In the fast-paced world of cryptocurrencies, few projects capture the imagination quite like Reef (REEF) Coin. As of March 2025, Reef has experienced a significant price drop, falling from its all-time high of $0.05841 to the current price of $0.000501. This drop has sparked curiosity and concern among investors and enthusiasts alike. Today, we’ll delve into the reasons behind this decline, compare it to similar trends in other cryptocurrencies, and explore what the future might hold for Reef.

Contents

- 1 Understanding Reef (REEF) Coin: A Beginner’s Guide

- 2 The Recent Price Drop: From $0.05841 to $0.000501

- 3 Comparing Reef’s Trend to Other Cryptocurrencies

- 4 Market Conditions and Investor Sentiment

- 5 Key Indicators: Analyzing Reef’s Technical Performance

- 6 Support and Resistance Levels: Critical Price Points for Reef

- 7 Chart Analysis: Visualizing Reef’s Price Trends

- 8 Long and Short-Term Predictions for Reef

- 9 Can Reef (REEF) Coin Recover After Dropping to $0.000501?

- 10 Actionable Insights and Advice for Investors

- 11 Conclusion: Navigating Reef’s Future

Understanding Reef (REEF) Coin: A Beginner’s Guide

Reef (REEF) Coin is not just another token in the vast sea of cryptocurrencies; it’s a beacon for those looking to dive into the world of decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming. At its core, Reef is a layer-1 blockchain built using the Substrate Framework, which allows for high scalability and almost instant, low-cost transactions. This infrastructure supports Solidity and EVM, enabling developers to seamlessly migrate their decentralized applications (DApps) from Ethereum without altering the codebase.

The vision of Reef is to make DeFi, NFTs, and gaming accessible to everyone, particularly those new to the crypto space. Its founder, Denko Mancheski, aimed to simplify the complexities of blockchain technology and DeFi, offering a user-friendly platform that bridges multiple blockchains. This allows for easy porting of funds and liquidity, taking advantage of Reef’s scalability and low fees.

The Recent Price Drop: From $0.05841 to $0.000501

Reef’s journey from its peak of $0.05841 in March 2021 to its current price of $0.000501 in March 2025 has been turbulent. To understand this drop, we need to look at the broader market conditions and specific events affecting Reef.

The cryptocurrency market is known for its volatility, and Reef is no exception. In the past few years, the market has seen significant fluctuations due to regulatory changes, macroeconomic factors, and shifts in investor sentiment. For Reef, the price drop can be attributed to several factors:

- Market Correction: After a bullish run in 2021, many cryptocurrencies, including Reef, experienced a correction. Investors who bought at the peak might have sold off their holdings, leading to a downward spiral.

- Competition: The DeFi and NFT sectors have become increasingly competitive. New projects with innovative features might have drawn attention and investment away from Reef.

- Regulatory Uncertainty: The crypto industry faces ongoing regulatory scrutiny. Announcements about potential regulations or crackdowns can lead to market-wide sell-offs, impacting projects like Reef.

- Liquidity Issues: Reef’s trading volume has been relatively low compared to other major cryptocurrencies. Lower liquidity can exacerbate price drops as there are fewer buyers to absorb the selling pressure.

Comparing Reef’s Trend to Other Cryptocurrencies

To gain a deeper understanding of Reef’s price drop, let’s compare it to a similar or popular cryptocurrency, such as Dogecoin. Dogecoin, known for its meme-based appeal, has also experienced significant price fluctuations over the years. In 2021, Dogecoin saw a meteoric rise, reaching an all-time high of around $0.74 before plummeting to much lower levels. By March 2025, Dogecoin was trading at approximately $0.08, a far cry from its peak.

The reasons behind Dogecoin’s drop share similarities with Reef’s situation. Both experienced a surge in interest and investment followed by a market correction. However, Dogecoin’s recovery has been more robust, partly due to its strong community support and endorsements from high-profile figures like Elon Musk. In contrast, Reef has not enjoyed the same level of mainstream attention, which might have contributed to its slower recovery.

Market Conditions and Investor Sentiment

When analyzing Reef’s price drop, it’s crucial to consider the broader market conditions and investor sentiment. In early 2025, the crypto market was navigating a period of uncertainty due to global economic factors, including fluctuating interest rates and geopolitical tensions. These macro factors can influence investor behavior, leading to increased selling pressure across the board.

Investor sentiment towards Reef has been mixed. While some remain bullish, citing Reef’s strong fundamentals and potential for growth in the DeFi sector, others are more cautious, pointing to the project’s challenges in gaining widespread adoption. This divergence in sentiment can contribute to price volatility, as different groups of investors react to the same information in contrasting ways.

