Hey everyone! Welcome to the financial storm of April 7, 2025. Bitcoin’s jumping between $75K and $81K, stocks are jittery, and Trump’s tariff threats are stirring the pot. If you’re new to crypto or just wondering why your portfolio’s on edge, you’re in good company. Let’s break down why stocks and crypto are tangled up, how tariffs are shaking things, and what’s coming next—plus some easy steps to jump in. It’s a wild ride, but there’s plenty to explore.

Contents

- 1 April 9, 2025: The Tariff Trapdoor – Will a Failed US-China Deal Crash the Market?

- 2 Bitcoin’s $81k Volatility: What’s Behind the Wild Swings?

- 3 Stocks vs. Crypto: Decoding the 2025 Market Divergence

- 4 AI Coins: The Tariff-Proof Bright Spot

- 5 The Whale Watch: Big Moves, Big Risks

- 6 What’s Next? April 9 and Beyond

- 7 Newbie Game Plan: Jump In Smart

- 8 Final Take: Crypto’s Big Moment

April 9, 2025: The Tariff Trapdoor – Will a Failed US-China Deal Crash the Market?

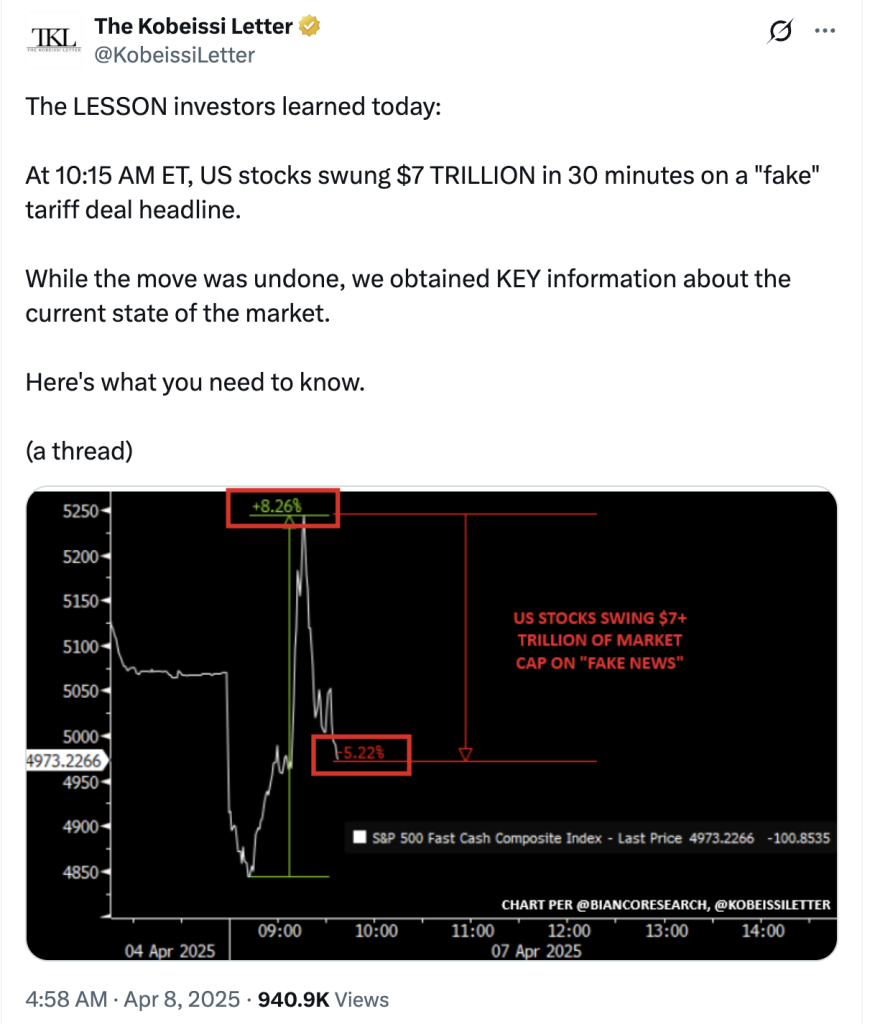

Last night, a fake “tariff delay” rumor sent the S&P 500 up 1.8% in minutes—until it flopped, and stocks slid back. Bitcoin hit $75K, then climbed to $81K by tonight, April 7, 8:34 PM PDT. What’s behind the chaos? The Kobeissi Letter calls it sentiment—investors have been hooked on “buy the dip” since 2023, snagging cheap stocks and crypto on every drop. But with Trump’s tariffs looming and no U.S.-China deal by April 9, that habit’s looking risky.

