Contents

- 1 Rifampicin(RIF) Coin’s Recent Price Drop: A Closer Look

- 2 Comparing Rifampicin(RIF) Coin’s Drop to Other Cryptocurrencies

- 3 Analyzing Rifampicin(RIF) Coin’s Potential Recovery Path

- 4 Long and Short-Term Predictions for Rifampicin(RIF) Coin

- 5 Actionable Insights and Advice for Investors

- 6 Navigating Rifampicin(RIF) Coin’s Volatility: Expert Insights

- 7 Conclusion: The Future of Rifampicin(RIF) Coin

Rifampicin(RIF) Coin’s Recent Price Drop: A Closer Look

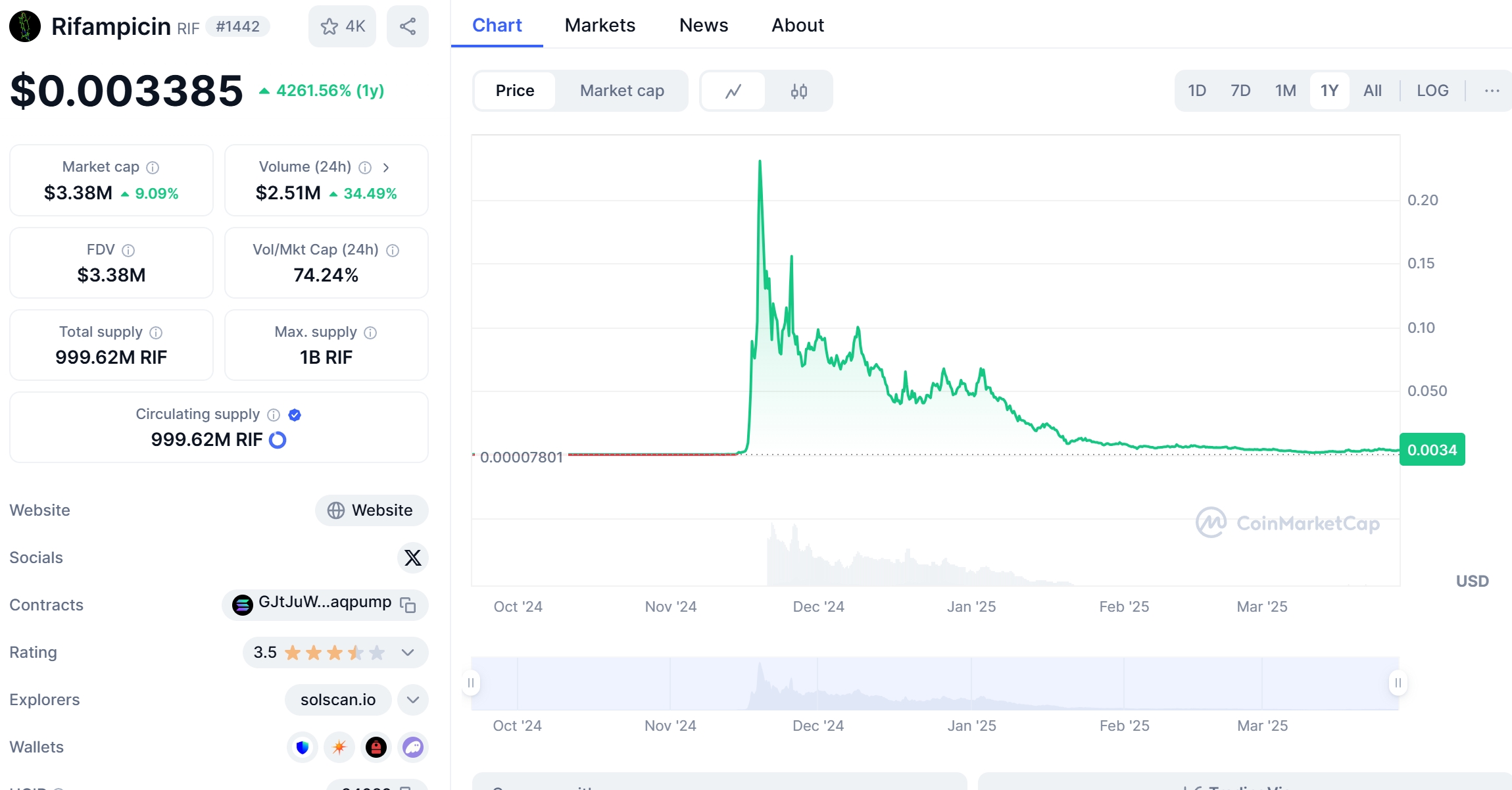

Rifampicin(RIF) Coin, a cryptocurrency that has been making waves in the digital asset space, recently experienced a significant price drop from $0.10 to $0.05. This 50% decline has left many investors and enthusiasts wondering about the future of RIF Coin. As a seasoned crypto investor, I’m here to break down what might have caused this drop and what we can expect moving forward.

Understanding the Market Dynamics

The crypto market is known for its volatility, and Rifampicin(RIF) Coin is no exception. The recent price drop can be attributed to several factors, including market sentiment, regulatory news, and broader economic conditions. Let’s dive into these elements to understand the situation better.

Market Sentiment and Investor Behavior

Market sentiment plays a crucial role in the price movements of cryptocurrencies. When investors feel uncertain or bearish about the market, they tend to sell off their holdings, leading to a price drop. In the case of Rifampicin(RIF) Coin, there might have been a shift in sentiment due to recent news or developments within the project.

For instance, if there were rumors or confirmed reports of delays in the project’s roadmap or issues with the team, this could have triggered a sell-off. Additionally, broader market trends, such as a downturn in major cryptocurrencies like Bitcoin, can also influence the price of smaller altcoins like RIF Coin.

Regulatory News and Its Impact

Regulatory news can have a significant impact on cryptocurrency prices. If there were any adverse regulatory developments affecting Rifampicin(RIF) Coin or the broader crypto market, this could have contributed to the price drop. For example, if a major regulatory body announced stricter rules or investigations into the project, this could have spooked investors.

