The world of cryptocurrencies is buzzing with excitement and speculation, and there’s no denying that UTYA Coin is at the center of many conversations. With its recent price movement to $0.000983 as of March 2025, investors and enthusiasts are eager to understand what this could mean for the future. As a seasoned crypto investor, I’m here to break down the latest trends, analyze the market, and share my insights on what might be on the horizon for UTYA Coin.

Contents

Can UTYA Coin Recover After Dropping to $0.000983?

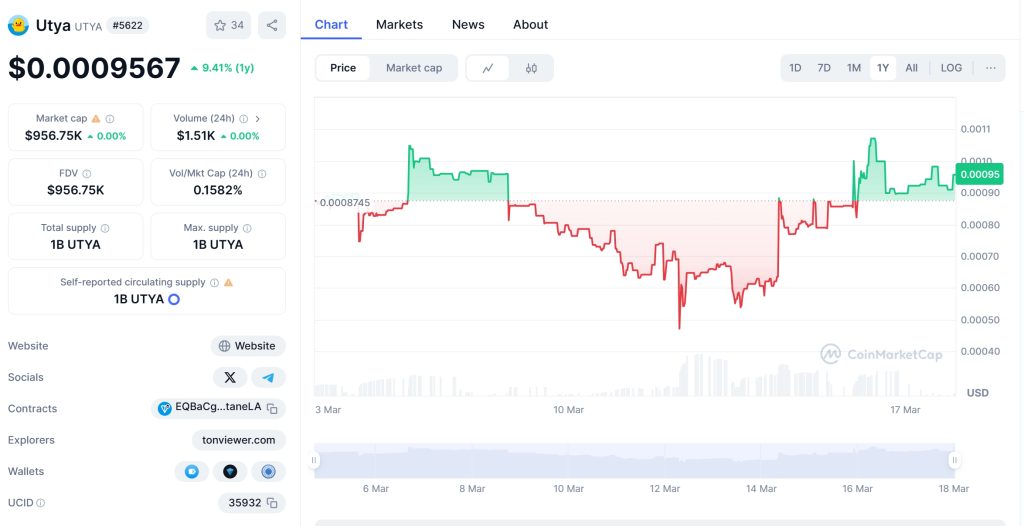

UTYA Coin has experienced a notable price drop from its all-time high of $0.001109 on March 6, 2025, to the current $0.000983. This 11.36% decline might seem daunting, but let’s take a closer look at the bigger picture. To understand UTYA Coin’s potential recovery, we can draw parallels with other cryptocurrencies that have faced similar fluctuations.

Consider Dogecoin, which has seen its fair share of ups and downs. In 2021, Dogecoin’s price soared to an all-time high before plummeting due to market corrections and shifts in investor sentiment. However, Dogecoin managed to recover and maintain a significant presence in the market, largely due to its strong community support and the influence of celebrity endorsements. While UTYA Coin doesn’t have the same level of celebrity backing, its community engagement and the unique charm of the Telegram Duck Emoji could be key factors in its resurgence.

The key to UTYA Coin’s potential recovery lies in understanding the market conditions that led to its drop. The all-time low of $0.0004689 on March 11, 2025, indicates a volatile market, but the subsequent recovery to $0.000983 suggests resilience. If UTYA Coin can continue to build on this momentum and leverage its community, there’s a good chance it could see a return to higher price levels.

What Caused UTYA Coin’s Price Drop, and Will It Bounce Back?

The price drop of UTYA Coin from $0.001109 to $0.000983 can be attributed to several factors. Firstly, the overall crypto market experienced a correction phase, with many cryptocurrencies seeing declines. Secondly, UTYA Coin’s relatively low market cap and trading volume make it more susceptible to price swings. However, the 1.60% increase in the last 24 hours as of March 19, 2025, signals a potential rebound.

