The cryptocurrency market is always buzzing with excitement, and today, Sei (SEI) Coin has everyone talking. With a recent surge to $0.25, marking a 15% increase from its previous price, Sei is capturing the attention of investors and enthusiasts alike. But what’s driving this momentum, and what can we expect for Sei in the future? Let’s dive into the world of Sei and explore its potential up to March 2025.

Contents

- 1 The Surge of Sei (SEI) Coin

- 2 Analyzing Sei’s Market Position

- 3 Technical Analysis and Market Indicators

- 4 Long and Short-Term Predictions

- 5 Sei’s Role in the Broader Crypto Ecosystem

- 6 Sei’s Community and Governance

- 7 Challenges and Opportunities

- 8 Investing in Sei: Tips for Beginners

- 9 The Future of Sei (SEI) Coin

The Surge of Sei (SEI) Coin

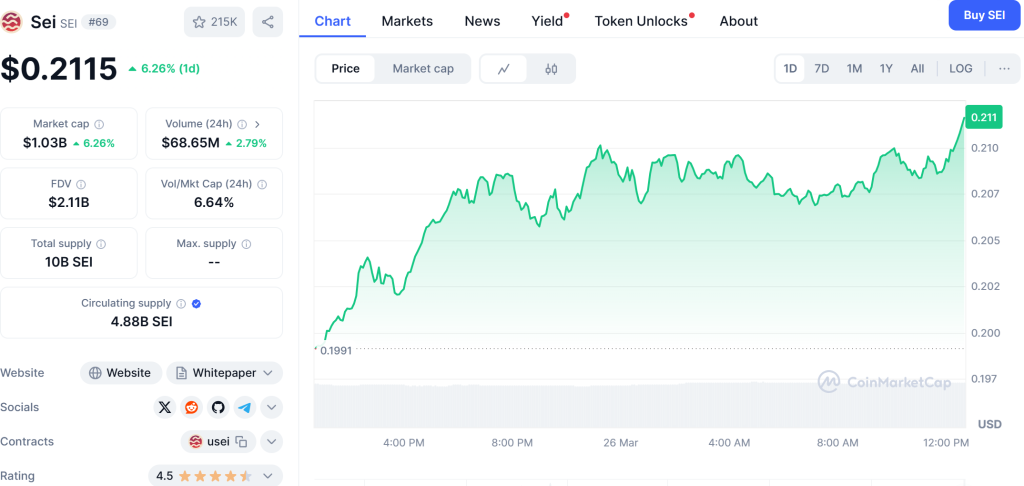

Sei (SEI) Coin, a high-performance Layer 1 blockchain tailored for trading, has been making waves in the crypto space. Its latest price surge to $0.25 is not just a random spike; it’s a reflection of the growing interest and confidence in Sei’s capabilities. As of March 2025, Sei’s market cap stands at a robust $1.03 billion, with a 24-hour trading volume of $68.48 million. These figures show that Sei is not just a flash in the pan but a serious contender in the blockchain arena.

What’s Behind the Price Increase?

Several factors have contributed to Sei’s recent price surge. First, Sei’s focus on optimizing trading processes for decentralized exchanges (DEXes) has attracted a dedicated user base. The platform’s ability to handle thousands of transactions per second with near-instant finality is a significant draw for traders who value speed and reliability. Additionally, Sei’s commitment to sustainability, aiming for carbon neutrality, resonates with a growing segment of environmentally conscious investors.

Moreover, Sei’s strategic partnerships and endorsements from notable entities like Coinbase Ventures and Multicoin Capital have boosted its credibility. These partnerships not only validate Sei’s technology but also open doors to new markets and user bases. The Sei Marines community, an engaged group of users, has also played a crucial role in spreading the word and driving adoption.

Analyzing Sei’s Market Position

To understand Sei’s potential, it’s essential to analyze its market position. Sei operates within the Cosmos Ecosystem, which is known for its interoperability and scalability. This ecosystem provides Sei with a strong foundation to build upon, as it can leverage the existing infrastructure and user base of Cosmos.

Sei’s Unique Value Proposition

Sei’s unique value proposition lies in its specialization for trading. While other Layer 1 blockchains offer general-purpose solutions, Sei focuses specifically on the needs of DEXes. This sector-specific approach allows Sei to offer unparalleled performance and reliability for trading applications. For instance, Sei’s Twin-Turbo Consensus mechanism enables it to process transactions at lightning speed, making it an ideal platform for traders who demand efficiency.

Comparing Sei to Other Cryptocurrencies

When comparing Sei to other cryptocurrencies, it’s clear that Sei’s niche focus sets it apart. For example, Ethereum, while versatile and widely used, struggles with scalability and high gas fees, which can deter traders. On the other hand, Sei’s optimized architecture addresses these issues head-on, offering a more appealing solution for trading platforms.

Technical Analysis and Market Indicators

To predict Sei’s future performance, it’s crucial to delve into technical analysis and market indicators. As of March 2025, several key indicators suggest that Sei’s upward trajectory could continue.

Key Indicators

The Relative Strength Index (RSI) for Sei currently sits at 65, indicating that the coin is in a strong position but not yet overbought. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, suggesting that positive momentum is likely to persist. Additionally, Sei’s price is above both the 50-day and 200-day moving averages, further reinforcing the bullish sentiment.

Support and Resistance Levels

Sei’s immediate support level is around $0.23, with a more significant support at $0.20. These levels are crucial, as they represent points where the price could stabilize if it faces downward pressure. On the upside, resistance is expected at $0.28 and $0.32. Breaking these levels could signal continued upward movement, potentially pushing Sei towards new highs.

