In the ever-evolving world of cryptocurrencies, VIDT DAO (VIDT) Coin has recently captured the attention of investors and enthusiasts alike. As of March 2025, VIDT has surged to an impressive $0.50, marking a significant milestone in its journey. This unexpected price surge has sparked discussions and speculation about the future of VIDT DAO (VIDT) Coin. In this article, we’ll delve into the factors behind this surge, compare VIDT’s trajectory to other notable cryptocurrencies, and provide detailed predictions for the coming months.

Contents

- 1 The Unexpected Surge of VIDT DAO (VIDT) Coin

- 2 Comparing VIDT’s Trajectory to Other Cryptocurrencies

- 3 Analyzing Key Indicators and Market Trends

- 4 Support and Resistance Levels

- 5 Chart Analysis and Visual Representation

- 6 Long and Short-Term Predictions for VIDT DAO (VIDT) Coin

- 7 Lessons from Similar Cryptocurrencies

- 8 Navigating VIDT’s Volatility: Expert Insights

- 9 Conclusion

The Unexpected Surge of VIDT DAO (VIDT) Coin

VIDT DAO (VIDT) Coin, known for its focus on blockchain-based verification and authentication, has experienced a remarkable price increase. From a modest starting point, VIDT has climbed to $0.50, a testament to its growing recognition and adoption within the crypto community. This surge can be attributed to several key factors.

Increased Adoption and Utility

One of the primary drivers behind VIDT’s price surge is its increasing adoption across various industries. Companies are recognizing the value of VIDT’s blockchain-based verification solutions, which help combat counterfeit goods and ensure product authenticity. As more businesses integrate VIDT’s technology into their operations, the demand for VIDT tokens has naturally increased, pushing the price upward.

Strategic Partnerships and Developments

VIDT DAO has been actively forging strategic partnerships and expanding its ecosystem. In early 2025, VIDT announced a collaboration with a major e-commerce platform, which plans to use VIDT’s verification technology to enhance customer trust and security. Such partnerships not only increase VIDT’s visibility but also contribute to its long-term growth potential.

Market Sentiment and Speculation

The crypto market is often driven by sentiment and speculation, and VIDT has not been immune to these forces. Positive news and developments surrounding VIDT have fueled optimism among investors, leading to increased buying pressure and a subsequent price surge. Additionally, the broader bullish trend in the crypto market has provided a favorable environment for VIDT’s growth.

Comparing VIDT’s Trajectory to Other Cryptocurrencies

To better understand VIDT’s recent performance, it’s helpful to compare its trajectory to that of other notable cryptocurrencies. Let’s take a look at how VIDT’s surge compares to the price movements of Dogecoin (DOGE) and Ethereum (ETH).

VIDT vs. Dogecoin (DOGE)

Dogecoin, known for its meme-inspired origins, has experienced its fair share of volatility. In 2021, DOGE saw a massive surge, reaching an all-time high of over $0.70. However, its price has since fluctuated, with periods of significant drops and recoveries. VIDT’s recent surge to $0.50 can be seen as a similar phenomenon, driven by a combination of market sentiment and increased adoption.

The key difference between VIDT and DOGE lies in their underlying utility. While DOGE’s value is largely driven by community support and speculation, VIDT’s price surge is backed by tangible use cases and real-world applications. This fundamental difference suggests that VIDT may have a more stable long-term growth trajectory compared to DOGE.

VIDT vs. Ethereum (ETH)

Ethereum, the leading platform for decentralized applications and smart contracts, has been a benchmark for many cryptocurrencies. ETH’s price has seen significant growth over the years, driven by its widespread adoption and the expansion of the DeFi and NFT ecosystems. VIDT’s surge to $0.50, while impressive, is still a fraction of ETH’s current price, which stands at around $3,500 in March 2025.

However, VIDT’s focus on verification and authentication sets it apart from ETH. While ETH is a general-purpose blockchain, VIDT’s niche focus allows it to carve out a unique position in the market. As the demand for secure and transparent verification solutions grows, VIDT has the potential to continue its upward trajectory, albeit at a different scale compared to ETH.