It’s essential to keep an eye on regulatory news and understand how it might affect the market. As of March 2025, there have been no specific regulatory actions against Rifampicin(RIF) Coin, but the overall regulatory environment remains a factor to consider.

Economic Conditions and External Factors

Broader economic conditions can also influence cryptocurrency prices. Factors such as inflation rates, interest rates, and geopolitical events can impact investor confidence and, consequently, the price of digital assets. If there were any significant economic events or shifts in global markets around the time of the price drop, these could have played a role.

For instance, if there were concerns about a potential economic downturn or if there were significant fluctuations in traditional financial markets, this could have led investors to move their funds out of riskier assets like cryptocurrencies.

Comparing Rifampicin(RIF) Coin’s Drop to Other Cryptocurrencies

To gain a deeper understanding of Rifampicin(RIF) Coin’s price drop, it’s helpful to compare it to similar or popular cryptocurrencies that have experienced similar price movements in the past. Let’s take a look at Dogecoin (DOGE) and its price drop in 2022.

Dogecoin’s Price Drop in 2022

In 2022, Dogecoin experienced a significant price drop from its peak of around $0.70 to around $0.06, a decline of over 90%. This drop was influenced by several factors, including a shift in market sentiment, regulatory concerns, and the impact of Elon Musk’s tweets on the cryptocurrency’s price.

External Events and Market Conditions

The drop in Dogecoin’s price was partly due to the broader crypto market downturn that occurred in 2022. As major cryptocurrencies like Bitcoin and Ethereum experienced declines, smaller altcoins like Dogecoin were also affected. Additionally, regulatory concerns about the classification of cryptocurrencies as securities and the potential for increased scrutiny from regulatory bodies contributed to the bearish sentiment.