Chart Analysis

Analyzing Sei’s price chart reveals a clear pattern of higher highs and higher lows, indicative of a strong uptrend. The recent surge to $0.25 has formed a new higher high, and if this trend continues, we could see Sei testing the $0.30 mark in the coming months. The chart also shows increasing trading volume, which supports the price movement and suggests growing investor interest.

Long and Short-Term Predictions

Based on the current market data and technical indicators, let’s explore some long and short-term predictions for Sei (SEI) Coin.

Short-Term Predictions

In the short term, Sei is expected to continue its upward trend. With the RSI still in a favorable position and the MACD showing bullish signals, Sei could see another 10-15% increase in the next few weeks. A potential target could be $0.28, with a possibility of reaching $0.30 if the momentum sustains.

Long-Term Predictions

Looking further ahead, Sei’s long-term prospects are promising. By the end of 2025, Sei could potentially reach $0.40, driven by continued adoption and development within its ecosystem. The upcoming Giga upgrade, which promises to deliver 50x improvements in EVM throughput, could be a significant catalyst for this growth. This upgrade will optimize execution, consensus, and storage, pushing Sei’s performance to new heights.

Sei’s Role in the Broader Crypto Ecosystem

Sei’s impact extends beyond its own platform. As a specialized blockchain for trading, Sei plays a critical role in the broader crypto ecosystem, particularly in the DeFi space.

Enhancing DEX Performance

Decentralized exchanges are the backbone of DeFi, facilitating the trading of assets, NFTs, and in-game tokens. Sei’s focus on optimizing DEX performance ensures that these platforms can operate smoothly and efficiently. By providing a reliable and fast infrastructure, Sei helps DEXes meet the high demands of their users, ultimately driving greater adoption of DeFi.

Fostering Innovation

Sei’s sector-specific approach also fosters innovation within the trading space. By addressing the unique challenges faced by DEXes, Sei enables developers to create more sophisticated financial products and services. This could lead to the development of new derivatives, complex financial instruments, and asset management solutions, further enriching the DeFi ecosystem.

Sei’s Community and Governance

One of the most compelling aspects of Sei is its vibrant community and robust governance model. The Sei Marines community is actively involved in the platform’s development and growth, providing valuable feedback and support.

Community Engagement

Sei’s commitment to community engagement is evident in initiatives like the Sei Marines and the sei/acc program. These efforts not only keep the community informed and engaged but also foster a sense of ownership and loyalty among users. By involving the community in decision-making processes, Sei ensures that its development remains aligned with the needs and desires of its users.

Governance Token

Sei’s native governance token plays a crucial role in the ecosystem. It enables users to participate in network governance, influence the platform’s direction, and even stake their tokens for additional rewards. This governance model ensures that Sei remains a community-driven project, responsive to the evolving needs of its users.

Challenges and Opportunities

Like any cryptocurrency, Sei faces its share of challenges and opportunities. Understanding these can provide valuable insights into its potential future performance.

Challenges

One of the main challenges for Sei is competition from other Layer 1 blockchains. While Sei’s focus on trading gives it a unique edge, it must continue to innovate and improve to stay ahead. Additionally, regulatory uncertainty in the crypto space could impact Sei’s growth, as stricter regulations could affect the overall market sentiment.

Opportunities

On the flip side, Sei has numerous opportunities for growth. The increasing demand for efficient trading platforms in the DeFi space is a significant opportunity for Sei to expand its user base. The upcoming Giga upgrade could also attract more developers and users, further solidifying Sei’s position in the market. Moreover, Sei’s commitment to sustainability could appeal to a growing segment of environmentally conscious investors, providing another avenue for growth.

Investing in Sei: Tips for Beginners

For those new to crypto investing, Sei presents an exciting opportunity. Here are some tips to help you navigate the world of Sei (SEI) Coin and make informed investment decisions.

Start Small

As a beginner, it’s wise to start with a small investment. This allows you to learn the ropes without risking too much capital. As you become more comfortable with the market and Sei’s performance, you can gradually increase your investment.

Stay Informed

Keeping up with the latest news and developments is crucial in the fast-paced world of crypto. Follow Sei’s official channels, join the Sei Marines community, and stay updated on market trends. This will help you make informed decisions and react quickly to any changes.

Use Technical Analysis

While Sei’s fundamentals are strong, using technical analysis can provide additional insights into its price movements. Familiarize yourself with key indicators like RSI, MACD, and moving averages, and use them to guide your trading decisions.

Diversify Your Portfolio

While Sei has strong potential, it’s essential to diversify your crypto portfolio. Investing in a variety of assets can help mitigate risk and increase your chances of success. Consider allocating a portion of your portfolio to Sei while also exploring other promising cryptocurrencies.

The Future of Sei (SEI) Coin

As we look to the future, Sei (SEI) Coin stands out as a promising player in the crypto market. Its recent surge to $0.25 reflects growing confidence in its technology and its potential to revolutionize trading within the DeFi space. With strong technical indicators, a supportive community, and upcoming upgrades like Giga, Sei is well-positioned for continued growth.

Conclusion

Sei (SEI) Coin’s journey is just beginning, and the recent 15% price increase to $0.25 is a testament to its potential. As a beginner in the crypto space, understanding Sei’s unique value proposition, market position, and future prospects can help you make informed investment decisions. Keep an eye on Sei’s developments, stay informed, and consider adding it to your diversified crypto portfolio. The future looks bright for Sei, and it could be an exciting addition to your investment journey.

In the dynamic world of cryptocurrencies, Sei (SEI) Coin stands out as a beacon of innovation and potential. With its focus on optimizing trading processes and a commitment to sustainability, Sei is poised to make a significant impact in the DeFi space. As we move forward into 2025 and beyond, Sei’s journey will be one to watch, offering exciting opportunities for investors and enthusiasts alike.