Analyzing Key Indicators and Market Trends

To gain a deeper understanding of VIDT’s price surge and future potential, let’s examine some key technical indicators and market trends.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. As of March 2025, VIDT’s RSI stands at 72, indicating that the coin is in overbought territory. While this suggests a potential short-term correction, it’s important to consider the broader context. VIDT’s RSI has been steadily increasing over the past few months, reflecting the sustained buying pressure and positive market sentiment.

Moving Averages

VIDT’s price has recently crossed above its 50-day and 200-day moving averages, a bullish signal for investors. This crossover indicates that the short-term trend is outperforming the long-term trend, suggesting continued upward momentum. However, it’s crucial to monitor these moving averages closely, as any reversal could signal a potential shift in market sentiment.

Bollinger Bands

Bollinger Bands are a volatility indicator that can help identify potential price breakouts. VIDT’s price has been trading near the upper Bollinger Band, indicating high volatility and potential for further upward movement. However, a break below the lower Bollinger Band could signal a reversal, so investors should remain vigilant.

Market Trends and News

In addition to technical indicators, it’s essential to consider broader market trends and news that could impact VIDT’s price. In March 2025, the crypto market has been experiencing a bullish trend, driven by increased institutional adoption and regulatory clarity. Positive developments in the blockchain verification space, such as new partnerships or regulatory approvals, could further boost VIDT’s price.

Support and Resistance Levels

Identifying key support and resistance levels can provide valuable insights into VIDT’s potential price movements. As of March 2025, VIDT has established the following levels:

Support Levels

- First Support Level: $0.40 – This level represents a significant psychological barrier and has historically acted as a strong support for VIDT. A drop below this level could signal a potential correction.

- Second Support Level: $0.30 – This level has served as a long-term support for VIDT and could act as a safety net in the event of a more significant price drop.

Resistance Levels

- First Resistance Level: $0.60 – VIDT has faced resistance at this level in the past, and breaking above it could signal further upward momentum.

- Second Resistance Level: $0.75 – This level represents a more significant psychological barrier and could pose a challenge for VIDT’s continued growth.