Key Indicators: Analyzing Reef’s Technical Performance

To provide a comprehensive analysis, let’s explore some key technical indicators that can offer insights into Reef’s market trends:

- Relative Strength Index (RSI): As of March 2025, Reef’s RSI stands at around 45, indicating a neutral position. An RSI below 30 would suggest an oversold condition, potentially signaling a buying opportunity, while an RSI above 70 might indicate an overbought situation.

- Moving Average Convergence Divergence (MACD): The MACD line for Reef has been below the signal line, suggesting a bearish trend. However, the histogram is showing signs of convergence, which could indicate a potential shift in momentum.

- Bollinger Bands: Reef’s price has been trading near the lower Bollinger Band, suggesting it might be undervalued. A rebound from the lower band could signal a potential price increase.

- Fibonacci Retracement: Applying Fibonacci levels to Reef’s price chart from its peak in 2021 to its low in 2025, we find that the current price of $0.000501 is near the 61.8% retracement level. This level often acts as a strong support or resistance point.

Support and Resistance Levels: Critical Price Points for Reef

Identifying support and resistance levels can help investors anticipate potential price movements. For Reef, key support levels to watch include:

- $0.0003548: This is the all-time low reached in March 2025. If Reef falls below this level, it could indicate further bearish momentum.

- $0.0004487: The 24-hour low as of March 2025 could serve as a near-term support level.

On the other hand, key resistance levels include:

- $0.0005248: The 24-hour high as of March 2025 represents a near-term resistance level.

- $0.0005841: A significant resistance level, as it marks the all-time high. Breaking above this level would be a strong bullish signal.

These levels are influenced by market behavior and recent news or events. For instance, any positive developments in the DeFi space or partnerships announced by Reef could impact these levels.

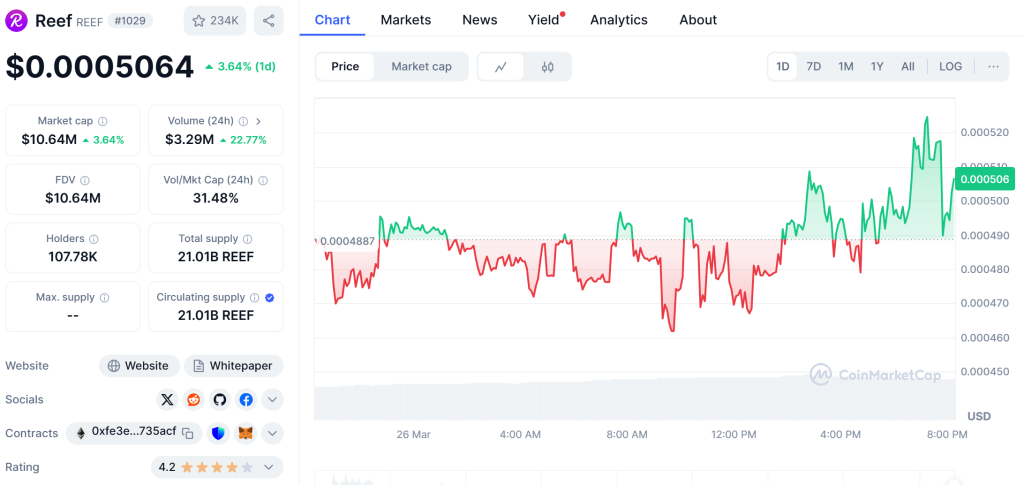

Chart Analysis: Visualizing Reef’s Price Trends

Visual representations of price trends and patterns can provide valuable insights. Let’s consider an annotated chart of Reef’s price movement over the past year:

- Price Chart (March 2024 – March 2025): The chart shows a clear downtrend with occasional spikes in volatility. The most significant drop occurred in March 2025, coinciding with broader market downturns.

- Volume Analysis: Trading volumes have been relatively low, which can exacerbate price drops. An increase in volume could signal renewed interest and potentially lead to a price recovery.

- Comparative Graphs: Comparing Reef’s performance to other DeFi tokens can highlight its relative strength or weakness. For example, while some DeFi tokens have shown resilience in the face of market downturns, Reef has struggled to maintain its value.

Long and Short-Term Predictions for Reef

Looking ahead, let’s consider both short-term and long-term predictions for Reef based on current data and trends:

Short-Term Predictions (Next Few Months)

In the short term, Reef faces challenges but also potential opportunities. The current price of $0.000501 is near a significant support level, suggesting that a rebound could be on the horizon if market conditions improve. Positive news or developments within the DeFi sector could provide a catalyst for a price increase.

