As we delve into the world of cryptocurrencies, there’s arguably no hotter topic on the planet right now than stablecoins, and the USD DWIN (USDW) token is at the forefront of this discussion. It’s now up more than 140% during the past three months, and shows no signs of stopping anytime soon. In 2025, it’s already up 14%, making it one of the top-performing stablecoins. But what’s behind this surge, and where might it lead in the coming years?

Let’s explore the journey of USDW, a stable digital currency operated by Dwin Intertrade Company Limited. The core idea behind USDW is simple yet powerful: 1 USDW equals 1 USD. This stability is backed by assets collateralized in dollars by Investment Bank Limited, Malaysia, which reports to the relevant authorities weekly. This means that every week, the account undergoes a financial audit, providing a level of security that’s often absent in the volatile world of cryptocurrencies. For those new to crypto investing, this kind of stability can be a reassuring entry point into the market.

Contents

- 1 The Rise of USDW: A Closer Look at Its Stability and Market Performance

- 2 Comparing USDW to Other Stablecoins: Insights and Trends

- 3 Analyzing USDW’s Price Movements: Technical Insights and Market Sentiment

- 4 Long and Short-Term Predictions for USDW: Where Might It Go?

- 5 Navigating USDW’s Volatility: Expert Insights for Investors

- 6 Conclusion: The Future of USDW and Stablecoins

The Rise of USDW: A Closer Look at Its Stability and Market Performance

When we talk about the rise of USDW, it’s crucial to understand the context of the stablecoin market. Stablecoins are designed to minimize the volatility often associated with cryptocurrencies, offering a more predictable value relative to a fiat currency like the US dollar. USDW’s peg to the US dollar provides this stability, making it an appealing choice for investors looking to hedge against the wild swings of other cryptocurrencies.

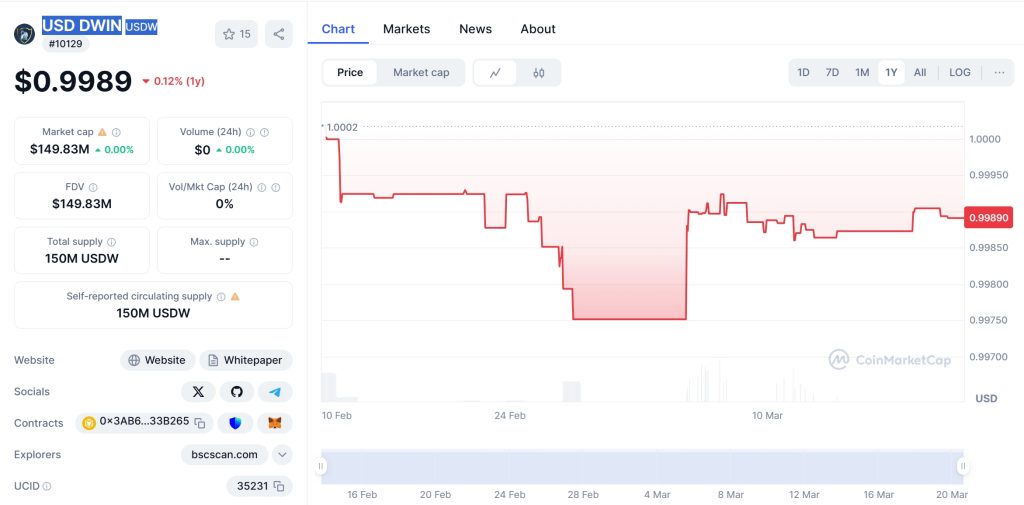

As of March 2025, the live USDW price today stands at $0.9989, with a 24-hour trading volume that remains steady. This reflects the token’s commitment to maintaining its dollar peg, even as the broader crypto market experiences fluctuations. The total supply of USDW is capped at 150 million, which contributes to its stability by preventing inflationary pressures.

One of the key aspects to consider is the market cap of USDW, which currently sits at $149.83 million. This figure, while modest compared to some of the giants in the crypto space, underscores the token’s growing acceptance and utility within the ecosystem. It’s a testament to the trust that users place in USDW’s stability and the rigorous auditing process that underpins it.

Comparing USDW to Other Stablecoins: Insights and Trends

To fully appreciate USDW’s journey, let’s compare it to another prominent stablecoin, Tether (USDT). Both USDW and USDT aim to maintain a 1:1 peg to the US dollar, but their approaches differ. USDT, for instance, has faced scrutiny over its reserve backing, whereas USDW’s weekly audits provide a more transparent and secure foundation.