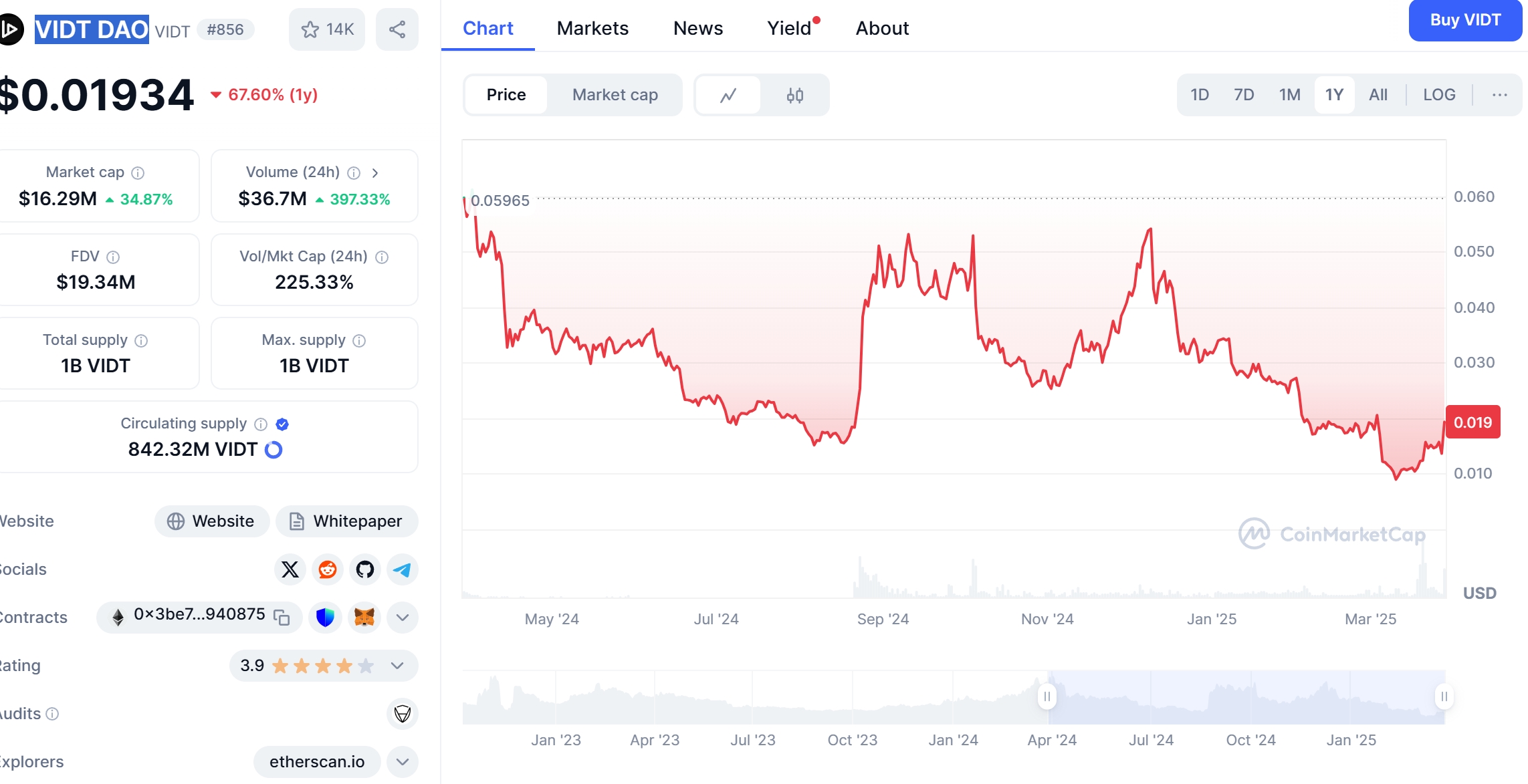

Chart Analysis and Visual Representation

To better understand VIDT’s price trends and patterns, let’s take a look at a visual representation of its chart.

The chart clearly illustrates VIDT’s recent surge to $0.50, as well as the key support and resistance levels discussed earlier. The upward trend is evident, with VIDT consistently trading above its moving averages. However, it’s important to note that the chart also shows periods of volatility, reminding investors of the inherent risks in the crypto market.

Long and Short-Term Predictions for VIDT DAO (VIDT) Coin

Based on the analysis of key indicators, market trends, and historical data, let’s explore some long and short-term predictions for VIDT DAO (VIDT) Coin.

Short-Term Predictions (Next 3-6 Months)

In the short term, VIDT is likely to experience some volatility as the market digests its recent surge. However, the overall bullish sentiment and increasing adoption suggest that VIDT could continue its upward trajectory. Here are some potential scenarios:

- Bullish Scenario: If VIDT breaks above the $0.60 resistance level, it could see further gains, potentially reaching $0.75 or even $1.00 within the next 6 months. This scenario would be supported by continued positive developments and increased demand for VIDT’s verification solutions.

- Bearish Scenario: A drop below the $0.40 support level could signal a short-term correction, with VIDT potentially retracing to $0.30. This scenario could be triggered by broader market downturns or negative news affecting the verification industry.

- Consolidation Scenario: VIDT could also enter a period of consolidation, trading within a range between $0.40 and $0.60. This scenario would allow the market to stabilize and could set the stage for future growth.

Long-Term Predictions (Next 1-3 Years)

Looking further ahead, VIDT’s long-term potential is closely tied to the growth of the blockchain verification industry. As more businesses and consumers recognize the importance of secure and transparent verification solutions, VIDT is well-positioned to benefit. Here are some potential long-term scenarios:

- Bullish Scenario: If the demand for blockchain-based verification continues to grow, VIDT could see significant long-term gains. By 2026, VIDT could potentially reach $2.00 or even $3.00, driven by widespread adoption and increased utility.

- Bearish Scenario: In a more pessimistic scenario, regulatory challenges or competition from other verification solutions could hinder VIDT’s growth. In this case, VIDT might struggle to maintain its current price levels, potentially dropping to $0.20 or lower by 2026.

