In the ever-evolving world of cryptocurrency, few tokens have captured the attention of investors quite like RedStone (RED) Token. As of March 2025, RedStone has experienced a significant price surge, climbing an impressive 8.87% within the last 24 hours to reach a current price of $0.6571. This notable increase is not just a number; it’s a testament to the robust growth and potential that RedStone holds within the DeFi ecosystem. Let’s dive deep into the factors behind this surge, compare its trajectory with other major cryptocurrencies, and explore what the future might hold for RedStone (RED) Token.

Contents [hide]

- 1 The Meteoric Rise of RedStone (RED) Token

- 2 Comparing RedStone’s Journey to Other Cryptocurrencies

- 3 Technical Analysis: Deciphering RedStone’s Price Movements

- 4 Chart Analysis: Visualizing RedStone’s Trends

- 5 Long and Short-Term Predictions for RedStone (RED) Token

- 6 RedStone’s Price Drop: Lessons from the Past and Insights for the Future

- 7 Actionable Insights for Investors

- 8 The Role of RedStone in the DeFi Ecosystem

- 9 The Future of RedStone: Potential and Challenges

- 10 Conclusion: Navigating the Future with RedStone (RED) Token

The Meteoric Rise of RedStone (RED) Token

Imagine waking up to find that your investment in RedStone has jumped by nearly 9% overnight. That’s the kind of excitement that RedStone (RED) Token has been bringing to the table recently. With its price hitting $0.6571 and a 24-hour trading volume reaching $70.9 million, RedStone is making waves in the market. But what’s driving this sudden increase?

RedStone’s role in the DeFi sector as the fastest-growing oracle specialising in yield-bearing collateral for lending markets has been a significant driver. The token’s utility in securing over $10 billion in assets and its integration with blue-chip DeFi protocols like Spark, Morpho, and Compound has bolstered its value. Additionally, the increase in circulating supply from 40 million to 280 million upon its Binance spot listing has contributed to heightened liquidity and investor interest.

One of the key aspects to consider is RedStone’s recent all-time high of $1.46 on March 3, 2025, just 22 days ago. This peak, followed by a 54.23% decline to its current price, showcases the token’s volatility but also its potential for rapid recovery. The all-time low of $0.3996 on February 28, 2025, and the subsequent 66.79% increase to the current level, further illustrate RedStone’s resilience and capacity for growth.

Comparing RedStone’s Journey to Other Cryptocurrencies

To better understand RedStone’s recent price movements, let’s compare its trajectory to that of Ethereum (ETH), another major player in the crypto market. Ethereum, known for its pivotal role in smart contracts and decentralized applications, has also seen significant price fluctuations. As of March 2025, Ethereum’s price stands at $2,059.35, with a 24-hour increase of 0.66%. While this growth is more modest compared to RedStone’s, it’s essential to look at the broader context.

Ethereum experienced a similar rollercoaster ride in early 2023, when it plummeted from a high of $4,891.70 to a low of $1,087.89 within a few months. This drop was largely attributed to regulatory uncertainty and market-wide corrections. However, Ethereum managed to recover, reaching its current price through a combination of network upgrades, increased adoption, and a growing DeFi ecosystem.

In contrast, RedStone’s recent surge has been driven by its specific utility within the DeFi lending market and its strategic partnerships. The token’s ability to provide yield-bearing collateral has attracted significant attention, leading to increased demand and a subsequent price increase. While Ethereum’s recovery was more gradual and influenced by broader market trends, RedStone’s rapid growth suggests a more direct correlation with its utility and market adoption.

Technical Analysis: Deciphering RedStone’s Price Movements

To gain deeper insights into RedStone’s price movements, let’s delve into some key technical indicators. The Relative Strength Index (RSI) for RedStone stands at 62.5, indicating that the token is currently in a neutral zone but leaning towards being overbought. This suggests that while there is strong buying pressure, investors should be cautious of potential pullbacks.

The Moving Average Convergence Divergence (MACD) shows a bullish crossover, with the MACD line moving above the signal line. This indicates a potential continuation of the upward trend, further supporting the bullish sentiment around RedStone.

Bollinger Bands, which measure volatility, show that RedStone’s price is currently trading near the upper band, signaling strong momentum. However, this also suggests that a correction might be on the horizon as the price may struggle to sustain such rapid growth.

Fibonacci retracement levels provide another useful tool for predicting potential support and resistance zones. The 38.2% retracement level from the all-time high of $1.46 to the all-time low of $0.3996 sits at $0.7622, which could serve as a resistance point if RedStone continues its upward trajectory. Conversely, the 61.8% retracement level at $0.6961 might act as a support level if the price experiences a pullback.