However, the low trading volume remains a concern. Without increased liquidity, any recovery could be slow and volatile. Investors should monitor the RSI and MACD for signs of a trend reversal, which could indicate a buying opportunity.

Long-Term Predictions (2025 and Beyond)

Over the long term, Reef’s potential hinges on its ability to gain traction in the DeFi, NFT, and gaming sectors. The project’s focus on accessibility and user-friendliness could position it well for growth as these industries continue to expand.

By 2030, if Reef can successfully onboard more developers and users, and if the broader crypto market experiences a bull run, we could see Reef’s price climb back towards its previous highs. However, this scenario would require significant improvements in adoption and liquidity.

In a more conservative outlook, if Reef struggles to differentiate itself from competitors and fails to attract substantial investment, its price might remain stagnant or continue to decline. Investors should keep an eye on Reef’s development roadmap and any partnerships or integrations that could boost its visibility and utility.

Can Reef (REEF) Coin Recover After Dropping to $0.000501?

The question on many investors’ minds is whether Reef can recover from its current price of $0.000501. While no one can predict the future with certainty, we can look at historical trends and current market conditions to form a hypothesis.

Lessons from Dogecoin: Could Reef Follow a Similar Path?

Dogecoin’s recovery from its post-2021 slump offers valuable lessons. Dogecoin’s strong community support and occasional endorsements from influential figures played a significant role in its resurgence. Reef, while not as widely recognized, has a dedicated community and a clear focus on DeFi and NFTs, which could serve as a foundation for recovery.

However, Reef faces different challenges. Its lower liquidity and less mainstream appeal might make its recovery more challenging. Still, if Reef can leverage its unique features and attract more developers and users, it could follow a similar path to recovery.

What Caused Reef’s Price Drop, and Will It Bounce Back?

The drop from $0.05841 to $0.000501 can be attributed to a combination of market correction, increased competition, regulatory uncertainty, and liquidity issues. While these factors have put pressure on Reef’s price, they also present opportunities for recovery.

To bounce back, Reef needs to address these challenges head-on. Increasing liquidity through partnerships and exchanges, enhancing its DeFi offerings, and improving user engagement could all contribute to a price recovery. Additionally, positive developments in the broader crypto market could provide a tailwind for Reef’s recovery.

For investors looking to navigate Reef’s volatility, here are some expert insights:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversifying across different cryptocurrencies can help mitigate risk.

- Stay Informed: Keep up with the latest news and developments in the DeFi and NFT sectors. Positive news could signal a buying opportunity, while negative news might warrant caution.

- Use Technical Analysis: Tools like RSI, MACD, and Bollinger Bands can help you make informed trading decisions. Look for signs of a trend reversal that could indicate a potential price increase.

- Set Clear Goals: Determine your investment goals and risk tolerance. If you’re in it for the long haul, consider holding through short-term volatility. If you’re looking for quick gains, be prepared for the risks associated with trading.

Actionable Insights and Advice for Investors

As an investor, you have several options when it comes to Reef:

- Buy the Dip: If you believe in Reef’s long-term potential, buying at the current price of $0.000501 could offer a good entry point. However, be prepared for potential further volatility.

- Wait for a Recovery Signal: Monitor key technical indicators and market conditions. A breakout above the $0.0005248 resistance level could signal the start of a recovery.

- Consider Dollar-Cost Averaging (DCA): Instead of investing a lump sum, consider spreading your investment over time. This strategy can help you mitigate the impact of short-term price fluctuations.

- Stay Informed and Patient: The crypto market is unpredictable, but staying informed and patient can help you make better investment decisions. Keep an eye on Reef’s development and the broader market trends.

Reef (REEF) Coin’s journey from $0.05841 to $0.000501 has been a rollercoaster, reflecting the volatility and unpredictability of the crypto market. While the recent price drop poses challenges, it also offers opportunities for investors who believe in Reef’s vision and potential.

By understanding the factors behind the drop, comparing Reef’s trend to other cryptocurrencies, and staying informed about market conditions and technical indicators, investors can make more informed decisions. Whether Reef can recover and reach new heights depends on its ability to address current challenges and capitalize on future opportunities.

As we move forward into 2025 and beyond, keep an eye on Reef. Its focus on DeFi, NFTs, and gaming, combined with its user-friendly approach, could position it for a strong recovery if market conditions align. Whether you’re a seasoned investor or a crypto newcomer, Reef offers an intriguing story to follow in the ever-evolving world of cryptocurrencies.