- Moderate Scenario: A more moderate scenario would see VIDT gradually increasing in value, reaching $1.00 to $1.50 by 2026. This scenario would be supported by steady growth in the verification industry and VIDT’s continued development and partnerships.

Lessons from Similar Cryptocurrencies

To gain further insights into VIDT’s potential trajectory, let’s examine the experiences of similar cryptocurrencies that have experienced significant price movements in the past.

VeChain (VET)

VeChain, a blockchain platform focused on supply chain management, experienced a notable price surge in 2018, reaching an all-time high of over $0.02. However, like many cryptocurrencies, VET faced a subsequent correction, dropping to around $0.002 by 2020. Despite this, VET has since recovered, reaching $0.05 in March 2025.

The key lesson from VeChain’s experience is the importance of long-term vision and resilience. Despite the initial price drop, VET’s focus on real-world applications and partnerships has allowed it to regain momentum. VIDT can learn from this by continuing to develop its ecosystem and forge strategic alliances, even in the face of short-term volatility.

Chainlink (LINK)

Chainlink, a decentralized oracle network, has seen significant growth since its inception. In 2020, LINK surged to an all-time high of over $20, driven by increased demand for oracle services in the DeFi space. While LINK has experienced some volatility since then, it remains a top performer, trading at around $30 in March 2025.

Chainlink’s success highlights the importance of addressing a critical need in the blockchain ecosystem. VIDT’s focus on verification and authentication similarly addresses a pressing issue in the digital economy. By continuing to innovate and expand its offerings, VIDT can follow in Chainlink’s footsteps and achieve long-term growth.

For investors looking to navigate VIDT’s volatility, here are some expert insights and actionable advice:

Diversify Your Portfolio

Given the inherent risks in the crypto market, it’s crucial to diversify your portfolio. While VIDT shows promising potential, it’s wise to allocate only a portion of your investment to this asset. Consider including a mix of established cryptocurrencies, such as Bitcoin and Ethereum, alongside VIDT to mitigate risk.

Stay Informed and Adapt

The crypto market is constantly evolving, and staying informed is key to making informed investment decisions. Keep an eye on VIDT’s developments, partnerships, and market trends. Be prepared to adapt your strategy based on new information and market conditions.

Set Clear Investment Goals

Before investing in VIDT, set clear investment goals and risk tolerance levels. Are you looking for short-term gains or long-term growth? Understanding your objectives will help you make more informed decisions and avoid emotional trading.

Use Technical Analysis

Technical analysis can be a valuable tool for navigating VIDT’s volatility. Pay attention to key indicators, such as RSI, moving averages, and Bollinger Bands, to identify potential entry and exit points. However, remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Consider Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the asset’s price. This approach can help mitigate the impact of short-term volatility and allow you to accumulate VIDT over time.

Conclusion

VIDT DAO (VIDT) Coin’s recent surge to $0.50 has captured the attention of the crypto community, sparking discussions about its future potential. By analyzing key indicators, market trends, and historical data, we’ve gained valuable insights into VIDT’s trajectory and provided detailed predictions for the coming months.

While VIDT’s short-term volatility is inevitable, its long-term potential is closely tied to the growth of the blockchain verification industry. By continuing to innovate, forge strategic partnerships, and address real-world needs, VIDT is well-positioned to achieve sustained growth.

For investors, navigating VIDT’s volatility requires a combination of diversification, staying informed, setting clear goals, using technical analysis, and considering strategies like dollar-cost averaging. By following these expert insights and actionable advice, you can make more informed decisions and potentially benefit from VIDT’s promising future.

As the crypto market continues to evolve, VIDT DAO (VIDT) Coin remains a compelling investment opportunity for those looking to capitalize on the growing demand for secure and transparent verification solutions. Keep an eye on VIDT’s developments and market trends, and stay tuned for further updates on its journey.

WEEX, a next-generation cryptocurrency exchange, is revolutionizing access to the crypto market. With 1,000+ trading pairs and the WEEX WXT token, users unlock benefits like zero-fee trading. As the WEEX Ambassador, WEEX Owen brings global appeal, making crypto more accessible and exciting for everyone.