There’s arguably no hotter cryptocurrency on the planet right now than Treble (TREB). It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it the top-performing major cryptocurrency. Treble Coin has experienced a rollercoaster ride in recent months, capturing the market’s attention with large price swings and major regulatory developments. On Jan. 16, the token surged to a multi-year high of $0.8132, fueled by strong market sentiment. However, the rally was short-lived. TREB Price Prediction remains a hot topic as investors scrutinize every price movement, and today we dive deep into how these forecasts compare with the emerging promise of a new payments solution. In a landscape filled with volatile digital assets, many wonder, “Would you buy Treble (TREB) at $0.06?”

Contents

Understanding Treble (TREB) Coin

Treble (TREB) Coin is not just another cryptocurrency. It’s the first modular V4 Decentralized Exchange (DEX) on the Base blockchain, providing a full-suite DeFi Hub designed to meet the needs of both retail and institutional users. With its DeFAI features, Treble offers a seamless experience that includes cross-chain swaps, fiat on/off ramps, CEX onramps, no-KYC crypto spending, and farming & staking opportunities. Treble is your one-stop-shop for everything DeFi, bringing efficiency, flexibility, and accessibility to the Base ecosystem.

Analyzing Treble (TREB) Coin’s Recent Price Drop

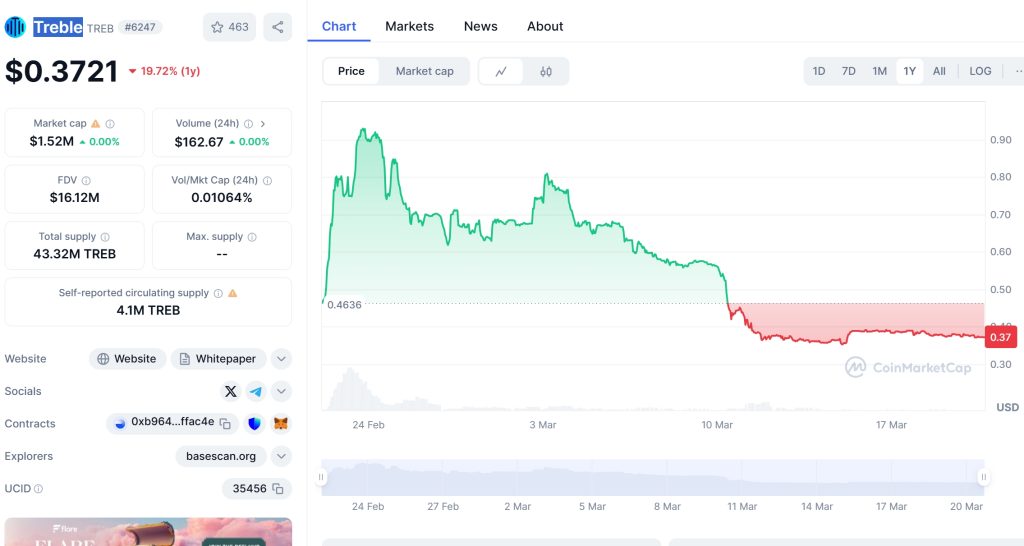

Treble (TREB) Coin recently experienced a significant price drop from its all-time high of $0.8132 on March 2, 2025, to its current price of $0.3796. This drop has left many investors puzzled and eager for insights into what might happen next.

Can Treble (TREB) Recover After Dropping to $0.3796?

To understand if Treble (TREB) can recover, let’s look at a similar cryptocurrency that experienced a comparable price movement in the past—XRP. XRP faced a dramatic price drop following the SEC lawsuit in late 2020, plummeting from around $0.70 to $0.17. However, after the lawsuit’s resolution in July 2023, XRP not only recovered but surged to new highs, reaching $3.39 in January 2025. The recovery was driven by positive regulatory news and increased institutional interest.

