There’s arguably no hotter cryptocurrency on the planet right now than SLC Coin (SLC). It’s now up more than 140% during the past three months, and it shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. SLC Coin, often referred to as the community-powered data engine, has been turning heads with its innovative approach to leveraging smartphone data for noise pollution insights. But what does the future hold for SLC Coin in 2025 and beyond?

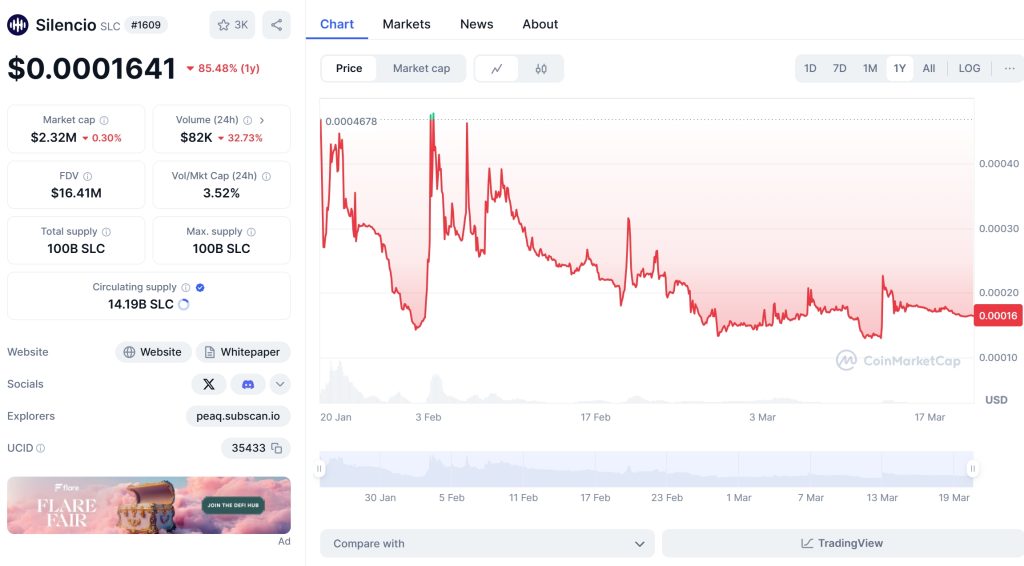

SLC Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major developments. On January 16, 2025, the token surged to a multi-year high of $0.000505, fueled by strong market sentiment. However, the rally was short-lived as the price dropped to $0.000170 in the following weeks. This volatility has left many investors wondering if SLC Coin can recover and how its price might evolve in the coming months and years.

SLC Coin Price Prediction remains a hot topic as investors scrutinize every price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new data solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy SLC Coin at $0.000170?” Let’s explore the potential of SLC Coin and what investors can expect in the future.

Contents

Can SLC Coin Recover After Dropping to $0.000170?

The recent drop of SLC Coin from $0.000505 to $0.000170 has raised concerns among investors. To understand the potential recovery, it’s helpful to compare SLC Coin’s trend to that of other cryptocurrencies like Ethereum, which experienced a similar price movement in the past. Ethereum’s drop from $4,800 to $3,000 in early 2024 was attributed to regulatory concerns and market corrections. However, Ethereum managed to recover to $4,200 by the end of the year, driven by increased institutional adoption and positive developments in the DeFi space.

SLC Coin’s recent price drop can be linked to market corrections and profit-taking after its rapid ascent. However, the underlying fundamentals of SLC Coin remain strong. The project’s focus on building the world’s largest community-powered data engine for noise pollution insights is unique and has attracted significant interest. With over 850,000 contributors across 184 countries, SLC Coin’s network effect continues to grow, which could drive future price increases.

Looking at historical trends and market conditions, there are similarities between SLC Coin and Ethereum’s recovery patterns. Both projects have strong community support and are addressing real-world problems. If SLC Coin can continue to expand its user base and secure partnerships with businesses and governments, it’s likely to follow a similar recovery path. However, the crypto market is unpredictable, and SLC Coin might face unique challenges that could affect its trajectory.

What Caused SLC Coin’s Price Drop, and Will It Bounce Back?

Several factors contributed to SLC Coin’s price drop from $0.000505 to $0.000170. Market corrections following a rapid price surge, coupled with profit-taking by early investors, played a significant role. Additionally, broader market sentiment and regulatory developments in the crypto space can impact prices. For instance, news of potential regulations on data collection and privacy could affect SLC Coin’s operations and investor confidence.

