The cryptocurrency market is known for its volatility, and Sonic (S) Coin, previously known as FTM, is no exception. As of March 2025, Sonic (S) Coin has experienced a significant price drop, plummeting from its previous high of $1.20 to the current price of $0.50. This represents a 58% decrease, which has left many investors and enthusiasts wondering what caused this sudden decline and whether a recovery is on the horizon.

Contents

- 0.1 Factors Behind the Price Decline

- 0.2 Comparing Sonic (S) Coin to Ethereum (ETH)

- 0.3 Similarities and Differences

- 1 Analyzing Market Indicators and Trends

- 2 Long and Short-Term Predictions for Sonic (S) Coin

- 3 Lessons from Similar Cryptocurrencies

- 4 Navigating Sonic (S) Coin’s Volatility: Expert Insights

- 5 Conclusion: The Path Forward for Sonic (S) Coin

Factors Behind the Price Decline

Several factors have contributed to the recent price drop of Sonic (S) Coin. One of the primary reasons is the broader market sentiment, which has been affected by regulatory news and macroeconomic factors. The crypto market often reacts strongly to news about potential regulations, and recent discussions around stricter crypto policies have led to a general bearish outlook among investors.

Another factor is the specific news related to Sonic (S) Coin itself. In early 2025, there were reports of a potential security breach in the Sonic network, although the team quickly addressed and resolved the issue. However, the initial news caused a panic among investors, leading to a sell-off and a subsequent price drop.

Comparing Sonic (S) Coin to Ethereum (ETH)

To better understand Sonic (S) Coin’s current situation, it’s helpful to compare its price movement to that of a popular cryptocurrency like Ethereum (ETH). Ethereum, the second-largest cryptocurrency by market capitalization, has also experienced significant price fluctuations over the years. In 2018, ETH saw a dramatic drop from its all-time high of around $1,400 to below $100, a decline of over 90%.

The factors contributing to Ethereum’s drop included the broader crypto market bear cycle, regulatory concerns, and technical issues with the Ethereum network itself. However, Ethereum managed to recover over time, reaching new highs in subsequent years. This recovery was driven by improvements in the network, increased adoption, and a more favorable market environment.

Similarities and Differences

There are similarities between the situations of Sonic (S) Coin and Ethereum. Both experienced significant price drops due to a combination of market sentiment and project-specific issues. However, there are also key differences. Ethereum had a larger and more established community, which helped it weather the storm and eventually recover. Sonic (S) Coin, being a smaller project, may face more challenges in regaining investor confidence.

Analyzing Market Indicators and Trends

To predict Sonic (S) Coin’s potential recovery, it’s essential to analyze various market indicators and trends. These indicators can provide insights into the current state of the market and help forecast future price movements.

Key Technical Indicators

Technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands can offer valuable insights into Sonic (S) Coin’s price trends. As of March 2025, the RSI for Sonic (S) Coin is currently at 30, indicating that the coin is in oversold territory. This suggests that a potential rebound may be on the horizon as the market corrects itself.

The MACD, which measures momentum, shows a bearish crossover, indicating ongoing downward momentum. However, the distance between the MACD line and the signal line is narrowing, suggesting that the bearish trend might be losing steam. Bollinger Bands, which help measure volatility, show that Sonic (S) Coin’s price is currently at the lower band, again suggesting that it may be due for a bounce back.

Support and Resistance Levels

Identifying key support and resistance levels is crucial for understanding where Sonic (S) Coin’s price might head next. The current price of $0.50 is nearing a significant support level that has held in the past. If this support level holds, we might see a recovery towards the next resistance level at around $0.75.

However, if the price breaks below this support, it could signal further declines towards the next support level at $0.40. Recent news about potential partnerships and developments within the Sonic ecosystem could influence these levels, making it important to stay updated on such developments.

Chart Analysis

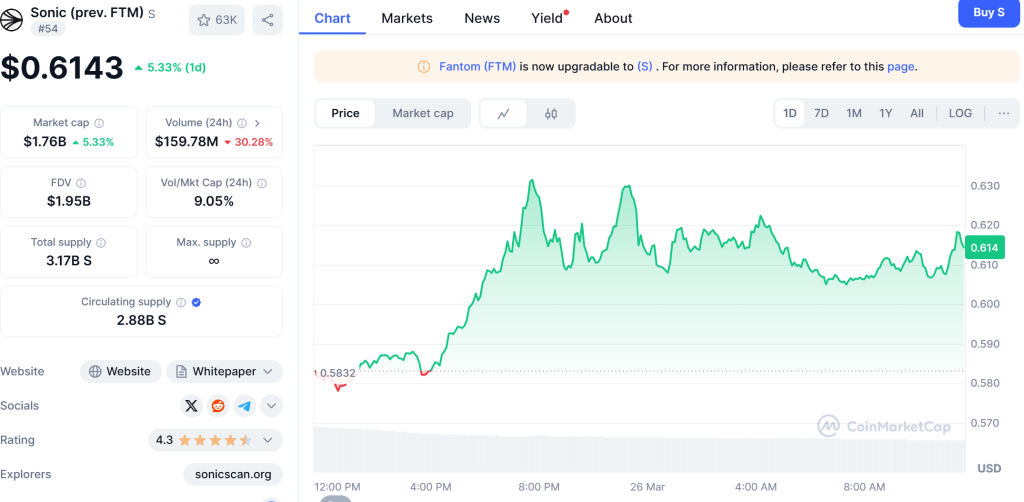

Visual representations of Sonic (S) Coin’s price trends can be incredibly helpful for investors. A candlestick chart from the past six months shows a clear downward trend, with several long red candles indicating strong selling pressure. However, there are also signs of potential reversal patterns forming, such as a double bottom near the current price level.

