In the ever-evolving world of cryptocurrencies, a new contender has emerged that’s capturing the attention of investors and meme enthusiasts alike. Cocoro ($COCORO), the officially licensed token inspired by the new pup of Atsuko Sato, the woman behind the original Doge meme, is making waves. If you’re new to the crypto scene, buckle up as we delve into what makes Cocoro a potential game-changer in the market.

Trade COCORO USDT on WEEX.

Contents

The Origin Story of Cocoro

Cocoro is not just another meme coin; it’s a token with a story that resonates with the crypto community. Launched on the Base blockchain, Cocoro embodies the spirit of the beloved Shiba Inu, much like its predecessor, Dogecoin. Atsuko Sato, the owner of the original Doge pup, Kabosu, has now introduced her new dog, Cocoro, to the world. This new meme coin is not only a tribute to her endearing pets but also a testament to the lasting power of internet culture in the crypto space.

The connection to Dogecoin is undeniable, as both tokens share a common heritage and community spirit. While Dogecoin has long been the king of meme coins, Cocoro’s arrival on the scene brings a fresh twist to the narrative, offering investors a new opportunity to be part of a burgeoning crypto phenomenon.

Market Performance and Price Dynamics

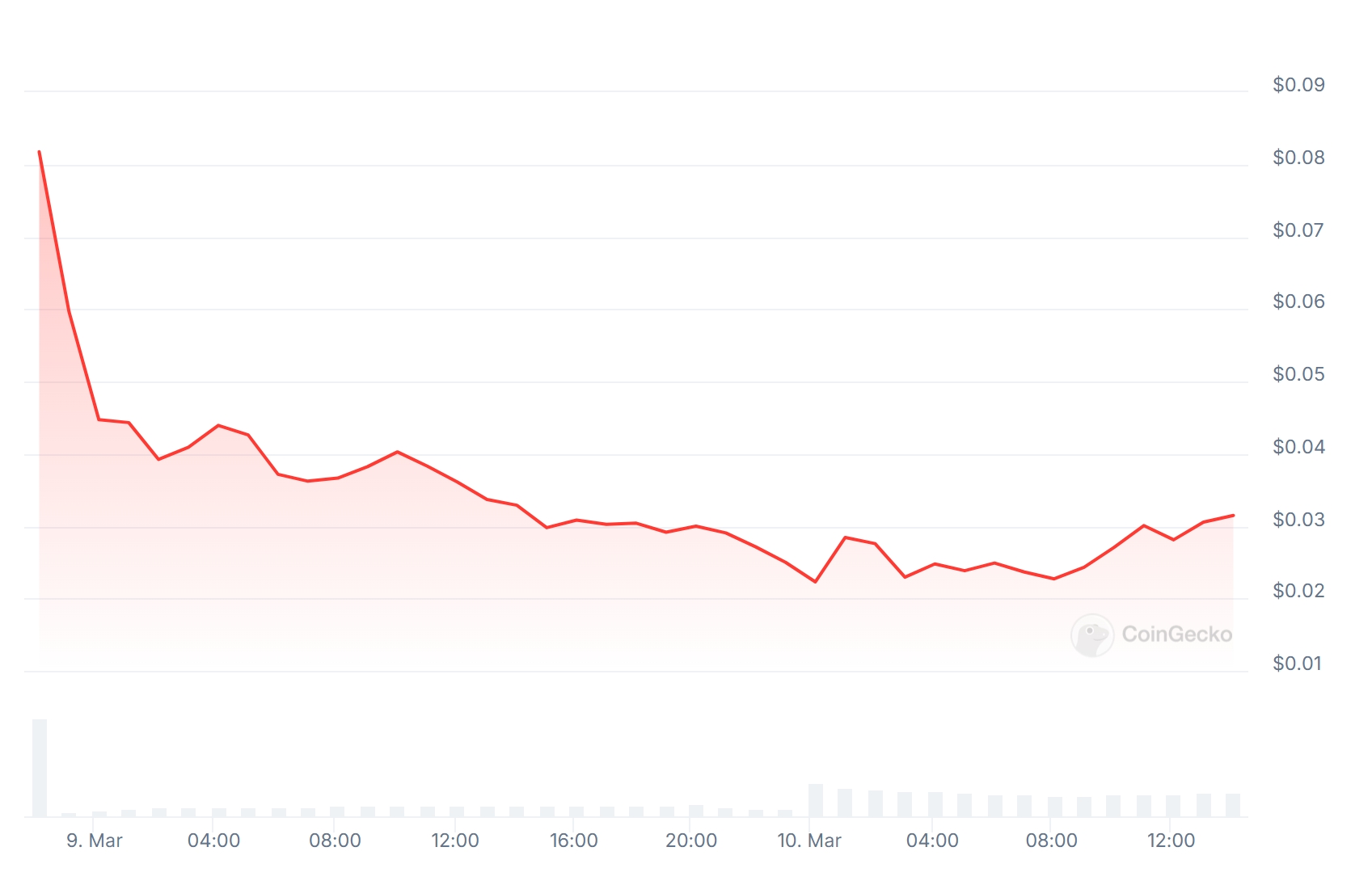

As of February 2025, Cocoro’s price stands at approximately $0.03017, with a 24-hour trading volume of $31,726,675. The token has seen a significant 18.4% price increase in the last 24 hours, showcasing its volatile yet promising market behavior. The fully diluted valuation of Cocoro is estimated at $30,172,224, reflecting the potential for growth as more investors join the bandwagon.