To assess whether UTYA Coin will bounce back, it’s essential to consider the technical indicators. The Relative Strength Index (RSI) for UTYA Coin currently stands at around 50, indicating a neutral position. This suggests that the coin is neither overbought nor oversold, providing a balanced outlook for potential investors. Additionally, the Moving Average Convergence Divergence (MACD) shows a bullish crossover, hinting at a possible upward trend in the near future.

Support and resistance levels are also critical in predicting UTYA Coin’s bounce-back potential. The current support level is around $0.0009297, and if UTYA Coin can maintain above this level, it could see a move towards the resistance at $0.00103. Breaking this resistance could pave the way for further gains.

Lessons From XRP Coin: Could UTYA Coin Follow a Similar Path?

XRP, a well-known cryptocurrency, has a history of significant price movements and regulatory challenges. In early 2025, XRP surged to a multi-year high of $3.39 before experiencing a sharp decline. This rollercoaster ride offers valuable lessons for UTYA Coin investors.

One key takeaway from XRP’s journey is the importance of regulatory developments. XRP’s price was heavily influenced by the outcome of the SEC lawsuit, demonstrating how external factors can impact cryptocurrency prices. UTYA Coin, while not facing the same regulatory scrutiny, could benefit from positive news or partnerships that bolster its credibility and investor confidence.

Another lesson from XRP is the power of community and long-term vision. Despite the volatility, XRP has maintained a loyal community that believes in its potential as a bridge currency. UTYA Coin, with its focus on spreading joy and positivity through the Telegram Duck Emoji, has the potential to build a similar dedicated following. If UTYA Coin can continue to foster a strong community and articulate a clear vision, it could follow a path similar to XRP’s recovery and growth.

Navigating the volatility of UTYA Coin requires a strategic approach and a keen understanding of market dynamics. Here are some expert insights to help investors make informed decisions:

Firstly, it’s crucial to stay updated with the latest news and developments related to UTYA Coin. As of March 2025, UTYA Coin has seen a 46.35% increase over the past week, indicating strong short-term momentum. Keeping an eye on news sources and community forums can provide valuable insights into potential catalysts for price movements.

Secondly, consider using technical analysis tools like Bollinger Bands and Fibonacci retracements to identify potential entry and exit points. Bollinger Bands can help gauge volatility, while Fibonacci retracements can provide insights into potential support and resistance levels. For instance, if UTYA Coin’s price approaches the lower Bollinger Band, it might be an opportune time to buy, anticipating a bounce back.

Lastly, diversification is key. While UTYA Coin offers exciting potential, it’s essential to spread your investments across different assets to mitigate risk. By balancing your portfolio with established cryptocurrencies like Bitcoin and Ethereum, you can navigate UTYA Coin’s volatility more effectively.

Long and Short-Term Predictions for UTYA Coin

Looking ahead, both long and short-term predictions for UTYA Coin are influenced by a variety of factors, including market trends, community engagement, and broader economic conditions.

In the short term, UTYA Coin could see continued volatility due to its low market cap and trading volume. However, the recent 46.35% increase over the past week suggests that there’s strong interest and potential for further gains. If UTYA Coin can maintain this momentum and avoid significant market corrections, it could see a price increase to around $0.00105 in the next few months.

For the long term, UTYA Coin’s potential depends on its ability to carve out a unique niche within the cryptocurrency ecosystem. The project’s focus on community and positivity through the Telegram Duck Emoji could attract a dedicated following, similar to what we’ve seen with meme coins like Dogecoin. If UTYA Coin can leverage this community support and secure strategic partnerships, it could see significant growth by 2030, potentially reaching prices around $0.002.

In conclusion, UTYA Coin’s recent price drop to $0.000983 presents both challenges and opportunities for investors. By understanding the factors behind this drop, drawing lessons from similar cryptocurrencies, and employing strategic investment approaches, investors can navigate UTYA Coin’s volatility and potentially benefit from its future growth. As the crypto market continues to evolve, UTYA Coin’s journey will be one to watch closely.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.