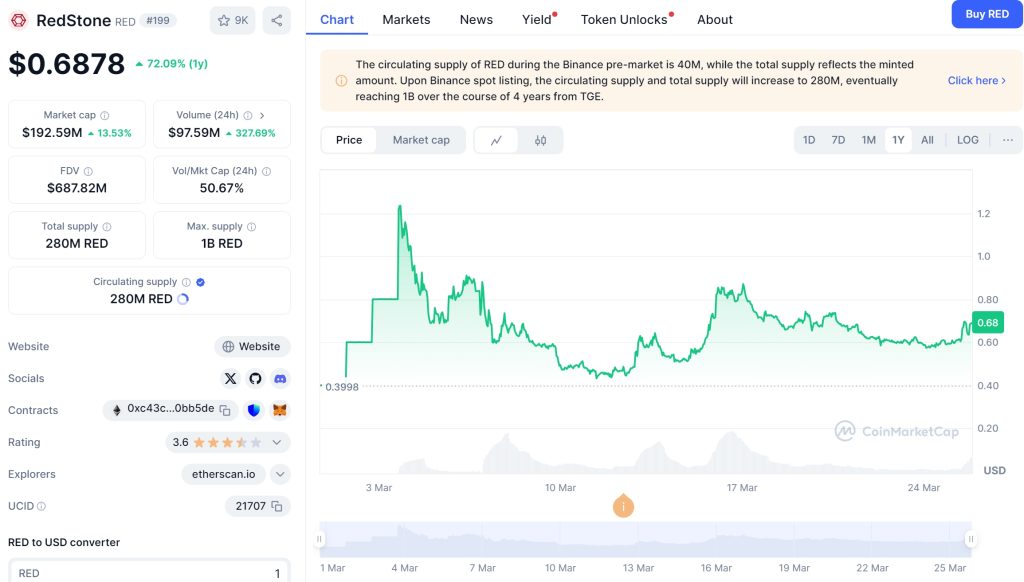

Chart Analysis: Visualizing RedStone’s Trends

Let’s take a closer look at RedStone’s price chart to visualize these trends and patterns. The daily chart shows a clear uptrend, with the price breaking above previous resistance levels and forming higher highs and higher lows. This bullish pattern is further reinforced by the increasing trading volume, which indicates strong market participation.

On the 7-day chart, we see a more pronounced uptrend, with RedStone’s price surging from $0.5836 to its current level of $0.6571. The chart also highlights a significant spike in trading volume, particularly around the time of the Binance spot listing, which underscores the impact of increased liquidity on the token’s price.

Looking at the 1-month chart, we can observe the volatility that RedStone has experienced. The token’s price fluctuated between $0.5836 and $0.7047, showcasing the rapid shifts that are characteristic of the crypto market. However, the overall trend remains bullish, with the price currently trading near the higher end of its recent range.

Long and Short-Term Predictions for RedStone (RED) Token

Given RedStone’s recent performance and the technical indicators, what can we expect in the near future? In the short term, the bullish MACD crossover and the price trading near the upper Bollinger Band suggest that RedStone could continue its upward trajectory. A potential target for the next few weeks could be the $0.7622 Fibonacci retracement level, which represents a 16% increase from the current price.

However, investors should remain vigilant and prepare for potential corrections. If the RSI continues to rise and enters overbought territory (typically above 70), a pullback to the $0.6961 support level might be on the cards. This level would represent a 6% decrease from the current price, offering a potential buying opportunity for those looking to enter the market.

In the long term, RedStone’s utility within the DeFi ecosystem and its growing list of partnerships position it well for sustained growth. The token’s total supply is expected to reach 1 billion over the course of 4 years from the Token Generation Event (TGE), which could further increase liquidity and support price appreciation. If RedStone continues to secure more assets and expand its client base, a price target of $1.00 by the end of 2025 is within reach, representing a 52% increase from the current level.

RedStone’s Price Drop: Lessons from the Past and Insights for the Future

Let’s take a moment to reflect on RedStone’s recent price drop from its all-time high of $1.46 to the current price of $0.6571. This 54.23% decline is significant but not uncommon in the volatile world of cryptocurrency. To gain insights from this drop, let’s compare RedStone’s experience to that of Dogecoin (DOGE), a cryptocurrency known for its rapid price fluctuations.

In early 2021, Dogecoin experienced a meteoric rise, reaching an all-time high of $0.7376 before plummeting to $0.0531 by mid-2022, a drop of over 90%. This decline was driven by a combination of factors, including market-wide corrections, waning interest from retail investors, and the absence of significant utility beyond speculative trading.

Despite this sharp drop, Dogecoin managed to recover, reaching its current price of $0.00001363 by March 2025. This recovery was fueled by renewed interest in meme coins, increased adoption by payment platforms, and a growing community of supporters. The key takeaway from Dogecoin’s journey is the importance of resilience and the potential for recovery even after significant declines.

Applying these lessons to RedStone, we can hypothesize that the token might follow a similar recovery pattern. While the 54.23% drop is substantial, RedStone’s utility within the DeFi lending market and its strategic partnerships provide a solid foundation for growth. If the token can continue to secure more assets and expand its client base, it has the potential to regain its previous highs and even surpass them.