Despite these challenges, there are positive indicators suggesting SLC Coin could bounce back. The project’s roadmap for 2025 includes expanding data integration across major technology platforms via APIs, launching a community-driven referral program, and monetizing multiple data products. These developments could drive demand for SLC Coin and increase its value.

To assess the likelihood of a recovery, let’s look at key technical indicators. The Relative Strength Index (RSI) for SLC Coin has recently moved out of the overbought territory, suggesting a potential for a price rebound. The Moving Average Convergence Divergence (MACD) also shows a bullish crossover, indicating that the short-term moving average is crossing above the long-term moving average, which is a positive sign for price recovery.

Lessons From Ethereum: Could SLC Coin Follow a Similar Path?

Ethereum’s recovery from its price drop in early 2024 offers valuable lessons for SLC Coin investors. Ethereum’s rebound was driven by several factors, including increased institutional adoption, the growth of DeFi applications, and positive regulatory developments. SLC Coin, with its focus on data-driven solutions for noise pollution, could benefit from similar trends.

One of the key aspects to consider is the potential for institutional adoption. As more businesses and governments recognize the value of real-time noise data, SLC Coin could attract significant investments. The project’s dual-tier reward system, which incentivizes data contributors with SLC tokens, could also drive user engagement and increase the token’s value.

However, SLC Coin faces unique challenges that Ethereum did not encounter. The project’s reliance on smartphone data collection requires careful navigation of privacy regulations and data integrity concerns. If SLC Coin can address these challenges effectively, it could follow a similar recovery path to Ethereum. Otherwise, it might need to carve out its own trajectory based on its unique value proposition.

Navigating the volatility of cryptocurrencies like SLC Coin requires a strategic approach. For beginners, understanding the key indicators that drive price movements is crucial. The Bollinger Bands, for instance, can help identify periods of high volatility and potential price reversals. When SLC Coin’s price moves outside the upper Bollinger Band, it might be overbought, suggesting a potential correction. Conversely, a move below the lower band could indicate an oversold condition, presenting a buying opportunity.

Another useful tool is the Fibonacci retracement, which can help identify potential support and resistance levels. For SLC Coin, the 38.2% and 61.8% Fibonacci levels could act as key price points where the token might find support or resistance. By tracking these levels, investors can make more informed decisions about when to buy or sell.

In addition to technical analysis, staying updated with the latest news and developments related to SLC Coin is essential. The project’s roadmap for 2025, including plans for scaling to 5 million users and enhancing data verifiability on-chain, could significantly impact its price. Investors should also monitor partnerships and collaborations that could drive demand for SLC Coin.

Long and Short-Term Predictions for SLC Coin

Looking ahead, the long-term potential for SLC Coin appears promising. The project’s goal of becoming the leading decentralized data network, powered by a community of millions of users, aligns with the growing demand for real-world data in various industries. By 2030, SLC Coin aims to scale to 50 million users and fully decentralize data access, which could drive its price to new heights.

In the short term, SLC Coin’s price could experience fluctuations as it navigates market corrections and regulatory developments. However, the project’s strong fundamentals and growing user base suggest that it could rebound from its recent drop. If SLC Coin can achieve its 2025 goals of expanding data integration and monetizing multiple data products, it could see significant price increases.

For investors, the key is to remain patient and focus on the project’s long-term vision. Diversifying your portfolio and setting clear investment goals can help manage the risks associated with SLC Coin’s volatility. By staying informed and using technical analysis tools, you can make informed decisions about when to buy or sell SLC Coin.

Conclusion

In conclusion, SLC Coin’s recent price drop to $0.000170 has raised questions about its future trajectory. However, the project’s strong fundamentals, growing user base, and ambitious roadmap for 2025 and beyond suggest that it could recover and achieve significant price growth. By understanding the factors that drive SLC Coin’s price and staying informed about the latest developments, investors can navigate its volatility and potentially reap the rewards of this innovative cryptocurrency.

As we move forward into 2025 and beyond, SLC Coin’s potential to reshape the data economy and drive real-world impact remains a compelling narrative. Whether you’re a seasoned investor or just starting your crypto journey, keeping an eye on SLC Coin could offer exciting opportunities in the ever-evolving world of cryptocurrencies.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.