Treble (TREB), on the other hand, has not faced similar regulatory challenges but has been affected by broader market sentiment and liquidity issues. The current market cap of Treble is $1.56 million, with a 24-hour trading volume of just $109.18, indicating low liquidity. This low liquidity can exacerbate price volatility, making the coin more susceptible to sharp declines.

What Caused Treble (TREB)’s Price Drop, and Will It Bounce Back?

The primary reason for Treble’s recent price drop appears to be a combination of market correction and liquidity concerns. After reaching its peak, the market naturally corrected itself, leading to a sell-off. Additionally, the low trading volume suggests that there might not be enough buying pressure to support the price at higher levels.

However, there are signs that Treble (TREB) could bounce back. The coin’s unique features, such as cross-chain swaps and no-KYC crypto spending, position it well within the DeFi space. As more users and developers become aware of these features, demand could increase, potentially leading to a price recovery.

Lessons From XRP: Could Treble (TREB) Follow a Similar Path?

XRP’s recovery journey offers valuable lessons for Treble (TREB). While Treble hasn’t faced the same regulatory hurdles, the importance of community support, technological advancements, and market sentiment cannot be overstated. XRP’s recovery was bolstered by a strong community and positive developments within the Ripple ecosystem.

Treble (TREB) could follow a similar path if it continues to develop its platform and increase liquidity. The coin’s current sentiment is bearish, with a Fear & Greed Index of 32, indicating fear in the market. However, if Treble can attract more users and increase its trading volume, the sentiment could shift, paving the way for a recovery.

Navigating the volatility of Treble (TREB) requires a strategic approach. For beginners, it’s crucial to understand the following key indicators:

- RSI (Relative Strength Index): Currently at 9.28, indicating an oversold market, which could be a buying opportunity.

- MACD (Moving Average Convergence/Divergence): This indicator can help identify trend reversals. A positive crossover could signal a potential uptrend.

- Bollinger Bands: These can help gauge volatility. When the bands contract, it often precedes a significant price move.

- Moving Averages: The 50-day and 200-day moving averages can provide insights into long-term trends. A crossover above these averages could indicate a bullish trend.

- Fibonacci Retracements: These levels can help identify potential support and resistance zones. A retracement to the 61.8% level could be a significant support level for Treble.

Long and Short-Term Predictions for Treble (TREB)

Short-Term Predictions

In the short term, Treble (TREB) could see some volatility due to its low liquidity. However, if the coin can increase its trading volume and attract more users, we might see a price increase. The current price of $0.3796 is significantly lower than its all-time high, suggesting there could be room for growth. A target of $0.50 by the end of Q2 2025 seems feasible if market conditions improve.

Long-Term Predictions

Looking further ahead, Treble (TREB) has the potential to reach $1 by the end of 2025. This prediction is based on the coin’s unique features and the growing interest in DeFi solutions. If Treble can continue to innovate and expand its user base, it could see significant growth over the next few years. By 2030, a price of $5 could be within reach if the DeFi sector continues to expand and Treble maintains its competitive edge.

Actionable Insights for Investors

For investors looking to navigate Treble (TREB)’s volatility, here are some actionable insights:

- Diversify: Don’t put all your eggs in one basket. Consider diversifying your portfolio to mitigate risk.

- Stay Informed: Keep an eye on market news and developments within the Treble ecosystem. Positive news could drive the price up.

- Use Technical Analysis: Utilize tools like RSI, MACD, and moving averages to make informed trading decisions.

- Set Realistic Expectations: Understand that cryptocurrency markets are highly volatile. Set realistic goals and be prepared for fluctuations.

Conclusion

Treble (TREB) Coin has shown remarkable growth and potential within the DeFi space. Despite its recent price drop, the coin’s unique features and the growing interest in DeFi suggest that it could recover and even reach new heights. By understanding the market indicators and staying informed, investors can navigate Treble’s volatility and potentially reap significant rewards. Keep an eye on Treble (TREB) as it continues to develop and expand its offerings in the ever-evolving world of cryptocurrency.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.