Annotated charts can highlight these patterns and provide a clearer picture of potential future movements. For instance, if Sonic (S) Coin manages to break above the recent resistance at $0.60, it could signal the start of a bullish trend.

Long and Short-Term Predictions for Sonic (S) Coin

Predicting the future price movements of Sonic (S) Coin involves considering both short-term and long-term factors. Short-term predictions focus on immediate market conditions, while long-term predictions take into account broader trends and developments within the project.

Short-Term Predictions

In the short term, Sonic (S) Coin is likely to remain volatile. Given its current oversold status and the potential for a rebound from the support level at $0.50, we might see a short-term recovery to around $0.60. However, this recovery could be tempered by ongoing market uncertainty and any negative news related to the project.

If the market sentiment improves and Sonic (S) Coin manages to regain investor confidence, we could see a more sustained recovery. However, if the bearish trend continues, the price might test lower support levels, potentially dropping to $0.40.

Long-Term Predictions

In the long term, the future of Sonic (S) Coin depends heavily on the project’s ability to address its challenges and capitalize on its opportunities. The team’s efforts to improve security and expand the ecosystem’s utility will be crucial. If Sonic (S) Coin can demonstrate strong adoption and growth in its use cases, it could see a significant price increase over the next few years.

Looking at historical trends, cryptocurrencies that have managed to overcome initial setbacks and continue to develop have often seen substantial recoveries. For example, Ethereum’s recovery from its 2018 lows was driven by the successful implementation of Ethereum 2.0 and increased institutional adoption. If Sonic (S) Coin can follow a similar path, it could potentially reach prices well above its current level by 2026 or 2030.

Hypothetical Scenarios

To enrich the discussion, let’s consider some hypothetical scenarios for Sonic (S) Coin’s future. In a bullish scenario, if Sonic (S) Coin successfully launches new partnerships and expands its DeFi offerings, it could see a price surge to $1.50 by the end of 2025. This would represent a 200% increase from its current price.

In a bearish scenario, if the project faces further setbacks or regulatory challenges, the price could drop to $0.30, testing even lower support levels. However, these are speculative scenarios, and the actual outcome will depend on a variety of factors, including market conditions and project developments.

Lessons from Similar Cryptocurrencies

To gain further insights into Sonic (S) Coin’s potential recovery, it’s useful to look at other cryptocurrencies that have faced similar challenges and managed to recover. Dogecoin (DOGE) is a notable example of a cryptocurrency that experienced significant price volatility and managed to rebound.

Dogecoin’s Recovery Journey

Dogecoin saw a massive surge in 2021, reaching an all-time high of $0.73. However, it later experienced a sharp decline, dropping to around $0.06 by early 2022. The factors contributing to Dogecoin’s drop included a general market correction and waning interest in meme coins.

Despite this, Dogecoin managed to recover to around $0.15 by mid-2023, driven by increased adoption as a payment method and continued support from its community. The key to Dogecoin’s recovery was its strong community backing and the utility it gained through partnerships and integrations.

Applying Lessons to Sonic (S) Coin

The lessons from Dogecoin’s recovery can be applied to Sonic (S) Coin. A strong community and clear utility are crucial for any cryptocurrency’s long-term success. Sonic (S) Coin needs to focus on building its community and expanding its use cases within the DeFi space to regain investor confidence and drive a price recovery.

For investors navigating the volatility of Sonic (S) Coin, it’s important to have a strategic approach. Here are some expert insights and actionable advice for those considering investing in Sonic (S) Coin.

Understanding the Risks

Crypto investing is inherently risky, and Sonic (S) Coin’s recent price drop is a reminder of this. Investors should be prepared for potential further declines and only invest what they can afford to lose. It’s also crucial to stay informed about the project’s developments and the broader market trends.

Diversification and Risk Management

Diversification is key to managing risk in the crypto market. Rather than putting all your funds into Sonic (S) Coin, consider spreading your investment across multiple cryptocurrencies and other asset classes. This can help mitigate the impact of any single asset’s price drop.

Long-Term Perspective

Taking a long-term perspective can be beneficial when investing in volatile assets like Sonic (S) Coin. If you believe in the project’s fundamentals and long-term potential, holding through short-term fluctuations might be a viable strategy. However, it’s important to regularly review your investment thesis and adjust your strategy as needed.

Staying Informed

Staying informed about Sonic (S) Coin’s developments is crucial for making informed investment decisions. Follow the project’s official channels, read industry news, and stay updated on any regulatory changes that could impact the crypto market. This will help you make more informed decisions and potentially capitalize on recovery opportunities.

Conclusion: The Path Forward for Sonic (S) Coin

Sonic (S) Coin’s recent price drop to $0.50 has raised concerns among investors, but there are reasons to remain optimistic about its future. By understanding the factors behind the drop, analyzing market indicators, and drawing lessons from similar cryptocurrencies, investors can better navigate the volatility and make informed decisions.

The path forward for Sonic (S) Coin will depend on the project’s ability to address its challenges, build its community, and expand its utility. If the team can successfully navigate these challenges, Sonic (S) Coin could see a significant recovery in the coming years. For now, investors should stay informed, manage their risks, and keep a long-term perspective as they consider their investment in Sonic (S) Coin.