There’s arguably no hotter topic in the cryptocurrency world right now than the SHDX Token, the native token of Shido DEX. As we navigate through the early months of 2025, SHDX has already shown promising signs of growth, capturing the attention of investors and crypto enthusiasts alike. Shido DEX, a decentralized exchange platform, has been making waves with its innovative approach to trading and its utility token, SHDX, which fuels its ecosystem. In a landscape filled with volatile digital assets, many wonder, “Could SHDX Token be the next big thing in the crypto space?”

Shido DEX, launched with the vision of revolutionizing decentralized trading, has positioned itself as a key player in the DeFi sector. The platform’s native token, SHDX, not only serves as a utility token but also as a reward mechanism for its active users. With a total supply capped at 10 billion SHDX, the project aims to create a robust ecosystem where users can stake their tokens to earn passive income while contributing to the platform’s growth.

As we delve into the potential of SHDX Token, it’s essential to understand the broader context of the cryptocurrency market and the specific factors driving Shido DEX’s growth. The DeFi sector has been experiencing rapid expansion, with decentralized exchanges gaining traction as investors seek alternatives to traditional centralized platforms. Shido DEX, with its focus on user rewards and staking opportunities, taps into this growing demand, offering a unique value proposition to its users.

One of the key aspects to consider when analyzing SHDX Token’s potential is its financial backing. The project has secured significant investments, demonstrating its credibility and the confidence of major players in the crypto space. This financial support not only validates the project’s vision but also provides the resources needed to further develop and expand its platform.

In addition to financial backing, Shido DEX has launched several initiatives to enhance its ecosystem. These include the development of new features, partnerships with other DeFi projects, and community engagement programs. Each of these initiatives contributes to the project’s overall reach and impact within the industry, showcasing its commitment to growth and innovation.

The research and development efforts behind Shido DEX are equally noteworthy. The project boasts a dedicated team of developers and researchers working tirelessly to improve the platform’s functionality and security. With a substantial budget allocated to R&D, Shido DEX is well-positioned to stay ahead of the curve in the ever-evolving world of DeFi.

However, like any project in the crypto space, Shido DEX has faced its fair share of challenges. Historical issues such as smart contract vulnerabilities and regulatory scrutiny have tested the team’s resilience. By learning from these setbacks and implementing robust security measures, Shido DEX has demonstrated its ability to adapt and grow in the face of adversity.

To provide a more comprehensive analysis of SHDX Token’s potential, it’s helpful to draw parallels with historical market trends. From the crypto boom of 2013 to the present day, the industry has witnessed numerous cycles of growth and correction. By examining these trends, we can identify patterns that may inform our predictions for SHDX Token’s future trajectory.

