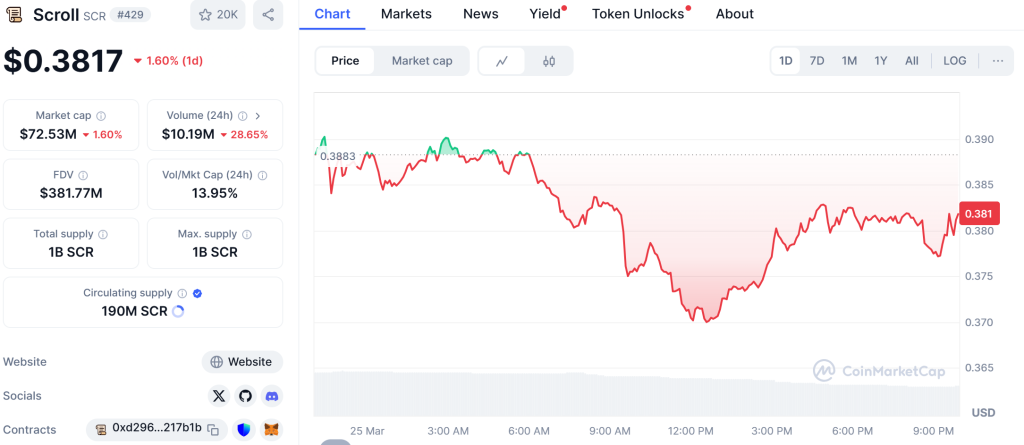

The cryptocurrency market is a rollercoaster of highs and lows, and Scroll (SCR) Coin is no exception. Recently, Scroll (SCR) Coin experienced a significant price drop, plummeting 15% from its previous high to a current price of $0.3817. This sudden shift has left many investors and enthusiasts wondering what could have caused such a drop and what the future might hold for Scroll (SCR) Coin.

As a seasoned investor in the crypto and Web3 industry, I’m here to guide you through this turbulent time, offering insights into Scroll’s recent performance, its underlying technology, and what the future might hold. Let’s dive into the story of Scroll (SCR) Coin and explore its journey, challenges, and potential for recovery.

Contents

Understanding Scroll (SCR) Coin

Scroll (SCR) Coin is not just another cryptocurrency; it’s a Layer 2 scaling solution designed to enhance the efficiency and scalability of the Ethereum network. By leveraging zkRollup technology, Scroll aims to reduce transaction costs and increase throughput, addressing some of Ethereum’s most pressing issues such as high gas fees and network congestion.

At its core, Scroll is built on principles of decentralization and security, employing zero-knowledge proof technology. This allows for the verification of transactions without revealing any sensitive information, ensuring privacy and contributing to the scalability of Ethereum by processing more transactions off-chain.

Scroll has been rigorously tested and audited, with a bug bounty program in place to encourage community involvement in identifying potential vulnerabilities. Its recent launch on the mainnet has opened up new possibilities for developers, allowing them to build and deploy Ethereum applications more efficiently and at a lower cost.

Analyzing the 15% Price Drop

The 15% price drop of Scroll (SCR) Coin from its previous high to $0.3817 is a significant event that deserves a closer look. To understand what might have led to this drop, we need to consider various factors, including market sentiment, external events, and technical indicators.

Market Sentiment and External Events

Market sentiment plays a crucial role in the price movements of cryptocurrencies. The recent drop in Scroll’s price could be attributed to broader market trends or specific events affecting investor confidence. For instance, regulatory news or shifts in investor sentiment towards Layer 2 solutions might have impacted Scroll’s performance.

External events, such as major announcements or partnerships, can also sway the market. If there were any negative developments or lack of positive news around Scroll, this could have contributed to the price decline. It’s essential to stay informed about the latest news and developments in the crypto space to understand these dynamics better.

Technical Analysis

Technical indicators provide valuable insights into market trends and potential future movements. Let’s examine some key indicators that might shed light on Scroll’s recent price drop.

