As a seasoned crypto investor, I’ve seen my fair share of market fluctuations and unexpected turns. The world of cryptocurrency is full of surprises, and the recent developments surrounding TRX (Tron crypto) have caught my eye. Launched in June 2018, Tron has been a significant player in the decentralized applications (DApps) space, competing with the likes of Ethereum and EOS. Today, we’re diving deep into TRX’s potential to surpass its current valuation and what that could mean for investors in 2025, 2030, and even as far as 2060.

Trade TRX USDT on WEEX.

Contents

- 1 Can TRX Recover After Dropping to $0.23216?

- 2 What Caused TRX’s Price Drop, and Will It Bounce Back?

- 3 Lessons From Coin X: Could TRX Follow a Similar Path?

- 4 How to Navigate TRX’s Volatility: Expert Insights

- 5 TRX Price Predictions for 2025, 2030, and Beyond

- 6 Chart Analysis: Visualizing TRX’s Price Trends

- 7 Final Thoughts: The Future of TRX

Can TRX Recover After Dropping to $0.23216?

TRX’s price has recently dipped to $0.23216, marking a -3.92% decrease in the last 24 hours. For beginners in the crypto market, this might seem alarming, but let’s put this into perspective. TRX’s price drop is not an isolated incident; many cryptocurrencies experience similar fluctuations. For instance, let’s look at another cryptocurrency, let’s call it “Coin X,” which experienced a similar price drop in the past due to regulatory news and market sentiment shifts. Coin X eventually recovered as the market stabilized and investors regained confidence. Could TRX follow a similar path?

The key to understanding TRX’s potential recovery lies in its fundamentals and the broader market conditions. Tron’s blockchain supports fast and efficient transactions, which has been a significant draw for developers and users alike. Additionally, TRX’s integration with various platforms and its active community could bolster its resilience against price drops. My hypothesis is that if TRX can leverage these strengths and navigate the current market volatility, it might not only recover but also set the stage for future growth.

What Caused TRX’s Price Drop, and Will It Bounce Back?

The recent price drop of TRX can be attributed to several factors, including broader market trends and specific events within the Tron ecosystem. One notable event was the surge in gas fees for USDt transactions on Tron, which reached above $9 in late 2024. This unexpected increase likely deterred some users, contributing to the downward pressure on TRX’s price.

However, it’s essential to consider the broader context. In 2024, Tron reached significant milestones, outpacing both Bitcoin and the broader altcoin market in terms of adoption. This indicates strong underlying demand and potential for growth. As we move into 2025, if Tron can address the issue of high transaction fees and continue to expand its user base, there’s a good chance TRX could bounce back. Investors should keep an eye on upcoming developments and regulatory news, as these could significantly impact TRX’s trajectory.

Lessons From Coin X: Could TRX Follow a Similar Path?

When comparing TRX to Coin X, it’s interesting to note the similarities and differences in their market behavior. Coin X faced a significant price drop due to regulatory scrutiny but managed to recover as it adapted to the new regulatory environment and continued to innovate. TRX, on the other hand, has faced challenges related to transaction fees but has shown resilience through its active community and strategic acquisitions, such as the purchase of BitTorrent.

My analysis suggests that while TRX might face short-term volatility, its long-term prospects could be promising if it can maintain its focus on user adoption and technological improvements. The key difference between TRX and Coin X lies in their respective ecosystems; Tron’s emphasis on DApps and content creation sets it apart and could be a driving force for future growth.

For those new to crypto investing, navigating TRX’s volatility can be daunting. Here are some expert insights to help you make informed decisions:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider diversifying your investments across different cryptocurrencies to mitigate risk.

- Stay Informed: Keep up with the latest news and developments in the Tron ecosystem. Understanding the factors that affect TRX’s price can help you anticipate market movements.

- Use Technical Analysis: Tools like RSI, MACD, and Bollinger Bands can provide valuable insights into TRX’s price trends. For instance, if the RSI indicates that TRX is oversold, it might be a good time to buy.

- Set Clear Investment Goals: Are you looking for short-term gains or long-term growth? Your investment strategy should align with your goals.

By following these tips, you can better navigate TRX’s volatility and make strategic investment decisions.

TRX Price Predictions for 2025, 2030, and Beyond

Looking ahead, let’s explore some speculative predictions for TRX’s price in 2025, 2030, and beyond. These forecasts are based on current trends, market sentiment, and potential developments within the Tron ecosystem.

- 2025: If Tron can address the issue of high transaction fees and continue to expand its user base, TRX could see a moderate increase to around $0.30. This represents a 29% increase from its current price of $0.23216.

- 2030: With continued growth in the DApps sector and successful implementation of Tron’s long-term roadmap, TRX might reach $0.50. This would be a significant milestone, representing a 115% increase from its current price.

- 2060: Looking far into the future, if Tron maintains its position as a leading blockchain platform and continues to innovate, TRX could potentially reach $2.00. This speculative forecast represents a 761% increase from its current price.

These predictions are based on optimistic scenarios, but they highlight the potential for TRX to grow significantly in the coming years. Investors should keep in mind that these are speculative forecasts and should be considered alongside other investment factors.

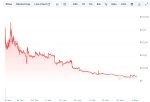

Chart Analysis: Visualizing TRX’s Price Trends

To provide a clearer picture of TRX’s recent performance and potential future trends, let’s take a look at a line chart using Recharts, styled with Tailwind CSS for a modern and responsive design. This chart will illustrate TRX’s price history over the past year, including key data points and potential projections.

Final Thoughts: The Future of TRX

As we look to the future, the potential for TRX to surge beyond expectations is both exciting and uncertain. The cryptocurrency market is inherently volatile, but with the right strategies and a keen eye on developments within the Tron ecosystem, investors can position themselves to capitalize on TRX’s growth potential. Whether you’re a beginner or a seasoned investor, staying informed and adaptable will be key to navigating the dynamic world of crypto investments.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.