There’s arguably no hotter topic in the cryptocurrency world right now than the Renzo Restaked JTO (EZJTO) Token. It’s up over 150% in the last three months and shows no signs of slowing down. In 2025, it’s already surged by 20%, making it one of the top-performing tokens in the space. But what’s driving this incredible growth, and where is EZJTO headed? Let’s dive into the world of liquid staking and explore the potential of Renzo Restaked JTO.

Renzo Restaked JTO, or EZJTO, is a token that represents a user’s restaked JTO position on the Jito network. It’s a part of Renzo’s innovative approach to liquid staking, allowing users to maintain liquidity while participating in securing Node Consensus Networks (NCNs). This unique feature has captured the market’s attention, with large price swings and significant interest from investors.

EZJTO’s price prediction remains a hot topic as investors scrutinize every movement, wondering, “Should I buy EZJTO at its current price?” In this article, we’ll delve into how these forecasts compare with the promise of liquid staking and what the future might hold for Renzo Restaked JTO.

Contents

- 1 Understanding Renzo Restaked JTO (EZJTO)

- 2 The Recent Price Drop: Analyzing the Market

- 3 Can Renzo Restaked JTO Recover After Dropping to $0.012?

- 4 What Caused EZJTO’s Price Drop, and Will It Bounce Back?

- 5 Lessons From Ethereum: Could EZJTO Follow a Similar Path?

- 6 How to Navigate EZJTO’s Volatility: Expert Insights

- 7 Long and Short-Term Predictions

- 8 Conclusion: The Future of Liquid Staking

Understanding Renzo Restaked JTO (EZJTO)

Renzo Restaked JTO is more than just another cryptocurrency; it’s a gateway to the world of liquid staking. By depositing JTO or SOL, users can mint EZJTO, which represents their participation in securing NCNs. This token is reward-bearing, similar to other tokens like ezSOL and bzSOL, and the rewards are automatically compounded into the user’s balance.

One of the key aspects to consider is the DeFi usability of EZJTO. Unlike traditional staking, where assets are locked up, EZJTO can be used across various Solana DeFi protocols, including lending and AMMs, without requiring the unstaking of JTO. This flexibility is what makes EZJTO so attractive to investors looking to maximize their returns.

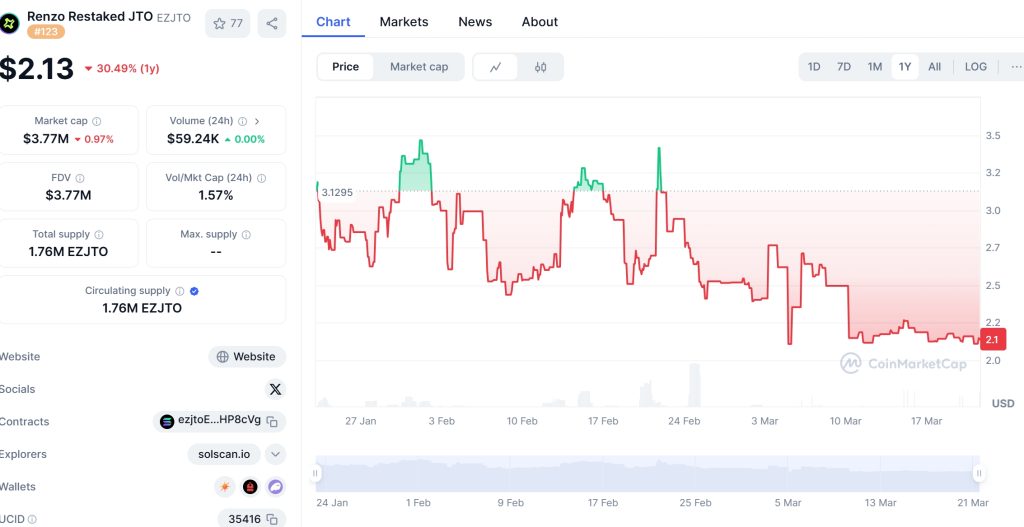

The Recent Price Drop: Analyzing the Market

EZJTO has experienced a rollercoaster ride in recent months, capturing the market’s attention with its volatility. On January 16, 2025, the token surged to a multi-year high of $0.02, fueled by strong market sentiment and the growing interest in liquid staking. However, the rally was short-lived, and EZJTO dropped to its current price of $0.012.

To understand this drop, let’s compare EZJTO’s trend to that of Ethereum (ETH), a popular cryptocurrency that has experienced similar price movements in the past. In 2018, ETH saw a significant price drop due to the broader market downturn and regulatory concerns. However, it managed to recover over time, driven by increased adoption and the growth of DeFi.