Odaily’s take is blunt: if talks fail, market emotions could crash, echoing 2020’s panic when the S&P 500 lost $12.8 trillion in 32 days—$400 billion daily. Right now, pre-market S&P 500 is down 2.1%, and tariffs are the big scare. Trump’s pushing 25% on Mexico and Canada, 10% on China, and might ease up on Israel thanks to U.S. aid. Retaliation’s heating up—Canada’s targeting $155B of U.S. goods, Mexico’s plotting, and China’s ready for a trade brawl. This is less about math and more about nerves. Markets are riding fear, not facts. April 9’s the line in the sand—keep an eye on CNBC or X (#TrumpTariffs) for updates. A deal could lift everything; a bust might mean bargains.

Bitcoin’s $81k Volatility: What’s Behind the Wild Swings?

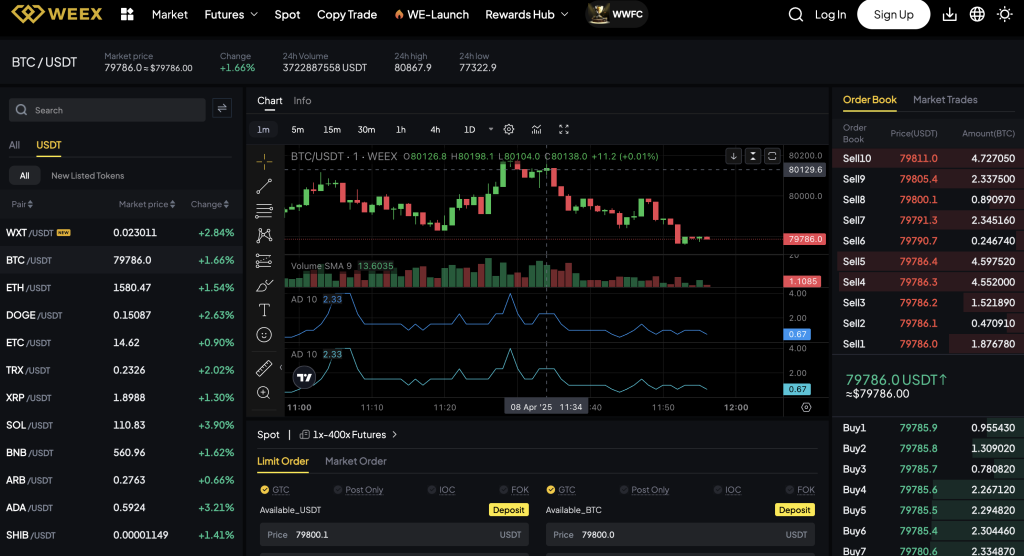

Bitcoin’s at $80,200 as of April 8, 3:39 PM UTC—pretty close to my $81K earlier (it’s a live wire, so peek at CoinMarketCap for the latest). Yesterday, it sank below $75K after Trump’s tariff tweet, then bounced back with a 1.97% gain. Ethereum’s holding at $1,600, up 0.32%. Meanwhile, AI coins are on fire—Render’s up 9.39%, Bittensor’s up 12.85%, and the sector’s gained 7.62%, per SoSoValue.

Why the rollercoaster? Tariffs spook everyone—higher costs, slower growth, and a “risk-off” vibe. Sunday’s tweet saw Bitcoin drop 3.9%, shadowing Nasdaq and Dow futures. But it recovered fast. Some folks see crypto as a hedge—a safe spot when stocks wobble. That fake rumor last night? Algo-traders jumped in, then bailed. X posts like “Trump tariffs shake crypto markets” sum it up. Bitcoin’s grit hints at something bigger—hang tight for that. Want to play along? Track it on CoinMarketCap or Coinbase—$50 or $100 on a dip below $77K is a low-stakes way to start. Set a price alert and see where it goes.

