If you’re new to the world of cryptocurrency, you might be wondering what all the fuss is about with Textopia (TXT) Coin. There’s no denying that TXT has been making waves in the crypto space, and with good reason. As of March 2025, TXT is trading at around $0.004529, but some analysts are buzzing about its potential to reach $0.01 by 2030. Let’s dive into what’s driving this excitement and what you need to know about TXT’s future prospects.

Textopia (TXT) Coin has captured the attention of investors and enthusiasts alike, not just for its current performance but for the promise it holds in the evolving landscape of digital assets. As we look ahead to 2030, the question on everyone’s mind is whether TXT can make that significant leap to $0.01. To understand this, we need to delve into the factors that could propel TXT’s growth and the hurdles it might face along the way.

Contents

- 1 Understanding Textopia (TXT) Coin’s Market Position

- 2 Analyzing TXT’s Recent Price Drop

- 3 Key Indicators and Market Trends

- 4 Support and Resistance Levels

- 5 Chart Analysis

- 6 Long and Short-Term Predictions

- 7 Navigating TXT’s Volatility: Expert Insights

- 8 Lessons from Other Coins: Could TXT Follow a Similar Path?

- 9 Conclusion

Understanding Textopia (TXT) Coin’s Market Position

Textopia (TXT) Coin stands out in the crypto market due to its unique focus on digital content creation and monetization. Launched as part of a platform that aims to revolutionize how creators and consumers interact with digital content, TXT has quickly garnered interest from those looking to invest in the future of digital media. The platform’s innovative approach to tokenizing content has positioned TXT as a contender in the rapidly growing sector of decentralized finance (DeFi) and Web3 technologies.

Currently, TXT’s market cap stands at an impressive $452,932, which might seem small compared to giants like Bitcoin or Ethereum, but it’s a testament to the growing interest in niche cryptocurrencies with real-world applications. The 24-hour trading volume of $217.83 indicates active trading, signaling that investors are closely watching TXT’s movements.

Analyzing TXT’s Recent Price Drop

TXT recently experienced a price drop from its historical high of $0.024097 to the current $0.004529. This decline might be concerning for some investors, but it’s essential to look at the bigger picture. To understand TXT’s situation better, let’s compare it to a similar cryptocurrency that faced a significant price drop and subsequently recovered.

Consider Dogecoin (DOGE), which has seen its fair share of volatility. In early 2021, DOGE experienced a meteoric rise, fueled by social media hype and endorsements from high-profile figures. However, it soon faced a sharp decline. The factors behind this drop included market corrections and shifts in investor sentiment. Despite this, DOGE managed to recover over time, driven by continued community support and strategic partnerships.

TXT’s price drop can be attributed to similar market dynamics. The broader crypto market has seen fluctuations, and TXT, being a smaller cap coin, is more susceptible to these swings. However, the underlying value proposition of TXT remains strong, with its focus on empowering digital content creators and consumers.

Key Indicators and Market Trends

To assess TXT’s potential for recovery and growth, we need to look at key technical indicators. The Relative Strength Index (RSI) for TXT currently sits at a neutral level, suggesting that the coin is neither overbought nor oversold. This could indicate potential for upward movement if market conditions improve.

The Moving Average Convergence Divergence (MACD) shows a bearish signal at the moment, but this could change with positive developments in the TXT ecosystem. Bollinger Bands, which measure volatility, suggest that TXT might be due for a breakout if it can sustain its current support levels.

In terms of market trends, the growing interest in decentralized content platforms and the increasing adoption of Web3 technologies could be significant catalysts for TXT’s growth. The rise in digital content consumption, coupled with the need for more equitable monetization models, aligns well with TXT’s mission.