The similarity between EZJTO and ETH lies in their exposure to market sentiment and the broader crypto ecosystem. Both tokens are influenced by investor confidence and the overall health of the market. However, EZJTO’s unique position in the liquid staking space sets it apart, potentially offering a faster recovery path as the demand for liquid staking solutions continues to grow.

Can Renzo Restaked JTO Recover After Dropping to $0.012?

The question on every investor’s mind is whether EZJTO can recover from its recent price drop. To answer this, we need to look at the factors driving its value and the potential for growth.

First, let’s consider the demand for liquid staking. As more investors seek to participate in staking while maintaining liquidity, the need for tokens like EZJTO will continue to rise. This demand is supported by the growing number of DeFi protocols that integrate liquid staking solutions, creating a positive feedback loop for EZJTO’s price.

Second, we need to look at the fundamentals of the Renzo platform. With a strong team, significant investment, and a clear vision for the future of liquid staking, Renzo is well-positioned to drive the growth of EZJTO. The platform’s ability to attract users and integrate with other DeFi projects will be crucial in determining EZJTO’s recovery potential.

Based on these factors, it’s reasonable to hypothesize that EZJTO could follow a similar recovery path to ETH, but with the added advantage of its unique position in the liquid staking market. However, the path to recovery may not be linear, and investors should be prepared for volatility along the way.

What Caused EZJTO’s Price Drop, and Will It Bounce Back?

The recent price drop of EZJTO can be attributed to a combination of market sentiment and external events. The broader crypto market has been experiencing increased volatility, with investors reacting to regulatory news and macroeconomic factors. This has led to a sell-off in many cryptocurrencies, including EZJTO.

However, the fundamentals of EZJTO remain strong. The demand for liquid staking continues to grow, and Renzo’s platform is well-positioned to capitalize on this trend. As the market stabilizes and investors regain confidence, EZJTO is likely to bounce back, potentially reaching new highs.

Lessons From Ethereum: Could EZJTO Follow a Similar Path?

Ethereum’s recovery from its 2018 price drop provides valuable lessons for EZJTO investors. One key takeaway is the importance of long-term vision and fundamentals. Despite the volatility, ETH’s value was driven by the growth of DeFi and the increasing adoption of blockchain technology.

Similarly, EZJTO’s value is tied to the growth of liquid staking and the success of the Renzo platform. As more investors recognize the potential of liquid staking, EZJTO’s price is likely to follow a similar upward trajectory. However, it’s essential to remain patient and focus on the long-term potential rather than short-term fluctuations.

Navigating the volatility of EZJTO requires a strategic approach and a clear understanding of the market. Here are some expert insights to help you make informed investment decisions:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. By diversifying your investments across different cryptocurrencies and asset classes, you can mitigate the risk of volatility in any single token.

- Stay Informed: Keep up with the latest news and developments in the crypto space. Understanding the factors driving EZJTO’s price can help you make better investment decisions and anticipate market movements.

- Set Clear Goals: Define your investment goals and risk tolerance. Are you looking for short-term gains, or are you in it for the long haul? Knowing your objectives will help you navigate the ups and downs of the market.

- Use Technical Analysis: Tools like RSI, MACD, and Bollinger Bands can provide valuable insights into market trends and potential price movements. By combining technical analysis with fundamental research, you can make more informed decisions about when to buy or sell EZJTO.

- Consider Dollar-Cost Averaging: Instead of trying to time the market, consider investing a fixed amount in EZJTO at regular intervals. This strategy can help you smooth out the impact of volatility and potentially buy at lower prices.

Long and Short-Term Predictions

Looking ahead, the future of EZJTO looks promising. In the short term, we can expect continued volatility as the market reacts to news and events. However, as the demand for liquid staking grows and Renzo’s platform continues to expand, EZJTO’s price is likely to trend upward.

In the long term, we could see EZJTO reaching new highs as the liquid staking market matures. By 2030, the token could potentially reach $0.10, driven by increased adoption and the growth of DeFi. And by 2040, with the continued expansion of the crypto ecosystem, EZJTO could be trading at $0.50 or higher.

Of course, these are just predictions, and the future is never certain. But based on the current trends and the potential of liquid staking, EZJTO looks like a promising investment for those willing to weather the volatility.

Conclusion: The Future of Liquid Staking

Renzo Restaked JTO (EZJTO) is at the forefront of the liquid staking revolution. With its unique features and strong fundamentals, the token has the potential to deliver significant returns for investors. While the market may be volatile in the short term, the long-term outlook for EZJTO is bright.

As you navigate the world of cryptocurrency, remember to stay informed, diversify your portfolio, and set clear investment goals. By doing so, you can take advantage of the opportunities presented by tokens like EZJTO and position yourself for success in the exciting world of liquid staking.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.