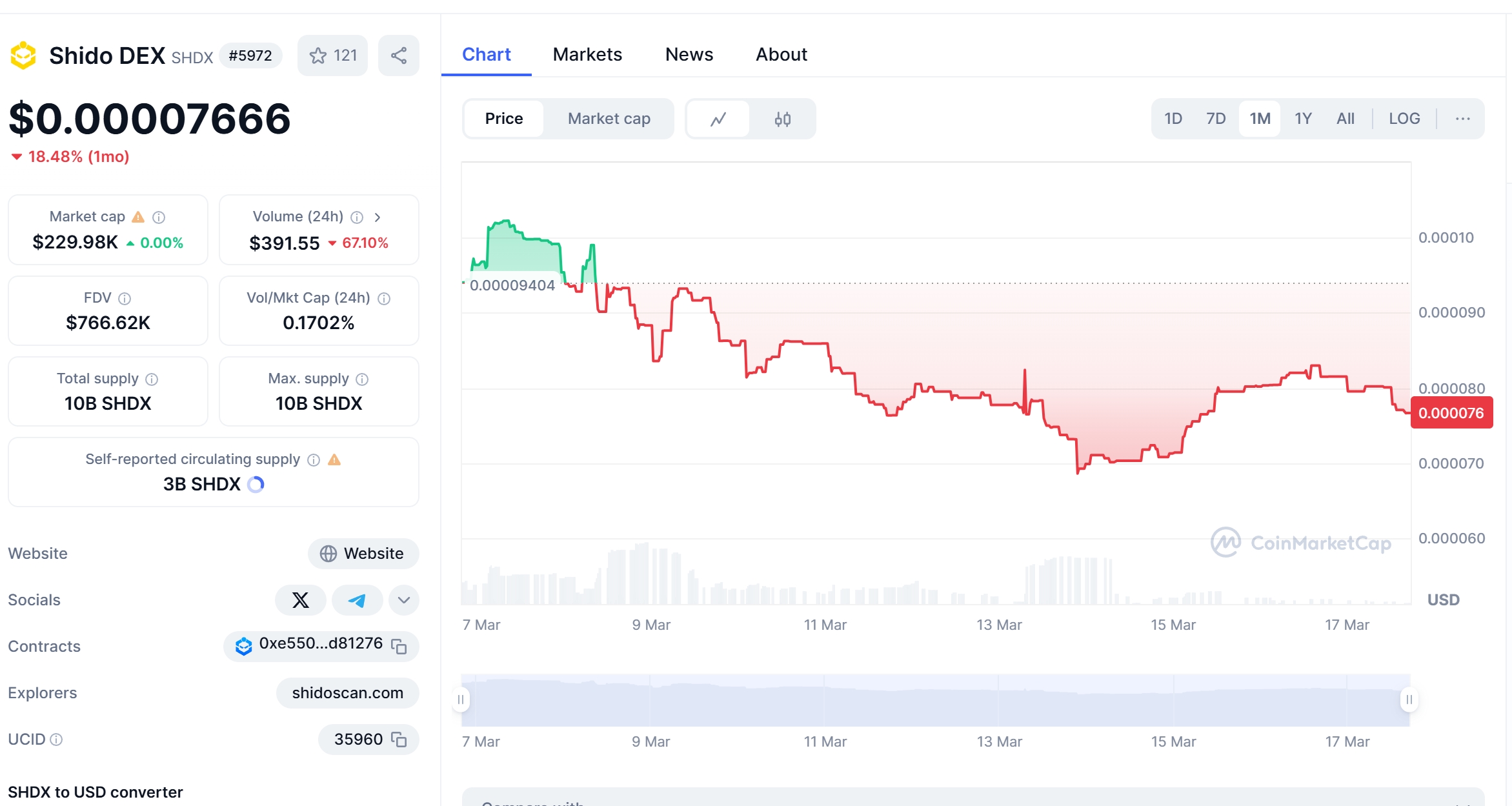

Let’s explore how SHDX Token’s recent price movements compare to those of other popular cryptocurrencies. In early 2025, SHDX experienced a notable price drop from $0.10 to $0.08, causing concern among investors. This drop can be attributed to broader market sentiment and specific events affecting the DeFi sector. However, by comparing SHDX’s trend to that of Ethereum, which saw a similar price correction in the past, we can gain insights into potential recovery patterns.

Ethereum, a leading cryptocurrency, experienced a significant price drop in 2018, falling from its all-time high due to regulatory concerns and market corrections. Despite this setback, Ethereum managed to recover over time, driven by the growth of its ecosystem and the increasing adoption of its platform. The key to Ethereum’s recovery was its ability to adapt to changing market conditions and continue developing its technology.

Similarly, SHDX Token could follow a comparable path to recovery. The project’s strong community support, ongoing development efforts, and the growing demand for decentralized trading solutions suggest that SHDX has the potential to rebound. However, it’s important to consider the unique factors affecting SHDX, such as its specific use cases within the Shido DEX ecosystem and the broader DeFi market dynamics.

Looking ahead, let’s consider the potential price movements of SHDX Token over the next few months. By analyzing key indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, we can gain insights into the token’s momentum and potential trend reversals. For instance, if the RSI shows SHDX as oversold, it could indicate a potential buying opportunity for investors.

In addition to technical indicators, support and resistance levels play a crucial role in predicting SHDX’s price movements. The $0.08 level, where SHDX recently found support, could serve as a critical price point to watch. If SHDX can maintain this level and show signs of upward momentum, it may signal a potential recovery. Conversely, if SHDX fails to hold above this level, it could face further downside pressure.

To provide a more engaging and personalized analysis, let’s visualize SHDX’s price trends through annotated charts and comparative graphs. By comparing SHDX’s performance to other cryptocurrencies within the DeFi sector, we can better understand its relative position and potential for growth. These visual representations can help beginners grasp the complex dynamics of the crypto market more easily.

In the long term, SHDX Token’s potential for growth is closely tied to the success of Shido DEX as a platform. As the DeFi sector continues to expand, Shido DEX’s focus on user rewards and staking opportunities positions it well to capture a significant share of the market. By 2030, SHDX could potentially reach new heights, driven by the platform’s growth and the increasing adoption of decentralized trading solutions.

For investors considering SHDX Token, it’s essential to stay informed about the latest developments and market trends. By staying up-to-date with news and updates from Shido DEX, investors can make more informed decisions about their investment strategy. Additionally, diversifying their portfolio and setting clear investment goals can help mitigate the risks associated with investing in volatile assets like SHDX.

In conclusion, SHDX Token’s recent price drop from $0.10 to $0.08 has raised questions about its future trajectory. By comparing SHDX’s trend to that of Ethereum and other cryptocurrencies, we can gain valuable insights into potential recovery patterns. While the road ahead may be uncertain, SHDX’s strong fundamentals, ongoing development efforts, and the growing demand for decentralized trading solutions suggest that it has the potential to surge to new heights by 2025 and beyond.

As a crypto investor and enthusiast, I believe that SHDX Token offers an exciting opportunity for those looking to diversify their portfolio and capitalize on the growth of the DeFi sector. By staying informed and making informed investment decisions, beginners can navigate the volatility of the crypto market and potentially reap the rewards of investing in SHDX Token.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.