Hey my friends. In the high-stakes world of cryptocurrency trading, where fortunes are made and lost in moments, the story of a whale who turned the tables on a team of hunters has captured the attention of investors worldwide. This tale isn’t just an intriguing narrative—it also offers critical lessons for traders, investors, and market participants about the dynamics of leverage, market manipulation, and risk management. Let’s delve into the details of what happened, analyze the strategies involved, and explore actionable insights for crypto investors.

Contents

The Incident: How It All Began

On the surface, this story begins with a bold move: a whale (a term used to describe an individual or entity with significant holdings in cryptocurrency) shorted Bitcoin ($BTC) with 40x leverage. This high-risk, high-reward strategy caught the attention of the crypto community, especially when a team, led by @Cbb0fe, publicly announced their intention to “hunt” the whale.

The goal of the hunt was straightforward: drive the price of $BTC above a critical threshold to force the whale into liquidation. Liquidation occurs when a trader’s position margin falls below the required maintenance level, leading to the automatic closure of the position. For a short position, this happens when the asset’s price rises significantly.

The Hunt in Action

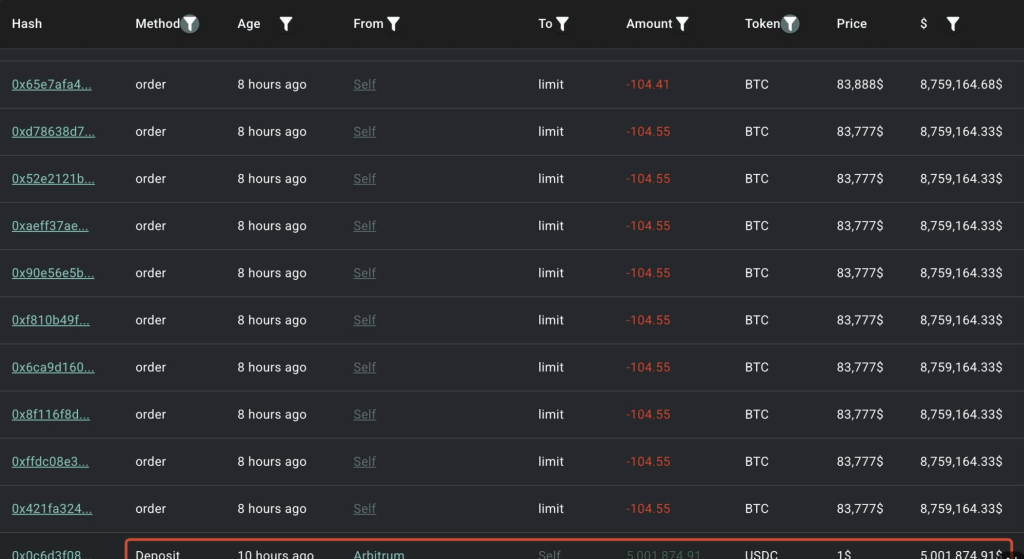

Just one hour after the team’s formation, the hunters sprang into action. They successfully drove $BTC above $84,690—a remarkable feat in a short period. This price surge put immense pressure on the whale, who was forced to deposit an additional $5 million in USDC to increase their margin and avoid liquidation.