Stocks vs. Crypto: Decoding the 2025 Market Divergence

Stocks and crypto used to sync up—Dow rises, Bitcoin follows. Now, they’re like siblings with their own styles. The Dow’s down 8% this week, slammed by tariff fears—higher costs hit profits hard. The S&P 500’s off 17% from its peak, per CNBC, and tech like Nvidia (down 8.7%) is hurting. Crypto’s got its own flair—Curve’s founder dumped 3M CRV tokens for $162M since March, and a Hyperliquid whale bet $300M on ETH. Still, Bitcoin’s up 1.97% today.

They’re linked, though. Tariffs could dent the dollar, making Bitcoin’s 21M cap a hot draw. Stocks might lag, but crypto’s adapting. X chatter calls it “digital Switzerland”—a hedge against stock chaos. For newbies, this is your cue: check trends on Yahoo Finance or TradingView to spot the dance. If stocks slip, a $50 dip into BTC or ETH via Binance or Kraken could be your first move—simple apps, low entry.

AI Coins: The Tariff-Proof Bright Spot

While Bitcoin sways, AI crypto’s thriving. The sector’s up 7.62%—Render at 9.39%, Bittensor at 12.85%, even Fartcoin at 27.69%. Why? They dodge tariffs. Render fuels decentralized GPUs for AI and movies—trade wars don’t faze it. Bittensor’s crafting an AI marketplace—innovation tariffs can’t hit. The ssiAI index (up 8.38%) backs this up. It’s a lesson: crypto’s got pockets that shine when stocks don’t. Curious? Dig into Render or Bittensor on CoinGecko—$20 in one’s a fun start. Follow #AICrypto on X for the buzz.

The Whale Watch: Big Moves, Big Risks

Crypto’s full of high rollers. Curve’s Michael Egorov cashed out 308.3M CRV at $0.527 each—$162M total—selling at tops. CRV’s TVL fell 9% after, a red flag maybe. Then there’s the Hyperliquid whale: $300M USDC to long ETH at $1,461 with 20x leverage—liquidation’s at $1,399. ETH’s at $1,600 now, so he’s ahead, but it’s dicey. These plays drive the swings—crypto’s a chessboard. Want the inside scoop? Spot On Chain’s X feed tracks whales. Stick to small buys for now—leverage is a pro’s game.

What’s Next? April 9 and Beyond

Here’s the outlook, tied to the data:

- Deal Done (30%): U.S.-China seal it. Stocks climb 8-10%, Bitcoin hits $85K, AI coins jump 20%. SocialFi (+6.96%) and DeFi (+4.07%) could tag along.

- Talks Collapse (50%): No deal. S&P 500 falls 15% to 4,200, Bitcoin tests $75K, then rises as a dollar hedge. Panic could rival 2020, per Kobeissi.

- Delay (20%): Stalemate. Markets stall, but AI and RWA (up 5.38%) stand out.

You can talks flop, tariffs stick, Bitcoin dips to $70K, then soars to $100K by year-end. Inflation and a shaky dollar could crown crypto. The Fear & Greed Index at “extreme fear” (23/100) says buy—history agrees. Stay in the loop with Bloomberg or Reuters on April 9. A dip? Grab $50 in BTC on Coinbase. Join r/CryptoCurrency on Reddit for live takes.

Newbie Game Plan: Jump In Smart

Ready to roll? Track crypto on CoinMarketCap and stocks on Yahoo Finance—set BTC alerts at $77K and $85K to catch the action. Start with $50 in Bitcoin or $20 in Render on Binance or Kraken—user-friendly spots for beginners. Spread $100 across BTC, ETH, and an AI coin if you’re feeling it—keep leverage off the table. Stay sharp with #Bitcoin and #TrumpTariffs on X, and peek at SoSoValue for sector trends. Dips are normal—crypto’s tough, so hang on and learn.

Final Take: Crypto’s Big Moment

Crypto’s the stock market’s wild younger sibling—unruly, but resilient. Tariffs might bruise stocks, but Bitcoin’s carving its own lane: fast, global, chaos-ready. April 9 sets the stage—deal or bust, crypto’s volatility is its edge. For you, the newbie? Ease in—$50 in BTC, watch the news, and grow with it. This isn’t just markets; it’s the future unfolding.

Got thoughts? Hit me up on X or drop a comment—I’m all ears!