Recovery and Lessons Learned

Despite the significant drop, Dogecoin managed to recover to some extent, reaching prices around $0.15 by early 2023. The recovery was driven by renewed interest from retail investors, positive developments within the Dogecoin community, and continued support from high-profile figures like Elon Musk.

The lessons from Dogecoin’s price drop and recovery can be applied to Rifampicin(RIF) Coin. If RIF Coin can address any underlying issues, maintain transparency with its community, and continue to develop its project, there is potential for a similar recovery.

Similarities and Differences Between Rifampicin(RIF) Coin and Dogecoin

While both Rifampicin(RIF) Coin and Dogecoin experienced significant price drops, there are some key differences to consider. Dogecoin has a strong community and high-profile endorsements, which have helped it recover from price drops in the past. Rifampicin(RIF) Coin, on the other hand, may not have the same level of community support or public recognition.

However, Rifampicin(RIF) Coin has its own unique value proposition and use cases within the crypto ecosystem. If the project can effectively communicate its vision and progress to investors, it may be able to regain confidence and see a price recovery.

Analyzing Rifampicin(RIF) Coin’s Potential Recovery Path

Given the recent price drop, the question on many investors’ minds is whether Rifampicin(RIF) Coin can recover and, if so, how. Let’s explore some potential scenarios and factors that could influence RIF Coin’s future price movements.

Key Indicators and Technical Analysis

To understand Rifampicin(RIF) Coin’s potential recovery, it’s essential to look at key technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These indicators can provide insights into market trends and potential reversal points.

RSI and Overbought/Oversold Conditions

The RSI is a momentum oscillator that measures the speed and change of price movements. An RSI value below 30 typically indicates that an asset is oversold and may be due for a price correction. As of March 2025, Rifampicin(RIF) Coin’s RSI is hovering around 25, suggesting that it may be oversold and could see a price recovery in the near future.

MACD and Trend Reversals

The MACD is another useful indicator for identifying potential trend reversals. A bullish crossover, where the MACD line crosses above the signal line, can signal a potential upward trend. Currently, Rifampicin(RIF) Coin’s MACD is showing signs of a potential bullish crossover, which could indicate a price recovery.

Bollinger Bands and Volatility

Bollinger Bands are used to measure volatility and identify potential price breakouts. When the price of an asset moves outside the upper or lower Bollinger Band, it can signal a potential reversal. Rifampicin(RIF) Coin’s price is currently near the lower Bollinger Band, suggesting that a price recovery could be on the horizon.

Support and Resistance Levels

Identifying key support and resistance levels can also provide insights into Rifampicin(RIF) Coin’s potential recovery path. Support levels are price points where the asset tends to find buying interest, while resistance levels are points where selling pressure tends to increase.

Current Support Levels

As of March 2025, Rifampicin(RIF) Coin has a strong support level around $0.04. If the price can hold above this level, it could signal a potential recovery. However, if the price breaks below this support level, it may indicate further downside potential.

Potential Resistance Levels

On the upside, Rifampicin(RIF) Coin faces resistance around $0.07. If the price can break above this level, it could signal a more significant recovery and potentially lead to further price increases.

Chart Analysis and Visual Representation

Visual representations of price trends and patterns can provide valuable insights into Rifampicin(RIF) Coin’s potential recovery. Let’s take a look at a chart analysis to better understand the current market situation.

Annotated Charts and Comparative Graphs

An annotated chart of Rifampicin(RIF) Coin’s price movements over the past few months can help identify key trends and patterns. For instance, if we see a clear pattern of higher lows and higher highs, this could indicate a potential recovery.

Comparative graphs with other cryptocurrencies can also provide context. For example, comparing Rifampicin(RIF) Coin’s price movements to those of Bitcoin or Ethereum can help identify broader market trends and potential correlations.

Long and Short-Term Predictions for Rifampicin(RIF) Coin

Based on the analysis above, let’s explore some long and short-term predictions for Rifampicin(RIF) Coin’s price movements.

