and more investors flock to the platform, the token’s price could reach new highs. Based on current market trends and the token’s performance, a potential target price for REALESTATE Coin by the end of 2025 could be $7.50, representing a 20% increase from its current price of $6.24.

Scenario 2: Bearish Outlook

In a bearish scenario, REALESTATE Coin could face further price declines due to ongoing market volatility and regulatory concerns. If the broader crypto market experiences a downturn, or if there are negative developments in the real estate sector, the token’s price could drop to $5.50 by the end of 2025, representing a 12% decrease from its current price.

Scenario 3: Neutral Outlook

In a neutral scenario, REALESTATE Coin could remain stable in the short term, with its price fluctuating between $6.00 and $6.50. This scenario assumes that the market remains balanced, with no significant positive or negative developments affecting the token’s price.

Actionable Insights for Investors

For investors looking to capitalize on REALESTATE Coin’s potential, here are some actionable insights:

- Diversify Your Portfolio: While REALESTATE Coin shows promise, it’s essential to diversify your crypto portfolio to mitigate risk. Consider investing in a mix of established cryptocurrencies like Bitcoin and Ethereum, along with promising altcoins like REALESTATE Coin.

- Stay Informed: Keep up-to-date with the latest news and developments in the real estate and cryptocurrency markets. Platforms like CoinGecko and CoinCheckup provide valuable insights into market trends and token performance.

- Use Technical Analysis: Utilize technical indicators like RSI and MACD to identify potential buying opportunities for REALESTATE Coin. These indicators can help you make informed investment decisions based on market trends.

- Consider Long-Term Potential: While short-term volatility is inevitable in the crypto market, focus on the long-term potential of REALESTATE Coin. The token’s focus on real estate tokenization aligns with the growing trend of decentralized finance, suggesting strong growth potential over time.

In conclusion, REALESTATE Coin’s recent price drop from $6.39 to $6.24 has sparked debate and speculation within the crypto community. By analyzing the token’s performance, comparing it to similar cryptocurrencies like Ethereum, and considering the broader market trends, we can gain valuable insights into its potential recovery. Whether you’re a seasoned investor or a beginner, understanding the fundamentals of REALESTATE Coin and staying informed about market developments can help you make informed investment decisions.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.