To understand Cocoro’s market dynamics, let’s compare its recent performance to that of Dogecoin. While Dogecoin has experienced a -9.34% drop in the last 24 hours, Cocoro’s surge suggests a different trajectory. This divergence could be attributed to the novelty factor and the strong community backing behind Cocoro.

Technical Analysis and Market Indicators

To provide a comprehensive analysis, let’s dive into some key technical indicators that could help forecast Cocoro’s future movements.

Relative Strength Index (RSI)

Cocoro’s RSI currently stands at around 65, indicating that the token is in a moderately overbought state. This suggests that a potential correction might be on the horizon, but the strong momentum could also propel it further if the buying pressure continues.

Moving Averages

The 50-day moving average for Cocoro is trending upwards, signaling a bullish sentiment. However, the 200-day moving average remains flat, indicating that the long-term trend is yet to be established. Investors should keep an eye on these indicators to gauge the sustainability of Cocoro’s current rally.

Bollinger Bands

Cocoro’s price is currently trading near the upper Bollinger Band, which often suggests that the asset is overbought. However, this can also indicate the beginning of a new trend if the price breaks through the upper band and continues its upward trajectory.

Fibonacci Retracement

Analyzing Cocoro’s recent price movements using Fibonacci retracement levels, we see that the token has found support at the 38.2% level after its recent dip. This could serve as a strong foundation for further growth, especially if the market sentiment remains positive.

Long and Short-Term Predictions

Given the current market conditions and technical indicators, let’s explore both short-term and long-term predictions for Cocoro.

Short-Term Predictions (Next Few Months)

In the short term, Cocoro is likely to experience continued volatility. If the community support remains strong and more exchanges list the token, we could see a price increase to around $0.05 by the end of Q2 2025. However, a potential correction could bring the price down to $0.025 if the market sentiment shifts.

Long-Term Predictions (2025-2030)

Looking further ahead, Cocoro’s long-term potential largely depends on its ability to carve out a unique niche within the meme coin market. If it gains widespread adoption and continues to capture the hearts of crypto enthusiasts, we could see Cocoro reaching $0.10 by the end of 2025 and possibly $0.50 by 2030. However, these projections are speculative and should be taken with a grain of salt.

Trading Strategies and Investment Tips

For beginners looking to invest in Cocoro, here are some practical tips and strategies:

Dollar-Cost Averaging (DCA)

Given Cocoro’s volatility, a DCA strategy can help mitigate risk. By investing a fixed amount regularly, you can average out the price you pay for the token over time, reducing the impact of short-term fluctuations.

Setting Stop-Loss Orders

To protect your investment, consider setting stop-loss orders. This can help you limit potential losses if the price of Cocoro suddenly drops.

Staying Informed

Keep an eye on the latest news and developments related to Cocoro. The crypto market is heavily influenced by sentiment and news, so staying informed can help you make more informed investment decisions.

Comparing Cocoro to Dogecoin

While Cocoro shares a similar origin story with Dogecoin, there are notable differences that could impact their market performance. Dogecoin, launched in 2013, has a more established presence in the crypto market, with a market cap of over $24 billion. In contrast, Cocoro is just starting its journey, with a much smaller market cap.

However, Cocoro’s recent surge and the strong community backing it has received could signal a different trajectory. If Cocoro can capture the same level of enthusiasm and adoption as Dogecoin did in its early days, it could have a significant impact on the meme coin market.

The Future of Meme Coins

The rise of Cocoro highlights the growing influence of meme coins in the crypto market. These tokens, often driven by community sentiment and internet culture, have the potential to disrupt traditional finance and offer new investment opportunities.

As a beginner in the crypto space, understanding the dynamics of meme coins like Cocoro can provide valuable insights into market trends and investment strategies. While the market remains highly speculative, the potential for high returns can be enticing for those willing to take the risk.

Chart Analysis: Cocoro Price Trends

To visually represent Cocoro’s recent price movements, we’ve created an interactive line chart using Recharts, styled with Tailwind CSS. This chart is designed to be responsive and user-friendly, making it easy to understand for beginners. The chart is placed after discussing Cocoro’s market performance to provide a clear visualization of the numerical data mentioned.

The chart uses line chart representation to show Cocoro’s price trends over the past week. The choice of Recharts allows for an interactive and responsive visualization, which is crucial for engaging readers on the WordPress platform. The placement of the chart immediately after discussing market performance ensures that readers can easily connect the numerical data with the visual representation.

Conclusion

Cocoro represents an exciting new chapter in the world of meme coins. With its strong community backing and a unique story, it has the potential to make a significant impact on the crypto market. As a beginner, understanding the nuances of Cocoro and other meme coins can provide valuable insights into the ever-changing landscape of cryptocurrency investments.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.