In the past year, USDT experienced a brief depeg event, where its value dropped below $1. This event shook investor confidence, but USDT managed to recover swiftly, thanks to increased transparency efforts. Now, let’s consider whether USDW might follow a similar path or take a different route.

Given USDW’s strong auditing process and commitment to transparency, it’s less likely to experience a significant depeg event. However, the crypto market is unpredictable, and external factors like regulatory changes or shifts in market sentiment could impact its stability. As an investor, keeping an eye on these factors will be crucial for navigating USDW’s future trajectory.

Analyzing USDW’s Price Movements: Technical Insights and Market Sentiment

Technical analysis can offer valuable insights into USDW’s price movements. Let’s delve into some key indicators that could help us understand the token’s current and future trends.

The Relative Strength Index (RSI) for USDW currently hovers around 50, indicating a balanced market condition. This suggests that the token is neither overbought nor oversold, maintaining a stable position relative to its recent price history.

Moving averages provide another perspective. The 50-day moving average for USDW is slightly above its current price, suggesting a potential for short-term upward movement. Conversely, the 200-day moving average remains steady, reflecting the token’s long-term stability.

Support and resistance levels are also critical in understanding USDW’s price behavior. The current support level is around $0.9975, which aligns with the token’s all-time low in February 2025. On the other hand, the resistance level sits at $1.00, the all-time high reached just a month ago. These levels serve as important markers for investors, signaling potential entry and exit points.

Recent news and developments in the stablecoin space can also impact USDW’s price. For instance, regulatory clarity around stablecoins could boost investor confidence, potentially pushing USDW closer to its resistance level. Conversely, any negative regulatory news could lead to increased volatility and a test of the support level.

Long and Short-Term Predictions for USDW: Where Might It Go?

Looking ahead, let’s explore some long and short-term predictions for USDW, backed by data and current trends.

In the short term, USDW is likely to maintain its stability around the $1 mark. The token’s strong auditing process and commitment to transparency should continue to support its peg to the US dollar. However, any significant market events or regulatory changes could introduce volatility, so investors should remain vigilant.

Over the next few months, we might see USDW’s price fluctuate between $0.9975 and $1.00. Given its current market performance and the stablecoin sector’s growth, a slight upward trend is possible, especially if more investors recognize the value of its stability.

Looking further ahead to 2026 and beyond, USDW’s trajectory will depend on several factors. If the stablecoin market continues to expand, with more adoption and use cases, USDW could see increased demand and potentially surpass its current resistance level. By 2030, we might see USDW trading consistently above $1, reflecting its growing role in the crypto ecosystem.

However, it’s essential to consider potential challenges. Historical trends show that stablecoins can face scrutiny and regulatory hurdles, which could impact USDW’s growth. By keeping an eye on these developments and understanding the broader market dynamics, investors can better navigate USDW’s future.

For those new to crypto investing, understanding how to navigate USDW’s volatility is crucial. While the token aims to maintain stability, external factors can still influence its price.

One strategy is to stay informed about regulatory news and market trends. Regulatory clarity can significantly impact stablecoins, so keeping an eye on developments from bodies like the SEC or other global regulators can provide valuable insights.

Another approach is to use technical analysis tools like RSI and moving averages to identify potential entry and exit points. These indicators can help you make more informed decisions, especially during periods of increased volatility.

Finally, consider diversifying your portfolio. While USDW offers stability, combining it with other cryptocurrencies can help mitigate risk and potentially enhance returns. By understanding the unique characteristics of each asset, you can build a more resilient investment strategy.

Conclusion: The Future of USDW and Stablecoins

In conclusion, USD DWIN (USDW) token stands out in the stablecoin market with its commitment to stability and transparency. As we move through 2025 and beyond, understanding its price movements and potential growth will be key for investors. By staying informed, using technical analysis, and considering broader market trends, you can navigate the future of USDW and the stablecoin space with confidence.

Remember, the world of crypto is ever-evolving, and staying adaptable is crucial. Whether you’re a seasoned investor or just starting your journey, USDW offers a stable entry point into the exciting world of digital currencies. Keep an eye on the trends, stay informed, and let’s see where USDW takes us in the years to come.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.