RSI (Relative Strength Index)

The RSI is a momentum oscillator that measures the speed and change of price movements. A high RSI value (above 70) indicates that a cryptocurrency might be overbought, while a low RSI value (below 30) suggests it might be oversold. If Scroll’s RSI was high before the drop, it could indicate that the coin was overbought, leading to a correction.

MACD (Moving Average Convergence Divergence)

The MACD helps identify trend changes and momentum. A bearish crossover, where the MACD line crosses below the signal line, can signal a potential price decline. Analyzing Scroll’s MACD could reveal whether such a crossover occurred before the price drop.

Bollinger Bands

Bollinger Bands consist of a middle band (a moving average) and two outer bands that are standard deviations away from the middle band. A price moving outside the upper band might indicate that it’s overbought, while moving outside the lower band could suggest it’s oversold. If Scroll’s price was touching or crossing the upper band before the drop, it might have signaled an impending correction.

Moving Averages

Moving averages help smooth out price data to identify trends. A crossover of a short-term moving average below a long-term moving average (known as a “death cross”) can signal a bearish trend. Analyzing Scroll’s moving averages could provide insights into whether such a signal was present before the price drop.

Fibonacci Retracement

Fibonacci retracement levels are used to identify potential support and resistance levels. If Scroll’s price dropped to a significant Fibonacci level, it could indicate a natural correction point. Examining these levels can help us understand where the price might find support for a potential rebound.

Comparing Scroll (SCR) Coin to Ethereum (ETH)

To gain a deeper understanding of Scroll’s price drop, let’s compare its trend to that of Ethereum (ETH), a cryptocurrency that Scroll aims to enhance. Ethereum, being the leading smart contract platform, has experienced its fair share of price volatility over the years.

Ethereum’s Price History

Ethereum has seen significant price movements in the past, including dramatic drops and subsequent recoveries. For instance, in May 2021, Ethereum experienced a sharp decline of over 50% from its all-time high, dropping from around $4,300 to below $2,000. This drop was attributed to various factors, including regulatory concerns and market-wide corrections.

However, Ethereum managed to recover, reaching new all-time highs in November 2021, surpassing $4,800. The recovery was driven by increased adoption, positive developments in the DeFi and NFT sectors, and overall bullish sentiment in the crypto market.

Similarities and Differences

Both Scroll and Ethereum are integral to the Ethereum ecosystem, with Scroll aiming to improve Ethereum’s scalability. However, there are key differences in their market positions and investor sentiment.

- Market Position: Ethereum is a well-established cryptocurrency with a large market cap and a significant role in the DeFi and NFT spaces. Scroll, on the other hand, is a newer project focused on Layer 2 scaling solutions, which might lead to different investor expectations and market dynamics.

- Investor Sentiment: Ethereum’s price movements are often influenced by broader market trends and developments in the Ethereum ecosystem. Scroll’s price, however, might be more sensitive to news and developments specific to Layer 2 solutions and zkRollup technology.

- External Events: While Ethereum’s price can be affected by regulatory news and market-wide events, Scroll’s price might be more influenced by technological developments and partnerships within the Layer 2 space.

Potential Recovery Path

Given Ethereum’s history of recovery from significant price drops, it’s worth considering whether Scroll might follow a similar path. Ethereum’s recovery was driven by increased adoption, technological advancements, and positive market sentiment. For Scroll to recover, it would need to demonstrate similar factors, such as:

- Increased Adoption: If more developers and projects start using Scroll for its scalability benefits, this could drive demand and increase its price.

- Technological Advancements: Continued development and improvements in Scroll’s zkRollup technology could enhance its appeal and attract more investors.

- Positive Market Sentiment: As the market becomes more optimistic about Layer 2 solutions and their role in Ethereum’s future, Scroll could see a price increase.

However, Scroll’s recovery might also take a different path due to its unique position in the market. For instance, if Scroll secures significant partnerships or receives positive regulatory news specific to Layer 2 solutions, it could experience a faster recovery than Ethereum did in the past.