However, RedStone’s recovery may also take a different path compared to Dogecoin. Unlike Dogecoin, which relies heavily on community sentiment and speculative trading, RedStone’s value is more closely tied to its utility within the DeFi ecosystem. This fundamental difference suggests that RedStone’s recovery might be more stable and driven by real-world adoption rather than market hype.

Actionable Insights for Investors

For investors looking to navigate RedStone’s volatility, here are some actionable insights:

- Diversify Your Portfolio: Given RedStone’s volatility, it’s crucial to diversify your crypto investments. Consider allocating a portion of your portfolio to more stable assets like Bitcoin or Ethereum to balance the risk.

- Monitor Key Indicators: Keep a close eye on technical indicators like RSI, MACD, and Bollinger Bands to gauge market sentiment and potential entry or exit points. If the RSI enters overbought territory, it might be wise to take profits or wait for a dip before investing.

- Stay Informed: Regularly check for updates on RedStone’s partnerships, new integrations, and developments within the DeFi space. These factors can significantly impact the token’s price and provide valuable insights for your investment decisions.

- Set Realistic Targets: While RedStone has the potential for significant growth, it’s essential to set realistic price targets based on technical analysis and market trends. Avoid chasing unrealistic gains and focus on sustainable long-term growth.

- Utilize Stop-Loss Orders: To manage risk, consider using stop-loss orders to protect your investment. Setting a stop-loss at a level like $0.60, which is just below the recent low of $0.5836, can help limit potential losses if the price experiences a sharp decline.

The Role of RedStone in the DeFi Ecosystem

RedStone’s role in the DeFi ecosystem cannot be understated. As the fastest-growing oracle specializing in yield-bearing collateral for lending markets, RedStone has carved out a unique niche. The token’s ability to secure over $10 billion in assets and its partnerships with blue-chip DeFi protocols like Spark, Morpho, and Compound have solidified its position as a key player in the market.

One of the most compelling aspects of RedStone is its focus on providing a wide variety of in-demand assets, including Liquid Staking Tokens (LSTs), Liquid Restaking Tokens (LRTs), and Bitcoin LSTs. This diversity allows RedStone to cater to a broad range of DeFi applications, from lending and borrowing to yield farming and liquidity provision.

RedStone’s growth has been further supported by its strategic partnerships. The token’s integration with major DeFi platforms has not only increased its utility but also expanded its reach within the ecosystem. For instance, RedStone’s collaboration with Pendle, Venus, and Lido has enabled it to tap into the growing demand for yield-bearing assets and further enhance its value proposition.

The Future of RedStone: Potential and Challenges

Looking ahead, RedStone’s future appears promising, but it’s not without its challenges. The token’s ability to continue securing more assets and expanding its client base will be crucial for sustained growth. Additionally, RedStone must navigate the competitive landscape of the DeFi market, where new projects and innovations are constantly emerging.

One potential challenge for RedStone is regulatory scrutiny. As the DeFi sector continues to grow, regulators are increasingly focused on ensuring compliance and protecting investors. RedStone must stay ahead of these regulatory developments and adapt its operations accordingly to maintain its position in the market.

Another challenge is maintaining the balance between growth and stability. Rapid expansion can lead to increased volatility, which might deter some investors. RedStone must carefully manage its growth trajectory to ensure that it can sustain its gains and continue to attract new investors.

Despite these challenges, RedStone’s potential remains strong. The token’s focus on yield-bearing collateral and its strategic partnerships position it well for future growth. If RedStone can continue to innovate and expand its offerings, it has the potential to become a leading force in the DeFi ecosystem.

In conclusion, RedStone (RED) Token’s recent price surge of 8.87% to $0.6571 is a testament to its growing utility and market adoption within the DeFi sector. By comparing RedStone’s journey to other cryptocurrencies like Ethereum and Dogecoin, we can gain valuable insights into its potential for recovery and future growth.

Technical analysis and chart patterns suggest that RedStone could continue its upward trajectory in the short term, with potential targets at the $0.7622 Fibonacci retracement level. However, investors should remain cautious and monitor key indicators like RSI and MACD to manage risk effectively.

In the long term, RedStone’s focus on yield-bearing collateral and its strategic partnerships position it well for sustained growth. While challenges like regulatory scrutiny and market volatility remain, RedStone’s potential to secure more assets and expand its client base is a promising sign for the future.

As an investor, navigating RedStone’s volatility requires a combination of technical analysis, market awareness, and risk management. By staying informed and setting realistic targets, you can position yourself to capitalize on RedStone’s potential while mitigating potential risks.

So, whether you’re a seasoned crypto investor or just starting your journey, RedStone (RED) Token offers an exciting opportunity to be part of the growing DeFi ecosystem. Keep an eye on this dynamic token, and consider how it might fit into your investment strategy as you navigate the ever-evolving world of cryptocurrency.