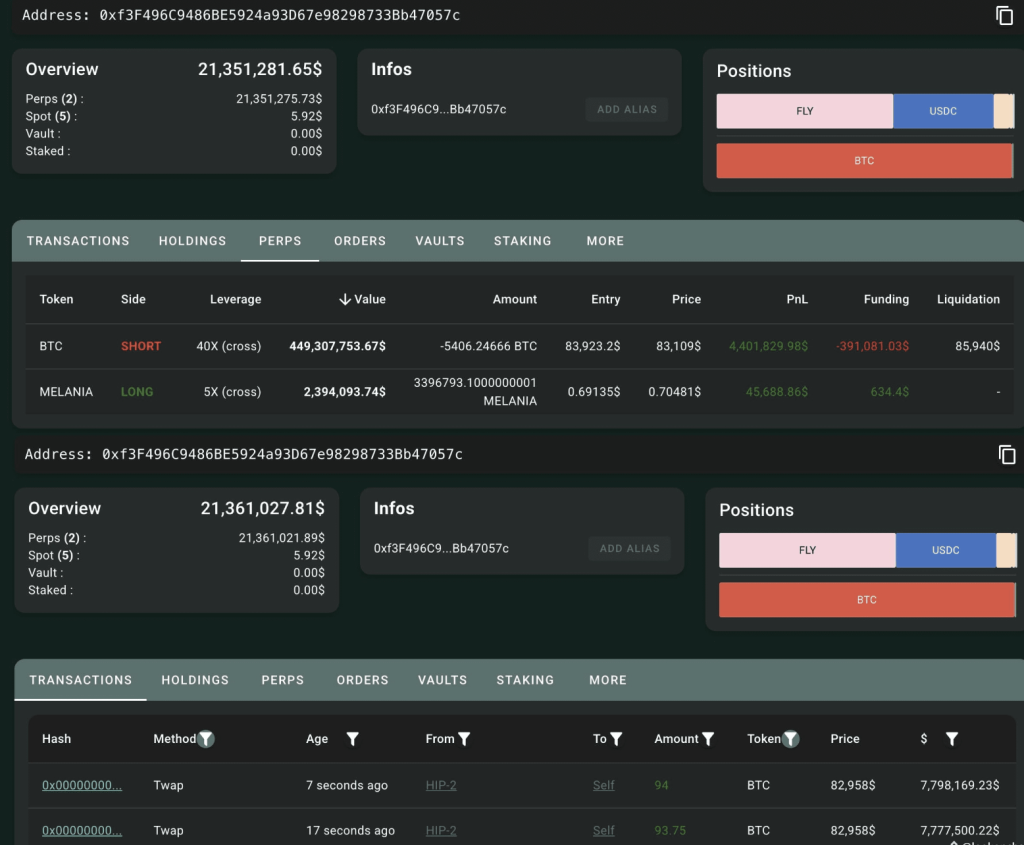

However, the hunt ultimately failed. Despite the coordinated effort, the whale managed to not only survive but also profit. By strategically increasing their position to short $BTC further, the whale turned the tables on the hunters. As of now, the whale holds a position of 5,406 $BTC (valued at $449 million) with an unrealized profit of $4.4 million. The whale is currently closing positions using the Time-Weighted Average Price (TWAP) strategy—a sophisticated approach to minimize market impact.

Analyzing the Whale’s Strategy

To understand how the whale outmaneuvered the hunters, we need to break down their strategy into key components:

1. Understanding Leverage and Risk

The whale’s initial move to short $BTC with 40x leverage was undoubtedly risky. Leverage amplifies both potential gains and losses, making it a double-edged sword. However, the whale likely had a deep understanding of market conditions and was prepared for the risks involved.

2. Margin Management

When the price of $BTC surged, the whale quickly deposited $5 million in USDC to increase their margin. This move demonstrated their preparedness and ability to adapt to market conditions. Effective margin management is crucial for leveraged trading, as it allows traders to avoid forced liquidation and maintain control over their positions.

3. Strategic Positioning

Instead of panicking, the whale doubled down on their short position. This move may seem counterintuitive, but it was likely based on a thorough analysis of market trends and sentiment. By increasing their position, the whale was able to capitalize on subsequent price movements.

4. Using TWAP for Position Closure

The whale’s use of the TWAP strategy to close positions is a testament to their sophistication as a trader. TWAP involves executing trades at regular intervals over a specified period, which helps to minimize market impact and reduce slippage. This approach ensures that the whale can exit their position without causing significant price fluctuations.

Lessons for Crypto Investors

This incident offers several valuable lessons for crypto investors, regardless of their experience level:

1. The Risks of Leverage

Leverage can be a powerful tool, but it should be used with caution. Traders must understand the risks involved and have a clear plan for managing margin requirements and potential losses.

2. The Importance of Risk Management

Effective risk management is crucial for success in crypto trading. This includes setting stop-loss orders, maintaining adequate margin, and avoiding overexposure to a single position.

3. Market Dynamics and Manipulation

The coordinated effort to drive up the price of $BTC highlights the potential for market manipulation in the crypto space. Investors should be aware of these dynamics and avoid making impulsive decisions based on short-term price movements.

4. The Role of Advanced Strategies

Sophisticated strategies like TWAP can provide a significant edge in the market. Investors should take the time to learn about these techniques and consider incorporating them into their trading arsenal.

What This Means for the Crypto Market

This incident underscores the complexity and unpredictability of the crypto market. It also highlights the growing influence of large players, such as whales, who have the resources and expertise to navigate even the most challenging market conditions.

For retail investors, this serves as a reminder to approach crypto trading with caution and to prioritize education and risk management. The crypto market is not a level playing field, and understanding the strategies employed by larger players can help investors make more informed decisions.

The Role of Crypto Exchanges: Why WEEX Stands Out

In the fast-paced world of crypto trading, having the right platform can make all the difference. This is where WEEX, one of the best crypto trading platforms, comes into play. WEEX offers a range of features that cater to both novice and experienced traders, including:

- User-Friendly Interface: WEEX provides an intuitive platform that makes it easy for users to execute trades and manage their portfolios.

- Advanced Trading Tools: From leverage options to risk management tools, WEEX equips traders with everything they need to succeed.

- Security and Reliability: With robust security measures and a track record of reliability, WEEX ensures that users can trade with confidence.

- Educational Resources: WEEX offers a wealth of educational materials to help users improve their trading skills and stay informed about market trends.

By choosing a platform like WEEX, investors can gain access to the tools and resources they need to navigate the complexities of the crypto market.

Conclusion

The story of the whale who outsmarted the hunters is a fascinating example of the challenges and opportunities in the crypto market. It highlights the importance of strategy, risk management, and adaptability in the face of adversity.

For investors, this incident serves as a valuable case study and a reminder to approach crypto trading with caution and preparation. By learning from the strategies employed by successful traders and leveraging the features of platforms like WEEX, investors can position themselves for success in this dynamic and rapidly evolving market.

Whether you’re a seasoned trader or just starting your crypto journey, the lessons from this incident and the resources offered by WEEX can help you make more informed and confident investment decisions. The crypto market may be unpredictable, but with the right tools and mindset, you can navigate its challenges and seize its opportunities.