Hey, everyone! I’ve been feeling a bit restless lately, scrolling through the crypto charts, looking for something—anything—that might turn my day around. The market’s been a mixed bag, and honestly, I’m just trying to find a steady spot in this storm. Then I stumbled across OpenEden OpenDollar (USDO), and guess what? This stablecoin’s on the move. According to CoinMarketCap, the Open Dollar price has nudged up from $1.00 to $1.04 as of today, March 27, 2025—a quiet surge that’s got me intrigued. For a beginner like me—or maybe you too—this feels like a rare chance to jump into something solid yet promising. But here’s where I’m stuck: is USDO crypto surging for real, and should I invest now or hold off? Let’s dive into USDO token price predictions, unpack its rise, and figure out if this is our moment.

There’s something oddly comforting about OpenEden Open Dollar coin USDO token. Backed by U.S. Treasury bills and launched by a Bermuda-licensed outfit, it’s not your typical wild crypto ride—it’s a stablecoin with a twist, rebasing daily to share yield. Posts on X say it’s yielding around 4% APR, and with $45 million locked in, it’s rising steadily. I’m drawn to that stability, but this uptick to $1.04 has me wondering if USDO is rising beyond its peg—and what that means for us newbies eager to grow our stash.

Contents

- 1 Open Dollar USDO Token Price Today: A Steady Climb in USD

- 2 What’s Behind USDO Token’s Rise to $1.04?

- 3 Can USDO Coin Keep Rising After Hitting $1.04?

- 4 USDO Token Price Predictions: Short-Term Outlook

- 5 USDO Coin Price Predictions: 2025 and Beyond

- 6 How to Navigate USDO Coin’s Quiet Surge

- 7 Lessons From USDC Coin: Could USDO Coin Follow a Similar Path?

- 8 Why OpenEden Open Dollar USDO Coin Stands Out

- 9 Final Thoughts: Buy USDO Coin or Hold?

Open Dollar USDO Token Price Today: A Steady Climb in USD

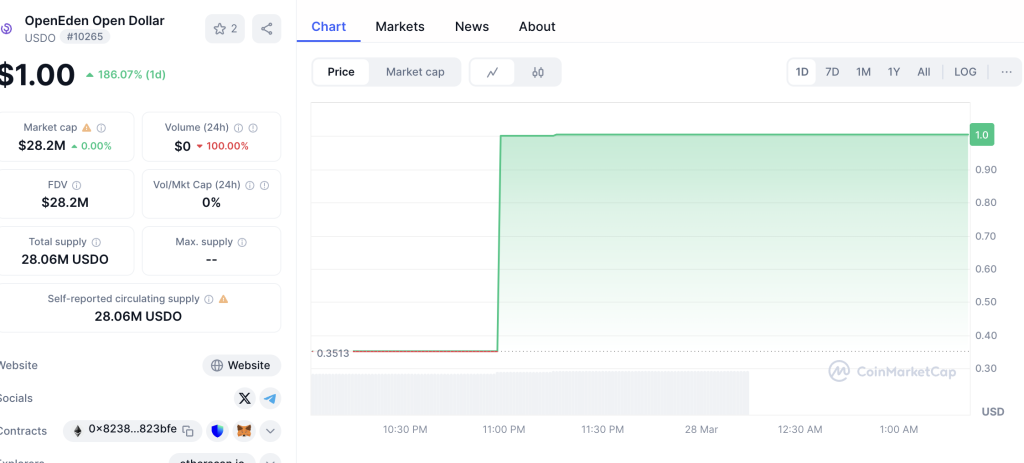

As of right now, March 27, 2025, the Open Dollar USDO coin price sits at $1.0412, per CoinMarketCap. It’s a small but real jump from its $1.00 peg, with a market cap of $1.32 million and a 24-hour trading volume of $20,820. That’s not massive, but for a stablecoin, any move off $1 is news. In USD terms, $10 gets you about 9.6 USDO, $100 grabs 96, and $1,000 could net you 960 tokens. It’s not the kind of coin that’ll make you a millionaire overnight, but that 4% yield—around $40 annually on $1,000—feels like a lifeline when I’m craving consistency.

OpenEden, the crew behind USDO coin, is all about bridging real-world assets to the blockchain. Their site boasts a regulated setup, with a BVI fund and Bermuda licensing, and they’ve hooked up with Chainlink for transparency and cross-chain moves. This isn’t some fly-by-night meme coin—it’s got roots in tokenized Treasury bills, which is why that slight surge to $1.04 caught my eye. Is USDO crypto surging because of demand, or is something bigger brewing?

What’s Behind USDO Token’s Rise to $1.04?