Support and Resistance Levels

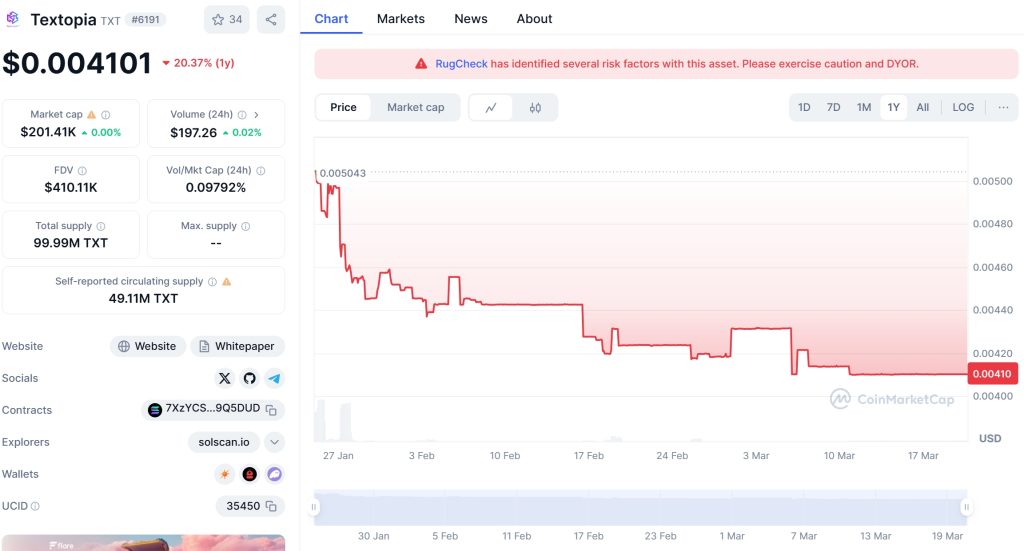

For TXT, current support levels are around $0.004, with resistance at $0.006. Breaking through this resistance could signal a bullish trend and pave the way for further gains. Recent news, such as partnerships with major content platforms or technological advancements in the TXT ecosystem, could provide the necessary momentum to push past these levels.

Chart Analysis

A look at TXT’s price chart reveals a pattern of consolidation following the recent drop. This consolidation phase could be the calm before the storm, with TXT poised to break out if market sentiment shifts in its favor. Annotated charts show that TXT has formed a solid base at its current price, which could serve as a springboard for future growth.

Long and Short-Term Predictions

In the short term, TXT might face some volatility as the market continues to adjust. However, if the project continues to develop its platform and attract more users and creators, we could see TXT’s price stabilize and begin to climb. By the end of 2025, TXT could reach $0.006, a modest but significant increase from its current level.

Looking further ahead, the long-term potential for TXT hinges on its ability to carve out a niche in the digital content space. If TXT can successfully implement its vision and gain widespread adoption, reaching $0.01 by 2030 is within the realm of possibility. This would represent a substantial 220% increase from its current price, highlighting the potential for significant returns for early investors.

For those new to crypto investing, navigating TXT’s volatility can be daunting. One strategy is to dollar-cost average (DCA) your investments, buying a fixed amount of TXT at regular intervals. This approach can help mitigate the impact of price swings and allow you to accumulate TXT over time.

Another tip is to stay informed about developments in the TXT ecosystem. Keep an eye on news related to partnerships, platform updates, and community initiatives. These can provide valuable insights into TXT’s future trajectory and help you make more informed investment decisions.

Lessons from Other Coins: Could TXT Follow a Similar Path?

Looking at other cryptocurrencies that have experienced similar price movements can offer valuable lessons for TXT investors. For example, Ethereum (ETH) faced significant volatility in its early days but has since established itself as a leader in the crypto space. ETH’s success was driven by continuous development, strong community support, and strategic partnerships.

If TXT can follow a similar path, focusing on innovation and building a robust ecosystem, it has the potential to not only recover from its recent drop but also grow significantly over the next few years. The key will be maintaining momentum and delivering on its promise to revolutionize digital content monetization.

Conclusion

Textopia (TXT) Coin offers an exciting opportunity for investors looking to get in on the ground floor of a project with real-world applications. While the recent price drop might be a cause for concern, the underlying fundamentals of TXT remain strong. With a focus on digital content creation and monetization, TXT is well-positioned to capitalize on the growing interest in Web3 technologies.

As we look to the future, the potential for TXT to reach $0.01 by 2030 hinges on its ability to execute its vision and gain widespread adoption. For those willing to navigate the volatility, TXT could offer significant returns. Keep an eye on this promising cryptocurrency as it continues to make its mark in the digital world.

By staying informed and adopting a strategic approach to investing, you can position yourself to benefit from TXT’s potential growth. Whether you’re a seasoned investor or just starting your crypto journey, Textopia (TXT) Coin is one to watch in the coming years.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.