Future Predictions for Scroll (SCR) Coin

Predicting the future of any cryptocurrency is challenging, but by analyzing current trends and developments, we can make educated guesses about Scroll’s potential trajectory.

Short-Term Predictions

In the short term, Scroll’s price might continue to experience volatility as the market digests recent developments and news. If the current bearish sentiment persists, we could see further price declines. However, if Scroll announces positive developments, such as new partnerships or technological advancements, this could lead to a price rebound.

Key indicators to watch in the short term include:

- RSI: If Scroll’s RSI moves into oversold territory (below 30), it could signal a potential buying opportunity for investors looking for a rebound.

- MACD: A bullish crossover, where the MACD line crosses above the signal line, could indicate a potential upward trend in the near future.

- Support and Resistance Levels: If Scroll’s price finds support at significant levels, such as Fibonacci retracement levels or historical lows, it could signal a potential bottom and subsequent recovery.

Long-Term Predictions

In the long term, Scroll’s potential for growth depends on several factors, including its ability to address Ethereum’s scalability challenges and its adoption by developers and users. If Scroll continues to improve its technology and gain traction within the Ethereum ecosystem, it could see significant price appreciation.

Some potential scenarios for Scroll’s long-term future include:

- Widespread Adoption: If Scroll becomes the go-to Layer 2 solution for Ethereum developers, its price could soar as demand increases. This would be driven by the need for scalable and cost-effective solutions in the Ethereum ecosystem.

- Regulatory Clarity: Positive regulatory developments for Layer 2 solutions could boost investor confidence and drive Scroll’s price higher. Regulatory clarity is crucial for the long-term success of any cryptocurrency.

- Technological Advancements: Continued improvements in Scroll’s zkRollup technology and its integration with other Ethereum tools and applications could enhance its value proposition and attract more investment.

- Market Trends: If the overall crypto market experiences a bullish trend, Scroll could benefit from increased investor interest in Layer 2 solutions and Ethereum’s ecosystem.

Actionable Insights for Investors

For investors looking to navigate Scroll’s volatility and potential recovery, here are some actionable insights:

Monitor Market Sentiment

Keep a close eye on market sentiment and news related to Scroll and the broader Layer 2 space. Positive developments and partnerships could signal a potential price increase, while negative news might lead to further declines.

Use Technical Indicators

Utilize technical indicators such as RSI, MACD, and Bollinger Bands to identify potential buying and selling opportunities. If Scroll’s RSI moves into oversold territory, it might be a good time to consider buying, while a bearish MACD crossover could signal a time to sell or wait for a better entry point.

Diversify Your Portfolio

Diversify your crypto portfolio to mitigate risk. While Scroll has significant potential, it’s essential to spread your investments across different assets to protect against volatility and potential losses.

Stay Informed

Stay informed about the latest developments in the Ethereum ecosystem and the Layer 2 space. Scroll’s success is closely tied to Ethereum’s, so understanding the broader trends and developments can provide valuable insights into Scroll’s future.

Consider Long-Term Potential

If you believe in Scroll’s long-term potential, consider holding onto your investments through short-term volatility. Scroll’s role in enhancing Ethereum’s scalability could lead to significant growth over time, making it a potentially rewarding long-term investment.

Conclusion

Scroll (SCR) Coin’s recent 15% price drop to $0.3817 is a reminder of the volatility inherent in the cryptocurrency market. By understanding the factors behind this drop, comparing Scroll’s trend to Ethereum’s, and analyzing potential future scenarios, investors can make more informed decisions about their investments.

Whether Scroll follows a path similar to Ethereum’s recovery or takes a different route, its potential to address Ethereum’s scalability challenges makes it an exciting project to watch. By staying informed, using technical indicators, and considering both short-term and long-term predictions, investors can navigate Scroll’s volatility and potentially benefit from its future growth.

As we continue to see developments in the crypto space, Scroll (SCR) Coin remains a key player in the quest for a more scalable and efficient Ethereum network. Keep an eye on Scroll, and you might just witness the next big leap in blockchain technology.