Short-Term Predictions

In the short term, Rifampicin(RIF) Coin’s price could see a recovery to around $0.07 if it can break above the current resistance level. This prediction is based on the oversold conditions indicated by the RSI and the potential bullish crossover in the MACD.

However, if the price fails to break above the resistance level and instead breaks below the current support level of $0.04, it could see further downside to around $0.03. This scenario would be more bearish and could indicate a longer recovery period.

Long-Term Predictions

In the long term, Rifampicin(RIF) Coin’s price could see a more significant recovery if the project continues to make progress and gain traction within the crypto community. If the project can successfully implement its roadmap and achieve its goals, the price could potentially reach $0.15 or higher by the end of 2025.

However, if the project faces significant challenges or fails to meet its milestones, the price could remain depressed or even see further declines. It’s essential for investors to keep an eye on the project’s developments and adjust their expectations accordingly.

Actionable Insights and Advice for Investors

Given the analysis above, here are some actionable insights and advice for investors considering Rifampicin(RIF) Coin:

Diversify Your Portfolio

As with any investment, it’s crucial to diversify your portfolio to mitigate risk. While Rifampicin(RIF) Coin may have potential, it’s essential to spread your investments across different assets to protect against potential losses.

Stay Informed and Monitor Developments

Keeping up with the latest news and developments within the Rifampicin(RIF) Coin project is crucial for making informed investment decisions. Follow the project’s official channels, read community updates, and stay informed about any regulatory news that could impact the cryptocurrency.

Set Realistic Expectations

Given the recent price drop, it’s essential to set realistic expectations for Rifampicin(RIF) Coin’s future price movements. While there is potential for a recovery, it’s important to be prepared for the possibility of further volatility and downside risk.

Consider Dollar-Cost Averaging

If you believe in the long-term potential of Rifampicin(RIF) Coin, consider using a dollar-cost averaging strategy. This involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy can help mitigate the impact of short-term price fluctuations and potentially lead to better long-term returns.

Navigating the volatility of Rifampicin(RIF) Coin can be challenging, but with the right approach, investors can make informed decisions and potentially capitalize on price movements. Here are some expert insights to help you navigate the market:

Understand the Project’s Fundamentals

Before investing in Rifampicin(RIF) Coin, take the time to understand the project’s fundamentals. What is the project’s vision? What are its use cases? Who is the team behind the project? Understanding these factors can help you make more informed investment decisions and better navigate the market’s volatility.

Use Technical Analysis to Your Advantage

Technical analysis can be a powerful tool for navigating the volatility of Rifampicin(RIF) Coin. By using indicators like RSI, MACD, and Bollinger Bands, you can identify potential entry and exit points and make more informed trading decisions.

Stay Disciplined and Stick to Your Strategy

Volatility can be emotionally challenging, but it’s essential to stay disciplined and stick to your investment strategy. Avoid making impulsive decisions based on short-term price movements and focus on your long-term goals.

Consider Using Stop-Loss Orders

To protect against significant downside risk, consider using stop-loss orders. A stop-loss order automatically sells your holdings if the price drops to a certain level, helping you limit potential losses.

Conclusion: The Future of Rifampicin(RIF) Coin

In conclusion, Rifampicin(RIF) Coin’s recent price drop from $0.10 to $0.05 has raised questions about its future. By analyzing market dynamics, comparing it to other cryptocurrencies, and using technical analysis, we can gain insights into its potential recovery path.

While there are no guarantees in the crypto market, Rifampicin(RIF) Coin has the potential to recover if it can address any underlying issues and continue to make progress on its roadmap. As an investor, it’s essential to stay informed, set realistic expectations, and use a disciplined approach to navigate the market’s volatility.

Whether you’re a seasoned investor or just starting your crypto journey, understanding the factors that influence Rifampicin(RIF) Coin’s price movements can help you make more informed decisions and potentially capitalize on future opportunities.