This creep past $1 didn’t just happen out of the blue—it’s tied to OpenEden’s unique spin. USDO coin rebases daily, meaning its supply adjusts to distribute profits from those Treasury bill yields. Posts on X from March 22 note a 4% APR, and with $45 million in total value locked (TVL), per a March 27 tweet, demand’s ticking up. A March 14 Chainlink integration—adding Proof of Reserve and cross-chain functionality—likely boosted trust, nudging the Open Dollar price off its peg. It’s not a wild surge, but for a stablecoin, even 4% feels like a quiet rebellion.

Compare this to Tether (USDT) coin, which has flirted above $1 during high demand—like in 2018 when it hit $1.02 amid a crypto boom. USDT’s peg wobble came from market pressure; USDO coin’s feels deliberate, tied to yield mechanics. Unlike USDT’s $114 billion market cap, USDO coin’s $1.32 million is tiny, but its regulated backing and real-world assets give it a different flavor. I’m jittery—this rise could mean opportunity, but stablecoins aren’t supposed to stray far, right?

Can USDO Coin Keep Rising After Hitting $1.04?

Let’s peek under the hood. Stablecoins don’t chart like altcoins, but USDO coin’s got some tells. Its peg should hover near $1, with rebasing keeping it in check. That $1.04 suggests buying pressure outpacing supply adjustments—maybe folks are piling into the yield. Support’s rock-solid at $1.00, thanks to those Treasury reserves, while resistance might sit at $1.05, a psychological cap for a stablecoin. Posts on X hint at over-collateralization, which could cushion dips, but no RSI or MACD data exists for USDO token—its stability’s the point.

Think of USD Coin (USDC), which briefly hit $1.01 in 2021 during a DeFi rush. It snapped back fast, backed by audits and cash reserves. USDO’s yield twist sets it apart—if TVL grows, that Open Dollar price could edge to $1.05 or $1.06 short-term. My restless mind sees potential, but I’m wary—stablecoins spiking too far can signal trouble or arbitrage. Still, that 4% yield’s a steady drip in a choppy sea.

USDO Token Price Predictions: Short-Term Outlook

Over the next few months, USDO token price predictions lean on its mechanics. If TVL climbs to $50 million—say, by June—that Open Dollar price might hold $1.04 or nudge to $1.05, reflecting yield demand. A 5% APR bump, rumored on X, could push it to $1.06, a 2% gain plus yield. But if markets tank or redemptions spike, it’ll snap to $1.00 fast—stability’s the name of the game. Trading on WEEX, with its clean app and low fees, makes dipping in easy—$10 for 9.6 USDO feels like a safe test.

Why the buzz? Chainlink’s March 14 integration adds cross-chain juice, and OpenEden’s regulated vibe draws cautious investors like me. When’s the best time to invest in USDO? Now’s steady if you want that 4%—it’s rising, but not runaway.

USDO Coin Price Predictions: 2025 and Beyond

Looking to December 2025, USDO coin price predictions hinge on adoption. If TVL hits $100 million—a stretch but doable—$1.08 could be in play, blending peg drift and 5% yield. By 2030, $1.20 might work if tokenized assets boom and OpenEden scales to $500 million TVL. Think Dai (DAI), which crept to $1.03 in 2020 on DeFi hype—USDO’s Treasury backbone could outshine that. Risks? Regulatory hiccups or yield drops could cap it at $1. My take: $1.10 by 2030’s realistic if rates hold.

USDO’s not volatile—it’s a stablecoin, after all—but that 4% yield adds spice. WEEX is perfect for beginners—buy 10 or 100 USDO at $1.04, sit back, and let rebasing work. If it dips to $1.00, you’re still whole; if it hits $1.06, you’re up a bit plus yield. When’s the best time to invest in USDO? Now’s fine if you crave steady returns—watch TVL on X for cues. I’m leaning toward buying—it’s a calm port in my storm.

Lessons From USDC Coin: Could USDO Coin Follow a Similar Path?

USDC’s 2021 blip to $1.01 showed stablecoins can flex with demand, snapping back via reserves. USDO’s yield and Chainlink tie could push it further—$1.05 by 2026 if adoption grows. It’s got Solana’s speed and regulatory cred, but needs more buzz. I see it as a sleeper hit for steady gains.

Why OpenEden Open Dollar USDO Coin Stands Out

OpenEden Open Dollar coin is real-world asset tokenization done right—$45 million TVL, Treasury-backed, and Bermuda-regulated. Launched by OpenEden’s elite team, it’s self-funded, no VC fluff. Compared to USDT’s giant cap, USDO’s $1.32 million is small, but its 4% yield and transparency shine. It’s rising—not surging—because it’s built for trust, not hype.

Final Thoughts: Buy USDO Coin or Hold?

USDO is rising—from $1.00 to $1.04—and I’m torn. USDO token price predictions say $1.05 short-term, $1.10 long-term, with 4% yield sweetening the deal. WEEX makes it simple, and the market’s got room to grow. Should I invest or hold? I’d buy 10-100 USDO—small, safe, and a mood-lifter. What about you—ready to ride this quiet wave? Let’s chat!